Best Ph.D. Student Loans

Expertise: Student loans, personal loans, home equity, credit, budgeting

Rebecca Safier is a personal finance writer with nearly a decade of experience writing about student loans, personal loans, budgeting, and related topics. She is certified as a student loan counselor through the National Association of Certified Credit Counselors.

Expertise: Insurance planning, education planning, retirement planning, investment planning, military benefits, behavioral finance

Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.

Ph.D. student loans offer a pathway to finance the extensive costs of higher education, covering tuition and living expenses. We’ve identified the best Ph.D. student loans from the Department of Education and private lenders.

| Federal student loans | Not rated | |

| Private student loans | 5/5 | |

| Best for cosigners | 4.8/5 | |

| Best for large loans | 4.7/5 | |

| Best for member benefits | 4.7/5 | |

| Best for student advisors | 4.5/5 |

Consider federal Ph.D. student loans first

If you must borrow Ph.D. student loans, consider Direct Unsubsidized Loans as your first funding source. Federal student loans from the U.S. Department of Education offer fixed interest rates, provide more repayment flexibility, and may come with the potential for loan forgiveness.

The other type of federal loan available to Ph.D. students, Grad PLUS loans, charge higher rates and a more substantial origination fee, so we recommend balancing these factors with the likelihood you’ll take advantage of federal borrower benefits once you’ve maxed out your Direct Unsubsidized Loans. Private student loans might make more sense than Grad PLUS loans for certain borrowers.

| Unsubsidized | Grad PLUS | |

| Rates | 8.08% | 9.08% |

| Origination fee | 1.057% | 4.228% |

| Credit check required? | No | Yes |

| Loan amounts | Up to $20,500 per year | Up to 100% of certified costs |

Federal Direct Unsubsidized loans

The first federal loan option to consider is the Direct Unsubsidized Loan . These loans don’t require students to demonstrate financial need and allow for up to $20,500 in annual federal funding toward your Ph.D. program, depending on your actual educational expenses.

One benefit is that you don’t need a cosigner or a credit check when you apply. File the FAFSA to apply.

Federal Grad PLUS loans

The Department of Education offers Direct PLUS Loans to graduate students to cover advanced education. If you’re eligible, you could borrow up to the school-certified cost of attendance minus any grants or scholarships.

Unlike some federal loans, Grad PLUS Loans aren’t available to you if you have an adverse credit history, and you’ll undergo a credit check to prove you don’t.

Best private Ph.D. student loans

If you need funds to pay for your doctoral degree , private Ph.D. student loans might make sense in addition to or instead of federal loans.

Private student loans can be harder to qualify for and may have less flexible repayment plans. Our team spent hours evaluating the options to choose the best Ph.D. student loans. Among other factors, we considered their options for deferment, repayment plans, cosigner policies, and grace periods .

College Ave

Best overall

Why it’s one of the best

College Ave is an online lender offering new student loans and refinancing. The company covers a variety of doctorate programs, including those for Ph.D.s.

It stands out for its 36-month grace period. Repayment terms can reach 15 years, shorter than other lenders that let you spread payments out over 20 years. However, you can borrow anywhere from $1,000 up to the total cost of attendance each year.

- Choose between 20 different repayment schedules

- 36-month grace period

- Deferment during postdoctoral research or internships

| 4.22% – 14.49% | |

| $1,000 – cost of attendance | |

| 5, 8, 10, or 15 years | |

| Be a U.S. citizen, permanent resident, or international student with a U.S. Social Security number and qualified cosigner. Be enrolled in an eligible school Meet credit and income requirements |

Best for cosigners

Sallie Mae is the largest private student loan lender in the country. It offers loans for graduate students seeking various degrees and certifications, covering up to 100% of your educational costs. Sallie Mae doesn’t have a Ph.D.-specific student loan product, but it offers graduate loans for students in master’s and doctorate programs.

Sallie Mae provides loans for up to 100% of your certified educational expenses, with no maximum loan limit. Repayment terms are up to 15 years, and cosigners can be released after 12 months of on-time payments. Student borrowers may still be eligible for loan payment deferment in 12-month increments.

- Cosigner release after 12 months of consecutive on-time payments

- Up to 48 months of deferment during postdoctoral research or internships

- No origination or prepayment penalty

| 4.15% – 14.97% | |

| $1,000 – cost of attendance | |

| 15 years | |

| Be a U.S. citizen, permanent resident, or international student with a qualified cosigner Meet credit approval and identity verification guidelines Be enrolled at a participating degree-granting school |

Best for large loans

Earnest is a popular online lender offering private student loans and the ability to refinance student loans. The Earnest Graduate School Loan covers Ph.D. programs in all states except Nevada.

These can help cover between $1,000 and up to 100% of your school-certified educational costs. You can choose from five repayment terms, and Earnest provides a nine-month grace period.

| 4.17% – 16.85% | |

| $1,000 – cost of attendance | |

| 5, 7, 10, 12, or 15 years | |

| Be a U.S. citizen, permanent resident, DACA student, or asylee Live in a participating state or Washington, D.C. Be enrolled at least half-time at a Title IV, not-for-profit institution Have a minimum FICO score of 650 and at least three years of credit history Not have a bankruptcy in the past or any accounts in collections |

Best for member benefits

SoFi stands out for its extensive member benefits, which include financial products, financial planning, and other resources to help borrowers succeed. Its no-fee structure, competitive rates, and rate discounts for return borrowers make SoFi a terrific choice for those seeking comprehensive support beyond student loans.

- Extensive member benefits

- No origination, application, or prepayment fees

- Option to prequalify without affecting your credit score

- Flexible repayment options for in-school and deferred payments

| 4.74% – 15.86% | |

| $1,000 – cost of attendance | |

| 5, 7, 10, or 15 years | |

| Be a U.S. citizen, permanent resident, or non-permanent resident alien Be enrolled at least half-time in a certificate- or degree-granting program at an eligible school (students in their final semester can be enrolled less than half-time) |

Best for student loan advisors

ELFI stands out due to its personalized customer service, offering applicants a dedicated student loan advisor to assist them throughout the application process. This personalized support ensures borrowers understand their loan terms and repayment options, making the process smoother and less stressful. ELFI’s commitment to guiding borrowers from start to finish helps them make informed financial decisions, making ELFI a top choice for those seeking expert advice and support with their student loans.

- Personalized service with a dedicated student loan advisor for each applicant

- Competitive rates with no origination, application, or prepayment fees

- Flexible repayment terms ranging from five to 15 years

- Available for undergraduate, graduate, and parent loans

- Offers forbearance for up to 12 months for financial hardship or medical difficulty

| 4.50% – 14.22% | |

| $1,000 – cost of attendance | |

| 5, 7, 10, or 15 years | |

| Be a U.S. citizen or permanent resident alien Reside in a state where ELFI lends Be enrolled at least half-time at an eligible institution Have a credit score of at least 680 (or cosigner with a credit score of at least 680) |

Best Graduate Student Loans

How are Ph.D. student loans different from graduate student loans?

Ph.D. student loans tend to be the same as other graduate student loans.

When determining which loan to borrow, look for one with a competitive interest rate, flexible repayment terms, and low or no fees. Review your options for when repayment starts. Can you make immediate, interest-only, or deferred payments while in school and for several months after you graduate or start a postdoctoral research or internship program?

How much does taking out a student loan for a Ph.D. cost?

Most private student loans for Ph.D. programs don’t include an application or origination fee, but you must pay interest charges. Interest starts accruing on your loan balance from the date of disbursement. The higher your rate, the more you’ll pay in interest over time.

Let’s say, for example, you take out a Ph.D. student loan for $50,000 with a 7% interest rate. Over 10 years of repayment, you’d pay $19,665 in total interest charges. If your rate were higher, at 10%, your total interest charges over 10 years would be $29,290.

