- July 30, 2017

- by Sachin Patil

Normally, when a financial document is entered in SAP FI module, user has the option of entering the cost center in the financial document. However, when documents are entered from different modules or a cross-module financial transaction occurs, such as from MM or SD, there is no option of entering the cost center in the document. In this situation, the SAP system will derive the cost center through automatic SAP CO account assignment, substitutions, or through default settings made in the primary cost element.

Automatic SAP CO Account Assignment

The automatic account assignment has to be configured in the transaction code OKB9 . For posting made in external accounting, such as for price differences, exchange rate differences, etc., the SAP system automatically checks entries in the OKB9 settings and derives the cost center.

If you do not enter a CO object (order, cost center, or project) in external accounting postings made in FI, MM or SD modules and the posting is cost relevant, then the automatic account assignment checks the relevant cost center and makes the posting.

Here are examples of automatic account assignments:

- Banking fees, exchange rate differences and discounts in FI

- Minor differences and price differences in MM

The account assignment objects that can be maintained in the transaction OKB9 are:

- Cost center

- Profit center (profitability segment)

Normally, the automatic account assignment runs on the company code level along with the CO object. However, if the user wants to make the posting on the business area level, valuation area level or profit center level, it is also available in OKB9 settings. So basically it includes the following levels:

- Company code level

- Business area level

- Valuation area level

- Profit center level

The above 3 excluding the company code level are used in cases when the account assignment is needed below the company code level.

Prerequisites

Here are the prerequisites of activating automatic SAP CO account assignment:

- Activation of the cost center accounting

- Creation of cost centers

- Maintenance of cost elements

Additionally, you can also create orders and profit centers as per the business requirements.

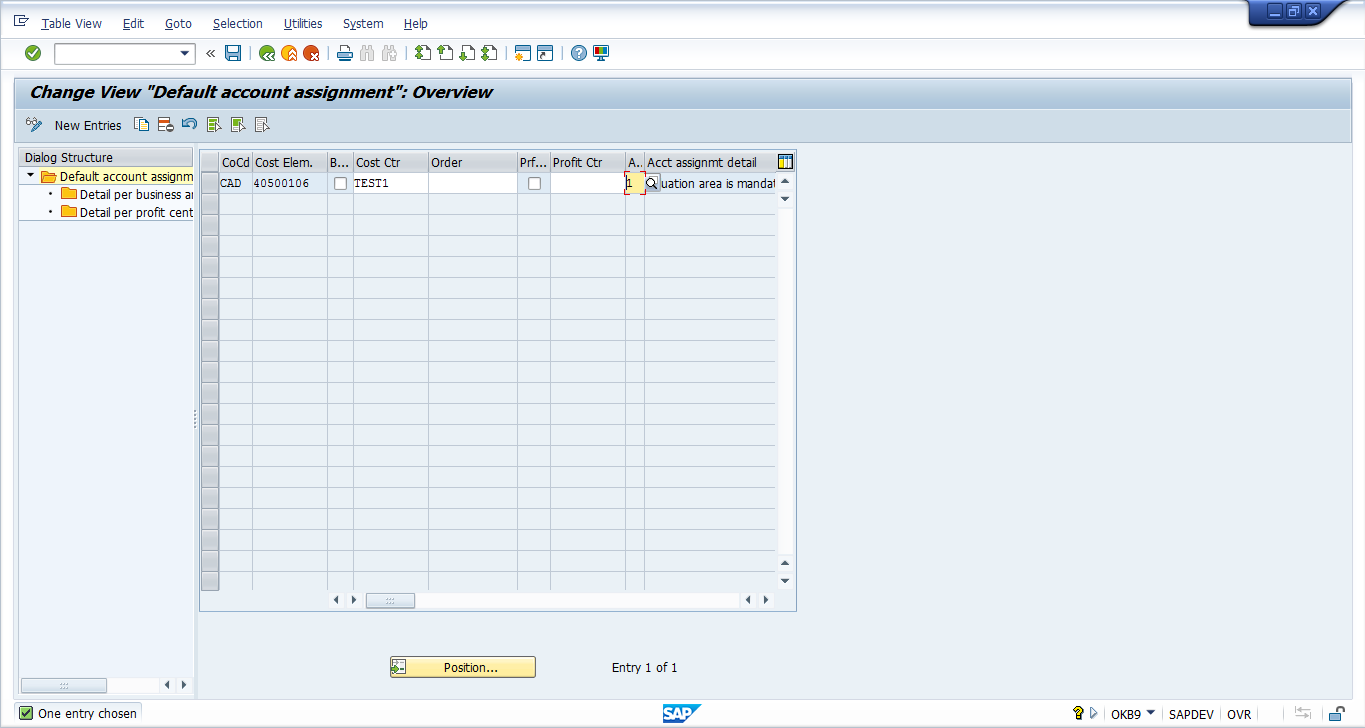

Settings in Transaction OKB9

Let’s discuss settings that are possible for automatic SAP CO account assignment in OKB9 transaction.

Start SPRO transaction and navigate to the following path:

Controlling – Cost Center Accounting – Actual Postings – Manual Actual Postings – Edit Automatic Account Assignment (OKB9)

Alternatively, you can start OKB9 transaction directly from the command bar.

- If you want to have the setting on the company code level only, then enter the company code and the cost element along with the corresponding CO object, i.e. a cost center, an order or a profit center.

- If you want to have the settings on the valuation area level, then enter the company code and the cost element and chose the ‘valuation area’ option in the account assignment detail as ‘1’.

- Similarly, if you want to have the settings on the business area or profit center level, then choose the option ‘2’ or ‘3’ respectively.

