Information

- Author Services

Initiatives

You are accessing a machine-readable page. In order to be human-readable, please install an RSS reader.

All articles published by MDPI are made immediately available worldwide under an open access license. No special permission is required to reuse all or part of the article published by MDPI, including figures and tables. For articles published under an open access Creative Common CC BY license, any part of the article may be reused without permission provided that the original article is clearly cited. For more information, please refer to https://www.mdpi.com/openaccess .

Feature papers represent the most advanced research with significant potential for high impact in the field. A Feature Paper should be a substantial original Article that involves several techniques or approaches, provides an outlook for future research directions and describes possible research applications.

Feature papers are submitted upon individual invitation or recommendation by the scientific editors and must receive positive feedback from the reviewers.

Editor’s Choice articles are based on recommendations by the scientific editors of MDPI journals from around the world. Editors select a small number of articles recently published in the journal that they believe will be particularly interesting to readers, or important in the respective research area. The aim is to provide a snapshot of some of the most exciting work published in the various research areas of the journal.

Original Submission Date Received: .

- Active Journals

- Find a Journal

- Proceedings Series

- For Authors

- For Reviewers

- For Editors

- For Librarians

- For Publishers

- For Societies

- For Conference Organizers

- Open Access Policy

- Institutional Open Access Program

- Special Issues Guidelines

- Editorial Process

- Research and Publication Ethics

- Article Processing Charges

- Testimonials

- Preprints.org

- SciProfiles

- Encyclopedia

Article Menu

- Subscribe SciFeed

- Recommended Articles

- Google Scholar

- on Google Scholar

- Table of Contents

Find support for a specific problem in the support section of our website.

Please let us know what you think of our products and services.

Visit our dedicated information section to learn more about MDPI.

JSmol Viewer

Mapping financial literacy: a systematic literature review of determinants and recent trends.

1. Introduction

2. data and methods, 3. bibliometric analysis, 4. mapping financial literacy—financial literacy determinants and outcomes, 5. trends in financial literacy literature, 5.1. financial literacy of the youth, 5.2. financial literacy and gender, 5.3. financial literacy and financial inclusion, 5.4. financial literacy and retirement planning, 6. financial literacy and technology, 6.1. financial literacy and digital finance, 6.2. digital financial literacy, 7. discussion, 8. conclusions, author contributions, conflicts of interest.

- OECD. OECD/INFE 2020 International Survey of Adult Financial Literacy. 2020. Available online: www.oecd.org/financial/education/launchoftheoecdinfeglobalfinancialliteracysurveyreport.htm (accessed on 10 October 2022).

- Lusardi, A.; Mitchell, O.S. The economic importance of financial literacy: Theory and evidence. J. Econ. Lit. 2014 , 52 , 5–44. [ Google Scholar ] [ CrossRef ] [ PubMed ] [ Green Version ]

- Huston, S.J. Measuring financial literacy. J. Consum. Aff. 2010 , 44 , 296–316. [ Google Scholar ] [ CrossRef ]

- U.S. Financial Literacy and Education Commission. U.S. National Strategy for Financial Literacy 2020, U.S. Department of the Treasury. 2020. Available online: https://home.treasury.gov/policy-issues/consumer-policy/financial-literacy-and-education-commission (accessed on 28 November 2022).

- Nicolini, G.; Haupt, M. The assessment of financial literacy: New evidence from Europe. Int. J. Financ. Stud. 2019 , 7 , 54. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Klapper, L.; Lusardi, A.; Van Oudheusden, P. Financial literacy around the world. World Bank 2015 , 2 , 218–237. [ Google Scholar ]

- Pașa, A.T.; Picatoste, X.; Gherghina, E.M. Financial Literacy and Economic Growth: How Eastern Europe is Doing? Economics 2022 , 16 , 27–42. [ Google Scholar ] [ CrossRef ]

- Grohmann, A.; Klühs, T.; Menkhoff, L. Does financial literacy improve financial inclusion? Cross country evidence. World Dev. 2018 , 111 , 84–96. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- French, D.; McKillop, D. Financial literacy and over-indebtedness in low-income households. Int. Rev. Financ. Anal. 2016 , 48 , 1–11. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Fernandes, D.; Lynch, J.G., Jr.; Netemeyer, R.G. Financial literacy, financial education, and downstream financial behaviors. Manag. Sci. 2014 , 60 , 1861–1883. [ Google Scholar ] [ CrossRef ]

- Goyal, K.; Kumar, S. Financial literacy: A systematic review and bibliometric analysis. Int. J. Consum. Stud. 2020 , 45 , 80–105. [ Google Scholar ] [ CrossRef ]

- Xiao, Y.; Watson, M. Guidance on conducting a systematic literature review. J. Plan. Educ. Res. 2019 , 39 , 93–112. [ Google Scholar ] [ CrossRef ]

- Ajzen, I. The theory of planned behavior. Organ. Behave. Human Decis. Process. 1991 , 50 , 179–211. [ Google Scholar ] [ CrossRef ]

- Chen, H.; Volpe, R.P. An analysis of personal financial literacy among college students. Financ. Serv. Rev. 1998 , 7 , 107–128. [ Google Scholar ] [ CrossRef ]

- Bernheim, B.D.; Garrett, D.M.; Maki, D.M. Education and saving: The long-term effects of high school financial curriculum mandates. J. Public Econ. 2001 , 80 , 435–465. [ Google Scholar ] [ CrossRef ]

- Barber, B.M.; Odean, T. Boys will be boys: Gender, overconfidence, and common stock investment. Q. J. Econ. 2001 , 116 , 261–292. [ Google Scholar ] [ CrossRef ]

- Campbell, J.Y. Household finance. J. Financ. 2006 , 61 , 1553–1604. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Lusardi, A.; Mitchell, O.S. Baby boomer retirement security: The roles of planning, financial literacy, and housing wealth. J. Monet. Econ. 2007 , 54 , 205–224. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Lusardi, A.; Mitchell, O.S. Financial Literacy and Retirement Preparedness: Evidence and Implications for Financial Education. Bus. Econ. 2007 , 42 , 35–44. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Lusardi, A.; Mitchell, O.S. Planning and financial literacy: How do women fare? Am. Econ. Rev. 2008 , 98 , 413–417. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Hilgert, M.A.; Hogarth, J.M.; Beverly, S.G. Household financial management: The connection between knowledge and behavior. Fed. Res. Bull. 2003 , 89 , 309–322. [ Google Scholar ]

- Bernheim, B.D.; Garrett, D.M. The effects of financial education in the workplace: Evidence from a survey of households. J. Public Econ. 2003 , 87 , 1487–1519. [ Google Scholar ] [ CrossRef ]

- Willis, L.E. Against financial-literacy education. Iowa L. Rev. 2008 , 94 , 197. [ Google Scholar ]

- Stango, V.; Zinman, J. Exponential growth bias and household finance. J. Financ. 2009 , 64 , 2807–2849. [ Google Scholar ] [ CrossRef ]

- Agarwal, S.; Driscoll, J.C.; Gabaix, X.; Laibson, D. The age of reason: Financial decisions over the life-cycle with implications for regulation. Brook. Pap. Econ. Act. 2009 , 40 , 51–118. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Mandell, L.; Klein, L.S. The impact of financial literacy education on subsequent financial behavior. J. Financ. Couns. Plan. 2009 , 20 , 15–24. [ Google Scholar ]

- Lusardi, A.; Tufano, P. Debt Literacy, Financial Experiences and over Indebtedness. 2009. Available online: https://www.nber.org/papers/w14808 (accessed on 28 November 2022).

- Lusardi, A.; Mitchell, O.S. Financial literacy around the world: An overview. J. Pension Econ. Financ. 2011 , 10 , 497–508. [ Google Scholar ] [ CrossRef ] [ PubMed ] [ Green Version ]

- Lusardi, A.; Mitchell, O.S. Financial literacy and retirement planning in the United States. J. Pension Econ. Financ. 2011 , 10 , 509–525. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Van Rooij, M.; Lusardi, A.; Alessie, R. Financial literacy and stock market participation. J. Financ. Econ. 2011 , 101 , 449–472. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Sekita, S. Financial literacy and retirement planning in Japan. J. Pension Econ. Financ. 2011 , 10 , 637–656. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Cole, S.; Sampson, T.; Zia, B. Prices or knowledge? What drives demand for financial services in emerging markets? J. Finance. 2011 , 66 , 1933–1967. [ Google Scholar ] [ CrossRef ]

- Alessie, R.; Van Rooij, M.; Lusardi, A. Financial literacy and retirement preparation in the Netherlands. J. Pension Econ. Financ. 2011 , 10 , 527–545. [ Google Scholar ] [ CrossRef ]

- Bucher-Koenen, T.; Lusardi, A. Financial literacy and retirement planning in Germany. J. Pension Econ. Financ. 2011 , 10 , 565–584. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Klapper, L.; Panos, G.A. Financial literacy and retirement planning: The Russian case. J. Pension Econ. Financ. 2011 , 10 , 599–618. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Fornero, E.; Monticone, C. Financial literacy and pension plan participation in Italy. J. Pension Econ. Financ. 2011 , 10 , 547–564. [ Google Scholar ] [ CrossRef ]

- Van Rooij, M.C.; Lusardi, A.; Alessie, R.J. Financial literacy and retirement planning in the Netherlands. J. Econ. Psychol. 2011 , 32 , 593–608. [ Google Scholar ] [ CrossRef ]

- Lusardi, A.; Mitchell, O.S. Financial literacy and planning: Implications for retirement wellbeing. Natl. Bur. Econ. Res. 2011 , w17078. [ Google Scholar ] [ CrossRef ]