When taking out a private student loan, your or your cosigner’s credit score has a major impact on the rate you get. Borrowers with the best credit may qualify for a lender’s lowest rates, while those with weaker credit could pay a higher interest rate.

If you can boost your credit score or apply with a creditworthy cosigner, you’ll improve your chances of getting a competitive interest rate on your Ph.D. student loan.

Is a Ph.D. student loan right for you?

A Ph.D. student loan may be right for you if you need funding for school. Before borrowing a private student loan, it’s smart to consider the following:

- Pursue gift aid you don’t need to pay back, such as grants and scholarships

- Max out your eligibility for federal Direct Unsubsidized Loans, which come with benefits including income-driven repayment and potential eligibility for loan forgiveness

- Work part-time to minimize the amount you must borrow in loans

If you still have a gap in funding, consider a federal Grad PLUS loan or a private Ph.D. student loan. Federal PLUS loans offer more repayment options and protections, but private loans may give creditworthy borrowers better rates and lower costs.

In July 2024, Grad PLUS loans have a fixed rate of 9.08% and loan fees of 4.228%, for example, whereas some private lenders offer rates starting around 4% and don’t charge origination fees. Compare both options to see which loan type would have a lower cost of borrowing for you.

How to get a student loan for a Ph.D. program

A graduate loan can be crucial in paying for your Ph.D. program. Whether you’re looking to cover tuition and fees, housing, or miscellaneous expenses, federal and private student loans can help.

Our expert’s take on loans for Ph.D. students

Erin Kinkade

The student loans needed for a Ph.D. program will likely be more than a bachelor’s or master’s degree. But along with that, the earning potential could be greater and facilitate an easier repayment. It’s important to understand the repayment terms; try to make extra payments while pursuing the Ph.D., and don’t wait until you graduate or get a job, if possible. Of course, make room in your budget for this payment, and when job searching, ask whether the employer offers any benefits for paying back student loans, such as 401(K) employer plan matching . This will assist with “lost” retirement savings and help you gain traction to meet your retirement goals.

To gain access to these loans, you must do the following.

- Fill out the FAFSA . The Free Application for Federal Student Aid is a form you must fill out months before the deadline for each year you want financial aid. It helps determine your financial need and is required if you hope to take out federal loans for any part of your educational expenses.

- Consider federal loans . Federal student loans have protections and features private loans don’t offer. While you may be limited in how much you can borrow based on financial need and annual limits, consider borrowing as much as you can with Direct Unsubsidized Loans before turning to Grad PLUS or private loans.

- Shop around for a private loan . Shopping around is a wise step when looking for the right private student loan, and it can help you find the right loan with the right terms and rates.

- Add a cosigner . If your credit history is limited, you have a low score, or you don’t meet the income requirements for a particular lender, consider adding a creditworthy cosigner to your private loans. This cosigner is equally responsible for your loans until you refinance or release them, but adding them when you apply can often unlock lower rates and higher loan limits.

- Provide documentation . Before disbursing your loan, your new lender may want to see documentation. This could include proof of employment, academic progress, or identity.

- Get your loan . Once approved, your loan funds are sent to your school and applied to any outstanding balance. Your school should refund the difference to you after the start of the semester.

Alternatives to a Ph.D. student loan

If you’re looking for alternatives to Ph.D. student loans, consider these funding options that could help lower the cost of attendance.

Tuition reimbursement

Look into tuition reimbursement programs with your employer—where your employer will repay a portion of your tuition costs in exchange for an employment contract.

Program support

Some Ph.D. programs offer financial support, which can be structured in several ways. The first is a fully funded Ph.D. program, which covers tuition, fees, and a stipend for living expenses.

You can also search for Ph.D. fellowship programs. These programs offer financial help during your studies based on merit, and a service requirement may be attached to the funding.

Which Ph.D. student loan is the best?

Federal student loans are often the best place to start your search. Federal loans offer more benefits and protections than private student loans. They may even allow you to have some of your debt forgiven later, particularly if you plan to work in public service.

If you consider private funding, the best Ph.D. student loan for you is the one that offers approval at the lowest interest rate with the best repayment terms for your unique situation. This lender may be different for each student borrower, so it’s wise to shop around first.

Do I need a cosigner for Ph.D. student loans?

Depending on your credit history, credit score, and current income, you might need to add a cosigner to qualify for a private Ph.D. loan. In exchange for adding a creditworthy cosigner, you may be eligible for certain loans, rates, and repayment terms you didn’t qualify for.

Depending on the lender, you could release your cosigner from this obligation after a certain number of on-time payments.

Do Ph.D. student loans cover living expenses?

A Ph.D. loan can help cover your school-certified expenses, which may include housing. It’s important to note that lenders may have annual or aggregate limits. If you take out too much for tuition and fees, you might need to consider adding a private loan to cover your living expenses.

How much can I borrow with Ph.D. student loans?

The amount you can borrow with a Ph.D. student loan depends on the type of loan and even the specific lender. Federal graduate loans limit you to a maximum of $20,500 per year (though certain healthcare fields may qualify for higher limits). With private loans, you might be able to take out up to 100% of your eligible expenses.

When does repayment on Ph.D. student loans start?

Your grace period usually begins once you drop below half-time enrollment or graduate (depending on the lender). This grace period often ranges from six to nine months, during which you don’t need to make any Ph.D. loan payments. After that grace period, repayment will start.

How we chose the best Ph.D. student loans

LendEDU evaluates student loan lenders to help readers find the best student loans. Our latest analysis reviewed 725 data points from 25 lenders and financial institutions, with 29 data points collected from each. This information is gathered from company websites, online applications, public disclosures, customer reviews, and direct communication with company representatives.

These star ratings help us determine which companies are best for different situations. We don’t believe two companies can be the best for the same purpose, so we only show each best-for designation once.

Recap of the best Ph.D. student loans

| Dept. of Education | Federal student loans | Not rated |

| Private student loans | 5/5 | |

| Best for cosigners | 4.8/5 | |

| Best for large loans | 4.7/5 | |

| Best for member benefits | 4.7/5 | |

| Best for student advisors | 4.5/5 |

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

- Student Loans

How The FAFSA Differs For Grad School

Updated: Jan 30, 2024, 10:41am

Returning to school for a graduate or professional degree is a big decision that more people are choosing. In fact, the National Center for Education Statistics (NCES) estimates that enrollment in master’s, doctoral and professional degree programs will increase 6% by 2031.

Graduate school can be expensive, but many students don’t realize financial aid is available. Besides loans, you can use grants, assistantships and work-study programs to finance your degree.

To access financial aid, you must complete the Free Application for Federal Student Aid (FAFSA)—the same form you filled out during undergrad. However, the FAFSA works differently for graduate students.

Find the Best Private Student Loans of 2024

Do i need to file a fafsa for grad school.

Earning a master’s degree can help accelerate your career, but you may be worried about the high cost of graduate school—and with good reason. The average annual cost of tuition and fees is about $20,000 for full-time graduate students, according to the NCES.

However, there are many financial aid opportunities available, if, you fill out the FAFSA .

Submitting the form, which should take under an hour, could result in major savings. The most recent data from the NCES shows the following statistics for the 2019-2020 award year:

- 74% of graduate students received some form of financial aid

- 43% of graduate students received grants, averaging $11,300 per student

- 12% of graduate students received assistantships, worth an average value of $18,800

- 39% of graduate students took out direct unsubsidized loans

- 11% of graduate students loans took out direct PLUS loans

If you skip the FAFSA as a graduate student, you could miss out on valuable financial aid, including gift aid that doesn’t require repayment.

How Does the FAFSA Work for Grad School?

The FAFSA for grad school is pretty similar to the FAFSA for undergraduate students. You’ll need the following information for the FAFSA form:

- Federal Student Aid (FSA) ID to sign into StudentAid.gov

- Social Security number or Alien Registration number

- Account statements for your checking and savings accounts

- Information about investment accounts

- Federal income tax returns

- Records of untaxed income

However, the FAFSA for graduate school differs in several key ways:

- Dependency status. Almost all graduate students are considered independent for financial aid purposes . This means you’ll only have to enter your own income and asset information rather than your parents’.

