- My presentations

Auth with social network:

Download presentation

We think you have liked this presentation. If you wish to download it, please recommend it to your friends in any social system. Share buttons are a little bit lower. Thank you!

Presentation is loading. Please wait.

Sales and Use Tax Tracking

Published by Peregrine Fox Modified over 6 years ago

Similar presentations

Presentation on theme: "Sales and Use Tax Tracking"— Presentation transcript:

6 th Annual Focus Users’ Conference 6 th Annual Focus Users’ Conference Point of Sale Presented by: Natasha Leon Presented by: Natasha Leon.

Copyright © 2003 Americas’ SAP Users’ Group AFS Roundtable Session 2 of 2 Brian Nennmann & Gene Martinez Tuesday, May 20th.

Are you on track to graduate? Please do not leave until you are seen by your counselor and you have signed off on your credit check 1 senioritis.

Basic Introduction Training Lindsey Cook. By the end of the session, you will be able to: Define Study Island Implement the program with students.

CHECK IT OFF! Did you complete your paperwork?. 10/25/2015 Sign in Sheet 1.Please make sure you have signed the sign in sheet. 2.If it is an all day session,

Advanced Payroll Troubleshooting Presented by Bronwyn Betts.

Advanced Payroll with Union Discussion Presented by Bronwyn Betts.

Payroll Troubleshooting Presented by Bronwyn Betts.

th Annual PABUG Conference 1098T Banner Process – Easy or Difficult? Cathy Poiesz Messiah College.

Year-End Payroll Issues Presented by Bronwyn Betts.

Tech Advice Presented by Matt Straka. Welcome If you are applying for CPE credit, please be sure to sign in and sign out. Please write legibly! Additionally,

Foundation Services SaaS & P4C Chad Ode. Welcome If you are applying for CPE credit, please be sure to sign in and sign out. Please write legibly! Additionally,

Bank Reconciliation Presented by Melissa Wood. Welcome If you are applying for CPE credit, please be sure to sign in and sign out. Please write legibly!

A/P and A/R Troubleshooting Stefanie Walesch. Welcome If you are applying for CPE credit, please be sure to sign in and sign out. Please write legibly!

Nature Coast Chapter FGFOA Annual Conference April 16, 2014 Patricia Williams, Chapter President.

Overhead Allocation Presented by Melissa Wood. Welcome If you are applying for CPE credit, please be sure to sign in and sign out. Please write legibly!

Document Imaging and A/P Routing Presented by Brian Cancian.

Jeffrey S. Leafer, EA, MBA

Over/Under Billing Presented by Brian Cancian. Welcome If you are applying for CPE credit, please be sure to sign in and sign out. Please write legibly!

Implementing Multicurrency in an Existing Dynamics GP Environment Rod O’Connor 20-NOV-2014.

About project

© 2024 SlidePlayer.com Inc. All rights reserved.

Sales Tax vs. Use Tax

Aug 14, 2014

30 likes | 242 Views

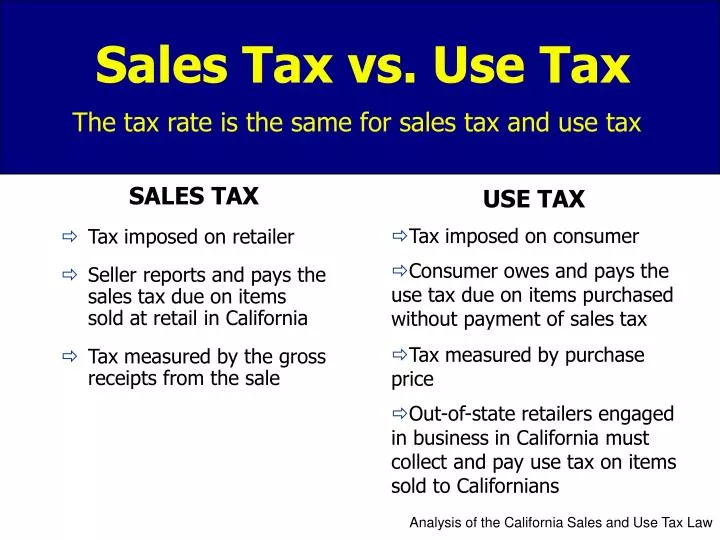

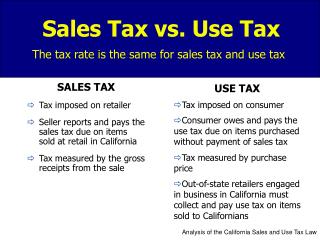

SALES TAX Tax imposed on retailer Seller reports and pays the sales tax due on items sold at retail in California Tax measured by the gross receipts from the sale. Sales Tax vs. Use Tax. The tax rate is the same for sales tax and use tax. USE TAX Tax imposed on consumer