- Lusardi, A.; Mitchell, O.S.; Curto, V. Financial literacy among the young. J. Consum. Aff. 2010 , 44 , 358–380. [ Google Scholar ] [ CrossRef ]

- Remund, D.L. Financial literacy explicated: The case for a clearer definition in an increasingly complex economy. J. Consum. Aff. 2010 , 44 , 276–295. [ Google Scholar ] [ CrossRef ]

- Christelis, D.; Jappelli, T.; Padula, M. Cognitive abilities and portfolio choice. Eur. Econ. Rev. 2010 , 54 , 18–38. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Shim, S.; Barber, B.L.; Card, N.A.; Xiao, J.J.; Serido, J. Financial socialization of first-year college students: The roles of parents, work, and education. J. Youth Adolesc. 2010 , 39 , 1457–1470. [ Google Scholar ] [ CrossRef ]

- Jappelli, T. Economic literacy: An international comparison. Econ. J. 2010 , 120 , 429–451. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Van Rooij, M.C.; Lusardi, A.; Alessie, R.J. Financial literacy, retirement planning and household wealth. Econ. J. 2012 , 122 , 449–478. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Behrman, J.R.; Mitchell, O.S.; Soo, C.K.; Bravo, D. How financial literacy affects household wealth accumulation. Am. Econ. Rev. 2012 , 102 , 300–304. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Atkinson, A.; Messy, F.A. Measuring financial literacy: Results of the OECD/International Network on Financial Education (INFE) pilot study. OECD Work. Pap. Financ. Insur. Priv. Pensions 2012 , 15. [ Google Scholar ] [ CrossRef ]

- Fonseca, R.; Mullen, K.J.; Zamarro, G.; Zissimopoulos, J. What explains the gender gap in financial literacy? The role of household decision making. J. Consum. Aff. 2012 , 46 , 90–106. [ Google Scholar ] [ CrossRef ] [ PubMed ] [ Green Version ]

- Hastings, J.S.; Madrian, B.C.; Skimmyhorn, W.L. Financial literacy, financial education, and economic outcomes. Annu. Rev. Econ. 2013 , 5 , 347–373. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Jappelli, T.; Padula, M. Investment in financial literacy and saving decisions. J. Bank. Financ. 2013 , 37 , 2779–2792. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Klapper, L.; Lusardi, A.; Panos, G.A. Financial literacy and its consequences: Evidence from Russia during the financial crisis. J. Bank. Financ. 2013 , 37 , 3904–3923. [ Google Scholar ] [ CrossRef ]

- Disney, R.; Gathergood, J. Financial literacy and consumer credit portfolios. J. Bank. Financ. 2013 , 37 , 2246–2254. [ Google Scholar ] [ CrossRef ]

- Lusardi, A.; Tufano, P. Debt literacy, financial experiences, and overindebtedness. J. Pension Econ. Financ. 2015 , 14 , 332–368. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Almenberg, J.; Dreber, A. Gender, stock market participation and financial literacy. Econ. Lett. 2015 , 137 , 140–142. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Calcagno, R.; Monticone, C. Financial literacy and the demand for financial advice. J. Bank. Financ. 2015 , 50 , 363–380. [ Google Scholar ] [ CrossRef ]

- Allgood, S.; Walstad, W.B. The effects of perceived and actual financial literacy on financial behaviors. Econ. Inq. 2016 , 54 , 675–697. [ Google Scholar ] [ CrossRef ]

- Gaudecker, H.M.V. How does household portfolio diversification vary with financial literacy and financial advice? J. Financ. 2015 , 70 , 489–507. [ Google Scholar ] [ CrossRef ]

- Lusardi, A.; Michaud, P.C.; Mitchell, O.S. Optimal financial knowledge and wealth inequality. J. Political Econ. 2017 , 125 , 431–477. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Bucher-Koenen, T.; Lusardi, A.; Alessie, R.; Van Rooij, M. How financially literate are women? An overview and new insights. J. Consum. Aff. 2017 , 51 , 255–283. [ Google Scholar ] [ CrossRef ]

- Stolper, O.A.; Walter, A. Financial literacy, financial advice, and financial behavior. J. Bus. Econ. 2017 , 87 , 581–643. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Lusardi, A.; Mitchell, O.S. How ordinary consumers make complex economic decisions: Financial literacy and retirement readiness. Q. J. Financ. 2017 , 7 , 1750008. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Drexler, A.; Fischer, G.; Schoar, A. Keeping it simple: Financial literacy and rules of thumb. Am. Econ. J. Appl. Econ. 2014 , 6 , 1–31. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Kaiser, T.; Menkhoff, L. Does financial education impact financial literacy and financial behavior, and if so, when? World Bank Econ. Rev. 2017 , 31 , 611–630. [ Google Scholar ] [ CrossRef ]

- Servon, L.J.; Kaestner, R. Consumer financial literacy and the impact of online banking on the financial behavior of lower-income bank customers. J. Consum. Aff. 2008 , 42 , 271–305. [ Google Scholar ] [ CrossRef ]

- Gathergood, J. Self-control, financial literacy and consumer over-indebtedness. J. Econ. Psychol. 2012 , 33 , 590–602. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Grohmann, A.; Kouwenberg, R.; Menkhoff, L. Childhood roots of financial literacy. J. Econ. Psychol. 2015 , 51 , 114–133. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Sohn, S.H.; Joo, S.H.; Grable, J.E.; Lee, S.; Kim, M. Adolescents’ financial literacy: The role of financial socialization agents, financial experiences, and money attitudes in shaping financial literacy among South Korean youth. J. Adolesc. 2012 , 35 , 969–980. [ Google Scholar ] [ CrossRef ] [ PubMed ]

- Skagerlund, K.; Lind, T.; Strömbäck, C.; Tinghög, G.; Västfjäll, D. Financial literacy and the role of numeracy–How individuals’ attitude and affinity with numbers influence financial literacy. J. Behav. Exp. Econ. 2018 , 74 , 18–25. [ Google Scholar ] [ CrossRef ]

- Atkinson, A.; Messy, F.A. Assessing financial literacy in 12 countries: An OECD/INFE international pilot exercise. J. Pension Econ. Financ. 2011 , 10 , 657–665. [ Google Scholar ] [ CrossRef ]

- Murendo, C.; Mutsonziwa, K. Financial literacy and savings decisions by adult financial consumers in Zimbabwe. Int. J. Consum. Stud. 2017 , 41 , 95–103. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Almenberg, J.; Säve-Söderbergh, J. Financial literacy and retirement planning in Sweden. J. Pension Econ. Financ. 2011 , 10 , 585–598. [ Google Scholar ] [ CrossRef ]

- Crossan, D.; Feslier, D.; Hurnard, R. Financial literacy and retirement planning in New Zealand. J. Pension Econ. Financ. 2011 , 10 , 619–635. [ Google Scholar ] [ CrossRef ]

- Lusardi, A.; Mitchell, O.S. Financial literacy and retirement planning: New evidence from the Rand American Life Panel. Mich. Retire. Res. Cent. Res. Pap. 2007 , 157 . [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Lusardi, A.; Mitchell, O.S.; Curto, V. Financial literacy and financial sophistication in the older population. J. Pension Econ. Financ. 2014 , 13 , 347–366. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Ali, A.; Rahman, M.S.A.; Bakar, A. Financial satisfaction and the influence of financial literacy in Malaysia. Soc. Indic. Res. 2015 , 120 , 137–156. [ Google Scholar ] [ CrossRef ]

- Kadoya, Y.; Khan, M.S.R. What determines financial literacy in Japan? J. Pension Econ. Financ. 2020 , 19 , 353–371. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Garg, N.; Singh, S. Financial literacy among youth. Int. J. Soc. Econ. 2018 , 45 , 173–186. [ Google Scholar ] [ CrossRef ]

- Finke, M.S.; Howe, J.S.; Huston, S.J. Old age and the decline in financial literacy. Manag. Sci. 2017 , 63 , 213–230. [ Google Scholar ] [ CrossRef ]

- Boisclair, D.; Lusardi, A.; Michaud, P.C. Financial literacy and retirement planning in Canada. J. Pension Econ. Financ. 2017 , 16 , 277–296. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Bannier, C.E.; Neubert, M. Gender differences in financial risk taking: The role of financial literacy and risk tolerance. Econ. Lett. 2016 , 145 , 130–135. [ Google Scholar ] [ CrossRef ]

- Klapper, L.; Lusardi, A. Financial literacy and financial resilience: Evidence from around the world. Financ. Manag. 2020 , 49 , 589–614. [ Google Scholar ] [ CrossRef ]

- Xiao, J.J.; Porto, N. Financial education and financial satisfaction: Financial literacy, behavior, and capability as mediators. Int. J. Bank Mark. 2017 , 35 , 805–817. [ Google Scholar ] [ CrossRef ]

- Lusardi, A.; Samek, A.; Kapteyn, A.; Glinert, L.; Hung, A.; Heinberg, A. Visual tools and narratives: New ways to improve financial literacy. J. Pension Econ. Financ. 2017 , 16 , 297–323. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Meier, S.; Sprenger, C.D. Discounting financial literacy: Time preferences and participation in financial education programs. J. Econ. Behav. Organ. 2013 , 95 , 159–174. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Hastings, J.; Mitchell, O.S. How financial literacy and impatience shape retirement wealth and investment behaviors. J. Pension Econ. Financ. 2020 , 19 , 1–20. [ Google Scholar ] [ CrossRef ] [ PubMed ] [ Green Version ]

- Monticone, C. How much does wealth matter in the acquisition of financial literacy? J. Consum. Aff. 2010 , 44 , 403–422. [ Google Scholar ] [ CrossRef ]