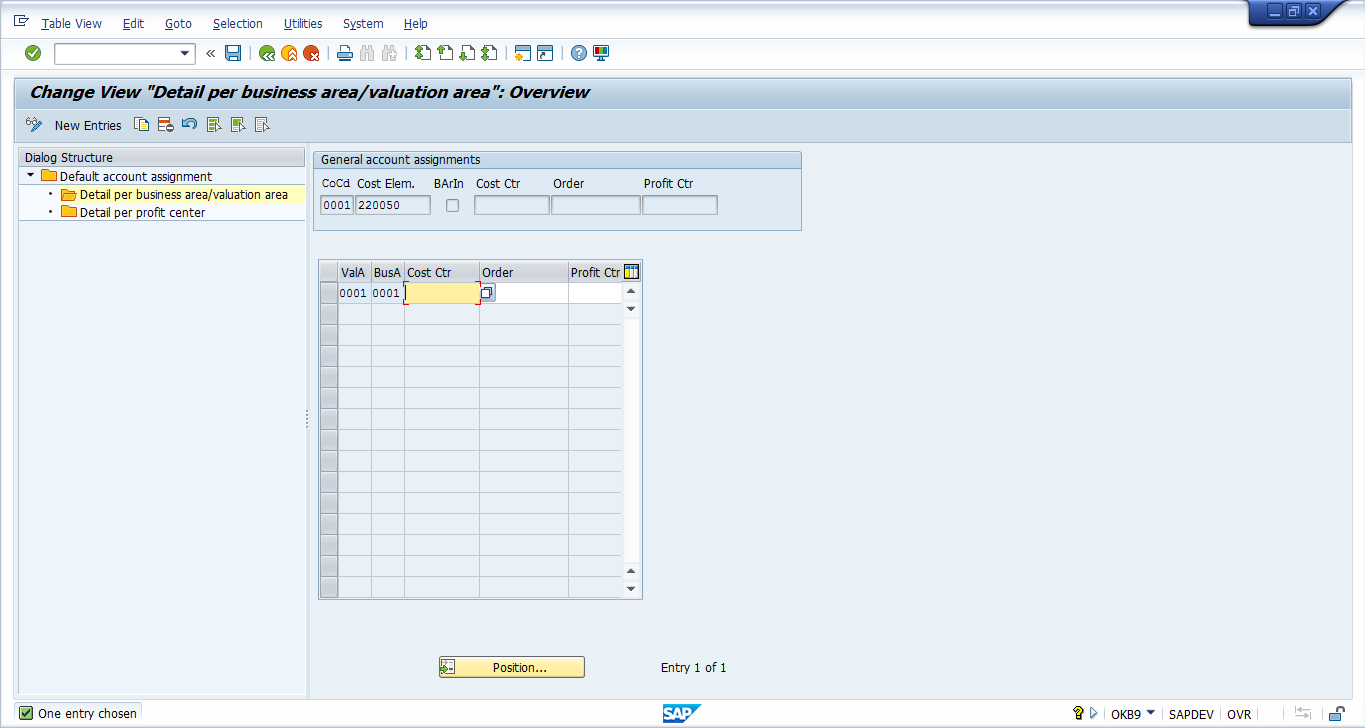

If you have chosen account assignment detail ‘1’ or ‘2’, then click on ‘Detail per business area/valuation area’ on the left sidebar.

Default SAP CO Account Assignment

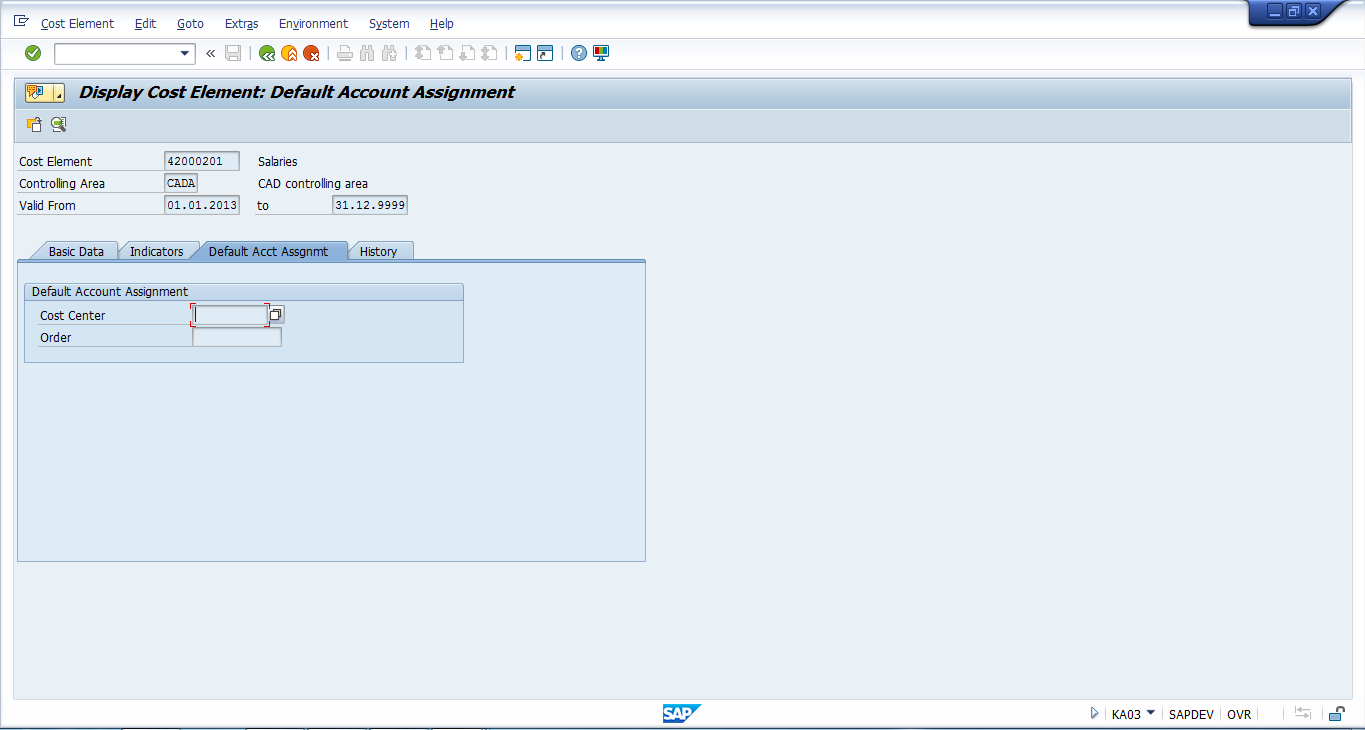

In order to determine the correct CO account assignment, the SAP system performs several checks in the following sequence. First it checks the document which a user is posting. If the cost center is empty in the document, then the system checks if any substitutions are maintained for the particular G/L account. Next, if the substitution is also missing, then the system moves on to the OKB9 settings for automatic SAP CO account assignments. Finally, if these settings are also missing, the SAP system checks master data of the primary cost element (G/L Account) under the tab of Default Account Assignment . You can display this master data using the transaction KA03 .

You can maintain the cost center and the order in the master data of the primary cost element.

So, basically the order of checks the system makes is:

- Financial document – Cost center

- Substitutions – transaction OKC9

- Automatic account assignments – transaction OKB9

- Default account assignments – transaction KA03 / KA02

Lastly, if any of the above is not maintained, then the SAP system throws an error ‘Account X requires an assignment to a CO Object’ and doesn’t allow posting of a document.