Share Presentation

- gross receipts

- use tax law

- purchase price

- seller reports

Presentation Transcript

SALES TAX Tax imposed on retailer Seller reports and pays the sales tax due on items sold at retail in California Tax measured by the gross receipts from the sale Sales Tax vs. Use Tax The tax rate is the same for sales tax and use tax • USE TAX • Tax imposed on consumer • Consumer owes and pays the use tax due on items purchased without payment of sales tax • Tax measured by purchase price • Out-of-state retailers engaged in business in California must collect and pay use tax on items sold to Californians Analysis of the California Sales and Use Tax Law

- More by User

Arizona Sales Tax Use Tax Chunyan Pan Tax Manager Financial Services Office

2. Sales Tax Defined. Transaction Privilege Tax: tax imposed on vendors for the privilege of doing business in AZVendors register as a merchant in AZ and have a AZ business licenseAZ vendors usually pass the tax on to the customers, but the vendors are ultimately liable for the tax (file sales tax return and remit the tax to the State).

644 views • 30 slides

GENERAL SALES TAX

GENERAL SALES TAX. WHAT IS GST? 1. Is a Broad-Based, Multi-Stage Tax on Value Added Broad–based: charged on a wide range of goods and services Multi-stage: charged at every level of the economic chain

377 views • 20 slides

Sales & Use Tax Guideline

Sales & Use Tax Guideline. Table of Contents. University’s Tax Status University’s Roles & Responsibilities Tangible Personal Property (TPP) Sales Tax vs. Use Tax Accounts Payable Process How to Determine The Taxability on a Purchase. University’s Tax Status .

362 views • 11 slides

2. Sales Tax Defined. Transaction Privilege Tax: tax imposed on vendors for the privilege of doing business in AZVendors register as a merchant in AZ and have a AZ business licenseAZ vendors usually pass the tax on to the customers, but the vendors are ultimately liable for the tax (file sales ta

254 views • 23 slides

Sales Tax. Brave new world. 3 things about sales tax (mostly). Compliance Environment is getting tougher Exemption Certificates – protect against private use Business Activities – plans to improve our understanding. Compliance Environment. Interested persons Governmental Audits

304 views • 6 slides

437 views • 1 slides

Sales tax referendum

Sales tax referendum. May 6, 2014. Brunswick County’s Population. The County is currently the 47 th fastest growing county in the United States. Population.

83 views • 0 slides

Washington Sales and Use Tax

Washington Sales and Use Tax. University of Washington. Agenda. Retail Sales and Use Tax overview Destination Based Sales Tax Exemptions and How to Take Them PAS Procard Questions. Retail Sales Tax Defined. Retail Sales Tax Applies to tangible personal property

535 views • 34 slides

Sales tax referendum. Property Tax Rate and Schools Overview. Brunswick County’s Population. Student Population. Brunswick County Economic Overview: Assessed Valuation. The County e xperienced e xponential growth in its ad valorem b ase in FY08. Revaluation Year *Budgeted.

195 views • 7 slides

Local Sales and Use Tax Information

Local Sales and Use Tax Information. League of Municipalities Midwinter Conference February 25, 2014. Kim Conroy Tax Commissioner k [email protected] 402-471-5604 Garner Girthoffer Legislative Liaison g [email protected] 402-471-5885 Karen Barrett

418 views • 28 slides

Sales & Use Tax… The Little Known “BIG “ Tax

Sales & Use Tax… The Little Known “BIG “ Tax. Presented By: Berranthia Brown, CMI – The Coca-Cola Company Kim Ciamarra , CPA, CMI – Crowe Horwath , LLP. Today’s Agenda. Introduction and Overview of Sales & Use Tax Georgia Statistics on Sales & Use Tax

432 views • 27 slides

Sales Tax and Sales Tax Frauds

Sales Tax and Sales Tax Frauds. Muhammad Aamir Ilyas. Basic concepts. Sales Tax is levied and collected under Sales Tax Act 1990. Basic concepts. Rate of Tax is 17% of value of supply Tax is charged, levied and paid by the registered person on supply of taxable goods

362 views • 17 slides

Colorado Sales & Use Tax

Colorado Sales & Use Tax. Presenter: Alan Smith – Sales Tax Colorado, LLC. Varied State vs. Local Laws and Rates State and State-collected (statutory) cities, counties and special districts Home-Rule Cities Zip Code Issues Mailing addresses don’t reflect actual jurisdiction

444 views • 25 slides

Kentucky Sales and Use Tax

Kentucky Sales and Use Tax. Auctioneers’ Training Guide 2013 . Part I- General Information. Background/History General Forms Resources. Background/History. Part I: (A).

521 views • 27 slides

University of Washington. Washington Sales and Use Tax. Agenda. Retail Sales and Use Tax overview Destination Based Sales Tax Exemptions and How to Take Them PAS/Procard Common situations Questions. BUT, Why do I Have to Understand State Tax?.

462 views • 37 slides

Sales and Use Tax Nonprofit Organizations

Sales and Use Tax Nonprofit Organizations. Board of Equalization. *The information contained herein is intended to provide general guidance and therefore is not eligible for consideration under section 6596, Excusable Delay-Reliance on Advice. Course Objectives.