- Brown, M.; Henchoz, C.; Spycher, T. Culture and financial literacy: Evidence from a within-country language border. J. Econ. Behav. Organ. 2018 , 150 , 62–85. [ Google Scholar ] [ CrossRef ]

- Jorgensen, B.L.; Savla, J. Financial literacy of young adults: The importance of parental socialization. Fam. Relat. 2010 , 59 , 465–478. [ Google Scholar ] [ CrossRef ]

- Ward, A.F.; Lynch, J.G., Jr. On a need-to-know basis: How the distribution of responsibility between couples shapes financial literacy and financial outcomes. J. Consum. Res. 2019 , 45 , 1013–1036. [ Google Scholar ] [ CrossRef ]

- James, B.D.; Boyle, P.A.; Bennett, J.S.; Bennett, D.A. The impact of health and financial literacy on decision making in community-based older adults. Gerontology 2012 , 58 , 531–539. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Bennett, J.S.; Boyle, P.A.; James, B.D.; Bennett, D.A. Correlates of health and financial literacy in older adults without dementia. BMC Geriatr. 2012 , 12 , 1–9. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Anderson, A.; Baker, F.; Robinson, D.T. Precautionary savings, retirement planning and misperceptions of financial literacy. J. Financ. Econ. 2017 , 126 , 383–398. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Abreu, M.; Mendes, V. Financial literacy and portfolio diversification. Quant. Financ. 2010 , 10 , 515–528. [ Google Scholar ] [ CrossRef ]

- Liao, L.; Xiao, J.J.; Zhang, W.; Zhou, C. Financial literacy and risky asset holdings: Evidence from China. Account. Financ. 2017 , 57 , 1383–1415. [ Google Scholar ] [ CrossRef ]

- Finlayson, A. Financialisation, financial literacy and asset-based welfare. Br. J. Politics Int. Relat. 2009 , 11 , 400–421. [ Google Scholar ] [ CrossRef ]

- Sevim, N.; Temizel, F.; Sayılır, Ö. The effects of financial literacy on the borrowing behavior of Turkish financial consumers. Int. J. Consum. Stud. 2012 , 36 , 573–579. [ Google Scholar ] [ CrossRef ]

- Chu, Z.; Wang, Z.; Xiao, J.J.; Zhang, W. Financial literacy, portfolio choice and financial well-being. Soc. Indic. Res. 2017 , 132 , 799–820. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Bianchi, M. Financial literacy and portfolio dynamics. J. Financ. 2018 , 73 , 831–859. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Bucher-Koenen, T.; Ziegelmeyer, M. Once burned, twice shy? Financial literacy and wealth losses during the financial crisis. Rev. Financ. 2014 , 18 , 2215–2246. [ Google Scholar ] [ CrossRef ]

- Huston, S.J. Financial literacy and the cost of borrowing. Int. J. Consum. Stud. 2012 , 36 , 566–572. [ Google Scholar ] [ CrossRef ]

- Moreno-Herrero, D.; Salas-Velasco, M.; Sánchez-Campillo, J. Factors that influence the level of financial literacy among young people: The role of parental engagement and students’ experiences with money matters. Child. Youth Serv. Rev. 2018 , 95 , 334–351. [ Google Scholar ] [ CrossRef ]

- Breitbach, E.; Walstad, W.B. Financial literacy and financial behavior among young adults in the United States. In Economic Competence and Financial Literacy of Young Adults—Status and Challenges ; Verlag Barbara Budrich: Leverkusen, Germany, 2016; pp. 81–100. [ Google Scholar ]

- Folke, T.; Gjorgjiovska, J.; Paul, A.; Jakob, L.; Ruggeri, K. Asset: A new measure of economic and financial literacy. Eur. J. Psychol. Assess. 2021 , 37 , 65–80. [ Google Scholar ] [ CrossRef ]

- Caplinska, A.; Ohotina, A. Analysis of financial literacy tendencies with young people. Entrep. Sustain. Issues 2019 , 6 , 1736–1749. [ Google Scholar ] [ CrossRef ]

- Taft, M.K.; Hosein, Z.Z.; Mehrizi, S.M.T.; Roshan, A. The relation between financial literacy, financial wellbeing and financial concerns. Int. J. Bus. Manag. 2013 , 8 , 63–75. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Shim, S.; Serido, J.; Tang, C.; Card, N. Socialization processes and pathways to healthy financial development for emerging young adults. J. Appl. Dev. Psychol. 2015 , 38 , 29–38. [ Google Scholar ] [ CrossRef ]

- Abdullah, N.; Fazli, S.M.; Muhammad Arif, A.M. The Relationship between Attitude towards Money, Financial Literacy and Debt Management with Young Worker’s Financial Well-being. Pertanika J. Soc. Sci. Humanit. 2019 , 27 , 361–378. [ Google Scholar ]

- Mata, O. The effect of financial literacy and gender on retirement planning among young adults. Int. J. Bank Mark. 2021 , 39 , 1068–1090. [ Google Scholar ] [ CrossRef ]

- Munyuki, T.; Jonah, C.M.P. The nexus between financial literacy and entrepreneurial success among young entrepreneurs from a low-income community in Cape Town: A mixed-method analysis. J. Entrep. Emerg. Econ. 2021 , 14 , 137–157. [ Google Scholar ] [ CrossRef ]

- Bilal, M.A.; Khan, H.H.; Irfan, M.; Ul Haq, S.M.; Ali, M.; Kakar, A.; Ahmed, W.; Rauf, A. Influence of Financial Literacy and Educational Skills on Entrepreneurial Intent: Empirical Evidence from Young Entrepreneurs of Pakistan. J. Asian Financ. Econ. Bus. 2021 , 8 , 697–710. [ Google Scholar ]

- Gathergood, J.; Weber, J. Financial literacy, present bias and alternative mortgage products. J. Bank. Financ. 2017 , 78 , 58–83. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Lusardi, A.; Tufano, P. Teach workers about the perils of debt. Harv. Bus. Rev. 2009 , 87 , 22–24. [ Google Scholar ]

- Van Rooij, M.; Lusardi, A.; Alessie, R. Financial Literacy and Stock Market Participation. National Bureau of Economic Research. 2007. Available online: https://www.nber.org/papers/w13565 (accessed on 18 December 2007).

- Hastings, J.S.; Tejeda-Ashton, L. Financial literacy, information, and demand elasticity: Survey and experimental evidence from Mexico. Natl. Bur. Econ. Res. 2008 , w14538. [ Google Scholar ] [ CrossRef ]

- Lusardi, A. Financial literacy and financial education: Review and policy implications. NFI Policy Brief 2006 , 2006-PB , 11. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Dundure, E.; Sloka, B. Financial Literacy Self-Evaluation of Young People in Latvia. Eur. Integr. Stud. 2021 , 15 , 160–169. [ Google Scholar ] [ CrossRef ]

- Fletschner, D.; Mesbah, D. Gender disparity in access to information: Do spouses share what they know? World Dev. 2011 , 39 , 1422–1433. [ Google Scholar ] [ CrossRef ]

- Chen, H.; Volpe, R.P. Gender differences in personal financial literacy among college students. Financ. Serv. Rev. 2002 , 11 , 289–307. [ Google Scholar ]

- Siegfried, C.; Wuttke, E. What Influences the Financial Literacy of Young Adults? A Combined Analysis of Socio-Demographic Characteristics and Delay of Gratification. Front. Psychol. 2021 , 12 , 5318. [ Google Scholar ] [ CrossRef ] [ PubMed ]

- Lučić, A.; Barbić, D.; Uzelac, M. The role of financial education in adolescent consumers’ financial knowledge enhancement. Market-Tržište 2020 , 32 , 115–130. [ Google Scholar ] [ CrossRef ]

- Shim, S.; Xiao, J.J.; Barber, B.L.; Lyons, A.C. Pathways to life success: A conceptual model of financial well-being for young adults. J. Appl. Dev. Psychol. 2009 , 30 , 708–723. [ Google Scholar ] [ CrossRef ]

- Bhatia, S.; Chawla, D.; Singh, S. Determinants of financial literacy of young adults: Testing the influence of parents and socio-demographic variables. Int. J. Indian Cult. Bus. Manag. 2021 , 22 , 256–271. [ Google Scholar ] [ CrossRef ]

- Pandey, A.; Ashta, A.; Spiegelman, E.; Sutan, A. Catch them young: Impact of financial socialization, financial literacy and attitude towards money on financial well-being of young adults. Int. J. Consum. Stud. 2020 , 44 , 531–541. [ Google Scholar ]

- Vijaykumar, J.H. The Association of Financial Socialization with Financial Self-Efficacy and Autonomy: A Study of Young Students in India. J. Fam. Econ. Issues 2022 , 43 , 397–414. [ Google Scholar ] [ CrossRef ]

- Bamforth, J.; Jebarajakirthy, C.; Geursen, G. Understanding undergraduates’ money management behaviour: A study beyond financial literacy. Int. J. Bank Mark. 2018 , 36 , 1285–1310. [ Google Scholar ] [ CrossRef ]

- Esmail Alekam, J.M. The effect of family, peer, behavior, saving and spending behavior on financial literacy among young generations. Int. J. Organ. Leadersh. 2018 , 7 , 309–323. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Pahlevan Sharif, S.; Ahadzadeh, A.S.; Turner, J.J. Gender differences in financial literacy and financial behaviour among young adults: The role of parents and information seeking. J. Fam. Econ. Issues 2020 , 41 , 672–690. [ Google Scholar ] [ CrossRef ]