SAP CO Account Assignment using Substitution

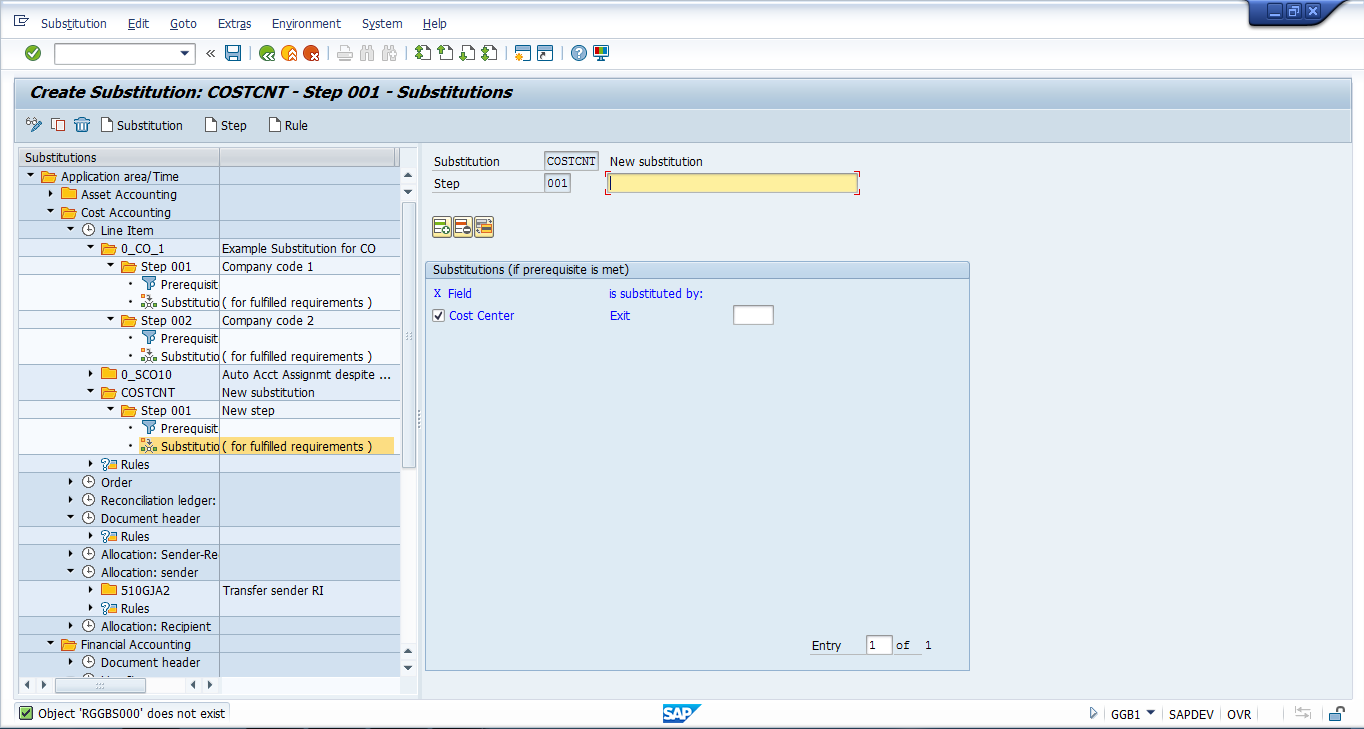

In cases where you don’t need OKB9 or default account assignment, the user can go for user exits where a specific G/L account is mentioned under the company and the value in the cost center is substituted by the cost center given in the substitution.

The transaction for maintaining the substitution is GGB1 .

Usage of substitutions for SAP CO account assignment is justified by the business requirement and usually SAP CO account assignment requirements are fulfilled by OKB9 or default account assignments.

Post comment

Cancel reply.

You must be logged in to post a comment.

I share experience and observations knowledge about the SAP and peripheral systems.

Copyright © 2022 Sachin H Patil . All Rights Reserved.

- SAP Training Blog ›

S/4 HANA Finance - Dealing with SAP Cost Elements

.png)

by Janet Salmon

This blog post about S4HANA Cost Elements is from our friends at SAPexpert - the source for trusted SAP tutorials, tips, and training content.

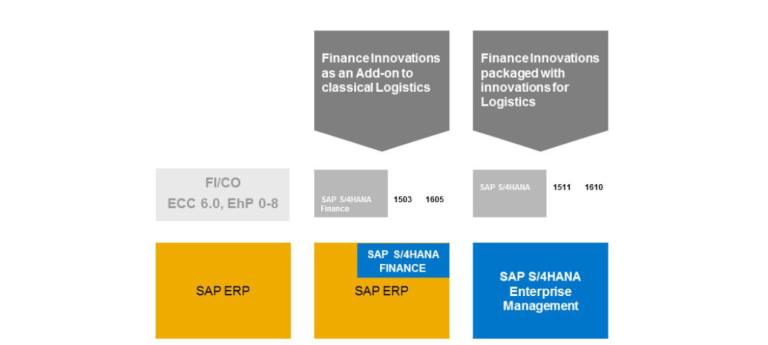

With S/4HANA Finance , the universal journal includes a single field account that covers both the general ledger (G/L) account and the cost element. As companies migrate to S/4HANA Finance, the system merges their existing G/L accounts and cost elements.

The transactions for the creation and maintenance of cost elements become obsolete, replaced by a single transaction for account maintenance. However, this technical change does not mean that the idea of a cost element has disappeared with S/4HANA Finance. Learn what changes come with S/4HANA Finance and what remains as before.

Key Concept

The cost element design within the controlling area is a vital part of setting up your controlling (CO) system. In S/4HANA Finance, as the accounts and cost elements are merged, the following changes result:

- The primary cost elements represent the profit-and-loss accounts used to classify your journal entries. In all accounting approaches, you use cost elements to represent wages and salaries, material expenses, depreciation, and many others. If you use account-based profitability analysis (CO-PA) or if you have make-to-order processes requiring results analysis and settlement, you also use cost elements for revenues or sales deductions. In S/4HANA Finance, the G/L account and the primary cost elements merge into one.

- The secondary cost elements record the value flows within CO, such as the charging of utility costs from a support cost center to an operational cost center or the charging of machine-hours to a production order. Additional examples include the charging of consulting time to a Work Breakdown Structure (WBS) element or the settlement of research and development costs to CO-PA. In S/4HANA Finance, accounts are created for every secondary cost element so that all value flows are visible in the universal journal and thus in reports such as the trial balance.