- Aid options. Graduate students have different loan and aid options than undergraduate students. As a graduate student, the only loans you can qualify for are direct unsubsidized loans and grad PLUS , so you’re responsible for all interest that accrues on your loan. Most grad students are also ineligible for Pell Grants, though you may qualify for other types of grant aid.

- Borrowing limits. Undergraduate student loans have annual and aggregate borrowing limits . Graduate unsubsidized loans also have borrower caps, but grad PLUS loans have no borrower maximum. You can borrow up to the total school-certified cost of attendance.

Grad School FAFSA Eligibility

As with undergraduate students, graduate school applicants are only eligible for federal financial aid if they meet the following requirements:

- Are U.S. citizens or eligible noncitizens

- Are planning to attend an accredited university in an eligible degree program

- Demonstrate financial need for programs like grants and work-study

In general, any degree you pursue after earning a bachelor’s degree is considered graduate school from a financial aid perspective. Graduate school financial aid includes financing for master’s degrees, business school and doctorate programs, as well as law, medical or dental school.

Financial Aid Options for Grad School

There are several forms of federal financial aid you can receive as a graduate student, based on your FAFSA information:

- Student loans. The government uses the FAFSA to determine your eligibility for federal student loans, which tend to have lower interest rates and more repayment options than private student loans for graduate school .

- Grants. You may be eligible for federal, state or local grants based on your FAFSA information. Grants are a form of gift aid and don’t need to be repaid. For federal grants, graduate students pursuing an education degree may be eligible for the Teacher Education Assistance for College and Higher Education (TEACH) Grant.

- Work-study. Another federal program available to graduate students, the work-study program helps you get a part-time job to offset your education expenses.

Grad School Loan Limits and Fees

If you’re like most graduate students, you’ll borrow some money to pay for your degree. On average, graduate borrowers took out about $26,000 in loans for the 2019-20 school year alone. For federal loans, there are two borrowing options:

- Direct unsubsidized loans. Direct unsubsidized loans for graduate students have an interest rate of 7.05% for the 2023-24 school year. The annual borrowing limit is $20,500 and lifetime limit is $138,500; any federal loans you took out for your undergraduate degree also count toward the lifetime maximum. The loan disbursement fee for unsubsidized loans is 1.057%.

- Grad PLUS loans. Unlike direct unsubsidized loans, PLUS loans don’t have an annual or aggregate limit. You can borrow up to the total cost of attendance in your program. However, PLUS loans have the highest interest rate of all federal loan options, at 8.05% for the 2023-24 school year. They also have a disbursement fee of 4.228%.

What To Expect After You Submit Your Graduate FAFSA

Submit your FAFSA as soon as you can after the application opens each year. After you submit it, you’ll receive your federal Student Aid Report (SAR) . The SAR summarizes the information on your FAFSA and explains your eligibility for financial aid. For the 2024-25 award year and onward, the SAR will be replaced with the FAFSA Submission Summary.

Contact your intended school’s financial aid office to see if there are any other steps you need to complete. Some universities have their own financial aid applications you’ll have to submit, or you may have to send in additional information to be considered for scholarships or other institutional aid.

The university will review your FAFSA information and other documents to determine your financial aid awards. They will send you a financial aid award letter detailing what grants, scholarships and student loans you’re eligible for and what steps you must complete to accept.

Once you’ve received your financial aid offer from the university and are enrolled at least half-time, any federal student loans you have from your undergraduate studies should be automatically deferred. If they’re not, you should ask the school you’re attending to report your enrollment to make you eligible for in-school deferment .

Planning for Graduate School

If you’re pursuing a master’s or another professional degree, filling out the FAFSA is an essential first step in paying for grad school . While the FAFSA for grad school has slightly different requirements than it does for undergraduate students, it can help you qualify for grants, work-study programs and federal student loans. To get the maximum amount of financial aid you deserve, apply as early as possible.

Looking for a student loan?

- Best Private Student Loans

- Best Student Loan Refinance Lenders

- Best Low-Interest Student Loans

- Best Student Loans For Bad or No Credit

- Best Parent Loans For College

- Best Graduate Student Loans

- Best Student Loans Without A Co-Signer

- Best International Student Loans

- Best 529 Plans

- SoFi Student Loans Review

- College Ave Student Loans Review

- Earnest Student Loans Review

- Ascent Student Loans Review

- Citizens Bank Student Loans Review

- Student Loan Calculator

- Student Loan Refinance Calculator

- Net Price Calculator

- What Is The FAFSA ?

- Applying Financial Aid Using The FAFSA

- When Is The FAFSA Deadline ?

- Answers To Biggest FAFSA Questions

- FAFSA Mistakes To Avoid

- Guide To Hassle-Free FAFSA Renewal

- How To Correct Or Change Your FAFSA

- How Do Student Loans Work?

- How To Get A Private Student Loan

- How To Refinance Student Loans

- How To Get A Student Loan Without Co-Signer

- How To Apply For Federal & Private Student Loans

- How To Pay Off Student Loan Debt

- How To Recover From Student Loan Default

- How Much Can You Borrow In Student Loans?

Next Up In Student Loans

- Best Student Loan Refinance Lenders Of August 2024

- Student Loan Calculator: Estimate Your Payments

- Best Private Student Loans Of August 2024

- Best Low-Interest Student Loans Of August 2024

- Best Parent Loan For College Of August 2024: Parent PLUS Loan & Private Options

- How To Get A Student Loan Without A Co-Signer

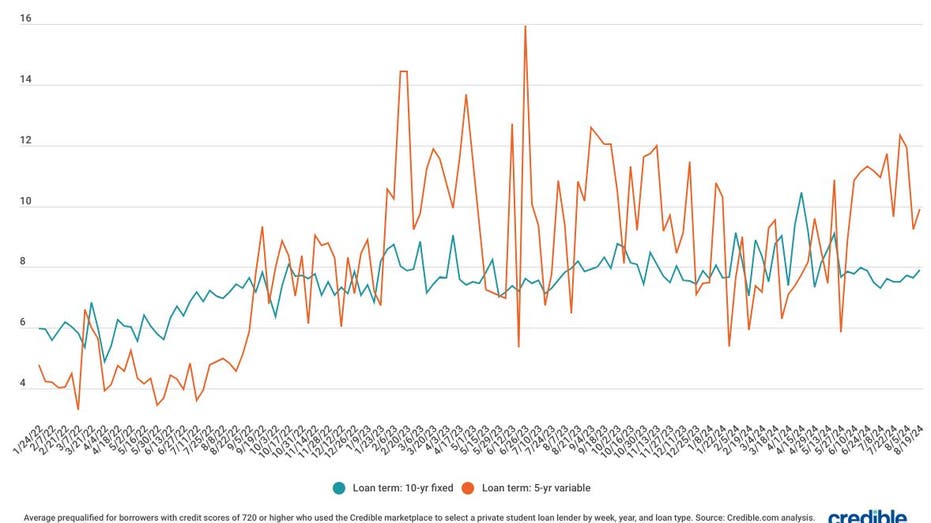

Private Student Loan Rates: August 27, 2024—Loan Rates Move Up

How Student Loan Debt Affects Homeownership And Other Financial Milestones

Student Loan Forgiveness: What Might Happen Under A Harris-Walz Presidency

Will A Trump-Vance Presidency Kill Student Loan Forgiveness?

Best Private Student Loans Of 2024: Compare Top Lenders

Private Student Loan Rates: August 20, 2024—Loan Rates Slip

For the past seven years, Kat has been helping people make the best financial decisions for their unique situations, whether they're looking for the right insurance policies or trying to pay down debt. Kat has expertise in insurance and student loans, and she holds certifications in student loan and financial education counseling.