- Zsoter, B. Examining the Financial Literacy of Young Adults. Public Financ. Q. 2018 , 63 , 39–54. [ Google Scholar ]

- Cwynar, A.; Cwynar, W.; Patena, W.; Sibanda, W. Young adults’ financial literacy and overconfidence bias in debt markets. Int. J. Bus. Perform. Manag. 2020 , 21 , 95–113. [ Google Scholar ] [ CrossRef ]

- Mancebon, M.J.; Ximénez-de-Embún, D.P.; Mediavilla, M.; Gómez-Sancho, J.M. Factors that influence the financial literacy of young Spanish consumers. Int. J. Consum. Stud. 2019 , 43 , 227–235. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Totenhagen, C.J.; Casper, D.M.; Faber, K.M.; Bosch, L.A.; Wiggs, C.B.; Borden, L.M. Youth financial literacy: A review of key considerations and promising delivery methods. J. Fam. Econ. Issues 2015 , 36 , 167–191. [ Google Scholar ] [ CrossRef ]

- Potrich, A.C.G.; Vieira, K.M.; Kirch, G. How well do women do when it comes to financial literacy? Proposition of an indicator and analysis of gender differences. J. Behav. Exp. Financ. 2018 , 17 , 28–41. [ Google Scholar ] [ CrossRef ]

- Lotto, J. Understanding sociodemographic factors influencing households’ financial literacy in Tanzania. Cogent Econ. Financ. 2020 , 8 , 1792152. [ Google Scholar ] [ CrossRef ]

- Rink, U.; Walle, Y.M.; Klasen, S. The financial literacy gender gap and the role of culture. Q. Rev. Econ. Financ. 2021 , 80 , 117–134. [ Google Scholar ] [ CrossRef ]

- Bahovec, V.; Barbić, D.; Palić, I. The regression analysis of individual financial performance: Evidence from Croatia. Business Systems Research. Int. J. Soc. Adv. Innov. Res. Econ. 2017 , 8 , 1–13. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Preston, A.C.; Wright, R.E. Understanding the gender gap in financial literacy: Evidence from Australia. Econ. Rec. 2019 , 95 , 1–29. [ Google Scholar ] [ CrossRef ]

- Driva, A.; Lührmann, M.; Winter, J. Gender differences and stereotypes in financial literacy: Off to an early start. Econ. Lett. 2016 , 146 , 143–146. [ Google Scholar ] [ CrossRef ]

- Agnew, S.; Cameron-Agnew, T. The influence of consumer socialisation in the home on gender differences in financial literacy. Int. J. Consum. Stud. 2015 , 39 , 630–638. [ Google Scholar ] [ CrossRef ]

- Bottazzi, L.; Lusardi, A. Stereotypes in financial literacy: Evidence from PISA. J. Corp. Financ. 2021 , 71 , 101831. [ Google Scholar ] [ CrossRef ]

- Longobardi, S.; Pagliuca, M.M.; Regoli, A. Can problem-solving attitudes explain the gender gap in financial literacy? Evidence from Italian students’ data. Qual. Quant. 2018 , 52 , 1677–1705. [ Google Scholar ] [ CrossRef ]

- Arellano, A.; Cámara, N.; Tuesta, D. Explaining the gender gap in financial literacy: The role of non-cognitive skills. Econ. Notes Rev. Bank. Financ. Monet. Econ. 2018 , 47 , 495–518. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Tinghög, G.; Ahmed, A.; Barrafrem, K.; Lind, T.; Skagerlund, K.; Västfjäll, D. Gender differences in financial literacy: The role of stereotype threat. J. Econ. Behav. Organ. 2021 , 192 , 405–416. [ Google Scholar ] [ CrossRef ]

- Kubak, M.; Gavurova, B.; Majcherova, N.; Nemec, J. Gender Differences in Rationality and Financial Literacy. Transform. Bus. Econ. 2021 , 20 , 558–571. [ Google Scholar ]

- Al-Bahrani, A.; Buser, W.; Patel, D. Early causes of financial disquiet and the gender gap in financial literacy: Evidence from college students in the Southeastern United States. J. Fam. Econ. Issues 2020 , 41 , 558–571. [ Google Scholar ] [ CrossRef ]

- Moon, C.S.; Ohk, K.; Choi, C. Gender differences in financial literacy among Chinese university students and the influential factors. Asian Women 2014 , 30 , 3–25. [ Google Scholar ]

- Yu, K.M.; Wu, A.M.; Chan, W.S.; Chou, K.L. Gender differences in financial literacy among Hong Kong workers. Educ. Gerontol. 2015 , 41 , 315–326. [ Google Scholar ] [ CrossRef ]

- Marinelli, N.; Mazzoli, C.; Palmucci, F. How does gender really affect investment behavior? Econ. Lett. 2017 , 151 , 58–61. [ Google Scholar ] [ CrossRef ]

- Cupák, A.; Fessler, P.; Schneebaum, A. Gender differences in risky asset behavior: The importance of self-confidence and financial literacy. Financ. Res. Lett. 2021 , 42 , 101880. [ Google Scholar ] [ CrossRef ]

- Bannier, C.; Meyll, T.; Röder, F.; Walter, A. The gender gap in ‘Bitcoin literacy’. J. Behav. Exp. Financ. 2019 , 22 , 129–134. [ Google Scholar ] [ CrossRef ]

- Chen, J.; Jiang, J.; Liu, Y.J. Financial literacy and gender difference in loan performance. J. Empir. Financ. 2018 , 48 , 307–320. [ Google Scholar ] [ CrossRef ]

- Meyll, T.; Pauls, T. The gender gap in over-indebtedness. Financ. Res. Lett. 2019 , 31 , 398–404. [ Google Scholar ] [ CrossRef ]

- Cwynar, A. Do women behave financially worse than men? Evidence from married and cohabiting couples. Cent. Eur. Bus. Rev. 2021 , 10 , 81–98. [ Google Scholar ] [ CrossRef ]

- Cupák, A.; Fessler, P.; Schneebaum, A.; Silgoner, M. Decomposing gender gaps in financial literacy: New international evidence. Econ. Lett. 2018 , 168 , 102–106. [ Google Scholar ] [ CrossRef ]

- Škreblin Kirbiš, I.; Vehovec, M.; Galić, Z. Relationship between financial satisfaction and financial literacy: Exploring gender differences. Društvena Istraživanja Časopis Za Opća Društvena Pitanja 2017 , 26 , 165–185. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Chhatwani, M.; Mishra, S.K. Financial fragility and financial optimism linkage during COVID-19: Does financial literacy matter? J. Behav. Exp. Econ. 2021 , 94 , 101751. [ Google Scholar ] [ CrossRef ]

- Furrebøe, E.F.; Nyhus, E.K. Financial self-efficacy, financial literacy, and gender: A review. J. Consum. Aff. 2022 , 56 , 743–765. [ Google Scholar ] [ CrossRef ]

- Adetunji, O.M.; David-West, O. The relative impact of income and financial literacy on financial inclusion in Nigeria. J. Int. Dev. 2019 , 31 , 312–335. [ Google Scholar ] [ CrossRef ]

- Morgan, P.J.; Long, T.Q. Financial literacy, financial inclusion, and savings behavior in Laos. J. Asian Econ. 2020 , 68 , 101197. [ Google Scholar ] [ CrossRef ]

- Ferrada, L.M.; Montaña, V. Inclusion and financial literacy: The case of higher education student workers in Los Lagos, Chile. Estud. Gerenc. 2022 , 38 , 211–221. [ Google Scholar ] [ CrossRef ]

- Rastogi, S.; Ragabiruntha, E. Financial inclusion and socioeconomic development: Gaps and solution. Int. J. Soc. Econ. 2018 , 45 , 1122–1140. [ Google Scholar ] [ CrossRef ]

- Mindra, R.; Moya, M. Financial self-efficacy: A mediator in advancing financial inclusion. Equal. Divers. Incl. Int. J. 2017 , 36 , 128–149. [ Google Scholar ] [ CrossRef ]

- Shen, Y.; Hueng, C.J.; Hu, W. Using digital technology to improve financial inclusion in China. Appl. Econ. Lett. 2020 , 27 , 30–34. [ Google Scholar ] [ CrossRef ]

- Hasan, M.; Le, T.; Hoque, A. How does financial literacy impact on inclusive finance? Financ. Innov. 2021 , 7 , 1–23. [ Google Scholar ] [ CrossRef ]

- Tinta, A.A.; Ouédraogo, I.M.; Al-Hassan, R.M. The micro determinants of financial inclusion and financial resilience in Africa. Afr. Dev. Rev. 2022 , 34 , 293–306. [ Google Scholar ] [ CrossRef ]

- Lyons, A.C.; Kass-Hanna, J. Financial inclusion, financial literacy and economically vulnerable populations in the Middle East and North Africa. Emerg. Mark. Financ. Trade 2021 , 57 , 2699–2738. [ Google Scholar ] [ CrossRef ]

- Koomson, I.; Villano, R.A.; Hadley, D. Intensifying financial inclusion through the provision of financial literacy training: A gendered perspective. Appl. Econ. 2020 , 52 , 375–387. [ Google Scholar ] [ CrossRef ]

- Geraldes, H.S.A.; Gama, A.P.M.; Augusto, M. Reaching Financial Inclusion: Necessary and Sufficient Conditions. Soc. Indic. Res. 2022 , 162 , 599–617. [ Google Scholar ] [ CrossRef ]

- Singh, A. Exploring demand-side barriers to credit uptake and financial inclusion. Int. J. Soc. Econ. 2021 , 48 , 898–913. [ Google Scholar ] [ CrossRef ]