A Controlling (CO) implementation typically starts with the decision regarding which profit-and-loss (P&L) accounts require primary cost elements and which don’t. There are typically a handful of P&L accounts that do not need to be reflected in CO—either because they have no impact on the operational business or are needed for a particular purpose, such as recording work in process (WIP).

However, for the majority of P&L accounts, the implementation team creates a separate primary cost element for each account. It makes sure that the correct CO account assignment can be updated as each journal entry is posted. This approach allows capturing salary postings by cost center or material expense postings by Work Breakdown Structure (WBS) element.

All these changes with S/4HANA Finance, where the accounts and cost elements merge, and the master data settings for the cost elements become part of the general ledger (G/L) account master.

This means that where you used to create primary cost elements using transaction code KA01, you now are directed to transaction code FS00 (Display G/L Account Centrally). While this all sounds quite radical, the fundamental nature of the account does not change, and you continue to use the field status groups to control which account assignments are valid for each business transaction as before.

The merge of accounts and cost elements does have an impact on your authorization profiles. You can create accounts with no CO impact if you have authorization for G/L account maintenance (these are typically given by account, company code, and account type). However, if you want to create an account that is simultaneously a cost element, you need authorization for both the G/L account and the cost element (authorization object K_CSKB).

The combination also means that you need to keep the period locks in sync and make sure that the account types that allow postings match the CO business transactions that allow postings at any given time.

Setting Up Your Accounts in S/4 HANA Finance

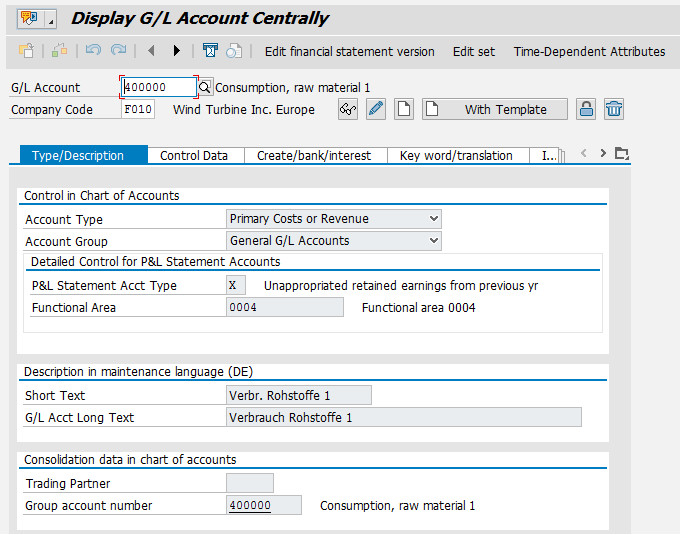

Figure 1 shows the account master data in S/4HANA Finance (transaction code FS00), which is a combination of the account maintenance and the previous cost element maintenance transactions (transaction code KA01-3).

Figure 1: G/L account showing the account type for the primary cost element

The main change to this screen is that you can choose between P&L accounts that do not require a cost assignment by selecting the account type Nonoperating Expense or Income and P&L accounts that are associated with a CO account assignment by selecting the Account Type Primary Costs or Revenue.

In my example, you have a raw material expense account, and any raw material posting to this account needs to be assigned to a CO account, such as a cost center, order, or WBS element. If you are migrating, your field status groups will already be set up to include these CO account assignments.

As you go through the screens, notice that the old Default Assignment tab in the cost element master record is gone, so the only way to set up the default account assignments is to use transaction code OKB9 or follow IMG menu path Controlling > Cost Center Accounting > Actual Postings > Manual Actual Postings > Edit Account Assignment. If you have entered default account assignments in your cost element master data, the migration process creates entries in table TKA3A for these default assignments. You can check them using transaction code OKB9.

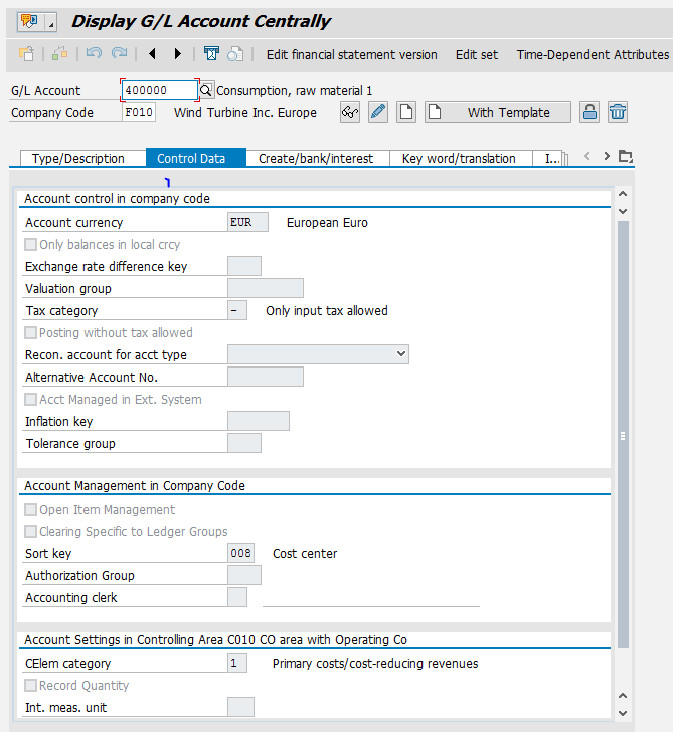

The account type alone does not define how the account is used in CO. This is done by assigning a cost element category to each account. To check the cost element category, select the Control Data tab as shown in Figure 2 .

In this tab, you see that your raw material account has the cost element category 1 (Primary costs/cost reducing revenues). (This value appears in the CElem category field.) You want similar accounts or cost elements for wages and salaries, asset depreciation, material movements, and many others.

You can also use cost elements of category 3 and 4 if you work with accrual postings. If you are using account-based profitability analysis (CO-PA), you also want cost elements of category 11 for revenue and category 12 for sales deductions.

You also use these cost element categories if you have make-to-order processes requiring results analysis, where revenue or direct costs are assigned to a project or sales order. If you have settlement processes that capitalize expenses as either asset under construction or finished goods inventory, you also want cost elements of category 22 for external settlement.

Note that the old restriction that WIP accounts must not be cost elements continue to apply (in other words, the account type for the WIP offsetting entry must be Nonoperating Expense or Income).

With the settings for the primary cost elements made to the relevant accounts, it’s time to think about the secondary cost elements. Before I go into detail here, it’s worth recalling how a primary cost element differs from a secondary cost element. A primary cost element is an extension of a P&L account, and the offsetting entry is always to a balance sheet account (so a salary expense will offset to accounts payable, a revenue posting will offset to accounts receivable, and so on).

A posting to a secondary cost element balances to zero, but under the same account. Hence, a direct activity allocation credits the cost center and debits the order under the same cost element.

The switch is in the sender (here cost center) and the receiver (the order), and this, in turn, may trigger a shift in profit centers or functional areas, all of which are captured as partner relationships in the universal journal.

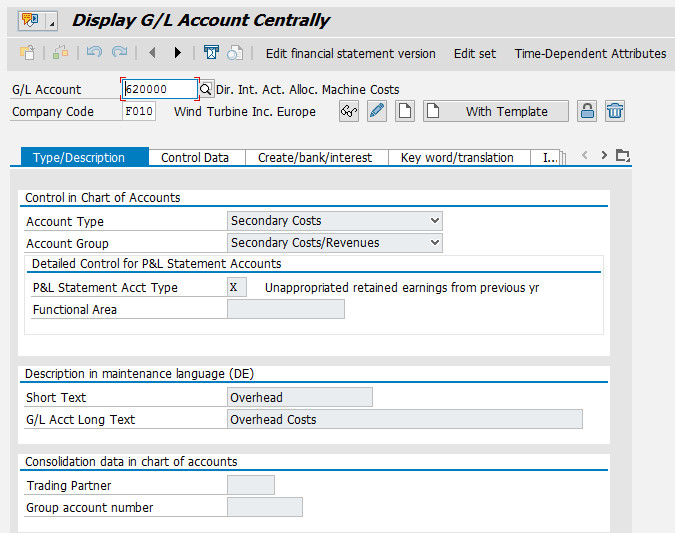

In the past, secondary cost elements were created using transaction code KA06, but in S/4HANA Finance, you again are redirected to transaction code FS00 (Display G/L Account Centrally). During migration, secondary cost elements are migrated into the G/L account tables (SKA1, SKB1, and SKAT) for all company codes assigned to the CO area. Figure 3 shows the G/L account master data for a secondary cost element for the allocation of machine costs.

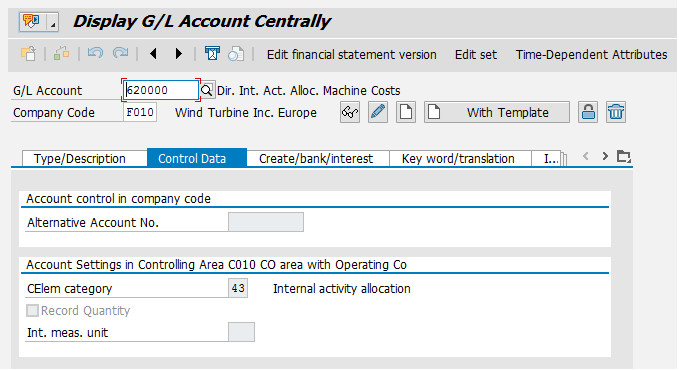

Again, you can see the cost element categories by selecting the Control Data tab. Figure 4 shows that this cost element can be used for internal activity allocations (in other words, to charge machine costs from a cost center to orders or projects).

As you think about your secondary cost element categories, think about these sender-receiver relationships. These relationships give you a cost element category of 43 for internal activity allocation (as shown in Figure 4 ), 21 for internal settlement, 41 for overhead rates, and 42 for assessment. You’ll see an example of such a sender-receiver relationship and the associated value flow when I explain how a secondary cost element appears in the trial balance at the end of this article.

If you’ve been working with the classic General Ledger, these movements are recorded in the reconciliation ledger if they cross-company code boundaries and are moved to the classic General Ledger at the period close using transaction code KALC. If you’ve been working with the SAP General Ledger, you probably have set up real-time integration to create journal entries for these movements. Both these approaches are obsolete in S/4HANA Finance.

You always see such movements reflected in the universal journal so that you won’t need a reconciliation ledger. Because the secondary cost elements are now G/L accounts, you won’t need to map the CO business transactions to reconciliation accounts in FI.

The secondary cost elements appear in your financial accounts whenever you perform the transactions listed above, provided that you include the new accounts in your financial statement versions. You can find the link by clicking the Edit financial statement version button shown in the ribbon in Figure 4 .

If you are building up your financial statement version from scratch, you can still use transaction code KA23 (Cost Elements: Master Data List) to list all the cost elements and their attributes in your system. This makes grouping them for reporting purposes much easier than trying to use the F4 help.

Other secondary cost elements exist that don’t represent such sender-receiver relationships. If you work with Result Analysis, you still need cost elements of type 31 (order/project results analysis). If you are working with Project System, you still potentially need cost elements of types 50, 51, 52 (project-related incoming orders), and 61 (earned value).

Working with Accounts and Cost Elements in S/4 HANA Finance

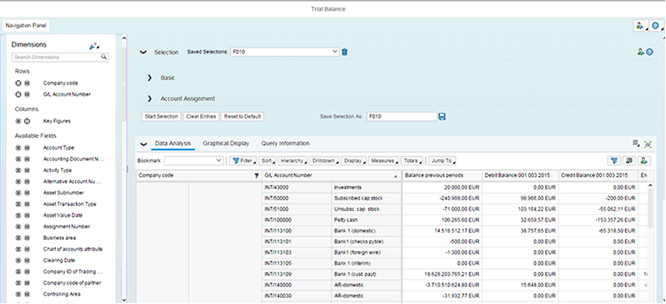

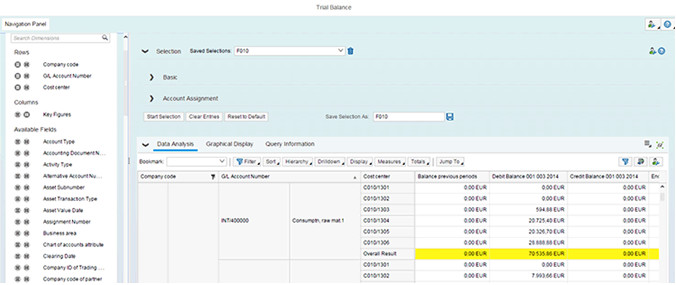

Figure 5 shows a sample trial balance in S/4HANA Finance. You see the classic view showing the balances by company code and account on the right, but also the option to drill-down by Account Type, Accounting Document, and Activity Type on the left.

This view enables you to drill down by account type (material, asset, vendor, customer) in Financial Accounting but also by activity type (for example, the machine hours that are allocated using the account or cost element shown in Figures 3 and 4 ) in CO. This same merge is available in all-new financial reports in S/4HANA Finance.

However, while the accounts and cost elements are merged in the new reports, you continue to see the term cost element on many of the screens. You find the term cost element in the assessment cycles, the settlement profiles, the costing sheets, and other areas. These configuration transactions work exactly as before.

You can use the example shown in Figures 3 and 4 to perform time recording or order confirmations via the work center. You can enter only accounts of cost element category 41 in your costing sheets and accounts of cost element category 42 in your assessment cycles, and so on.

What’s important is that your secondary cost elements provide the transparency you need for your analysis. Mainly if you’ve only worked with costing-based CO-PA in the past, there is a tendency to allocate and settle under a single cost element and rely on the value fields to give you the detail you need for reporting. You may want to create separate secondary cost elements to distinguish between marketing expenses and sales and administration expenses in your assessment cycles.

In Figure 6 , for example, select the account for raw material costs that you looked at in Figures 1 and 2 within the trial balance ( Figure 5 ) and drill down by cost center to show all the cost centers to which raw materials were posted within the selected time frame.

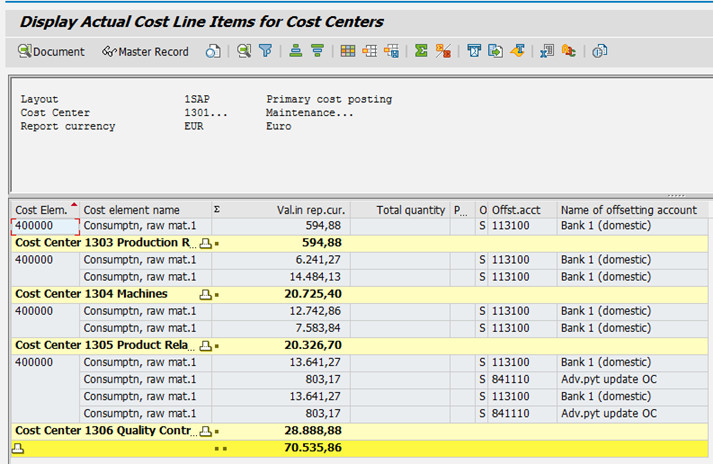

By comparison, in Figure 7 , a more classic approach is taken in which the cost center line-item report transaction code KSB1) is used to select all postings to the raw material cost element with these cost centers in the same time frame.

What’s happening here is that the system is using compatibility views to simulate the existence of CO line items even though the CO data has been subsumed in the universal journal. This means that you won’t need to rework your existing reports after migration to S/4HANA Finance.

Indeed, if you use the relationship browser in the CO line-item display, you find it appears to show an accounting document and a controlling document. However, both documents are views on the universal journal that display the data as if the old structures still existed. You could continue to explore the trial balance, focusing on single accounts, such as raw materials and selecting other account assignments (such as orders and projects) or looking at different accounts, such as revenue accounts and drilling down to the CO-PA characteristics.

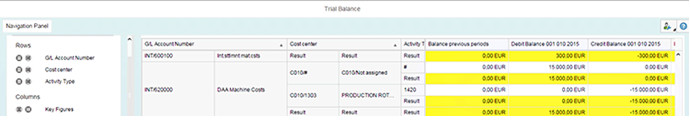

Instead, look at the account for the secondary cost element in Figures 3 and 4 , then drill down to the sender and receiver objects that were updated during these postings.

In Figure 8 , note that you’ve drilled down to the sender cost center (1303) and the sender activity type (1420), which gives you a credit balance. The offsetting line is a debit balance. To see the account assignment, you have to pull the order number by choosing the appropriate option in the navigation panel. This is a straightforward example, but it gives you an impression of the fundamental changes available with S/4HANA Finance.

Related Blogs

The SAP Asset History Sheet Report

The SAP Asset History Sheet report (AHS) is the most pow...

Account Based COPA - S/4 HANA Finance

As a reporting tool, profitability analysis (CO-PA) is very effective ...

Finance in S/4 HANA: What, Why, How & ACDOCA

Nowadays there is a tremendous interest in S/4 HANA, especially from current...

We offer thousands of SAP courses and real-world SAP sandboxes for individuals and corporate teams.

Support: [email protected]

Sales: [email protected]

+1 (415) 360-6249

- Success Stories

- Become an Affiliate

- Become an Instructor

- Scholarships

- Search Entire Website

- SAP Transaction Codes

- SAP Error Messages

- Authenticate Certificate

Have Questions?

Get In Touch.

Training License Required

/support/notes/service/sap_logo.png)

3046658 - Default Account Assignment for General Ledger Accounts is not Considered for Business Transaction Posting

In the Default Account Assignment for General Ledger Accounts you define a specific setting for a G/L Account, a cost center assignment or a free cost object assignment for example.

But when viewing the journal entry of a business transaction (such as a supplier or customer invoice), posting to the selected G/L Account, the defined setting is not derived.

Environment

SAP Business ByDesign

default account assignments for general ledger account, free cost object missing , KBA , SRD-FIN-GL , General Ledger , Problem

About this page

Search for additional results.

Visit SAP Support Portal's SAP Notes and KBA Search .

Privacy | Terms of use | Legal Disclosure | Copyright | Trademark

- Cost Element Accounting CO-OM-CEL

- Controlling CO

Report a missing table or a suggestion for improvement here... Additional tables for the following modules at ERP-TOP.COM : Financial Accounting Module FI General Ledger Module FI-GL Accounts Receivable Module FI-AR Accounts Payable Module FI-AP Banks Module FI-BL Fixed Assets Module FI-AA Controlling Module CO Cost Element Accounting Module CO-OM-CEL Cost Center Accounting Module CO-OM-CCA Internal Orders Module CO-OM-OPA Product Cost Controlling Module CO-PC Profitcenter Module EC-PCA Flexible Real Estate Management Module RE-FX Lease Management RE-FX-LA Sales and Distribution Module SD Materials Management Module MM Purchasing Module MM-PUR Quality-Management Module QM Plant Maintenance Module PM Production Planning and Manufacturing Module PP Production Planning Process Industries Module PP-PI Project System Module PS Personnel Management Module PA for ABAP for the Basis and Administrators Cross Module Business Partner AP-MD-BP

- SAP Simple Finance Tutorial

- SAP Simple Finance - Home

- SAP HANA - Introduction

- SAP Simple Finance - Introduction

- SAP Simple Finance - Architecture

- Extend G/L Coding Block

- Universal Journal

- Document Number

- Display Financial Tables

- Deployment Options

- Post & Reverse Documents

- Reporting Options

- SAP Simple Finance - Migration

- Manual Reposting of Costs

- SAP Simple Finance - G/L Accounting

- Create a Primary Cost

- Create a Secondary Cost

- SAP Simple Finance - Ledger Mgmt

- Asset Accounting

- Create an Asset

- SAP Simple Finance - Asset Scrapping

Create Default Account Assignment

- Management Accounting

- Profitability Analysis

- Period Lock Transaction

- New Period Closing Program

- SAP Simple Finance - Integration

- SAP Simple Finance - IBPF

- Consultant Capabilities

- SAP Simple Finance Resources

- SAP Simple Finance - Quick Guide

- SAP Simple Finance - Resources

- SAP Simple Finance - Discussion

- Selected Reading

- UPSC IAS Exams Notes

- Developer's Best Practices

- Questions and Answers

- Effective Resume Writing

- HR Interview Questions

- Computer Glossary

You can create a default account assignment for any cost element using Transaction code OKB9. Later, you can also post a document to check if that account assignment works.