- English Language Programs

- Postdoctoral Affairs

- Training Grant Support

- Request Information

THE GRADUATE SCHOOL

- About Graduate Funding

PhD Student Funding FAQs

General funding, what are the current stipend and tuition rates.

The current stipend rate can be found on the About Graduate Funding pag e , and current tuition rates can be found on the Student Finance website . The stipend rate is set by the dean of The Graduate School (TGS) and the budget office, and approved by the provost. This rate is typically announced during the winter quarter for the following year. Tuition rates are set by the provost’s office and approved by the Board of Trustees each spring. These rates are typically announced during the spring quarter.

Who determines a student’s funding sources (e.g., whether a student will be paid on a fellowship or graduate assistantship)?

Each program determines on a quarterly basis whether or not students will be funded using TGS funds or other sources (e.g., grants). When TGS funds are used, the program determines if this will be through a fellowship or graduate assistantship for each student. Students should refer to their admissions offer letter or program staff regarding their individual funding.

Are PhD students responsible for paying any fees out-of-pocket?

A PhD student's funding covers tuition, stipend, health services fees and the annual health insurance premium. Any other fees, such as the activity fee, are paid by the student.

How is a PhD student’s funding affected when registered for TGS 512 (Continuous Registration)?

Students do not receive funding (stipend or tuition scholarship) when registered for TGS 512 and are not eligible for the health insurance subsidy. In addition, they do not pay the activity fee and are not eligible for U-Pass. The current tuition charge for TGS 512 is $100/quarter.

Is PhD funding different for international students?

In general, international students are funded the same as domestic students. However, international students must pass TGS's English Proficiency Requirement before they can be funded as a graduate assistant/TA.

What other funding opportunities are available?

Additional funding opportunities may be available based on eligibility through The Office of Fellowships , the Evanston Office of Graduate Financial Aid (loans), Interdisciplinary Graduate Assistantships (GAships) , or TGS Internal Fellowships/Grants . It is the student’s responsibility to obtain approval from their program and coordinate other funding opportunities.

How do external fellowships affect my funding?

Your Northwestern funding package will be adjusted when you obtain external funding. You do not receive external fellowships on top of your full Northwestern funding.

Are financial resources available for relocation/moving expenses?

What is the process when a phd student’s tuition/fees are financially supported by direct billing to a 3rd party sponsor.

If a 3 rd party sponsor, such as an employer or scholarship sponsor, pays for a student’s tuition/fees upfront and without any stipulations, then it may fall under third party billing in which case the Student Finance department can set up a third party billing plan and invoice the sponsor directly; however, before they can do this, the student would need to provide them with an official sponsorship letter. The letter needs to be on company/sponsor letterhead and it needs to include the following information:

- Type of charges that will be covered (tuition, activity fee, student health plan, etc.)

- Coverage period (for example: Fall 2021 or 2021-2022 academic year)

- Address/email address where invoice should be sent

- Address where any refund/overpayment should be returned

Funding timeline

How many quarters of funding does a phd student receive .

PhD students in the Humanities and Social Sciences receive 20 quarters (5 full years) of funding. In most programs additional quarters may be banked through the fifth year and used in the sixth year (see banked quarters section below). PhD students in the Sciences and Engineering are typically funded for at least five years through a combination of funding by The Graduate School (TGS) and adviser/program funding. Graduate student funding is a shared responsibility. While financial commitments are made to PhD students for a set number of years, it is important to understand that the overall graduate funding budget is dependent on a significant number of PhD students obtaining external funding.

During what months/quarters are PhD stipends paid?

PhD students are paid year round including over the breaks while they are registered full-time (excluding TGS 512). Please note that the funding quarters do not exactly match the academic quarters . For example, the first stipend payment for new students is for the period of 9/1 – 9/30 even though classes do not start until late September. Conversely, a student who graduates in the Spring quarter (completes in May) is paid through 5/31 even though classes run a couple of weeks into June. Students receive 3 months of stipend for each quarter although the timing does not exactly match the academic schedule. Below are the funding quarters:

- Fall: September – November

- Winter: December – February

- Spring: March – May

- Summer: June- August

Is the funding for each program customized based on average time to degree?

No. The University’s funding commitment is standard across all PhD programs. It is not tied to time to degree in order to maximize the funding available to as many students as possible.

What funding from The Graduate School is limited to a PhD student’s first five years?

Any TGS quarters of funding, outside of eligible banked quarters, such as interdisciplinary GAships, cluster quarters, and competitively-awarded fellowships, such as the Nicholson Fellowship, TGS Buffet Fellowship, Ryan Fellowship etc., are limited to a PhD student’s first five years.

What funding options are available to a PhD student after their fifth year?

At the home school’s discretion, eligible banked quarters may be used through a PhD student’s sixth year in the Humanities and Social Sciences. In addition, there is no limitation on funding from outside of The Graduate School, external funding from outside of the University, or scholarships related to external funding. In addition, TGS continues to provide research assistant scholarships (RAS), health subsidies, and tuition scholarships for PhD students with external funding beyond 5 years across disciplines.

When a PhD student graduates, when does their stipend end?

A PhD student will receive a stipend payout through the end of the month in which they complete/submit all degree requirements.

Banked quarters (humanities and social sciences PhD students)

Can phd students bank some of their funding to be used later .

At the home school’s discretion, most Humanities and Social Sciences PhD students may use up to 4 banked quarters to extend their funding through their sixth year. Banked quarters are earned in years 1-5 when a student is funded on quarters outside of their 20 allocated quarters from TGS, such as through interdisciplinary GAships, external fellowships, grant funding, etc. Please check with your program staff or dean’s office to determine if your program participates in banked quarters.

Are banking policies consistent between schools?

The Weinberg College of Arts & Sciences (WCAS) has a formal banking policy that is consistent across most programs. Currently, it is standard in most programs for WCAS Humanities and Social Sciences PhD students to use banked quarters through their sixth year. Please check with your program staff or dean’s office to determine if your program participates in banked quarters.

Additional income (e.g., Permission to Work)

In addition to their stipend, can a phd student perform additional work for pay.

In order for a student to perform additional work for pay, A Permission to Work form must be submitted before the work begins if any of the following thresholds are exceeded:

- Student will work more than 10 hours/week

- Time period of service is more than one month

- Compensation is $600 or more

PhD and MFA students may work no more than 20 hours per week from all sources, including assistantships. Students are responsible for verifying that additional work for pay is permitted based on their funding source (e.g., NSF GRFP, etc.).

Payroll and Taxes

Where can i find out information about payroll, i-9 forms, fnis, direct deposit, w-4s etc.,, why can’t federal taxes be automatically withheld from graduate student fellowships.

Even though graduate student fellowships are considered taxable income, federal law does not require taxes to be withheld, and the amount to withhold varies by individual. To help avoid a significant tax payment at the end of the year, students are encouraged to complete a W-4 Form and indicate an amount they would like Payroll to withhold from each stipend payment. Learn more in the Taxes section .

Where can I receive assistance with filing my taxes?

Why can’t the student activity fee be automatically deducted from stipend payments.

There is not currently a mechanism in place across the multiple University systems to automatically deduct the student activity fee. If a student activity fee is not paid on time, a registration hold may be placed on the account and a late fee may be charged. Please be sure to check your student account in CAESAR every month.

Undocumented/DACA funding

How are undocumented or daca students funded.

Undocumented students who are not authorized to work in the U.S. must be funded on fellowships for their entire tenure in the program. DACA (Deferred Action for Childhood Arrivals, a.k.a. Dreamers) students who have work authorization may be funded on assistantships or fellowships.

Healthcare subsidy

Who is eligible for the health care subsidy.