- Bongomin, G.O.C.; Munene, J.C.; Ntayi, J.M.; Malinga, C.A. Nexus between financial literacy and financial inclusion: Examining the moderating role of cognition from a developing country perspective. Int. J. Bank Mark. 2018 , 36 , 1190–1212. [ Google Scholar ] [ CrossRef ]

- Liu, S.; Gao, L.; Latif, K.; Dar, A.A.; Zia-UR-Rehman, M.; Baig, S.A. The Behavioral Role of Digital Economy Adaptation in Sustainable Financial Literacy and Financial Inclusion. Front. Psychol. 2021 , 12 , 742118. [ Google Scholar ] [ CrossRef ]

- Ofosu-Mensah, A.J.; Attah-Botchwey, E.; Osei-Assibey, E.; Barnor, C. Financial inclusion and human development in frontier countries. Int. J. Financ. Econ. 2021 , 26 , 42–59. [ Google Scholar ] [ CrossRef ]

- Kodongo, O. Financial regulations, financial literacy, and financial inclusion: Insights from Kenya. Emerg. Mark. Financ. Trade 2018 , 54 , 2851–2873. [ Google Scholar ] [ CrossRef ]

- Agrawal, G.; Jain, P. Digital financial inclusion in India: A review. Behav. Financ. Decis. -Mak. Model. 2019 , 195–203. [ Google Scholar ] [ CrossRef ]

- Jonker, N.; Kosse, A. The interplay of financial education, financial inclusion and financial stability and the role of Big Tech. Contemp. Econ. Policy 2022 , 40 , 612–635. [ Google Scholar ] [ CrossRef ]

- Jungo, J.; Madaleno, M.; Botelho, A. Financial literacy and financial inclusion effects on stability and competitiveness indicators in the banking sector: Cross country evidence for Africa and the world. Glob. Econ. J. 2021 , 21 , 2150009. [ Google Scholar ] [ CrossRef ]

- Akpene, A.A.; Amidu, M.; Coffie, W.; Abor, J.Y. Financial literacy, financial inclusion and participation of individual on the Ghana stock market. Cogent Econ. Financ. 2022 , 10 , 2023955. [ Google Scholar ] [ CrossRef ]

- Didenko, I.V.; Vasylieva, T.A.; Osadcha, O.; Shymanska, K. The influence of the financial inclusion of the population on the level of illegally income in countries with different levels of economic development. Financ. Credit Act. Probl. Theory Pract. 2021 , 6 , 268–276. [ Google Scholar ]

- Sarpong-Kumankoma, E. Financial literacy and retirement planning in Ghana. Rev. Behav. Finance. 2023 , 15 , 103–118. [ Google Scholar ] [ CrossRef ]

- Niu, G.; Zhou, Y. Financial literacy and retirement planning: Evidence from China. Appl. Econ. Lett. 2018 , 25 , 619–623. [ Google Scholar ] [ CrossRef ]

- Niu, G.; Zhou, Y.; Gan, H. Financial literacy and retirement preparation in China. Pac. -Basin Financ. J. 2020 , 59 , 101262. [ Google Scholar ] [ CrossRef ]

- Kalmi, P.; Ruuskanen, O.P. Financial literacy and retirement planning in Finland. J. Pension Econ. Financ. 2018 , 17 , 335–362. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Tan, S.; Singaravelloo, K. Financial literacy and retirement planning among government officers in Malaysia. Int. J. Public Adm. 2020 , 43 , 486–498. [ Google Scholar ] [ CrossRef ]

- Yeh, T.M. An empirical study on how financial literacy contributes to preparation for retirement. J. Pension Econ. Financ. 2022 , 21 , 237–259. [ Google Scholar ] [ CrossRef ]

- Nguyen, T.A.N.; Polách, J.; Vozňáková, I. The role of financial literacy in retirement investment choice. Equilib. Q. J. Econ. Econ. Policy 2019 , 14 , 569–589. [ Google Scholar ] [ CrossRef ]

- Sun, R.; Zhang, H.; Turvey, C.G.; Xiong, X. Impact of Financial Literacy on Retirement Financial Portfolio: Evidence from China. Asian Econ. J. 2021 , 35 , 390–412. [ Google Scholar ] [ CrossRef ]

- Clark, R.; Lusardi, A.; Mitchell, O.S. Financial knowledge and 401 (k) investment performance: A case study. J. Pension Econ. Financ. 2017 , 16 , 324–347. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Kristjanpoller, W.D.; Olson, J.E. The effect of financial knowledge and demographic variables on passive and active investment in Chile’s pension plan. J. Pension Econ. Financ. 2015 , 14 , 293–314. [ Google Scholar ] [ CrossRef ]

- Chua, S.M.; Chin, P.N. What drives working adults to be better prepared for their retirements? Manag. Financ. 2022 , 48 , 1317–1333. [ Google Scholar ] [ CrossRef ]

- Fernández-López, S.; Otero, L.; Vivel, M.; Rodeiro, D. What Are the Driving Forces of Individuals’ Retirement Savings? Financ. A Uver Czech J. Econ. Financ. 2010 , 60 , 226–251. [ Google Scholar ]

- Ricci, O.; Caratelli, M. Financial literacy, trust and retirement planning. J. Pension Econ. Financ. 2017 , 16 , 43–64. [ Google Scholar ] [ CrossRef ]

- Koh, B.S.; Mitchell, O.S.; Fong, J.H. Trust and retirement preparedness: Evidence from Singapore. J. Econ. Ageing 2021 , 18 , 100283. [ Google Scholar ] [ CrossRef ]

- Fang, J.; Hao, W.; Reyers, M. Financial advice, financial literacy and social interaction: What matters to retirement saving decisions? Appl. Econ. 2022 , 54 , 1–24. [ Google Scholar ] [ CrossRef ]

- Angrisani, M.; Casanova, M. What you think you know can hurt you: Under/over confidence in financial knowledge and preparedness for retirement. J. Pension Econ. Financ. 2021 , 20 , 516–531. [ Google Scholar ] [ CrossRef ]

- Clark, R.; Lusardi, A.; Mitchell, O.S. Employee financial literacy and retirement plan behavior: A case study. Econ. Inq. 2017 , 55 , 248–259. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Holland, J.H.; Goodman, D.; Stich, B. Defined contribution plans emerging in the public sector: The manifestation of defined contributions and the effects of workplace financial literacy education. Rev. Public Pers. Adm. 2008 , 28 , 367–384. [ Google Scholar ] [ CrossRef ]

- Mahdzan, N.S.; Mohd-Any, A.A.; Chan, M.K. The influence of financial literacy, risk aversion and expectations on retirement planning and portfolio allocation in Malaysia. Gadjah Mada Int. J. Bus. 2017 , 19 , 267–288. [ Google Scholar ] [ CrossRef ]

- Nguyen, L.T.M.; Nguyen, P.T.; Tran, Q.N.N.; Trinh, T.T.G. Why does subjective financial literacy hinder retirement saving? The mediating roles of risk tolerance and risk perception. Rev. Behav. Financ. 2022 , 14 , 627–645. [ Google Scholar ] [ CrossRef ]

- Park, H.; Martin, W. Effects of risk tolerance, financial literacy, and financial status on retirement planning. J. Financ. Serv. Mark. 2022 , 27 , 167–176. [ Google Scholar ] [ CrossRef ]

- OECD (2022), OECD/INFE Toolkit for Measuring Financial Literacy and Financial Inclusion in 2022. Available online: https://www.oecd.org/finance/financial-education/toolkit-for-measuring-financial-literacy-and-financial-inclusion.htm (accessed on 10 August 2022).

- Prete, A.L. Digital and financial literacy as determinants of digital payments and personal finance. Econ. Lett. 2022 , 213 , 110378. [ Google Scholar ] [ CrossRef ]

- Andreou, P.C.; Anyfantaki, S. Financial literacy and its influence on internet banking behavior. Eur. Manag. J. 2021 , 39 , 658–674. [ Google Scholar ] [ CrossRef ]

- Meoli, M.; Rossi, A.; Vismara, S. Financial literacy and security-based crowdfunding. Corp. Gov. Int. Rev. 2022 , 30 , 27–54. [ Google Scholar ] [ CrossRef ]

- Mahdzan, N.S.; Sabri, M.F.; Husniyah, A.R.; Magli, A.S.; Chowdhury, N.T. Digital financial services usage and subjective financial well-being: Evidence from low-income households in Malaysia. Int. J. Bank Mark. 2022 . ahead of print . [ Google Scholar ] [ CrossRef ]

- Frimpong, S.E.; Agyapong, G.; Agyapong, D. Financial literacy, access to digital finance and performance of SMEs: Evidence From Central region of Ghana. Cogent Econ. Financ. 2022 , 10 , 2121356. [ Google Scholar ] [ CrossRef ]

- Thathsarani, U.S.; Jianguo, W. Do Digital Finance and the Technology Acceptance Model Strengthen Financial Inclusion and SME Performance? Information 2022 , 13 , 390. [ Google Scholar ] [ CrossRef ]

- Luo, Y.; Peng, Y.; Zeng, L. Digital financial capability and entrepreneurial performance. Int. Rev. Econ. Financ. 2021 , 76 , 55–74. [ Google Scholar ] [ CrossRef ]

- Luo, Y.; Zeng, L. Digital financial capabilities and household entrepreneurship. Econ. Political Stud. 2020 , 8 , 165–202. [ Google Scholar ] [ CrossRef ]

- Lin, A.; Peng, Y.; Wu, X. Digital finance and investment of micro and small enterprises: Evidence from China. China Econ. Rev. 2022 , 75 , 101846. [ Google Scholar ] [ CrossRef ]