Transaction code - OKB9

Step 1 − To create a new Account Assignment, click New Entries

Step 2 − In the next window, you have to enter the following fields −

- The values of CoCd box

- The value in Cost Elem. box

- The value in the Cost Ctr box

Step 3 − To save the entry, click the Save button at the top

Step 4 − To post a test document to check that the account assignment works, use Transaction code fb50 . In the next window, click Tree On.

Step 5 − Select the Screen Variant in the next window and click Tree Off button.

Step 6 − In the next window, enter the following details −

- The value in Doc Header Box

- Select entry Debit by clicking it

- Amount in doc. Curr. Box

- Select entry H credit by clicking it

- Amount in doc.curr. box

Step 7 − To make the document assignment, click the Save button at the top.

Defining General Ledger (G/L) Accounts and Cost Elements

After completing this lesson, you will be able to define a G/L account

Chart of Account

Each G/L is set up according to a chart of accounts. The chart of accounts contains the definitions of all G/L accounts. The definitions consist of the account number, the account name, and the type of G/L account (e.g. balance sheet, non operating expenses/revenues, primary costs/revenues, secondary costs or cash accounts).

Assignment of Company Codes to Chart of Accounts

A chart of accounts can be used by multiple company codes so that the general ledgers of these company codes have an identical structure.

General Ledger Account and Cost Element

The two segments of the G/L master record from a Financial Accounting perspective are as follows:

The chart of accounts segment contains a description of the account, the account type that classifies how the account can be used in FI and/or CO and, the account group that controls the company code segment fields, and the consolidation account number.

The company code segment contains values specific to how the company code will manage that account.

Account Groups

Accounts with the same account group normally have similar business functions. You can, for example, have an account group for:

Cash accounts

Expense accounts

Revenue accounts

Other balance sheet accounts

The account groups are assigned number ranges. You can control which account numbers are permissible for cash accounts, expense accounts, and so on, through the number ranges.

Account groups also control the appearance of the company code segment of G/L accounts. Account groups control:

The fields that are required for data entry

The fields that are optional for data entry

The fields that are display only.

The fields that do not show up at all in the company code segment

Reconciliation Accounts

Expenditures versus costs.

In the economical theory, there are two approaches for values:

In the first approach, the values in Financial Accounting and Management Accounting are the same:

Controlling provides additional reporting opportunities by separating the FI documents along additional characteristics, such as segments, profit centers, projects, stored in a coding block. The results may be P&L statements and balance sheets per segment, per profit center or per project.

In the second approach (most used in central Europe), Management Accounting is based on cost and revenues. Costs are only those expenditures, which are as follows:

Related to the business of the company

Exactly assigned to periods (source specific)

For example, a gift to a welfare organization is an expenditure, but not a cost, because it is not the business of the company to make gifts.

Expenditures, which do not meet the definition of costs, are only reflected in Financials, and not in Management Accounting. They are called neutral expenditures.

SAP provides the opportunity to realize each of the theories. In SAP S/4HANA revenues, expenditures, and cost are represented by financial accounts and separated by the Account Type of the accounts. Based on the account type, the accounts used in CO are also called cost elements.

Account Types

The controlling area-specific data is only needed for Secondary Costs and Primary Costs or Revenue accounts. In the controlling area-specific data, you assign a Cost Element category. This category determines which account can be used for which business transaction in CO.

Create a Primary Cost Account

Log in to track your progress & complete quizzes

Blog about all things SAP

ERProof » SAP CO » SAP CO Training » SAP CO Account Assignment

SAP CO Account Assignment

Normally, when a financial document is entered in SAP FI module , user has the option of entering the cost center in the financial document. However, when documents are entered from different modules or a cross-module financial transaction occurs, such as from MM or SD , there is no option of entering the cost center in the document. In this situation, the SAP system will derive the cost center through automatic SAP CO account assignment, substitutions, or through default settings made in the primary cost element.

Automatic SAP CO Account Assignment

The automatic account assignment has to be configured in the transaction code OKB9 . For posting made in external accounting, such as for price differences, exchange rate differences, etc., the SAP system automatically checks entries in the OKB9 settings and derives the cost center.

If you do not enter a CO object (order, cost center, or project) in external accounting postings made in FI, MM or SD modules and the posting is cost relevant, then the automatic account assignment checks the relevant cost center and makes the posting.

Here are examples of automatic account assignments:

- Banking fees, exchange rate differences and discounts in FI

- Minor differences and price differences in MM

The account assignment objects that can be maintained in the transaction OKB9 are:

- Cost center

- Profit center (profitability segment)

Normally, the automatic account assignment runs on the company code level along with the CO object. However, if the user wants to make the posting on the business area level, valuation area level or profit center level, it is also available in OKB9 settings. So basically it includes the following levels:

- Company code level

- Business area level

- Valuation area level

- Profit center level

The above 3 excluding the company code level are used in cases when the account assignment is needed below the company code level.

Prerequisites

Here are the prerequisites of activating automatic SAP CO account assignment:

- Activation of the cost center accounting

- Creation of cost centers

- Maintenance of cost elements

Additionally, you can also create orders and profit centers as per the business requirements.

Settings in Transaction OKB9

Let’s discuss settings that are possible for automatic SAP CO account assignment in OKB9 transaction.

Start SPRO transaction and navigate to the following path:

Controlling – Cost Center Accounting – Actual Postings – Manual Actual Postings – Edit Automatic Account Assignment (OKB9)

Alternatively, you can start OKB9 transaction directly from the command bar.

- If you want to have the setting on the company code level only, then enter the company code and the cost element along with the corresponding CO object, i.e. a cost center, an order or a profit center.

- If you want to have the settings on the valuation area level, then enter the company code and the cost element and chose the ‘valuation area’ option in the account assignment detail as ‘1’.

- Similarly, if you want to have the settings on the business area or profit center level, then choose the option ‘2’ or ‘3’ respectively.

If you have chosen account assignment detail ‘1’ or ‘2’, then click on ‘Detail per business area/valuation area’ on the left sidebar.

Default SAP CO Account Assignment

In order to determine the correct CO account assignment, the SAP system performs several checks in the following sequence. First it checks the document which a user is posting. If the cost center is empty in the document, then the system checks if any substitutions are maintained for the particular G/L account . Next, if the substitution is also missing, then the system moves on to the OKB9 settings for automatic SAP CO account assignments. Finally, if these settings are also missing, the SAP system checks master data of the primary cost element (G/L Account) under the tab of Default Account Assignment . You can display this master data using the transaction KA03 .

You can maintain the cost center and the order in the master data of the primary cost element.

So, basically the order of checks the system makes is:

- Financial document – Cost center

- Substitutions – transaction OKC9

- Automatic account assignments – transaction OKB9

- Default account assignments – transaction KA03 / KA02

Lastly, if any of the above is not maintained, then the SAP system throws an error ‘Account X requires an assignment to a CO Object’ and doesn’t allow posting of a document.

SAP CO Account Assignment using Substitution

In cases where you don’t need OKB9 or default account assignment, the user can go for user exits where a specific G/L account is mentioned under the company and the value in the cost center is substituted by the cost center given in the substitution.

The transaction for maintaining the substitution is GGB1 .

Usage of substitutions for SAP CO account assignment is justified by the business requirement and usually SAP CO account assignment requirements are fulfilled by OKB9 or default account assignments.

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP CO tutorials.

Navigation Links

Go to next lesson: SAP Adjustment Postings

Go to previous lesson: SAP Profit Center

Go to overview of the course: Free SAP CO Training

4 thoughts on “SAP CO Account Assignment”

it is helpful material i ask for more clear details for using substitution method for Account Assignment. thanks in advance

Sir, I am not receiving the training mails from yesterday 7/1/2019. I have completed my training till here(SAP CO Account Assignment) please do send the rest of the training emails for SAP CO. Hope you will do the needful.

I am getting the same error “Account 500911 requires an assignment to a CO object”. In OKB9, we have given company code, Cost element and ticked the check box ‘Indicator: Find profitability segment using substitution’ (V_TKA3A-BSSUBST) and not filled anything like cost center, order and profit center. in OKC9 we have created substitution. All the process happening through Idoc Message Type SINGLESETTRQS_CREATE and inside BAPI BAPI_SINGLESETTREQS_CREATEMULT triggering and raising this error. Cost center is not maintained in 1. Financial document – Cost center 2. Automatic account assignments – transaction OKB9 and 3. Default account assignments – transaction KA03/KA02 But we have substitution in transaction OKC9 to determine cost centre.

Where woulbe be the issue?

good explanation

Leave a Reply Cancel reply

Do you have a question and want it to be answered ASAP? Post it on our FORUM here --> SAP FORUM !

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

IMAGES

VIDEO

COMMENTS

For each cost assignment, enter the company code and the cost element that should be included in the account assignment. Enter the corresponding account assignment object (cost center or profit center). If you want the system to determine a profitability segment instead, you can use the PrfSeg checkbox. This is used when transferring data, such ...

The system was also not allowing the defauted cost center to be changed. I checked the cost element default account assignment (t-code OKB9) and found that the cost element 742500 was linked to the cost center 9000. I deleted this line from the OKB9 table. Now when I post any values to the G/L a/c 742500, the cost center field is mandatory but ...

Cost Element Default Account Assignment Tables in SAP. Search. SAP Database Tables; cost element default account assignment; Tables Related Searches # TABLE ... Transparent Table 11 : EKKN: account assignment in Purchasing Document MM - Purchasing: Transparent Table 12 : T030 Standard account s Table FI - Financial Accounting: Pooled Table 13 :

Default account assignment proposes default values when using specific accounts. It's utilized for automatically directing certain routine transactions to specific account assignment objects, such as posting office expenses to cost centers. Validation is used as an automated checking tool ensuring financial data meets predefined conditions.

Finally, if these settings are also missing, the SAP system checks master data of the primary cost element (G/L Account) under the tab of Default Account Assignment. You can display this master data using the transaction KA03. You can maintain the cost center and the order in the master data of the primary cost element. SAP Cost Element Master Data

If you have entered default account assignments in your cost element master data, the migration process creates entries in table TKA3A for these default assignments. You can check them using transaction code OKB9. The account type alone does not define how the account is used in CO. This is done by assigning a cost element category to each account.

So by setting defaults for these items, you narrow down the cost centers that can be assigned to an object. You can set defaults for: Business areas. Personnel areas. Personnel subareas. Company codes. When you do so, you are creating an Account Assignment (1008) infotype record. The inheritance principle applies to default settings.

The following table shows the cost element master data according to time dependency. ... Day-based fields (D) Description . Cost element characteristics . None . Default account assignment . Name . Cost element category : Record quantity indicator : Unit of measure : The following table shows: ... Default account assignment : Cost center/ order ...

In the Default Account Assignment for General Ledger Accounts you define a specific setting for a G/L Account, a cost center assignment or a free cost object assignment for example. But when viewing the journal entry of a business transaction (such as a supplier or cu. SAP Knowledge Base Article - Preview. 3046658-Default Account Assignment for ...

Cost Element Texts. S/4: Accounts for Primarycosts, Secondarycosts and Revenues are also filled in Tables SKA1, SKB1 and SKBT. SETHEADER. Set Header and Directory. Set Class (SETCLASS)=0102 for Cost Element Group. SETLEAF. Values in Sets. Set Class (SETCLASS)=0102 for Cost Element Group. SETNODE.

Step 1 − To create a new Account Assignment, click New Entries. Step 2 − In the next window, you have to enter the following fields −. The values of CoCd box. The value in Cost Elem. box. The value in the Cost Ctr box. Step 3 − To save the entry, click the Save button at the top. Step 4 − To post a test document to check that the ...

Chart of Account. Each G/L is set up according to a chart of accounts. The chart of accounts contains the definitions of all G/L accounts. The definitions consist of the account number, the account name, and the type of G/L account (e.g. balance sheet, non operating expenses/revenues, primary costs/revenues, secondary costs or cash accounts).

Finally, if these settings are also missing, the SAP system checks master data of the primary cost element (G/L Account) under the tab of Default Account Assignment. You can display this master data using the transaction KA03. You can maintain the cost center and the order in the master data of the primary cost element. SAP Cost Element Master Data