155 views • 3 slides

University of Washington. Washington Sales and Use Tax. Agenda. Retail Sales and Use Tax overview Destination Based Sales Tax Exemptions and How to Take Them PAS/ Procard / eProcurement Common situations Questions. BUT, Why do I Have to Understand State Tax?.

508 views • 35 slides

Sales and Use Tax

Sales and Use Tax. Erica Fernandez UC Merced Tax Manager. Sales vs. Use Tax. Sales tax Imposed on every retailer (seller/merchant) for the privilege of making retail sales of tangible personal property (TPP) in California Use tax

726 views • 31 slides

Arizona Sales Tax & Use Tax Tax Compliance Financial Services Office

Arizona Sales Tax & Use Tax Tax Compliance Financial Services Office. Sales Tax Defined. Transaction Privilege Tax: tax imposed on vendors for the privilege of doing business in AZ Vendors register as a merchant in AZ and have a AZ business license

492 views • 30 slides

Tax avoidance vs Tax evasion

Tax avoidance vs Tax evasion. Tax avoidance. is the legal utilization of the tax law to one's own advantage to reduce the amount of tax that is payable by means that are within the law Hiring a Tax Accountant is a strategy that many people use to reduce the expense of

675 views • 7 slides

19.1 Sales Tax and Excise Tax

19.1 Sales Tax and Excise Tax. Use the percent method to find the sales tax and excise tax. Find the marked price and sales tax from the total price. 19.1.1 Use the Percent Method to Find the Sales Tax and Excise Tax.

502 views • 38 slides

Sales Tax. Tax Break down in Canada. H.S.T. Provinces. PST. GST. Total $100.00. British Columbia 12% $112.00 Alberta no PST 5% no H.S.T. $105.00 Saskatchewan 5% 5% no H.S.T. $110.00 Manitoba 7% 5% no H.S.T. $112.00 Ontario 13% $113.00

196 views • 7 slides

COMMENTS

A tax on the sale, transfer, or exchange of a taxable item or service. Applies on the sale to the end user or consumer. Added to Sales Price and charged to purchaser. Applies to intrastate sales. Trust tax The storage, use or consumption of taxable property or services and includes the exercise of any right or power incident to the ownership of ...

The Sales and Use Tax rate is made up of: State Tax +Local Tax +Local Tax. +District Tax. 6.00% (2023) 1.00% (City or county operations) 0.25% (City or county transportation funds) 7.25% (Standard or Basic Statewide Tax Rate) 0.125% to ~3.50% (if applicable) Any city or county with applicable district taxes will have a sales and use tax rate ...

State Tax – 6.00% (2017) Local Tax – 1.25%. Equals Standard or Basic Statewide Tax Rate of 7.25% (6.00% state + 1.25% local) Plus. District Tax – .10% to 1.00% per district (if applicable) Any city or county with applicable district taxes will have a sales and use tax rate higher than 7.25%. A district may impose multiple district taxes ...

Course Objectives. After completing this course you will be able to: Apply the basic sales and use tax concepts for Minnesota and its local taxing jurisdictions to your business. Recognize the exceptions to the rule and the exemptions available. Distinguish how sales and use tax law applies to different types of businesses and their business ...

This course is an introduction to sales and use taxes in Minnesota. The purpose of the training is to provide the sales and use tax basics, including fundamental elements, local taxes, exemption certificates, record-keeping, filing and payment instructions, and contact information. It is meant to complement to our industry-specific webinars.

• Local Sales and Use Tax Guide • Local tax fact sheets Fact Sheet 164M, Minneapolis Special Local Taxes Fact Sheet 164S, Special Local Taxes • Tools to find tax rates Local Sales Tax Information 46 We offer a variety of tools including: • Sales Tax Rate Calculator • Sales Tax Rate Map

The total non-taxable amount (before shipping and handling) would be $1,000. No tax would be due. Sales and Use Tax. Erica Fernandez UC Merced Tax Manager. Sales vs. Use Tax. Sales tax Imposed on every retailer (seller/merchant) for the privilege of making retail sales of tangible personal property (TPP) in California Use tax Slideshow 3385831 ...

Presentation on theme: "Sales and Use Tax Tracking"— Presentation transcript: 1 Sales and Use Tax Tracking Presented by Brian Cancian

Sales and Use Taxes. Brunori Chapter 5. Success of the Tax. Slideshow 1646902 by duncan. ... Download Presentation Sales and Use Taxes.

Arizona Sales Tax Use Tax Chunyan Pan Tax Manager Financial Services Office. 2. Sales Tax Defined. Transaction Privilege Tax: tax imposed on vendors for the privilege of doing business in AZVendors register as a merchant in AZ and have a AZ business licenseAZ vendors usually pass the tax on to the customers, but the vendors are ultimately liable for the tax (file sales tax return and remit the ...