All TGS PhD students who are registered full-time (3-4 units), except for TGS 512, during the fall quarter are eligible for the healthcare subsidy for the full academic year (Sep 1-Aug 31). The subsidy is automatically applied during the fall quarter as long as the student is enrolled in the Northwestern health insurance plan.

More Assistance

Who should i contact with questions or issues related to my funding, who should i contact with questions or issues related to my student account in caesar.

Phd-Study-In-Uk

- PhD Loans for Doctoral Students – A Guide for 2024

Written by Mark Bennett

A UK PhD loan is worth up to £29,390 from Student Finance England or £28,655 from Student Finance Wales. The money only needs to be paid back when you earn over £21,000 a year.

On this page

| Student loans for PhD-level qualifications lasting up to eight years in all subjects. | |

| Up to £29,390 from Student Finance England for 2024-25 or £28,655 from Student Finance Wales. | |

| English- or Welsh-resident UK students, aged 59 or under and . | |

| Any UK university. | |

| 6% of income over £21,000 per year. Combined with . | |

| . |

You can borrow a PhD loan of up to £29,390 from Student Finance England for 2024-25 study or £28,655 from Student Finance Wales. All of the money is paid directly to your bank account . You can use it for PhD fees, research expenses, maintenance or other costs.

Doctoral loans aren't based on household income or means tested, so the amount you can borrow isn't affected by your income or savings.

It's up to you to decide how much you want to borrow (up to the maximum, of course). This amount will then be spread evenly across your PhD, in three instalments per academic year .

Frequently asked questions

Below we've answered a selection of commonly asked questions about PhD loan amounts.

Is the value of the doctoral loan linked to my fees?

No. You can borrow the same amount with a doctoral loan regardless of how much your PhD project or programme costs.

Can I change the amount I borrow?

Yes. You can change your PhD loan amount later by submitting a PhD loan request form (PDF). You can't do this online.

Can I borrow more than the cost of my PhD?

Yes. Any extra loan can be used to help with living costs or other expenses.

Do I have to borrow the full amount?

You can borrow anything between £1 and £29,390/£28,655 (for a 2024-25 PhD). Whatever you request will be divided equally across your PhD , but you can't receive more than £12,167 in any one year if your course started between 1 August 2023 and 31 July 2024, and £12,471 if your course starts on or after 1 August 2024.

Are extra loans available for maintenance?

No. You can use some of your doctoral loan for living costs, but there isn't any separate PhD maintenance loan.

Will the loan value increase?

The value of a doctoral loan usually increases slightly with inflation each year. However, this change only applies to new students. The maximum you can borrow with your PhD loan will be capped at the amount available when you began your PhD.

Why can't I borrow more than £12,167/£12,471 per year?

Capping the annual amount for a PhD loan at £12,167/£12,471 is designed to match the Masters student loan system : it means that doctoral students and Masters students can borrow the same amount per year.

The timing of your loan payments will be based on your intended submission date . This means that your loan payments may already have finished if your PhD takes longer than you expect, or you spend extra time 'writing up' your thesis. You should bear this in mind as you plan your project and budget for it.

Student eligibility

You can apply for a PhD student loan if you're a UK national and:

- You've lived in the UK for at least three years (not including time abroad for short-term travel or study)

- You are ordinarily resident in England or Wales (you don't just live there to study)

- You will be aged under 60 (59 or under) on the first day of the first academic year of your PhD (usually 1 September for degrees beginning in the autumn)

- You don't already have a PhD or other doctorate

- You won't be receiving UKRI funding for your PhD (and haven't been funded by a Research Council in the past)

- You won't be receiving other UK public funding for your doctorate, such as a Social Work or Educational Psychology bursary

- Your doctorate isn't eligible for NHS funding (if it is, you should apply for this instead)

PhD loans for Scottish and Northern Irish students

UK doctoral loans are currently only offered by Student Finance England and Student Finance Wales. You won't normally be eligible to apply for their support if you are resident in Scotland or Northern Ireland.

Student Finance Northern Ireland and Student Awards Agency Scotland may offer doctoral loans in the future. We'll let you know as soon as that happens.

PhD loans for EU students

You can apply for a UK doctoral loan as an EU student if:

- You began your PhD in the 2020-21 academic year or earlier

- You applied to the EU Settlement Scheme before 30 June 2021

EU students who are coming to study in the UK from 2021-22 onwards will count as international students (see below).

PhD loans for Irish students

Irish students can still apply for a UK PhD loan to study in either England or Wales. This right is guaranteed by the Common Travel Area and isn't affected by Brexit.

PhD loans for international students

International (non-UK) students aren't normally eligible for UK doctoral loans, but an exception may apply if:

- You have settled status in the UK

- You are an EU national and have applied to the UK's EU Settlement Scheme (see above)

- You are an Irish national (see above)

- You or a family member have been granted refugee status or humanitarian protection in the UK

- You are 18 or over and have lived in the UK for at least 20 years and / or half of your life

If you aren't sure whether you qualify for UK student finance, check advice from the UK Council for International Student Affairs (UKCISA) .

We've answered several questions about student eligibility for doctoral loans, covering residency criteria and more.

Where can I study?

If you are ordinarily resident in England or Wales before your course, you can use your PhD loan to study any UK PhD .

If you are ordinarily resident outside the UK, you can only use your PhD loan to study in England or Wales.

What if I have moved from England or Wales to another part of the UK for previous study?

You will still count as an English- or Welsh-resident student if you have studied your undergraduate degree or Masters in Scotland or Northern Ireland and want to continue straight on to a PhD. This means you will be able to apply for a doctoral loan.

What counts as being ordinarily resident in England or Wales?

To be eligible for a doctoral loan as a UK student you must be ordinarily resident in England or Wales. This means that you normally live in England or Wales and you haven’t moved there just to go to university.

You will normally count as being ordinarily resident in England or Wales if any or all of the following are true:

- You lived in England or Wales before you went to university for your Bachelors degree

- You received an undergraduate student loan from Student Finance England or Student Finance Wales

- You have lived and worked in England or Wales after graduating from university

Can I combine a PhD loan with a Research Council studentship?

No. Unfortunately you can't apply for a PhD loan if you're also receiving any form of Research Council funding from UKRI – including a 'fees-only' award.

Can I get a PhD loan now and apply for Research Council funding later?

Potentially. Some Research Council awards allow students to apply again for the second year of their PhD. Having had a PhD loan may not stop you doing this, provided you cancel it before receiving your Research Council funding.

Note that this still doesn't work the other way around: you can't apply for a PhD loan once you've been awarded Research Council funding.

Can I combine a doctoral loan with other PhD funding?

You can't combine a PhD loan with other funding from the UK Government, including Research Council studentships or Social Work, Educational Psychology or NHS bursaries. However, you can potentially top up your PhD loan with other PhD funding , including:

- A scholarship or bursary from your university

- A grant from a charity or trust

- One of our own FindAPhD scholarships

Are EU students still eligible for doctoral loans?

EU eligibility for UK student finance has changed following Brexit :

- All EU nationals can still apply for a doctoral loan for a PhD that began in the 2020-21 academic year

- EU nationals who applied to the EU Settlement Scheme before 31 December 2020 can also apply for a loan for a PhD that begins in 2021-22 or later

- EU nationals who are arriving in the UK after 1 January 2021 and beginning a PhD in the 2021-22 academic year will not normally be eligible for a doctoral loan

These criteria also apply to students from the EEA (Norway, Iceland and Liechtenstein) and Switzerland.

Are doctoral loans available for international students?

Non-UK students aren’t normally eligible for UK student loans, unless they are Irish nationals or have applied to the EU Settlement Scheme.

Exceptions may apply if you have lived in the UK legally for a very long time, have been granted humanitarian protection or have refugee status.

For more information on UK fees and finance as a postgraduate student we recommend you check the resources produced by the UK Council for International Student Affairs (UKCISA) .

And, if you can't get a loan, you might still be eligible for other international PhD funding in the UK .

