Advertisement

Supported by

Meta Profit Is Up 16% to $7.8 Billion in Recent Quarter

Wall Street investors were hoping the social media giant would regain its footing after more than a year of problems, including slumping ad sales.

- Share full article

By Mike Isaac

Mike Isaac has covered Meta and Facebook for more than a decade and reported this article from San Francisco.

Long before it was called Meta, Facebook was a Wall Street darling because of its breakneck growth and big profits. But the company had lost its luster with investors over the past 18 months thanks to a slump in ad sales and what some saw as self-inflicted wounds.

On Wednesday, the company appeared to regain some of its footing. Meta said its revenue for the second quarter jumped 11 percent from a year earlier, to $32 billion. Profits rose 16 percent, to $7.8 billion, fueled in part by improvements made to Meta’s advertising technology using artificial intelligence, as well as other product tweaks.

Meta’s improving finances are the second indication in two days that the online ad market, after a long slump brought on by a slowing economy, is showing signs of improvement. On Tuesday, Google’s parent company, Alphabet, also reported strong quarterly results , powered by ads for the Google search engine and renewed momentum for YouTube.

“We continue to see strong engagement across our apps, and we have the most exciting road map I’ve seen in a while,” Mark Zuckerberg, Meta’s chief executive, said in a statement. He also pointed to some of the company’s high points over the quarter, including the release of new A.I. technology and Meta’s answer to Twitter: Threads .

The results, which surpassed Wall Street’s expectations, were bolstered further by the company’s making more money from Reels, its TikTok-like video product inside Instagram, which Meta owns. More than 3.88 billion people each month had used one or more of Meta’s apps, which include Instagram, Messenger, WhatsApp and Facebook proper, in the most recent quarter, up 6 percent from a year earlier.

Analysts had expected a profit of $7.45 billion on sales of $31.1 billion, according to data compiled by FactSet. Shares of Meta rose 6 percent in after-hours trading on Wednesday.

We are having trouble retrieving the article content.

Please enable JavaScript in your browser settings.

Thank you for your patience while we verify access. If you are in Reader mode please exit and log into your Times account, or subscribe for all of The Times.

Thank you for your patience while we verify access.

Already a subscriber? Log in .

Want all of The Times? Subscribe .

Meta Q2 Revenue Up 11% to $32 Billion in Earnings Beat

By Todd Spangler

Todd Spangler

NY Digital Editor

- DirecTV Tells Customers It’s Hiking Prices Next Month, Coming Amid Blackout of ESPN, ABC and Other Disney Nets 13 hours ago

- Amid Disney Blackout, DirecTV Is Offering Customers a $30 Credit Toward Dish’s Sling or Fubo Streaming Services 1 day ago

- OnlyFans Payments Surged to Record $6.6 Billion in 2023, up 19% 1 day ago

Meta turned in a healthy 11% uptick in revenue for the second quarter of 2023, topping Wall Street expectations and signaling the social giant’s ad business is recovering after last year’s doldrums.

The parent company of Facebook and Instagram posted revenue of $32.0 billion and net profit of $7.79 billion ($2.98 per share), up 16%. On average, analysts expected revenue of $31.12 billion and earnings per share of $2.91, according to Refinitiv data.

Related Stories

Fubo’s Battle With Venu Sports Is a Stopgap Measure

Alicia Keys' 'Hell's Kitchen' Partners With ESPN in First-Time Music Collaboration With U.S Open (EXCLUSIVE)

Popular on variety.

The Facebook app’s average daily active user count for June was 2.06 billion, up slightly compared with 2.04 billion three months earlier and 1.97 billion a year ago. Total DAUs across Meta’s “family of apps” (Facebook, Instagram, WhatsApp, Messenger) in June reached 3.07 billion, versus 3.02 billion on average for March 2023.

On the earnings call Zuckerberg said that Reels — Meta’s TikTok-style video feature — is generating more than 200 billion daily views on Facebook and Instagram. In addition, he said Reels revenue is now on a $10 billion annual run rate, up from $3 billion last fall.

Like other tech companies, Meta has taken cost-cutting steps including laying off 11,000 workers last fall and cutting another 10,000 jobs this year . Meta’s headcount was 71,469 as of June 30, down 14% year-over-year (and a 7% decline from Q1). About half of the employees affected by the 2023 layoffs are included in the reported headcount as of June 30, the company said.

On regulatory matters, Meta commented that it saw a “positive development” with the European Commission’s adoption of a final adequacy decision, which “allows us to continue to provide our services in Europe.” That said, the company said it still sees “increasing legal and regulatory headwinds in the EU and the U.S. that could significantly impact our business and our financial results.”

Meta’s Q2 results come after the company launched a rival to Twitter (which owner Elon Musk is rebranding as X) called Threads, a text conversation app tied to Instagram, in early July. The app topped 100 million sign-ups in less than a week, according to the company, but third-party measurement firms have reported a drop in daily user engagement since its debut. On the call, Zuckerberg said Meta saw “dramatically” more people coming back to use Threads than expected and that the company is focused on building out features and driving it to the scale before monetizing it. “There’s still a lot basic functionality to build,” he said.

“We’ve run this playbook many times before, with Facebook, Instagram, WhatsApp Stories, Reels and more. And this is as good of a start as it as we can hope for,” Zuckerberg said.

Zuckerberg said Threads was built by a “relatively small team” on a tight deadline, leading to his larger point that he will run the company as efficiently as possible going forward.

More from Variety

Netflix Unveils South African Programming Slate at MIP Africa – Global Bulletin

Venu Legal Fight Is About More Than FuboTV: What’s at Stake for the Entire Industry

‘Dead Boy Detectives’ Canceled After One Season at Netflix (EXCLUSIVE)

‘Perfect Couple’ Premiere Red Carpet Swarmed By Gnats: ‘You Have a Bug on You!’

2024 Live Music Business Is Driving Record Revenues, but Some Data Points Raise Concerns

Vince McMahon Docuseries Sets Netflix Premiere Date

More from our brands, ‘pistol’: separating fact from fiction in danny boyle’s new sex pistols miniseries.

An NFL Legend’s Custom Vacation Retreat in Montana Is Heading to Auction This Month

Pegula’s Run Ends as Sabalenka Wins First U.S. Open

The Best Loofahs and Body Scrubbers, According to Dermatologists

Get Peacock for Free With Instacart+ to Stream Live NFL Games and More

More From Forbes

What to expect from meta platforms in q2.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

MENLO PARK, CALIFORNIA - OCTOBER 28: A pedestrian walks in front of a new logo and the name 'Meta' ... [+] on the sign in front of Facebook headquarters on October 28, 2021 in Menlo Park, California. (Photo by Justin Sullivan/Getty Images)

Meta Platforms (NASDAQ: META) is scheduled to report its fiscal Q2 2023 results on Wednesday, July 26, 2023. We expect the stock to beat the consensus estimates of earnings and revenues. The company outperformed expectations in the last quarter, with revenues increasing by 3% y-o-y to $28.65 billion. The growth was due to growth in advertising revenues. Further, the daily active users (DAUs) and ad impressions delivered across the META Family of Apps rose by 4% and 26% respectively. However, the positive impact was somewhat offset by a 17% drop in the average price per ad. We expect the same trend to continue in Q2.

Our forecast indicates that Meta Platforms’ valuation is $228 per share, which is 28% below the current market price of around $316. Our interactive dashboard analysis on Meta Platforms’ Earnings Preview has more details.