- Guo, C.; Wang, X.; Yuan, G. Digital finance and the efficiency of household investment portfolios. Emerg. Mark. Financ. Trade 2022 , 58 , 2895–2909. [ Google Scholar ] [ CrossRef ]

- Lu, X.; Guo, J.; Zhou, H. Digital financial inclusion development, investment diversification, and household extreme portfolio risk. Account. Financ. 2021 , 61 , 6225–6261. [ Google Scholar ] [ CrossRef ]

- Li, J.; Wu, Y.; Xiao, J.J. The impact of digital finance on household consumption: Evidence from China. Econ. Model. 2020 , 86 , 317–326. [ Google Scholar ] [ CrossRef ] [ Green Version ]

- Hu, X.; Wang, Z.; Liu, J. The impact of digital finance on household insurance purchases: Evidence from micro data in China. Geneva Pap. Risk Insur. -Issues Pract. 2022 , 47 , 538–568. [ Google Scholar ] [ CrossRef ]

- Barik, R.; Sharma, P. Analyzing the progress and prospects of financial inclusion in India. J. Public Aff. 2019 , 19 , e1948. [ Google Scholar ] [ CrossRef ]

- Senou, M.M.; Ouattara, W.; Acclassato Houensou, D. Is there a bottleneck for mobile money adoption in WAEMU? Transnatl. Corp. Rev. 2019 , 11 , 143–156. [ Google Scholar ] [ CrossRef ]

- Hasan, R.; Ashfaq, M.; Parveen, T.; Gunardi, A. Financial inclusion–does digital financial literacy matter for women entrepreneurs? Int. J. Soc. Econ. 2022 . ahead of print . [ Google Scholar ] [ CrossRef ]

- Li, J.; Meyer-Cirkel, A. Promoting financial literacy through a digital platform: A pilot study in Luxembourg. Int. J. Financ. Econ. 2021 , 26 , 73–87. [ Google Scholar ] [ CrossRef ]

- Banciu, D.; Arulanandam, B.V.; Munhenga, T.; Ivascu, L. Digital financial literacy and microfinancing among underprivileged communities in Cambodia. Rom. J. Inform. Technol. Autom. Control 2022 , 32 , 77–92. [ Google Scholar ]

- Raidev, A.A.; Modhvadiya, T.; Sudra, P. An Analysis of Digital Financial Literacy among College Students. Pac. Bus. Rev. Int. 2020 , 13 , 32–40. [ Google Scholar ]

- Ravikumar, T.; Suresha, B.; Prakash, N.; Vazirani, K.; Krishna, T.A. Digital financial literacy among adults in India: Measurement and validation. Cogent Econ. Financ. 2022 , 10 , 2132631. [ Google Scholar ] [ CrossRef ]

- Kass-Hanna, J.; Lyons, A.C.; Liu, F. Building financial resilience through financial and digital literacy in South Asia and Sub-Saharan Africa. Emerg. Mark. Rev. 2022 , 51 , 100846. [ Google Scholar ] [ CrossRef ]

- Setiawan, M.; Effendi, N.; Santoso, T.; Dewi, V.I.; Sapulette, M.S. Digital financial literacy, current behavior of saving and spending and its future foresight. Econ. Innov. New Technol. 2022 , 31 , 320–338. [ Google Scholar ] [ CrossRef ]

- Tian, G. Influence of Digital Finance on Household Leverage Ratio from the Perspective of Consumption Effect and Income Effect. Sustainability 2022 , 14 , 16271. [ Google Scholar ] [ CrossRef ]

- Su, L.; Peng, Y.; Kong, R.; Chen, Q. Impact of e-commerce adoption on farmers’ participation in the digital financial market: Evidence from rural China. J. Theor. Appl. Electron. Commer. Res. 2021 , 16 , 1434–1457. [ Google Scholar ] [ CrossRef ]

- Divaeva, E.; Kukharenko, O.; Gizyatova, A. Considering susceptibility of individuals to digital finance as a factor of increasing its prosperity. Int. Rev. 2021 , 1–2 , 137–145. [ Google Scholar ] [ CrossRef ]

Click here to enlarge figure

| Top 10 Journals | Top 10 Authors | |||||

|---|---|---|---|---|---|---|

| Journal of Consumer Affairs | 34 | 3.18% | Lusardi A | 26 | 2.43% | |

| Journal of Pension Economics Finance | 34 | 3.18% | Mitchell OS | 18 | 1.68% | |

| International Journal of Consumer Studies | 25 | 2.33% | Kadoya Y | 15 | 1.40% | |

| International Journal of Bank Marketing | 22 | 2.05% | Khan MSR | 15 | 1.40% | |

| Sustainability | 22 | 2.05% | Bennett DA | 10 | 0.93% | |

| Managerial Finance | 20 | 1.87% | Boyle PA | 10 | 0.93% | |

| Frontiers in Psychology | 16 | 1.49% | Xiao JJ | 10 | 0.93% | |

| Journal of Family and Economic Issues | 14 | 1.31% | Bongomin GOC | 8 | 0.75% | |

| International Journal of Social economics | 13 | 1.21% | Cwynar A | 8 | 0.75% | |

| Journal of Behavioral and Experimental Finance | 13 | 1.21% | De Witte K | 7 | 0.65% | |

| University of Pennsylvania | 24 | 2.24% | USA | 294 | 27.45% | |

| George Washington University | 21 | 1.96% | China | 96 | 8.96% | |

| Hiroshima University | 14 | 1.31% | India | 80 | 7.47% | |

| University of London | 14 | 1.31% | Australia | 62 | 5.79% | |

| Monash University | 11 | 1.03% | England | 48 | 4.48% | |

| University of Massachusetts System | 11 | 1.03% | Italy | 48 | 4.48% | |

| University of Southern California | 11 | 1.03% | Malaysia | 47 | 4.39% | |

| University System of Ohio | 11 | 1.03% | Germany | 45 | 4.20% | |

| European Central Bank | 10 | 0.93% | Indonesia | 38 | 3.55% | |

| Ku Leuven | 10 | 0.93% | Japan | 34 | 3.18% | |

| The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

Share and Cite

Zaimovic, A.; Torlakovic, A.; Arnaut-Berilo, A.; Zaimovic, T.; Dedovic, L.; Nuhic Meskovic, M. Mapping Financial Literacy: A Systematic Literature Review of Determinants and Recent Trends. Sustainability 2023 , 15 , 9358. https://doi.org/10.3390/su15129358

Zaimovic A, Torlakovic A, Arnaut-Berilo A, Zaimovic T, Dedovic L, Nuhic Meskovic M. Mapping Financial Literacy: A Systematic Literature Review of Determinants and Recent Trends. Sustainability . 2023; 15(12):9358. https://doi.org/10.3390/su15129358

Zaimovic, Azra, Anes Torlakovic, Almira Arnaut-Berilo, Tarik Zaimovic, Lejla Dedovic, and Minela Nuhic Meskovic. 2023. "Mapping Financial Literacy: A Systematic Literature Review of Determinants and Recent Trends" Sustainability 15, no. 12: 9358. https://doi.org/10.3390/su15129358

Article Metrics

Article access statistics, further information, mdpi initiatives, follow mdpi.

Subscribe to receive issue release notifications and newsletters from MDPI journals

To read this content please select one of the options below:

Please note you do not have access to teaching notes, measuring financial literacy: a literature review.

Managerial Finance

ISSN : 0307-4358

Article publication date: 21 September 2020

Issue publication date: 28 January 2021

The purpose of this paper is to review the main methods used in the literature to measure financial literacy (FL) of individuals.

Design/methodology/approach

The paper begins by describing how the different items used to measure the FL level of individuals are constructed. Then, it focuses on how do researchers select the items. Finally, it reviews the different calculation methods used in the literature to assess the FL level.

FL as a concept is tough to define and measure. Several studies focus on the definition and the measure of this concept. Different items are used in the literature and are mostly related to the study topics. The used calculation methods differ across the different studies.

Originality/value

This paper sheds light on the principal methodologies used in the literature to measure FL. It highlights the relationship between the items' content areas and the studies' subjects. Thus, this paper suggests guidance for future studies on measuring methods of FL.

- Financial literacy

- Objective measures

- Content areas

- Study topics

- Literature review

Ouachani, S. , Belhassine, O. and Kammoun, A. (2021), "Measuring financial literacy: a literature review", Managerial Finance , Vol. 47 No. 2, pp. 266-281. https://doi.org/10.1108/MF-04-2019-0175

Emerald Publishing Limited

Copyright © 2020, Emerald Publishing Limited

Related articles

All feedback is valuable.

Please share your general feedback

Report an issue or find answers to frequently asked questions

Contact Customer Support

Financial Literacy and Financial Education: An Overview

This article provides a concise narrative overview of the rapidly growing empirical literature on financial literacy and financial education. We first discuss stylized facts on the demographic correlates of financial literacy. We next cover the evidence on the effects of financial literacy on financial behaviors and outcomes. Finally, we review the evidence on the causal effects of financial education programs focusing on randomized controlled trial evaluations. The article concludes with perspectives on future research priorities for both financial literacy and financial education.

We thank Luis Oberrauch for excellent research assistance and Allen N. Berger, Phil Molyneux, and John O.S. Wilson for helpful comments. All errors are our own. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research.

MARC RIS BibTeΧ

Download Citation Data

More from NBER

In addition to working papers , the NBER disseminates affiliates’ latest findings through a range of free periodicals — the NBER Reporter , the NBER Digest , the Bulletin on Retirement and Disability , the Bulletin on Health , and the Bulletin on Entrepreneurship — as well as online conference reports , video lectures , and interviews .