Are Irish students eligible for PhD loans?

Yes, Irish students are able to apply for UK doctoral loans as part of the Common Travel Area. You will need to be doing your PhD in either England or Wales.

How will my residency be checked?

You’ll be asked to provide at least three years’ address history during your postgraduate loan application. Student Finance England may query any details that might affect your eligibility.

What if I have stayed in another part of the UK to work after university?

Living and working in a different part of the UK means you aren’t just there to go to university. This can change your residency status.

For example:

- You live in Scotland but go to university in England. After graduating you settle and work in England. If you eventually decide to study a PhD, you will now count as being ordinarily resident in England and can apply for a doctoral loan, even though you were once resident in Scotland.

The same would be true for an English student who had lived and worked elsewhere in the UK after graduating – it's possible that this could mean you are no longer classed as English-resident for student loan purposes.

If you aren’t sure about your residency status, check with Student Finance England .

What if I have moved to England or Wales from another part of the UK for previous study?

Because you only moved to England or Wales to study, your residency status won’t have changed. You will still count as being ordinarily resident elsewhere in the UK and, unfortunately, won't currently be able to apply for the PhD loan.

Are PhD loans means-tested?

No. You can borrow the same amount regardless of your income, savings or credit rating.

The only exceptions concern outstanding arrears to the Student Loans Company (for repayments you were eligible to make, but didn't). However, you may be able to apply for a loan if you clear these.

Can I get a doctoral loan if I’ve lived outside the UK in the last three years?

In order to apply for a student loan as a UK citizen you must have lived in the UK for three years prior to your course. You can travel abroad for holidays or other periods of ‘temporary absence’ during this period, but you shouldn’t have become ordinarily resident in another country.

Will a PhD loan affect my benefits?

Potentially, yes. Because the loan is paid directly to you it may be regarded as a form of income by the Department for Work and Pensions. You should check this if you are concerned about your benefit entitlement with a PhD loan.

Can I also apply for Disabled Students' Allowance?

Yes. You can have a PhD loan and receive Disabled Students' Allowance (DSA) during your PhD.

Can I have a PhD loan as well as a postgraduate Masters loan?

You can apply for a postgraduate doctoral loan if you've previously had a postgraduate Masters loan . However, you can't be receiving them both at the same time (you'll need to finish your Masters before you begin your PhD).

Course eligibility

The PhD loan is available for all types of research doctorate, in any subject . This includes academic doctorates such as a PhD and DPhil, as well as professional doctorates such as a DBA (Doctor of Business Administration) or EdD (Doctor of Education) .

However, you can't get a doctoral loan for a PhD by publication (you must be funding a programme of research and / or study).

UK students can study at any UK university . Eligible students who normally live outside the UK can use the doctoral loan to study at any English or Welsh university.

You can study full time or part time provided your PhD lasts between 3 and 8 years . You will be able to choose from different course lengths when you apply. These will be set by your university based on the intended submission date for your thesis.

Your course must have started on or after August 2018.

Below you can find the answers to a selection of questions about PhD loan course eligibility.

Can I study my PhD part time?

The loans don't actually distinguish between full-time and part-time students. Your PhD can last between 3 and 8 years, however you study.

In practice, most UK universities will regard a 3-4 year PhD as 'full time' and a 6-8 year PhD as 'part time'. You will agree the exact length of your programme with your university.

Can I get a loan for a PhD by publication?

No. You can't apply for a loan if you're submitting a PhD by published work (based on a portfolio of research you've already completed). In this case there would be no new project or programme for the loan to pay for!

Can I get a loan if my doctorate begins as an MPhil?

Yes. You can still apply for a doctoral loan for a programme that initially registers students at MPhil level before upgrading them to PhD candidacy.

However, if you are only enrolling for an MPhil, you should apply for a Masters loan instead.

Can I get a loan for a doctorate by distance learning?

Yes, provided you are living in England or Wales (depending on which loan you are applying for) on the first day of the first academic year of your PhD and living in the UK for the entire course.

You can't get a PhD loan to study by distance learning and live outside the UK.

Can I apply for a loan for a PhD that includes a Masters degree?

Yes. You can still get a loan for a PhD that also awards a Masters degree, including an integrated doctorate or a '1+3' programme. However, you must be registering to graduate with the doctorate, not the Masters.

Can I apply for a loan to 'top up' an existing qualification to PhD level?

No. To be eligible for a loan your project or programme must be a complete doctorate, begun after 1 August 2018. You can't get a loan to extend or 'top up' and existing MPhil or other qualification.

Can I get a loan for a joint doctorate?

Yes, provided the UK university is the lead institution for your PhD and you spend at least 50% of your course in the UK.

Can I study at a private university?

In order to receive a doctoral loan you must be doing your PhD at a university with Research Degree Awarding Powers (RDAPs). Most established UK universities have these powers, but your institution should be able to confirm if you aren't sure.

Can I get a loan if I've previously begun a PhD, but not completed it?

Yes, provided you haven't earned a doctoral qualification and you are starting a completely new doctorate (not continuing or resuming your previous programme or project).

However, you can't normally apply for a second doctoral loan, even if your first loan was for an incomplete qualification. Exceptions may apply if you can demonstrate compelling personal reasons for exiting your first doctorate - Student Finance England will consider your case if so.

Can I get a loan to study a doctorate abroad?

You can't get a PhD loan to study your entire doctorate abroad. However, you can spend part of your degree outside the UK, provided this does not exceed 50% of your programme and your UK university is the lead institution awarding your PhD.

Can I get a PhD loan for a professional doctorate?

Yes. All types of doctorate are eligible for PhD loans, provided the qualification is awarded for a programme of work at a UK university.

Applications

PhD loan applications are now open for doctorates beginning in 2024-25 (or earlier).

Make sure you apply to the correct student finance provider. This will be:

- Student Finance England for English-resident students or Irish students coming to study in England

- Student Finance Wales for Welsh-resident students or Irish students coming to study in Wales

If you have an existing student finance account and Customer Reference Number (CRN) you should use this to apply for your PhD loan. The application system will also ask for details about your PhD (or other doctoral degree), residency status and how much you want to borrow.

The application deadline is fairly relaxed – you have to apply within nine months of the first day of the final academic year of your doctorate. Depending on when you start your PhD during the year, there are four possible ‘first days’, which you can see in the table below.

| 1 August - 31 December | 1 September |

| 1 January - 31 March | 1 January |

| 1 April - 30 June | 1 April |

| 1 July - 31 July | 1 July |

As an example, if you start a three-year PhD on 22 October 2023, you should apply for a doctoral loan before 31 May 2026.

Remember though, that applying later in your PhD could limit the maximum amount you can borrow (you can't receive more than £12,167 in a single academic year if your course started between 1 August 2023 and 31 July 2024, or £12.471 if your course starts on or after 1 August 2024.).

If you have any further questions about applying for a PhD loan, hopefully the FAQs below will cover them.

When can I apply for a PhD loan?

Applications for 2024-25 PhD loans opened in June 2024. You can apply online or by post (PDF).

Will I receive a loan whilst I'm 'writing up' my PhD?

Only if you are still ahead of your submission date. Your university may allow you extra time to finish writing up your thesis, but you won't receive any extra payments if you've already had your full loan by that point.

When will I receive my first instalment?

You'll receive the first payment for your PhD loan once you start your PhD and your university confirms that you have registered on your project or programme.

When will I stop receiving my loan?

Your payment schedule will be based on the intended submission date for your doctoral thesis, agreed with your university at the start of your degree.

Should I apply at the beginning of my course, or wait?

This is up to you and depends on your funding circumstances.

The PhD loan is meant to be flexible though: you could apply for a loan to help support you throughout your doctorate, or use it to bridge gaps between funding or replace income from a part-time job as you focus on the later stages of your project.

Do I have to reapply in each year of my PhD?