META Earnings Estimates for FY2023Q2

(1) Revenues expected to top the consensus

Meta Platforms’ revenues marginally decreased to $116.6 billion in FY 2022. However, it posted a 3% growth in the first quarter of 2023. It was mainly due to an increase in ad impressions and DAUs, despite continued pricing pressure. The advertising demand on the platform has suffered in recent quarters due to tough macroeconomic conditions and limitations on ad targeting due to the iOS privacy update. We expect the Q2 results to be on similar lines. That said, the company is making efforts to diversify its revenue stream. It recently launched a microblogging platform (Threads0) and Meta Verified subscription service. Overall, Meta Platforms META ’ revenues are estimated to touch $122.35 billion in FY2023.

Trefis estimates Meta Platforms’ fiscal Q2 2023 net revenues to be around $31.59 billion, 2% above the $31.09 billion consensus estimate.

(2) EPS to beat the consensus estimates

Best Tax Software Of 2022

Best tax software for the self-employed of 2022, income tax calculator: estimate your taxes.

Meta Platforms Q2 2023 adjusted earnings per share is expected to be $2.95 per Trefis analysis, 1% above the consensus estimate of $2.91. The company’s adjusted net income decreased by 41% y-o-y in FY 2022. Further, the trend continued in Q1, with net income declining by 24% y-o-y driven by higher costs & expenses. We expect the net income margin to see some improvement in the second quarter. Overall, we estimate an annual GAAP EPS of around $10.02 in FY2023.

(3) Stock price estimate is 28% below the current market price

We arrive at Meta Platforms’ valuation , using a GAAP EPS estimate of around $10.02 and a P/E multiple of just below 23x in fiscal 2023. This translates into a price of $228, which is 28% lower than the current market price.

Note: P/E Multiples are based on Share Price at the end of the year and reported (or expected) Adjusted Earnings for the full year

What if you’re looking for a portfolio that aims for long-term growth? Here’s a value portfolio that’s done much better than the market since 2016.

META Return Compared with Trefis Multi-Strategy Portfolio

Invest with Trefis Market Beating Portfolios

See all Trefis Price Estimates

- Editorial Standards

- Reprints & Permissions

Join The Conversation

One Community. Many Voices. Create a free account to share your thoughts.

Forbes Community Guidelines

Our community is about connecting people through open and thoughtful conversations. We want our readers to share their views and exchange ideas and facts in a safe space.

In order to do so, please follow the posting rules in our site's Terms of Service. We've summarized some of those key rules below. Simply put, keep it civil.

Your post will be rejected if we notice that it seems to contain:

- False or intentionally out-of-context or misleading information

- Insults, profanity, incoherent, obscene or inflammatory language or threats of any kind

- Attacks on the identity of other commenters or the article's author

- Content that otherwise violates our site's terms.

User accounts will be blocked if we notice or believe that users are engaged in:

- Continuous attempts to re-post comments that have been previously moderated/rejected

- Racist, sexist, homophobic or other discriminatory comments

- Attempts or tactics that put the site security at risk

- Actions that otherwise violate our site's terms.

So, how can you be a power user?

- Stay on topic and share your insights

- Feel free to be clear and thoughtful to get your point across

- ‘Like’ or ‘Dislike’ to show your point of view.

- Protect your community.

- Use the report tool to alert us when someone breaks the rules.

Thanks for reading our community guidelines. Please read the full list of posting rules found in our site's Terms of Service.

The Definitive Voice of Entertainment News

Subscribe for full access to The Hollywood Reporter

site categories

Meta reports higher quarterly revenue amid “year of efficiency”.

On the earnings call, Mark Zuckerberg, Meta founder and CEO, said the new offering, Threads, had so far seen "unprecedented growth," but that the company will wait to monetize the app.

By Caitlin Huston

Caitlin Huston

Business Writer

- Share on Facebook

- Share to Flipboard

- Send an Email

- Show additional share options

- Share on LinkedIn

- Share on Pinterest

- Share on Reddit

- Share on Tumblr

- Share on Whats App

- Print the Article

- Post a Comment

Meta reported total revenue of $32 billion, an increase of 11 percent year-over-year and at the top end of the company’s previous guidance for the three months ended June 30.

Net income reached $7.8 billion, up 16 percent from $6.7 billion a year ago. Monthly active users on Facebook reached 3.03 billion as of June 30, 2023, an increase of 3 percent year-over-year, and up from 2.9 billion in the first quarter of the year.

Related Stories

Meta, universal music group to allow users to share songs on whatsapp, meta beats wall street estimates but warns ai spending will surge in 2025.

In March, Meta announced that it would lay off an additional 10,000 employees, after previously cutting 11,000 jobs in November. The March layoffs led to a $523 million hit in Q1, with total costs expected to reach $1 billion by the end of the year. On Wednesday, Meta said it had “substantially completed” planned layoffs but continued to assess “facilities consolidation and data center restructuring initiatives.” The company recorded restructuring charges of $705 million for the three months ended June 30.

As of June 30, total headcount was 71,469, a decrease of 14 percent year-over-year, but about half of employees impacted by the 2023 layoffs are included in the headcount.

In April, Meta also shut down original programming on Facebook Watch, which included shows such as Red Table Talk, a talk show co-hosted by Jada Pinkett Smith, Willow Smith and Adrienne Banfield-Norris.

These cuts came as part of CEO Mark Zuckerberg ’s proclaimed “year of efficiency,” which the executive first outlined in February 2023 and then reiterated as part of the layoffs in March.

“We should prepare ourselves for the possibility that this new economic reality will continue for many years. Higher interest rates lead to the economy running leaner, more geopolitical instability leads to more volatility, and increased regulation leads to slower growth and increased costs of innovation,” Zuckerberg said in March.

On the earnings call, Mark Zuckerberg, Meta founder and CEO, said Threads had so far seen “unprecedented growth,” but that the company will wait to monetize the app.

“I’m quite optimistic about our trajectory here. We saw unprecedented growth out of the gate and more importantly, we’re seeing more people coming back daily than I’d expected,” Zuckerberg said.

“And now we’re focused on retention and improving the basics and then after that, we’ll focus on growing the community to the scale that we think is going to be possible. Only after that are we going to focus on monetization,” he continued.

He also noted that the app was built by “a relatively small team,” as part of his efficiency directive for the company. Going forward, Meta will continue to hire for key roles, but the number of roles will still remain relatively low, he said.

“Now that we’ve gotten through the major layoffs, the rest of 2023 will be about creating stability for employees, removing barriers that slow us down, introducing new AI power tools to speed us up and so on,” he said.

Meta also continues to see success with Reels, its TikTok competitor which is hosted on Instagram. The video offering is now recording more than 200 billion daily views and has hit a $10 billion annual run rate, up from $3 billion last fall, Zuckerberg said.

Still, Meta warned that Reality Labs, its business segment that focuses on augmented and virtual reality. will see its operating losses increase in 2023, and those will continue to increase “meaningfully” in 2024 due to “ongoing product development efforts in augmented reality/virtual reality and investments to further scale our ecosystem.”

The company expects total revenue in Q3 between $32 billion and $34.5 billion. Expenses for the full 2023 year are also now expected to increase, hitting a range of $88 billion to $91 billion, due to legal expenses and restructuring charges.

In 2024, expenses are also expected to grow due to higher payroll expenses, which reflect higher-cost technical roles, as well as higher infrastructure costs. However, Meta did not give a Q4 revenue outlook, with Meta CFO Susan Lee noting that while the company is seeing “strong advertiser demand now,” the past year has been volatile and “it’s harder to predict as we look further forward.”

THR Newsletters

Sign up for THR news straight to your inbox every day

More from The Hollywood Reporter

Directv and disney offer dueling discounts as carriage dispute war of words escalates, paul harrell, youtube gun safety advocate, announces his own death in video message, the hollywood labor chief pay chart: top union leaders’ compensation revealed, new plan to “revitalize” cbs revealed in filing by skydance and paramount, donna langley talks ai, the nba and the “great paradox” of original vs. franchise ip, lionsgate names new head of inclusive content at movie group.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds Rates

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Stock Comparison

- Advanced Chart

- Currency Converter

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Best Free Checking

- Student Loans

- Personal Loans

- Car insurance

- Mortgage Refinancing

- Mortgage Calculator

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Financial Freestyle

- Capitol Gains

- Living Not So Fabulously

- Decoding Retirement

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Meta platforms (meta) to report q2 earnings: what to expect.

Meta Platforms META is set to report its second-quarter 2023 results on Jul 26. Meta expects total revenues between $29.5 billion and $32 billion for the second quarter of 2023. Unfavorable forex is expected to hurt year-over-year top-line growth by less than 1%. The Zacks Consensus Estimate for second-quarter revenues is pegged at $30.84 billion, indicating an increase of 7.01% from the year-ago quarter’s reported figure. The consensus mark for earnings stands at $2.85 per share, up by a cent over the past 30 days, suggesting growth of 15.85% from the figure reported in the year-ago quarter.

Meta Platforms, Inc. Price and EPS Surprise

Meta Platforms, Inc. price-eps-surprise | Meta Platforms, Inc. Quote

Meta’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters and missed twice, the average surprise being 15.46%. Meta had a terrific second quarter of 2023, outperforming the Zacks Internet Software industry. While the shares of the social media giant have returned 35.4%, the industry has risen 16.3%. Let’s see how things have shaped up for the upcoming announcement.

Factors to Note

Meta’s second-quarter top line is expected to have benefited from Facebook’s expanding user base (more than 3 billion daily active users) and growing adoption of reels. Higher engagement level is helping to steady its user growth across all regions, particularly Asia Pacific. Our model estimate for Asia Pacific Daily Active Users (DAUs) in the second quarter is pegged at 883 million, indicating 5.6% year-over-year growth, the fastest among the regions followed by the Rest of World, which we expect to grow 3.3% to 652 million DAUs. In terms of Monthly Active Users (MAUs), our estimate for Asia Pacific is pegged at 1.339 billion, suggesting 2.6% year-over-year growth. The Rest of World MAUs is expected to grow 2.4% to 982 million MAUs. Increased engagement for Meta’s offerings like Instagram, WhatsApp, Messenger and Facebook has been a major growth driver. Effective usage of artificial intelligence has been helping the company keep its users engaged. Our model estimate for Meta’s worldwide DAU is pegged at 2.034 billion, indicating 3.4% growth year over year. MAU is pegged at 2.985 billion, indicating a 1.7% increase year over year. Nevertheless, Meta’s top line is expected to reflect the negative impact of the challenging macroeconomic environment and high inflation that is anticipated to have kept ad spending budgets under pressure. This is likely to have weighed on ad revenues in the to-be-reported quarter. The company’s ad revenue business is facing a decline in growth due to ad targeting-related headwinds created by Apple ’s AAPL iOS changes. Apple’s iOS changes have made ad targeting difficult, which has increased the cost of driving outcomes. However, measuring these outcomes is tough. In the first quarter of 2023, Meta’s ad revenues represented 98.1% of total revenues, which increased 4.2% year over year to $31.25 billion. Our estimate for second-quarter 2023 ad revenues is pegged at $28.95 billion, indicating 2.8% year-over-year growth.

What Our Model Says

Per the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is the exact case here. Meta has an Earnings ESP of +5.89% and currently has a Zacks Rank #2. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks to Consider

Here are a few other companies worth considering, as our model shows that these too have the right combination of elements to beat on earnings in their upcoming releases: Tyler Technologies TYL has an Earnings ESP of +0.54% and sports a Zacks Rank #1 at present. You can see the complete list of today’s Zacks #1 Rank stocks here. Tyler shares have gained 25.3% year to date. TYL is set to report its second-quarter 2023 results on Jul 27. Cadence Design Systems CDNS has an Earnings ESP of +0.67% and a Zacks Rank #1. Cadence Design shares have gained 48.6% year to date. CDNS is set to report its second-quarter 2023 results on Jul 24. Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Tyler Technologies, Inc. (TYL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

- Search Search Please fill out this field.

- Company News

- Earnings Reports and News

What You Need To Know Ahead of Meta's Earnings Report

:max_bytes(150000):strip_icc():format(webp)/IMG_3010_Original-db52198185784c809b9c3e1b21f60c51.jpeg)

Chesnot / Contributor / Getty Images

UPDATE—July 30, 2024: This article has been updated to reflect more recent analyst estimates and share price information.

Key Takeaways

- Meta is set to report second-quarter earnings after the closing bell on Wednesday.

- Analysts expect the company to report year-over-year revenue and earnings growth. Investors will be watching for strength in Meta's advertising business.

- Meta will likely discuss the company's AI opportunity after launching a new open AI model, Llama 3.1.

Meta Platforms ( META ) is set to report second-quarter earnings after the closing bell on Wednesday, with investors watching for advertising revenue strength and updates on artificial intelligence (AI) plans after its most recent AI model announcement.

The Facebook and Instagram parent is expected to report revenue of $38.37 billion, according to estimates compiled by Visible Alpha, about a 20% rise from a year ago. Net income is projected to be $12.32 billion or $4.71 per share, up from $7.79 billion or $2.98 per share in the year-ago quarter.

| Analyst Estimates for Q2 2024 | Q1 2024 | Q2 2023 | |

| Revenue | $38.37 billion | $36.46 billion | $32 billion |

| Diluted Earnings Per Share | $4.71 | $4.71 | $2.98 |

| Net Income | $12.32 billion | $12.37 billion | $7.79 billion |

Key Metrics: Advertising Revenue Growth

Meta will report its second-quarter ad revenue with Citi analysts expecting the figure to grow 20.5% from the year-ago period to $37.95 billion, citing a strengthening ad environment, adoption of Instagram Reels, and new products for advertisers.

Most advertisers plan to spend more or maintain spending on Meta platforms, a survey conducted by Wedbush analysts found, which could contribute to strong second-quarter results and set the company on a positive trajectory for the second half of the year. The tech giant earlier this year expanded the AI tools it offers to advertisers .

Business Spotlight: AI Potential After Llama 3.1 Launch

Meta this month unveiled its Llama 3.1 open-source AI model. J.P. Morgan analysts said the launch could make Meta AI "the most used AI assistant by year-end, if not sooner."

The earnings report will offer Meta an opportunity to assure investors that its increased spending to invest in AI is helping the company capitalize on a growth opportunity.

Meta shares have gained close to one-third of their value since the start of the year, at $465.13 as of 11 a.m. ET Tuesday morning.

Meta Investor Relations. " Q2 2024 Earnings Call ."

Citi. "Meta Platforms Inc (META.O) | Buy 2Q24 Preview: Focused on Engagement, Monetization, & Efficiency Gains; Reels Tracking at 22% Ad Load in 2Q24."

Wedbush. "Meta Platforms Inc (META) 2Q24 Preview: Focus on 2H Growth and AI Investment Cycle; Outperform; $570 TP."

J.P. Morgan. "Meta Platforms Inc Meta AI Ambitions Reflected in Release of Llama 3.1 & Commitment to Open Source AI; Focus Into Earnings Next Week on Capex Intensity & AI Proof Points."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-19806700671-a324aa1483e84f0fbafd6bd9d1b7fa8b.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

Meta Reports Second Quarter 2023 Results

News provided by

Jul 26, 2023, 16:05 ET

Share this article

MENLO PARK, Calif. , July 26, 2023 /PRNewswire/ -- Meta Platforms, Inc. (Nasdaq: META ) today reported financial results for the quarter ended June 30, 2023 .

"We had a good quarter. We continue to see strong engagement across our apps and we have the most exciting roadmap I've seen in a while with Llama 2, Threads, Reels, new AI products in the pipeline, and the launch of Quest 3 this fall," said Mark Zuckerberg , Meta founder and CEO.

Second Quarter 2023 Financial Highlights

| ||||||

|

|

|

| |||

Revenue | $ 31,999 | $ 28,822 | 11 % | |||

Costs and expenses | 22,607 | 20,464 | 10 % | |||

Income from operations | $ 9,392 | $ 8,358 | 12 % | |||

|

|

| ||||

Provision for income taxes | $ 1,505 | $ 1,499 | — % | |||

|

|

| ||||

Net income | $ 7,788 | $ 6,687 | 16 % | |||

Diluted earnings per share (EPS) | $ 2.98 | $ 2.46 | 21 % | |||

Second Quarter 2023 Operational and Other Financial Highlights

- Family daily active people (DAP) – DAP was 3.07 billion on average for June 2023 , an increase of 7% year-over-year.

- Family monthly active people (MAP) – MAP was 3.88 billion as of June 30, 2023 , an increase of 6% year-over-year.

- Facebook daily active users (DAUs) – DAUs were 2.06 billion on average for June 2023 , an increase of 5% year-over-year.

- Facebook monthly active users (MAUs) – MAUs were 3.03 billion as of June 30, 2023 , an increase of 3% year-over-year.

- Ad impressions and price per ad – In the second quarter of 2023, ad impressions delivered across our Family of Apps increased by 34% year-over-year and the average price per ad decreased by 16% year-over-year.

- Revenue – Revenue was $32.0 billion , an increase of 11% year-over-year, and an increase of 12% year-over-year on a constant currency basis.

- Costs and expenses – Total costs and expenses were $22.61 billion , an increase of 10% year-over-year. This includes accrued legal expenses of $1.87 billion and restructuring charges of $780 million in the second quarter of 2023.

- Capital expenditures – Capital expenditures, including principal payments on finance leases, were $6.35 billion for the second quarter of 2023.

- Share repurchases – We repurchased $793 million of our Class A common stock in the second quarter of 2023. As of June 30, 2023 , we had $40.91 billion available and authorized for repurchases.

- Cash, cash equivalents, and marketable securities – Cash, cash equivalents, and marketable securities were $53.45 billion as of June 30, 2023 . Free cash flow was $10.96 billion in the second quarter of 2023.

- Long-term debt – Long-term debt was $18.38 billion as of June 30, 2023 .

- Headcount – Headcount was 71,469 as of June 30, 2023 , a decrease of 14% year-over-year. Approximately half of the employees impacted by the 2023 layoffs are included in our reported headcount as of June 30, 2023 .

Restructuring

Beginning in 2022, we initiated several measures to pursue greater efficiency and to realign our business and strategic priorities. As of June 30, 2023 , we have substantially completed planned employee layoffs while continuing to assess facilities consolidation and data center restructuring initiatives.

A summary of our restructuring charges, including subsequent adjustments, for the three and six months ended June 30, 2023 by major activity type is as follows (in millions):

|

| |||||||||||||||

|

|

|

|

|

|

|

| |||||||||

Cost of revenue | $ 9 | $ — | $ (51) | $ (42) | $ 67 | $ — | $ (220) | $ (153) | ||||||||

Research and development | 159 | 136 | — | 295 | 643 | 455 | — | 1,098 | ||||||||

Marketing and sales | 43 | 218 | — | 261 | 180 | 222 | — | 402 | ||||||||

General and administrative | 36 | 230 | — | 266 | 164 | 413 | — | 577 | ||||||||

Total | $ 247 | $ 584 | $ (51) | $ 780 | $ 1,054 | $ 1,090 | $ (220) | $ 1,924 | ||||||||

During the three and six months ended June 30, 2023 , we recorded total restructuring charges of $705 million and $1.64 billion under our FoA segment, respectively, and $75 million and $286 million under our RL segment, respectively. These charges lowered our operating margin by two percentage points and three percentage points for the three and six months ended June 30, 2023 , respectively, and our diluted EPS by $0.25 and $0.61 for the three and six months ended June 30, 2023 , respectively.

CFO Outlook Commentary

We expect third quarter 2023 total revenue to be in the range of $32 -34.5 billion. Our guidance assumes a foreign currency tailwind of approximately 3% to year-over-year total revenue growth in the third quarter, based on current exchange rates.

We anticipate our full-year 2023 total expenses will be in the range of $88 -91 billion, increased from our prior range of $86 -90 billion due to legal-related expenses recorded in the second quarter of 2023. This outlook includes approximately $4 billion of restructuring costs related to facilities consolidation charges and severance and other personnel costs. We expect Reality Labs operating losses to increase year-over-year in 2023.

While we are not providing a quantitative outlook beyond 2023 at this point, we expect a few factors to be drivers of total expense growth in 2024 as we continue to invest in our most compelling opportunities, including artificial intelligence (AI) and the metaverse.

- First, we expect higher infrastructure-related costs next year. Given our increased capital investments in recent years, we expect depreciation expenses in 2024 to increase by a larger amount than in 2023. We also expect to incur higher operating costs from running a larger infrastructure footprint.

- Second, we anticipate growth in payroll expenses as we evolve our workforce composition toward higher-cost technical roles.

- Finally, for Reality Labs, we expect operating losses to increase meaningfully year-over-year due to our ongoing product development efforts in augmented reality/virtual reality and investments to further scale our ecosystem.

We expect our full-year 2023 capital expenditures to be in the range of $27 -30 billion, lowered from our prior estimate of $30 -33 billion. The reduced forecast is due to both cost savings, particularly on non-AI servers, as well as shifts in capital expenditures into 2024 from delays in projects and equipment deliveries rather than a reduction in overall investment plans.

Looking ahead, while we will continue to refine our plans as we progress throughout this year, we currently expect total capital expenditures to grow in 2024, driven by our investments across both data centers and servers, particularly in support of our AI work.

Absent any changes to U.S. tax law, we expect the tax rate for the rest of the year to be similar to the second quarter of 2023.

In addition, we continue to monitor the active regulatory landscape. With respect to EU-U.S. data transfers, we saw a positive development with the European Commission's adoption of a final adequacy decision, which allows us to continue to provide our services in Europe . This is good news, though broadly speaking, we continue to see increasing legal and regulatory headwinds in the EU and the US that could significantly impact our business and our financial results.

Webcast and Conference Call Information

Meta will host a conference call to discuss the results at 2 p.m. PT / 5 p.m. ET today. The live webcast of Meta's earnings conference call can be accessed at investor.fb.com , along with the earnings press release, financial tables, and slide presentation. Meta uses the investor.fb.com and about.fb.com/news/ websites as well as Mark Zuckerberg's Facebook Page ( facebook.com/zuck ), Instagram account ( instagram.com/zuck ) and Threads profile ( threads.net/zuck ) as means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

Following the call, a replay will be available at the same website. A telephonic replay will be available for one week following the conference call at +1 (800) 633-8284 or +1 (402) 977-9140, conference ID 22027525.

Transcripts of conference calls with publishing equity research analysts held today will also be posted to the investor.fb.com website.

Meta builds technologies that help people connect, find communities, and grow businesses. When Facebook launched in 2004, it changed the way people connect. Apps like Messenger, Instagram, and WhatsApp further empowered billions around the world. Now, Meta is moving beyond 2D screens toward immersive experiences like augmented and virtual reality to help build the next evolution in social technology.

Investors: Kenneth Dorell [email protected] / investor.fb.com

Press: Ryan Moore [email protected] / about.fb.com/news/

Forward-Looking Statements

This press release contains forward-looking statements regarding our future business plans and expectations. These forward-looking statements are only predictions and may differ materially from actual results due to a variety of factors including: the impact of macroeconomic conditions on our business and financial results, including as a result of geopolitical events; our ability to retain or increase users and engagement levels; our reliance on advertising revenue; our dependency on data signals and mobile operating systems, networks, and standards that we do not control; changes to the content or application of third-party policies that impact our advertising practices; risks associated with new products and changes to existing products as well as other new business initiatives, including our metaverse efforts; our emphasis on community growth and engagement and the user experience over short-term financial results; maintaining and enhancing our brand and reputation; our ongoing privacy, safety, security, and content review efforts; competition; risks associated with government actions that could restrict access to our products or impair our ability to sell advertising in certain countries; litigation and government inquiries; privacy, legislative, and regulatory concerns or developments; risks associated with acquisitions; security breaches; and our ability to manage our scale and geographically-dispersed operations. These and other potential risks and uncertainties that could cause actual results to differ from the results predicted are more fully detailed under the caption "Risk Factors" in our Quarterly Report on Form 10-Q filed with the SEC on April 27, 2023 , which is available on our Investor Relations website at investor.fb.com and on the SEC website at www.sec.gov . Additional information will also be set forth in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2023 . In addition, please note that the date of this press release is July 26, 2023 , and any forward-looking statements contained herein are based on assumptions that we believe to be reasonable as of this date. We undertake no obligation to update these statements as a result of new information or future events.

Non-GAAP Financial Measures

To supplement our condensed consolidated financial statements, which are prepared and presented in accordance with generally accepted accounting principles in the United States (GAAP), we use the following non-GAAP financial measures: revenue excluding foreign exchange effect, advertising revenue excluding foreign exchange effect, and free cash flow. The presentation of these financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. In addition, these measures may be different from non-GAAP financial measures used by other companies, limiting their usefulness for comparison purposes. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from these non-GAAP financial measures.

We believe these non-GAAP financial measures provide investors with useful supplemental information about the financial performance of our business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management in operating our business.

We exclude the following items from our non-GAAP financial measures:

Foreign exchange effect on revenue. We translated revenue for the three and six months ended June 30, 2023 using the prior year's monthly exchange rates for our settlement or billing currencies other than the U.S. dollar, which we believe is a useful metric that facilitates comparison to our historical performance.

Purchases of property and equipment; Principal payments on finance leases. We subtract both purchases of property and equipment, net of proceeds and principal payments on finance leases in our calculation of free cash flow because we believe that these two items collectively represent the amount of property and equipment we need to procure to support our business, regardless of whether we procure such property or equipment with a finance lease. We believe that this methodology can provide useful supplemental information to help investors better understand underlying trends in our business. Free cash flow is not intended to represent our residual cash flow available for discretionary expenditures.

For more information on our non-GAAP financial measures and a reconciliation of GAAP to non-GAAP measures, please see the "Reconciliation of GAAP to Non-GAAP Results" table in this press release.

| |||||||

| |||||||

| |||||||

| |||||||

|

| ||||||

|

|

|

| ||||

| $ 31,999 | $ 28,822 | $ 60,645 | $ 56,729 | |||

| |||||||

Cost of revenue | 5,945 | 5,192 | 12,054 | 11,197 | |||

Research and development | 9,344 | 8,690 | 18,725 | 16,397 | |||

Marketing and sales | 3,154 | 3,595 | 6,198 | 6,907 | |||

General and administrative | 4,164 | 2,987 | 7,049 | 5,347 | |||

| 22,607 | 20,464 | 44,026 | 39,848 | |||

| 9,392 | 8,358 | 16,619 | 16,881 | |||

Interest and other income (expense), net | (99) | (172) | (19) | 213 | |||

Income before provision for income taxes | 9,293 | 8,186 | 16,600 | 17,094 | |||

Provision for income taxes | 1,505 | 1,499 | 3,102 | 2,942 | |||

| $ 7,788 | $ 6,687 | $ 13,498 | $ 14,152 | |||

| |||||||

Basic | $ 3.03 | $ 2.47 | $ 5.24 | $ 5.21 | |||

Diluted | $ 2.98 | $ 2.46 | $ 5.18 | $ 5.19 | |||

| |||||||

Basic | 2,568 | 2,704 | 2,577 | 2,714 | |||

Diluted | 2,612 | 2,713 | 2,604 | 2,729 | |||

(1) | The second quarter 2023 general and administrative expenses include accrued legal expenses of $1.87 billion, which mostly relate to the fine imposed by the Irish Data Protection Commission in the ongoing data transfers matter and the adoption of new fining guidelines by the European Data Protection Board. This resulted in a $1.30 billion increase in accruals related to our ongoing legal proceedings compared to the same period in 2022. | |||||||

| |||

| |||

| |||

| |||

|

| ||

| |||

Current assets: | |||

Cash and cash equivalents | $ 28,785 | $ 14,681 | |

Marketable securities | 24,661 | 26,057 | |

Accounts receivable, net | 12,511 | 13,466 | |

Prepaid expenses and other current assets | 3,603 | 5,345 | |

Total current assets | 69,560 | 59,549 | |

Non-marketable equity securities | 6,208 | 6,201 | |

Property and equipment, net | 87,949 | 79,518 | |

Operating lease right-of-use assets | 12,955 | 12,673 | |

Intangible assets, net | 856 | 897 | |

Goodwill | 20,659 | 20,306 | |

Other assets | 8,501 | 6,583 | |

| $ 206,688 | $ 185,727 | |

| |||

Current liabilities: | |||

Accounts payable | $ 3,093 | $ 4,990 | |

Partners payable | 772 | 1,117 | |

Operating lease liabilities, current | 1,396 | 1,367 | |

Accrued expenses and other current liabilities | 24,660 | 19,552 | |

Total current liabilities | 29,921 | 27,026 | |

Operating lease liabilities, non-current | 16,440 | 15,301 | |

Long-term debt | 18,382 | 9,923 | |

Other liabilities | 7,912 | 7,764 | |

Total liabilities | 72,655 | 60,014 | |

Commitments and contingencies | |||

Stockholders' equity: | |||

Common stock and additional paid-in capital | 69,159 | 64,444 | |

Accumulated other comprehensive loss | (3,106) | (3,530) | |

Retained earnings | 67,980 | 64,799 | |

Total stockholders' equity | 134,033 | 125,713 | |

| $ 206,688 | $ 185,727 | |

| ||||||||

| ||||||||

| ||||||||

| ||||||||

|

| |||||||

|

|

|

| |||||

| ||||||||

Net income | $ 7,788 | $ 6,687 | $ 13,498 | $ 14,152 | ||||

Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

Depreciation and amortization | 2,623 | 1,979 | 5,147 | 4,135 | ||||

Share-based compensation | 4,060 | 3,351 | 7,111 | 5,850 | ||||

Deferred income taxes | (1,137) | (453) | (1,757) | (1,016) | ||||

Impairment charges for facilities consolidation | 232 | — | 1,002 | — | ||||

Other | 212 | 189 | 204 | (33) | ||||

Changes in assets and liabilities: | ||||||||

Accounts receivable | (1,424) | (522) | 1,122 | 2,035 | ||||

Prepaid expenses and other current assets | (54) | (435) | 767 | 138 | ||||

Other assets | 37 | (25) | 67 | (132) | ||||

Accounts payable | (51) | 237 | (1,155) | (645) | ||||

Partners payable | (116) | 73 | (356) | (33) | ||||

Accrued expenses and other current liabilities | 5,290 | 1,180 | 5,624 | 1,943 | ||||

Other liabilities | (151) | (64) | 33 | (122) | ||||

| 17,309 | 12,197 | 31,307 | 26,272 | ||||

| ||||||||

Purchases of property and equipment | (6,216) | (7,572) | (13,058) | (13,013) | ||||

Proceeds relating to property and equipment | 82 | 44 | 101 | 170 | ||||

Purchases of marketable debt securities | (717) | (2,220) | (803) | (6,288) | ||||

Maturities and sales of marketable debt securities | 1,816 | 3,159 | 2,351 | 8,626 | ||||

Acquisitions of businesses and intangible assets | (83) | (363) | (527) | (1,216) | ||||

Other investing activities | (85) | (7) | (10) | (17) | ||||

| (5,203) | (6,959) | (11,946) | (11,738) | ||||

| ||||||||

Taxes paid related to net share settlement of equity awards | (1,692) | (1,002) | (2,701) | (1,927) | ||||

Repurchases of Class A common stock | (898) | (5,233) | (10,263) | (14,739) | ||||

Proceeds from issuance of long-term debt, net | 8,455 | — | 8,455 | — | ||||

Principal payments on finance leases | (220) | (219) | (484) | (452) | ||||

Other financing activities | (353) | (109) | (231) | (105) | ||||

| 5,292 | (6,563) | (5,224) | (17,223) | ||||

Effect of exchange rate changes on cash, cash equivalents, and restricted cash | (14) | (550) | 71 | (698) | ||||

Net increase (decrease) in cash, cash equivalents, and restricted cash | 17,384 | (1,875) | 14,208 | (3,387) | ||||

Cash, cash equivalents, and restricted cash at beginning of the period | 12,420 | 15,353 | 15,596 | 16,865 | ||||

| $ 29,804 | $ 13,478 | $ 29,804 | $ 13,478 | ||||

| ||||||||

Cash and cash equivalents | $ 28,785 | $ 12,681 | $ 28,785 | $ 12,681 | ||||

Restricted cash, included in prepaid expenses and other current assets | 165 | 228 | 165 | 228 | ||||

Restricted cash, included in other assets | 854 | 569 | 854 | 569 | ||||

| $ 29,804 | $ 13,478 | $ 29,804 | $ 13,478 | ||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

|

| |||||||

|

|

|

| |||||

| ||||||||

Cash paid for income taxes, net | $ 1,102 | $ 2,139 | $ 1,507 | $ 2,641 | ||||

Cash paid for interest, net of amounts capitalized | $ — | $ — | $ 182 | $ — | ||||

Non-cash investing and financing activities: | ||||||||

Property and equipment in accounts payable and accrued expenses and other current liabilities | $ 3,845 | $ 4,543 | $ 3,845 | $ 4,543 | ||||

Acquisition of businesses in accrued expenses and other current liabilities and other liabilities | $ 217 | $ 43 | $ 217 | $ 43 | ||||

Settlement of convertible notes in exchange of equity securities in other current assets | $ — | $ 131 | $ — | $ 131 | ||||

Other current assets through financing arrangement in accrued expenses and other current liabilities | $ 14 | $ 214 | $ 14 | $ 214 | ||||

Repurchases of Class A common stock in accrued expenses and other current liabilities | $ — | $ 70 | $ — | $ 70 | ||||

Segment Results

We report our financial results for our two reportable segments: Family of Apps (FoA) and Reality Labs (RL). FoA includes Facebook, Instagram, Messenger, WhatsApp, and other services. RL includes augmented and virtual reality related consumer hardware, software, and content.

The following table presents our segment information of revenue and income (loss) from operations:

| ||||||||

| ||||||||

| ||||||||

|

| |||||||

|

|

|

| |||||

Revenue: | ||||||||

Advertising | $ 31,498 | $ 28,152 | $ 59,599 | $ 55,150 | ||||

Other revenue | 225 | 218 | 430 | 433 | ||||

Family of Apps | 31,723 | 28,370 | 60,029 | 55,583 | ||||

Reality Labs | 276 | 452 | 616 | 1,146 | ||||

Total revenue | $ 31,999 | $ 28,822 | $ 60,645 | $ 56,729 | ||||

Income (loss) from operations: | ||||||||

Family of Apps | $ 13,131 | $ 11,164 | $ 24,351 | $ 22,647 | ||||

Reality Labs | (3,739) | (2,806) | (7,732) | (5,766) | ||||

Total income from operations | $ 9,392 | $ 8,358 | $ 16,619 | $ 16,881 | ||||

| ||||||||

| ||||||||

| ||||||||

|

| |||||||

|

|

|

| |||||

GAAP revenue | $ 31,999 | $ 28,822 | $ 60,645 | $ 56,729 | ||||

Foreign exchange effect on 2023 revenue using 2022 rates | 274 | 1,089 | ||||||

Revenue excluding foreign exchange effect | $ 32,273 | $ 61,734 | ||||||

GAAP revenue year-over-year change % | 11 % | 7 % | ||||||

Revenue excluding foreign exchange effect year-over-year change % | 12 % | 9 % | ||||||

GAAP advertising revenue | $ 31,498 | $ 28,152 | $ 59,599 | $ 55,150 | ||||

Foreign exchange effect on 2023 advertising revenue using 2022 rates | 269 | 1,075 | ||||||

Advertising revenue excluding foreign exchange effect | $ 31,767 | $ 60,674 | ||||||

GAAP advertising revenue year-over-year change % | 12 % | 8 % | ||||||

Advertising revenue excluding foreign exchange effect year-over-year change % | 13 % | 10 % | ||||||

Net cash provided by operating activities | $ 17,309 | $ 12,197 | $ 31,307 | $ 26,272 | ||||

Purchases of property and equipment, net | (6,134) | (7,528) | (12,957) | (12,843) | ||||

Principal payments on finance leases | (220) | (219) | (484) | (452) | ||||

Free cash flow | $ 10,955 | $ 4,450 | $ 17,866 | $ 12,977 | ||||

SOURCE Meta

Modal title

Also from this source.

Meta Announces Quarterly Cash Dividend

The Meta Platforms, Inc. (META) board of directors today declared a quarterly cash dividend of $0.50 per share of the company's outstanding Class A...

Meta Reports Second Quarter 2024 Results

Meta Platforms, Inc. (Nasdaq: META) today reported financial results for the quarter ended June 30, 2024. "We had a strong quarter, and Meta AI is on ...

Artificial Intelligence

Social Media

Computer & Electronics

Nvidia's Q2 Earnings Weren't The Mic Drop Moment Bulls Expected (Downgrade)

- Nvidia Corporation Q2 earnings beat expectations, highlighted by continued demand for AI chips.

- Guidance was mixed with some uncertainties related to the launch timing of the next-generation Blackwell architecture systems.

- A realization the company is past its peak growth stage may keep shares volatile going forward.

BING-JHEN HONG

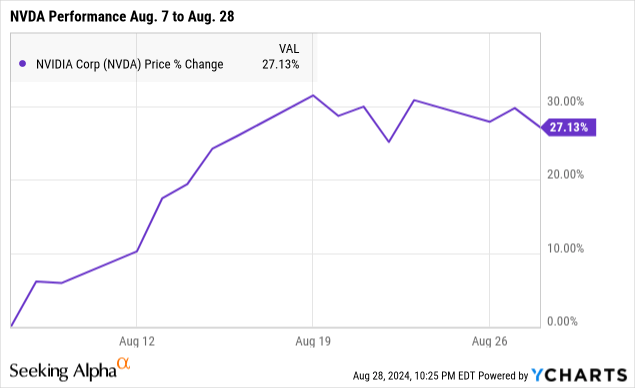

The initial market reaction to the second-quarter earnings report from Nvidia Corporation ( NASDAQ: NVDA ) was underwhelming. Despite a top and bottom-line beat to Wall Street estimates from the AI chip juggernaut, the stock fell by as much as 7% in after-hours trading.

Beyond the headline numbers, the sense is that the market needed a bit more, which becomes a problem when thinking about how the stock will reclaim its all-time high above $140 anytime soon.

Following several bullish calls in 2023, we last covered NVDA with a hold rating earlier this year. Between parts of the growth story losing its shine and a lofty valuation, we now see room to turn more bearish with a belief that increasing volatility will be the story going forward.

A Classic Sell-The-News Event

For what has been described as the most important stock in the world as a bellwether for the artificial intelligence revolution and sentiment towards the technology sector in general, all eyes were on Nvidia earnings.

Fiscal 2025 Q2 EPS of $0.68 came in $0.04 ahead of consensus, marking a 152% increase from the period last year. Revenue of $30.0 billion increased by 122% year-over-year and was also $1.3 billion above estimates.

At face value, this was a solid report. Growth was led by the core data center segment, capturing the global demand for the Hopper GPU computing platform, critical for training large language models and running generative AI applications. Smaller segments like gaming, visualization, and automotive solutions are also strong, even accelerating in recent quarters.

That being said, nothing in the market occurs within a bubble. It's important to recognize that shares of NVDA had already climbed nearly 30% in the past three weeks, going back to the period of tech sector weakness in early August. That was a massive move, likely anticipating this Nvidia report, effectively pricing in the potential good news. By this measure, the selloff likely represented a sell-the-news dynamic, where the stock had already been bought on the rumor.

If anything, the immediate pullback serves as a good lesson for investors that earnings are always high-risk events where any scenario is on the table.

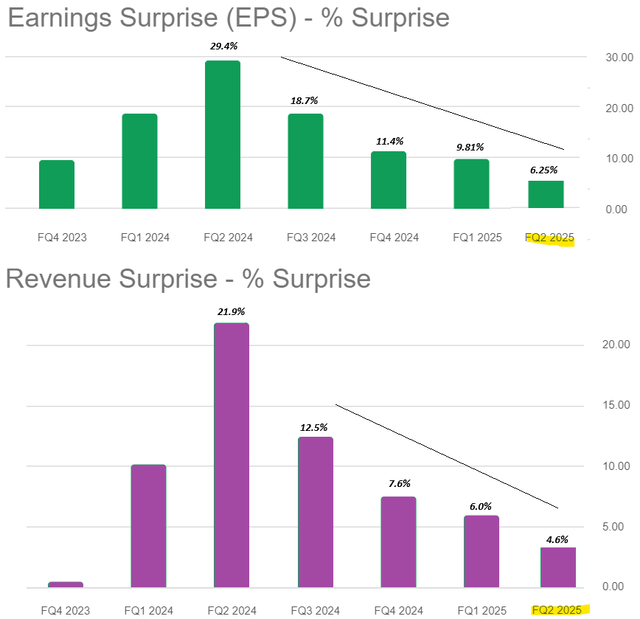

Diminishing Beats

What can't be overlooked is that even as Nvidia once again exceeded expectations for sales and earnings this quarter, it's clear the size of those beats has narrowed over the past.

For Q2, the EPS result was a modest 6.25% above the consensus, far from the breakthrough “mic drop” moment the company delivered last year when it blew away earnings estimates by 29%. Similarly, even as revenue this quarter was $1.3 billion ahead of what the market was forecasting, the 4.6% surprise was far less impressive than what was achieved in recent quarters.

This dynamic can be extended to critique the Q3 guidance , where Nvidia expects revenue of $32.5 billion, modestly 2.5% higher than the current market consensus of $31.7 billion. Not to downplay the implied 79% y/y revenue growth which any other company would be envious of, this is a case where good may not be good enough for Nvidia, which had appeared unstoppable thus far.

Seeking Alpha

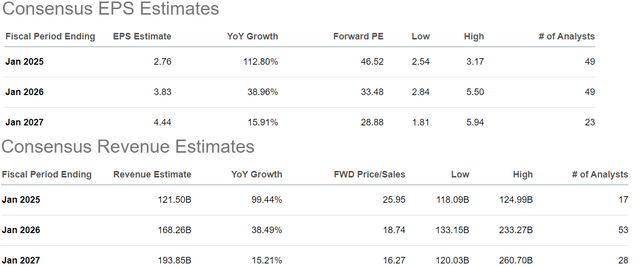

Tough Comps and Margins Uncertainty

The problem for Nvidia becomes managing expectations. Looking out over the next two years, growth is set to dramatically decelerate from the forecast 99% annual revenue increase this year towards 15% by fiscal 2027 against the high baseline of comparison.

This type of normalization is completely normal for a company transitioning from an ultra-high growth phase but also introduces several risks trading at a forward price to a sales multiple of 26x.

One scenario we envision is where Nvidia falls victim to its success, as it is set to launch the next-generation Blackwell architecture AI systems. Beyond any temporary timing delays or the cadence of the rollout, what is more uncertain is the demand tailwind long-term, with forecasts related to data center builds and computing power generally highly speculative.

It's possible that major customers, including mega-cap tech sector leaders that have already invested Billions in Hopper clusters, may find that an immediate upgrade to Blackwell is unnecessary. They may at least choose to be much more efficient in their next wave of investments.

There is also a concern with how margins for Nvidia will evolve long-term in consideration of average pricing and gradually rising competition. Notably, the Q2 adjusted gross margin at 75.7% already ticked lower from the record 78.9% in Q1. Comments in the earnings conference call suggest a “mid-70s” target for the full year, which will be a key metric to watch going forward.

So if there is a bearish case for Nvidia, it starts with a belief that consensus estimates into fiscal 2026 and 2027 have some downside. That doesn't mean sales will collapse or that “AI is a bubble,” but the market may still be too optimistic about how the industry will transform and where Nvidia fits in.

The Big Picture for Investors

We rate NVDA stock as a sell under the assumption that the company has passed its peak growth stage and near-term risks are tilted to the downside. For long-time shareholders with a low-cost basis, defensive strategies such as writing covered calls could make sense.

Down more than 20% from its all-time high, NVDA is already in a bear market, with an extreme range of volatility likely to continue in both directions. Shares were trading near $90 just a few weeks ago, with a return to that level well in the realm of possibilities. Investors looking at the stock for the first time may find a more attractive entry point down the line as the dust settles.

On the upside, bulls will be rooting for NVDA to rebound quickly towards its record high of $140.76 as a first step to rebuilding positive momentum. A close above that level would force us to reassess our bearish outlook.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. The information contained herein represents the personal opinions and views of Dan Victor only and is intended for informational and/or educational purposes. It should not be construed as a specific recommendation or solicitation to buy or sell any security or follow any particular investment strategy. Please consult with your financial advisor before making any investment decisions.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

About nvda stock.

| Symbol | Last Price | % Chg |

|---|

More on NVDA

Related stocks.

| Symbol | Last Price | % Chg |

|---|---|---|

| NVDA | - | - |

| NVDA:CA | - | - |

Trending Analysis

Trending news.

COMMENTS

Meta Earnings Presentation Q2 2023 investor.fb.com. $13,366$13,094 $15,062 $12,024$12,788$12,766 $15,005 $12,710 $14,131 $7,205$6,821 $8,174 $6,364 $6,360$5,707 $6,904 $6,269 ... Please see Meta's most recent quarterly or annual report filed with the SEC for definitions of user activity used to determine the number of our Facebook DAUs and MAUs ...

Meta Platforms, Inc. (Nasdaq: META) today reported financial results for the quarter ended June 30, 2023. "We had a good quarter. We continue to see strong engagement across our apps and we have the most exciting roadmap I've seen in a while with Llama 2, Threads, Reels, new AI products in the pipeline, and the launch of Quest 3 this fall," said Mark Zuckerberg, Meta founder and CEO. Second ...

July 26, 2023 02:00 PM PT. Listen to Webcast. Earnings Release (PDF) Slides (PDF) Earnings Call Transcript (PDF) Follow Up Call Transcript (PDF) Learn More. About. Create a page.

Meta will host a conference call to discuss its results at 2 p.m. PT / 5 p.m. ET the same day. The live webcast of the call can be accessed at the Meta Investor Relations website at investor.fb.com, along with the company's earnings press release, financial tables, and slide presentation.. Following the call, a replay will be available at the same website.

SA Transcripts. 148.99K Follower s. Meta Platforms, Inc. (NASDAQ: META) Q2 2023 Earnings Call Transcript July 26, 2023 5:00 PM ET. Company Participants. Kenneth Dorell - Director of IR. Mark ...

Meta said its revenue for the second quarter jumped 11 percent from a year earlier, to $32 billion. Profits rose 16 percent, to $7.8 billion, fueled in part by improvements made to Meta's ...

META. Meta Platforms META reported second-quarter 2023 adjusted earnings of $3.26 per share, beating the Zacks Consensus Estimate by 12.54%. Including restructuring charges, GAAP earnings were $2. ...

Here are the results. Earnings: $2.98 per share vs. $2.91 expected by Refinitiv. Revenue: $32 billion vs. $31.12 billion expected by Refinitiv. Wall Street is also focused on these numbers in the ...

Meta Platforms, Inc. Class A Common Stock (META) Earnings

Meta posted an 11% increase in revenue for Q2 2023, beating Wall Street earnings estimates and signaling its ad business is recovering. Plus Icon Film Plus Icon TV

Meta Platforms, Inc. (META) Morgan Stanley 2024 Technology, Media & Telecom Conference (Transcript) SA TranscriptsMon, Mar. 11. Meta Platforms, Inc. 2023 Q4 - Results - Earnings Call Presentation ...

Our second quarter headcount still included roughly half of the approximately 10,000 employees impacted by the 2023 layoffs. We expect that our third quarter headcount will no longer include the vast majority of impacted employees. Second quarter operating income was $9.4 billion, representing a 29% operating margin.

Meta Platforms Q2 2023 adjusted earnings per share is expected to be $2.95 per Trefis analysis, 1% above the consensus estimate of $2.91. The company's adjusted net income decreased by 41% y-o-y ...

Jul 26, 2023 7:35AM EDT. Credit: creativeneko / stock.adobe.com. A mid the recent surge in tech stocks, Meta Platforms ( META) stock has been on an absolute tear, skyrocketing 120% over the past ...

July 26, 2023 1:25pm. Meta's Mark Zuckerberg Tobias Hase/picture alliance/Getty Images. Meta reported total revenue of $32 billion, an increase of 11 percent year-over-year and at the top end of ...

Meta Platforms, Inc. (Nasdaq: META) today reported financial results for the quarter ended March 31, 2023. "We had a good quarter and our community continues to grow," said Mark Zuckerberg, Meta founder and CEO. "Our AI work is driving good results across our apps and business. We're also becoming more efficient so we can build better products faster and put ourselves in a stronger position to ...

Meta Platforms META is set to report its second-quarter 2023 results on Jul 26. Meta expects total revenues between $29.5 billion and $32 billion for the second quarter of 2023.

Summary. Meta Platforms is set to report its Q2 2023 results, with analysts expecting revenue of $31.0B, representing YoY growth of ~7.6%, and EPS of $2.89, representing ~17% YoY growth. The ...

The Facebook and Instagram parent is expected to report revenue of $38.37 billion, according to estimates compiled by Visible Alpha, about a 20% rise from a year ago. Net income is projected to be ...

Free cash flow was $10.96 billion in the second quarter of 2023. Long-term debt - Long-term debt was $18.38 billion as of June 30, 2023. Headcount - Headcount was 71,469 as of June 30, 2023, a ...

Meta Platforms (META) Earnings Date and Reports 2024

Earnings for SLM are expected to grow by 6.01% in the coming year, from $2.83 to $3.00 per share. SLM has not formally confirmed its next earnings publication date, but the company's estimated earnings date is Wednesday, October 23rd, 2024 based off prior year's report dates.

Meta Platforms, Inc. (Nasdaq: META) today reported financial results for the quarter and full year ended December 31, 2023. "We had a good quarter as our community and business continue to grow," said Mark Zuckerberg, Meta founder and CEO. "We've made a lot of progress on our vision for advancing AI and the metaverse." Fourth Quarter and Full Year 2023 Financial Highlights Three Months Ended ...

Nvidia reported second fiscal-quarter earnings Wednesday after the bell.

Meta Platforms, Inc. (Nasdaq: META) today reported financial results for the quarter ended September 30, 2023. "We had a good quarter for our community and business," said Mark Zuckerberg, Meta founder and CEO. "I'm proud of the work our teams have done to advance AI and mixed reality with the launch of Quest 3, Ray-Ban Meta smart glasses, and our AI studio." Third Quarter 2023 Financial ...

For Q2, the EPS result was a modest 6.25% above the consensus, far from the breakthrough "mic drop" moment the company delivered last year when it blew away earnings estimates by 29%.

Q2 Earnings Beat, Sales Miss Estimates Sarepta posted earnings of 7 cents per share in second-quarter 2024, beating the Zacks Consensus Estimate of breakeven earnings. In the year-ago period, the ...