- DOI: 10.14784/JFRS.2014117326

- Corpus ID: 154502913

A LITERATURE REVIEW ON FINANCIAL LITERACY

- Selim Aren , S. Aydemir

- Published 1 July 2014

34 Citations

Financial literacy: literature review and research directions, financial literacy of entrepreneurs: a systematic review, is there a relationship between financial literacy and investment decisions in the kingdom of bahrain, financial literacy and investment behavior of salaried individuals : a case study of wolaita sodo town 1 mr ., an empirical study of the relationship between financial literacy andtolerance towards financial risk among entrepreneurs in bosnia and herzegovina (doi: 10.14706/icesos1713), some insights into financial literacy among undergraduate students: a case of bosnia and herzegovina, financial literacy and behavioural biases of individual investors: empirical evidence of pakistan stock exchange, analysis of financial literacy level among undergraduate students, financial literacy and risk tolerance towards saving and investment: a case study in malaysia, financial literacy and money management among the young, 35 references, financial literacy and investment decisions of uae investors, impact of financial literacy on access to financial services in kenya, determinants of university working-students’ financial literacy at the university of cape coast, ghana, student perceptions of financial literacy: relevance to practice.

- Highly Influential

Prices or Knowledge? What Drives Demand for Financial Services in Emerging Markets?

Financial literacy and stock market participation, financial literacy key to retirement planning in malaysia, measuring financial literacy: results of the oecd / international network on financial education (infe) pilot study, an analysis of personal financial literacy among college students, consumer financial literacy and the impact of online banking on the financial behavior of lower‐income bank customers, related papers.

Showing 1 through 3 of 0 Related Papers

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Measuring financial literacy: a literature review

Related Papers

Fatemeh Kimiyaghalam

This article is a literature review on the concept of financial literacy and its measurements. Based upon the review of several studies, the conceptual definitions of financial literacy would be categorized in four groups; (1) knowledge of financial concepts, (2) ability in managing personal finances, (3) skill in making financial decisions and (4) confidence in future financial planning while in the rest of the studies, researchers apply the combination of these categories. Literature also shows that the applied methods for testing the level of financial literacy in individuals are not constant and they are varied based on the definition of financial literacy.

The Journal of Accounting and Management

Adriana Zait

AARF Publications Journals , monika aggarwal

The need for financial literacy has become increasingly significant with the deregulation of financial markets and the easier access to credit; the ready issue of credit cards; the rapid growth in marketing of financial products and the government's encouragement for people to take more responsibility for their retirement incomes. This paper reports the influence of various socio-demographic factors on different dimensions of financial literacy among the working population in urban India. The study also investigates the relationship between the dimensions of financial literacy. A survey method was employed using a sample of 230 respondents of Tricity. Hypothesis testing was conducted using one way annova test. By identifying the specific areas where financial literacy may be lacking, the paper may assist educators, regulators and financial institutions to design financial planning courses in helping youths to achieve greater financial freedom and be better equipped for retirement.

Indus Foundation International Journals UGC Approved

International Journal of Business and Management

Umberto Filotto

Our purpose is to validate a new questionnaire to measure financial literacy. We test our 18-item questionnaire using a sample of 269 respondents. Data come from an Internet survey in Italy from January to March 2019. Following the definition provided by Organizations of Economics Developments (OECD), we analyze three dimensions of financial literacy: knowledge, skills, and attitude. Regarding skills and attitude, we introduce a new set of items, whereas, for knowledge, we use items proposed by National Financial Capability Studies (NFCS) (2009). We conduct exploratory factor analysis, confirmatory factor analysis and structural equations models to verify the validity, reliability and applicability of the questionnaire. Our results show that the data fit reasonably well, thus proving the reliability and validity of the questionnaire to measure financial literacy.

International Journal of Consumer Studies

Brenda Cude

International Journal for Research in Applied Science and Engineering Technology IJRASET

IJRASET Publication

In today's advance and sophisticated financial landscape, financial literacy is important because it doesn't only influence and impact upon financial decisions at the firm level but also a country's wider financial wellbeing and socioeconomic development. This study compares the financial literacy levels of urban areas by utilizing the results of the survey from the questionnaire developed by the OECD and by examining demographic and socio economic factors that influence the level of financial literacy. The results show that overall, the extent of monetary literacy in both areas is low and necessary measures should be taken by the government to extend awareness of monetary related matters. The literature findings also reveal that demographic, economic, social, and psychological factors are the most determinants, that some common themes appear with reference to the results of monetary literacy on investment decisions, demographic factors, methodology and program effectiveness, and that gaps exist in the literature of financial literacy in Urban area with respect to types of investment and risk tolerance, measurement of monetary literacy, methodology and sources of data.

Journal of Security and Sustainability Issues

Jelena Titko

Policy Research Working Papers

Sustainability

Lejla Dedovic

Financial literacy is a critical life skill that is essential for achieving financial security and individual well-being, economic growth and overall sustainable development. Based on the analysis of research on financial literacy, we aim to provide a balance sheet of current research and a starting point for future research with the focus on identifying significant predictors of financial literacy, as well as variables that are affected by financial literacy. The main methods of our research are a systematic literature review, and bibliometric and bibliographical analysis. We establish a chronological path of the financial literacy topic in the scientific research. Based on the analysis of the most cited articles, we develop a comprehensive conceptual framework for mapping financial literacy. We identified a large number of predictors of financial literacy starting with education, gender, age, knowledge, etc. Financial literacy also affects variables such as retirement planning, fi...

Loading Preview

Sorry, preview is currently unavailable. You can download the paper by clicking the button above.

RELATED PAPERS

Harshit Gupta

Heritage and Sustainable Development

International Research Journal Commerce arts science

International Journal of Financial Research

khujan singh

CERN European Organization for Nuclear Research - Zenodo

Ashwini Jamuni

nishee nathwani

EURASIAN JOURNAL OF SOCIAL SCIENCES

sirli mändmaa

International Journal of Bank Marketing

Mateus Ponchio

Studies in Business and Economics

Francisco Ormazabal

Mazlina Mustapha

isara solutions

Interal Res journa Managt Sci Tech

Economics & Sociology

Arturo Garcia S

Anastasia Nikolaeva

Bhavna Sharma

Sriwijaya International Journal of Dynamic Economics and Business

Budi Setiawan

FWU Journal of Social Sciences

Santosh Kumar Mahapatra , Sanjib Das

Elisa Tejero

Journal of Emerging Economies and Islamic Research

azmi abdullah

Dr. Satyanarayan Pandey

Economics & Sociology

Mokhamad Anwar

JABE (JOURNAL OF ACCOUNTING AND BUSINESS EDUCATION)

pipit andarsari

RACE - Revista de Administração, Contabilidade e Economia

Israel José dos Santos Felipe

tullio jappelli

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

- Conference key note

- Open access

- Published: 24 January 2019

Financial literacy and the need for financial education: evidence and implications

- Annamaria Lusardi 1

Swiss Journal of Economics and Statistics volume 155 , Article number: 1 ( 2019 ) Cite this article

423k Accesses

322 Citations

217 Altmetric

Metrics details

1 Introduction

Throughout their lifetime, individuals today are more responsible for their personal finances than ever before. With life expectancies rising, pension and social welfare systems are being strained. In many countries, employer-sponsored defined benefit (DB) pension plans are swiftly giving way to private defined contribution (DC) plans, shifting the responsibility for retirement saving and investing from employers to employees. Individuals have also experienced changes in labor markets. Skills are becoming more critical, leading to divergence in wages between those with a college education, or higher, and those with lower levels of education. Simultaneously, financial markets are rapidly changing, with developments in technology and new and more complex financial products. From student loans to mortgages, credit cards, mutual funds, and annuities, the range of financial products people have to choose from is very different from what it was in the past, and decisions relating to these financial products have implications for individual well-being. Moreover, the exponential growth in financial technology (fintech) is revolutionizing the way people make payments, decide about their financial investments, and seek financial advice. In this context, it is important to understand how financially knowledgeable people are and to what extent their knowledge of finance affects their financial decision-making.

An essential indicator of people’s ability to make financial decisions is their level of financial literacy. The Organisation for Economic Co-operation and Development (OECD) aptly defines financial literacy as not only the knowledge and understanding of financial concepts and risks but also the skills, motivation, and confidence to apply such knowledge and understanding in order to make effective decisions across a range of financial contexts, to improve the financial well-being of individuals and society, and to enable participation in economic life. Thus, financial literacy refers to both knowledge and financial behavior, and this paper will analyze research on both topics.

As I describe in more detail below, findings around the world are sobering. Financial literacy is low even in advanced economies with well-developed financial markets. On average, about one third of the global population has familiarity with the basic concepts that underlie everyday financial decisions (Lusardi and Mitchell, 2011c ). The average hides gaping vulnerabilities of certain population subgroups and even lower knowledge of specific financial topics. Furthermore, there is evidence of a lack of confidence, particularly among women, and this has implications for how people approach and make financial decisions. In the following sections, I describe how we measure financial literacy, the levels of literacy we find around the world, the implications of those findings for financial decision-making, and how we can improve financial literacy.

2 How financially literate are people?

2.1 measuring financial literacy: the big three.

In the context of rapid changes and constant developments in the financial sector and the broader economy, it is important to understand whether people are equipped to effectively navigate the maze of financial decisions that they face every day. To provide the tools for better financial decision-making, one must assess not only what people know but also what they need to know, and then evaluate the gap between those things. There are a few fundamental concepts at the basis of most financial decision-making. These concepts are universal, applying to every context and economic environment. Three such concepts are (1) numeracy as it relates to the capacity to do interest rate calculations and understand interest compounding; (2) understanding of inflation; and (3) understanding of risk diversification. Translating these concepts into easily measured financial literacy metrics is difficult, but Lusardi and Mitchell ( 2008 , 2011b , 2011c ) have designed a standard set of questions around these concepts and implemented them in numerous surveys in the USA and around the world.

Four principles informed the design of these questions, as described in detail by Lusardi and Mitchell ( 2014 ). The first is simplicity : the questions should measure knowledge of the building blocks fundamental to decision-making in an intertemporal setting. The second is relevance : the questions should relate to concepts pertinent to peoples’ day-to-day financial decisions over the life cycle; moreover, they must capture general rather than context-specific ideas. Third is brevity : the number of questions must be few enough to secure widespread adoption; and fourth is capacity to differentiate , meaning that questions should differentiate financial knowledge in such a way as to permit comparisons across people. Each of these principles is important in the context of face-to-face, telephone, and online surveys.

Three basic questions (since dubbed the “Big Three”) to measure financial literacy have been fielded in many surveys in the USA, including the National Financial Capability Study (NFCS) and, more recently, the Survey of Consumer Finances (SCF), and in many national surveys around the world. They have also become the standard way to measure financial literacy in surveys used by the private sector. For example, the Aegon Center for Longevity and Retirement included the Big Three questions in the 2018 Aegon Retirement Readiness Survey, covering around 16,000 people in 15 countries. Both ING and Allianz, but also investment funds, and pension funds have used the Big Three to measure financial literacy. The exact wording of the questions is provided in Table 1 .

2.2 Cross-country comparison

The first examination of financial literacy using the Big Three was possible due to a special module on financial literacy and retirement planning that Lusardi and Mitchell designed for the 2004 Health and Retirement Study (HRS), which is a survey of Americans over age 50. Astonishingly, the data showed that only half of older Americans—who presumably had made many financial decisions in their lives—could answer the two basic questions measuring understanding of interest rates and inflation (Lusardi and Mitchell, 2011b ). And just one third demonstrated understanding of these two concepts and answered the third question, measuring understanding of risk diversification, correctly. It is sobering that recent US surveys, such as the 2015 NFCS, the 2016 SCF, and the 2017 Survey of Household Economics and Financial Decisionmaking (SHED), show that financial knowledge has remained stubbornly low over time.

Over time, the Big Three have been added to other national surveys across countries and Lusardi and Mitchell have coordinated a project called Financial Literacy around the World (FLat World), which is an international comparison of financial literacy (Lusardi and Mitchell, 2011c ).

Findings from the FLat World project, which so far includes data from 15 countries, including Switzerland, highlight the urgent need to improve financial literacy (see Table 2 ). Across countries, financial literacy is at a crisis level, with the average rate of financial literacy, as measured by those answering correctly all three questions, at around 30%. Moreover, only around 50% of respondents in most countries are able to correctly answer the two financial literacy questions on interest rates and inflation correctly. A noteworthy point is that most countries included in the FLat World project have well-developed financial markets, which further highlights the cause for alarm over the demonstrated lack of the financial literacy. The fact that levels of financial literacy are so similar across countries with varying levels of economic development—indicating that in terms of financial knowledge, the world is indeed flat —shows that income levels or ubiquity of complex financial products do not by themselves equate to a more financially literate population.

Other noteworthy findings emerge in Table 2 . For instance, as expected, understanding of the effects of inflation (i.e., of real versus nominal values) among survey respondents is low in countries that have experienced deflation rather than inflation: in Japan, understanding of inflation is at 59%; in other countries, such as Germany, it is at 78% and, in the Netherlands, it is at 77%. Across countries, individuals have the lowest level of knowledge around the concept of risk, and the percentage of correct answers is particularly low when looking at knowledge of risk diversification. Here, we note the prevalence of “do not know” answers. While “do not know” responses hover around 15% on the topic of interest rates and 18% for inflation, about 30% of respondents—in some countries even more—are likely to respond “do not know” to the risk diversification question. In Switzerland, 74% answered the risk diversification question correctly and 13% reported not knowing the answer (compared to 3% and 4% responding “do not know” for the interest rates and inflation questions, respectively).

These findings are supported by many other surveys. For example, the 2014 Standard & Poor’s Global Financial Literacy Survey shows that, around the world, people know the least about risk and risk diversification (Klapper, Lusardi, and Van Oudheusden, 2015 ). Similarly, results from the 2016 Allianz survey, which collected evidence from ten European countries on money, financial literacy, and risk in the digital age, show very low-risk literacy in all countries covered by the survey. In Austria, Germany, and Switzerland, which are the three top-performing nations in term of financial knowledge, less than 20% of respondents can answer three questions related to knowledge of risk and risk diversification (Allianz, 2017 ).

Other surveys show that the findings about financial literacy correlate in an expected way with other data. For example, performance on the mathematics and science sections of the OECD Program for International Student Assessment (PISA) correlates with performance on the Big Three and, specifically, on the question relating to interest rates. Similarly, respondents in Sweden, which has experienced pension privatization, performed better on the risk diversification question (at 68%), than did respondents in Russia and East Germany, where people have had less exposure to the stock market. For researchers studying financial knowledge and its effects, these findings hint to the fact that financial literacy could be the result of choice and not an exogenous variable.

To summarize, financial literacy is low across the world and higher national income levels do not equate to a more financially literate population. The design of the Big Three questions enables a global comparison and allows for a deeper understanding of financial literacy. This enhances the measure’s utility because it helps to identify general and specific vulnerabilities across countries and within population subgroups, as will be explained in the next section.

2.3 Who knows the least?

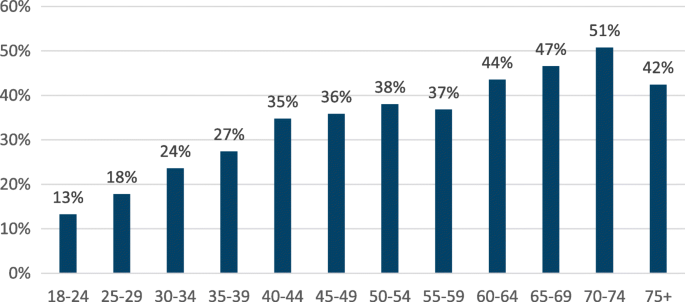

Low financial literacy on average is exacerbated by patterns of vulnerability among specific population subgroups. For instance, as reported in Lusardi and Mitchell ( 2014 ), even though educational attainment is positively correlated with financial literacy, it is not sufficient. Even well-educated people are not necessarily savvy about money. Financial literacy is also low among the young. In the USA, less than 30% of respondents can correctly answer the Big Three by age 40, even though many consequential financial decisions are made well before that age (see Fig. 1 ). Similarly, in Switzerland, only 45% of those aged 35 or younger are able to correctly answer the Big Three questions. Footnote 1 And if people may learn from making financial decisions, that learning seems limited. As shown in Fig. 1 , many older individuals, who have already made decisions, cannot answer three basic financial literacy questions.

Financial literacy across age in the USA. This figure shows the percentage of respondents who answered correctly all Big Three questions by age group (year 2015). Source: 2015 US National Financial Capability Study

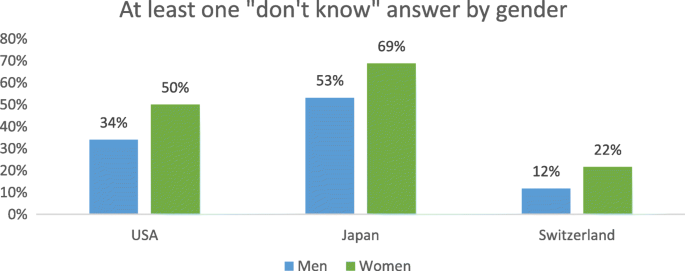

A gender gap in financial literacy is also present across countries. Women are less likely than men to answer questions correctly. The gap is present not only on the overall scale but also within each topic, across countries of different income levels, and at different ages. Women are also disproportionately more likely to indicate that they do not know the answer to specific questions (Fig. 2 ), highlighting overconfidence among men and awareness of lack of knowledge among women. Even in Finland, which is a relatively equal society in terms of gender, 44% of men compared to 27% of women answer all three questions correctly and 18% of women give at least one “do not know” response versus less than 10% of men (Kalmi and Ruuskanen, 2017 ). These figures further reflect the universality of the Big Three questions. As reported in Fig. 2 , “do not know” responses among women are prevalent not only in European countries, for example, Switzerland, but also in North America (represented in the figure by the USA, though similar findings are reported in Canada) and in Asia (represented in the figure by Japan). Those interested in learning more about the differences in financial literacy across demographics and other characteristics can consult Lusardi and Mitchell ( 2011c , 2014 ).

Gender differences in the responses to the Big Three questions. Sources: USA—Lusardi and Mitchell, 2011c ; Japan—Sekita, 2011 ; Switzerland—Brown and Graf, 2013

3 Does financial literacy matter?

A growing number of financial instruments have gained importance, including alternative financial services such as payday loans, pawnshops, and rent to own stores that charge very high interest rates. Simultaneously, in the changing economic landscape, people are increasingly responsible for personal financial planning and for investing and spending their resources throughout their lifetime. We have witnessed changes not only in the asset side of household balance sheets but also in the liability side. For example, in the USA, many people arrive close to retirement carrying a lot more debt than previous generations did (Lusardi, Mitchell, and Oggero, 2018 ). Overall, individuals are making substantially more financial decisions over their lifetime, living longer, and gaining access to a range of new financial products. These trends, combined with low financial literacy levels around the world and, particularly, among vulnerable population groups, indicate that elevating financial literacy must become a priority for policy makers.