No. You only have to apply for a doctoral loan once.

Can I use an existing student finance account?

Yes. If you have already have an account with Student Finance England you must use it to apply for your doctoral loan.

Do I need to be accepted for a PhD before I apply for a loan?

No. You will need to state which university you intend to research your doctorate at (and how long for) but you don't need to prove you've been accepted before you can apply for a PhD loan. However, you will need to register for your PhD before you receive any actual loan payments (your university should confirm this for you).

Can I apply for a loan for a PhD I've already started?

You can apply after the beginning of a PhD, but it must have started after 1 August 2018.

Doctoral loan repayments are income contingent . You only repay your PhD loan when you are earning over £21,000 a year (£1,750 a month or £404 a week) and you only repay 6% of what you earn over that threshold.

You'll begin repayments in the first April after you leave your course or in the April four years after your PhD starts (whichever is sooner). This means that you can be eligible to start repaying the doctoral loan during your PhD, but only if you're earning enough.

How you repay depends on your employment status:

- If you are employed in the UK HMRC will automatically deduct repayments from your salary on behalf of the Student Loans Company. This will usually happen monthly.

- If you are self-employed you will need to make repayments to HMRC as part of your annual tax return.

- If you are working outside the UK you will need to make repayment arrangements with the Student Loans Company. You should do this before you leave the UK.

- If you are unemployed you won't make repayments. The same applies if you are ever earning less than £21,000 a year.

You may also need to repay other student loans along wth your PhD loan:

- PhD and Masters loan repayments are combined – you will make one repayment of 6% of your income over £21,000 towards a single postgraduate loan debt

- All postgraduate loan repayments are concurrent with those for undergraduate loans – you will repay 6% of your income over £21,000 towards your Masters and / or PhD loan and 9% of your income over £26,575 towards your undergraduate loan

Interest is charged on a PhD loan at the same rate as Masters loans: RPI (the Retail Prices Index) +3%. As of June 2024, the rate is 7.8%, but this changes every year.

Any remaining PhD loan debt (including interest) is cancelled after 30 years from the point at which you begin repayments.

We've answered a few more FAQs about PhD loan repayments below.

When do repayments begin?

You will become eligible to start repaying your doctoral loan on one of the following dates:

- 6 April after your PhD ends

- 6 April four years after you begin your PhD

Note that this is slightly difference to repayments for other student loans, which only ever begin after graduation.

It means you could begin repaying your loan whilst you're still studying for your doctorate (and potentially still receiving loan payments). However, you will only ever make repayments when you're earning over £21,000 a year.

Do repayments still begin after 4 years if I study part time?

Yes, regardless of how you study, you will become eligible to repay a PhD loan (providing you're earning enough) four years after your course begins or in the April after you graduate (whichever is sooner).

Could I have to make PhD loan repayments on my pension?

Potentially, yes. If the money you receive from a pension counts as income you will need to make student loan repayments on it (alongside other potential deductions such as income tax). It's a good idea to check this with your pension plan provider.

Welsh PhD loans

Wales offers its own PhD loan for Welsh-resident UK students. You can borrow up to £28,655 for a degree that begins in 2024-25.

Welsh PhD loans work the same way as English PhD loans. The only difference is that you should apply to Student Finance Wales, not Student Finance England.

Scotland and Northern Ireland don't offer a doctoral loan yet.

Still looking for a PhD?

Head over to our PhD course listings to find the latest opportunities from around the world.

Like hearing about postgraduate funding changes?

So do we it really helps when we're putting together our free weekly newsletter., you may also like....

Our detailed guides and blogs cover everything you need to know about PhD loan eligibility, applications, repayments and much more.

It's time to start applying for postgraduate student finance. Read some tips and advice from the experts at the Student Loans Company.

Have your funding applications been unsuccessful? This blog discusses what it's like to self fund with a UK doctoral loan, and what it might mean for your studies.

PhD loan applications are open! Our handy checklist will help ensure yours is simple and successful.

You can now apply for a PhD loan for 2022! Here are a few things to bear in mind before you start your application.

Don't get lost looking for PhD funding. This simple guide will help you prioritise your search.

FindAPhD. Copyright 2005-2024 All rights reserved.

Unknown ( change )

Have you got time to answer some quick questions about PhD study?

Select your nearest city

You haven’t completed your profile yet. To get the most out of FindAPhD, finish your profile and receive these benefits:

- Monthly chance to win one of ten £10 Amazon vouchers ; winners will be notified every month.*

- The latest PhD projects delivered straight to your inbox

- Access to our £6,000 scholarship competition

- Weekly newsletter with funding opportunities, research proposal tips and much more

- Early access to our physical and virtual postgraduate study fairs

Or begin browsing FindAPhD.com

or begin browsing FindAPhD.com

*Offer only available for the duration of your active subscription, and subject to change. You MUST claim your prize within 72 hours, if not we will redraw.

Do you want hassle-free information and advice?

Create your FindAPhD account and sign up to our newsletter:

- Find out about funding opportunities and application tips

- Receive weekly advice, student stories and the latest PhD news

- Hear about our upcoming study fairs

- Save your favourite projects, track enquiries and get personalised subject updates

Create your account

Looking to list your PhD opportunities? Log in here .

LET US HELP

Welcome to Capella

Select your program and we'll help guide you through important information as you prepare for the application process.

FIND YOUR PROGRAM

Connect with us

A team of dedicated enrollment counselors is standing by, ready to answer your questions and help you get started.

- Capella University Blog

- PhD/Doctorate

How to fund your doctoral degree: advice from a financing coach

September 9, 2019

Earning a doctoral degree often requires a significant commitment of resources. However, you shouldnât let tuition figures stop you from achieving your goals. With some time and research, you can create a smart finance plan that may even include ways to reduce your overall educational expenses.

Alana John, a financing coach from Capella Universityâs Financial Support Team, suggests a six-step plan to budget for your doctoral degree journey.

Step 1: Submit your Free Application for Federal Student Aid (FAFSA) for the upcoming year.

Completing a FAFSA allows you to see what federal financial aid you qualify for. This includes work study and federal loans.

Alana says having your FAFSA completed before speaking to a university financing coach streamlines the process. Knowing exactly what you qualify for helps you and your financing coach determine how much extra you may need to borrow.

Step 2: Know your maximum loan amount.

All loans have specific requirements, including a maximum borrowing amount. As a graduate student, you can borrow up to $138,500 in Federal Direct loans. Once you reach the graduate level, you can only borrow Federal Direct unsubsidized loans up to the lifetime aggregate limit. There is also an annual limit on Federal Direct unsubsidized loans of $20,500 per aid year.

Alana warns to be careful with these limits. âIf you qualify for the maximum amount, donât immediately jump into borrowing that much,â she says. âUnderstanding how much you could take out will help you create a prudent plan for borrowing what you cannot cover out-of-pocket.â

Step 3: Research non-loan options.

Alana suggests imagining your financing as a bucket. She tells students that as much of the bucket as possible should contain non-repayable financial aid, such as scholarships, Federal Work Study, or employer reimbursements. The rest of the bucket should be topped off with loans as a last resort.

Searching for scholarships, grants, and other non-repayable funding before taking out a loan can help reduce your total borrowing cost. For example, you may be eligible for a tuition discount through an affiliation your employer has with your university, through military service, or if you have a degree from an affiliated college.

Step 4: Understand what you will need to borrow.

Once youâve found any non-loan options, youâre ready to calculate the total amount youâll still need.

âWhen figuring total cost, remember to total direct and indirect costs,â says Alana. Direct costs are tuition and fees, while indirect costs range from living expenses to transportation to Internet fees.

Subtract the amount of non-loan funding you qualify for, along with any out-of-pocket contributions you can make, from the total amount youâll need. This will help you determine how much extra you may need to borrow.

Step 5: Figure out repayment plans.

Now that youâre ready to explore your loan options, itâs important to compare repayment plans you might qualify for. Depending on the provider, you may have options as to how you can repay. From graduated to income-based repayment , you can determine whatâs best for you.

âSome loans have a six-month grace period after graduation,â explains Alana. âOnce that period is over, you will be responsible for monthly payments. Think about how much you can realistically afford, and choose the loan repayment plan that works best for your budget.â

Alana recommends using the repayment estimator at studentloans.gov to help you determine your payment plan.

Step 6: Decide if it makes sense to borrow to fund any remaining costs.

Once youâve done your research, itâs time to determine exactly how much you want to borrow.

âBe in the driverâs seat,â Alana says. âUnderstand what you have and what you want to borrow. What does this look like for your future self?â

If your monthly loan repayment will be a burden on you, reconsider. Creating a budget of your expected expenses and income, and then weighing it against your loan repayment, can help you build a feasible financial plan to pay for your doctoral degree.

Capella University offers a variety of scholarships for doctoral students to help make higher education more attainable . Learn more about financial aid at Capella.

You may also like

Can I transfer credits into a doctoral program?

January 8 2020

What are the steps in writing a dissertation?

December 11, 2019

The difference between a dissertation and doctoral capstone

November 25 2019

Start learning today

Get started on your journey now by connecting with an enrollment counselor. See how Capella may be a good fit for you, and start the application process.

Please Exit Private Browsing Mode

Your internet browser is in private browsing mode. Please turn off private browsing mode if you wish to use this site.

Are you sure you want to cancel?

- Postgraduate Doctoral Loan

- Academic excellence and merit

- Care experienced students

- Disabled students

- EU and international students

- Funding a year abroad

- Low income households

- Specific subjects

- Widening participation

- What is DSA?

- DSA eligibility FAQs

- How to apply for DSA

- What to expect from a DSA assessment

- Receiving confirmation of your DSA application

- DSA: Acronyms and abbreviations

- Disabled Students’ Allowance: Scotland

- Disabled Students' Allowance: Northern Ireland

- Disabled Students' Allowance: Wales

- Financial support for students not supported by their family (estranged)

- Cyllid i fyfyrwyr

- Student budgeting tips

- An overdraft will be your buffer

- Avoid hefty broadband bills

- Be the boss of your budget

- Check if you're covered by your parents' home insurance

- Credit cards aren't as cool as they might sound

- Don't let mighty mobile bills get you

- Get expensive software for free!

- Keep your wits about you when renting

- Register to vote

- Choosing a bank account

- Use your UCAS status codes to open a student account

- Managing student debt

- UCAS student discounts

- 10 money tips for starting uni

- How much does uni or college cost?

- Eight tips if you're worried about money at university

- How much will I spend during Freshers' week?

- Scholarship guidance for UK students

- What you can do if your student finance isn’t enough

- Balancing work and study

- Refugees, asylum seekers, and those with limited leave to remain

- Student finance in Scotland

- Student finance in Wales

- Undergraduate tuition fees

- Finance for part-time tuition fee only students

- Tuition Fee Loans - Part-time students

- Living costs for part-time students

Postgraduate Master's Loan

- Disabled Students' Allowance

- Parents' Learning Allowances for full-time students

- Childcare Grants for full-time students

- Adult Dependants' Grants for full-time students

- Other funding for full-time students

- Repaying your student loan

- Student finance guidance for parents and partners

- Taking a break or withdrawing from your course

Taking a break or withdrawing from your postgraduate studies

- Finance for independent students

- Student finance for migrant workers

- Student finance for family members of migrant workers

- Advanced Learner Loans

- Going through Clearing?

- Household income details needed!

- Going back to uni or repeating a year

- Student finance in Northern Ireland

What's on this page?

- What's available?

How to apply

Eligibility, what's available.

You could get a Postgraduate Doctoral Loan of up to:

- £29,390 if your course starts on or after 1 August 2024

- £28,673 if you started between 1 August 2023 and 31 July 2024

This is to help with your course and living costs while you’re studying, and has to be repaid .

Your loan payments will be spread out across all the academic years of your course. For example, if you’re studying over five years and apply for the maximum loan amount of £29,390, your payments would be £5,878 in each academic year. The loan is paid in three instalments at the start of each term.

You can apply for a Postgraduate Doctoral Loan amount in any year of your course, but if you apply after the first year, you might not get the maximum amount.

Disabled Students' Allowance

If you have a disability, including a long-term health condition, mental health condition, or specific learning difficulty, such as dyslexia, you might be able to get Disabled Students’ Allowance. This doesn’t have to be paid back. You don’t have to be getting a Postgraduate Doctoral Loan to apply.

Find out more

Applications for 2024 to 2025 Postgraduate Doctoral courses are now open! The quickest and easiest way to apply is online at www.gov.uk/studentfinance .

When you apply for student finance, you'll need to agree to Student Finance England's terms and conditions .

You can apply for a Postgraduate Doctoral Loan in any year of your course, but you might not get the full amount if you apply after the first year of your course.

To get a Postgraduate Doctoral Loan, you must apply no more than nine months after the first day of the final academic year of your course.

You don't need to apply each year for a Postgraduate Doctoral Loan.

If Student Finance England ask you for any evidence, send this as quickly as possible to avoid delays with your application.

If you don’t have a UK passport, you may have to send Student Finance England evidence, such as a non-UK passport, or a copy of your UK birth or adoption certificate.

You should send this as quickly as possible to avoid any delay in your application being processed. Remember to include your Customer Reference Number with everything you send them.

In some circumstances, you may be asked to send Student Finance England additional information or evidence, for example, evidence of your previous addresses or documents from the Home Office. They can’t process your application until they have everything they need, so you should send them anything they ask for as soon as possible, so your application isn’t delayed.

Changing your details

If any of your details change after you’ve applied for student finance, don’t worry – you can simply update your application. You can use your online account to make changes to your personal details before or after your course has started. To update any other details, such as your university or course, you need to send Student Finance England a completed postgraduate 'Change of circumstances' form. You can download this from www.gov.uk/doctoral-loan .

What happens next?

Once Student Finance England has assessed your application, they’ll send you a letter confirming how much Postgraduate Doctoral Loan you’re getting. The letter will also show the dates they expect to pay your Postgraduate Doctoral Loan to you. You should keep this letter safe, as your university might ask to see it when you register.

If you’re starting a full-time or part-time postgraduate Doctoral course in the 2023 to 2024 academic year, you could get a Postgraduate Doctoral Loan to help towards your course and living costs.

Nationality and residency

To apply for a Postgraduate Doctoral Loan you must:

- be a UK national or Irish Citizen or have 'settled status' under the EU Settlement Scheme or Indefinite leave to remain, with no restrictions on how long you can stay in the UK

- normally live in England

- have lived in the UK, the Channel Islands or the Isle of Man for three continuous years before the first day of your course, apart from temporary absences such as going on holiday. You can also have been living in the UK, Islands and/or Ireland, or the UK, Islands and/or the specified British Overseas Territories.

If you’re an EU national or a family member of an EU national, you may be eligible if all of the following apply:

- you have pre-settled status under the EU settlement scheme. (Irish citizens do not need EU Settlement Scheme status but need to have been living in the UK by 31 December 2020)

- you’ve normally lived in the UK, Gibraltar, the European Economic Area, Switzerland, or the Overseas territories for the past three years (this is also known as being ‘ordinarily resident’)

- you’ll be studying at a university in England

You may also be eligible if you’re a UK national (or family member of a UK national) or an Irish citizen who either:

- was living in the EU, Switzerland, Norway, Iceland or Liechtenstein on 31 December 2021, or returned to the UK by 31 December 2020 after living in the EU, Switzerland, Norway, Iceland or Liechtenstein

- has been living in the UK, the EU, Gibraltar, Switzerland, Norway, Iceland or Liechtenstein for the past three years

You can apply for funding if: