Gold-standard learning from the International Chamber of Commerce (ICC)

Industry-recognised professional qualifications, authored by ICC experts

PROFESSIONAL CERTIFICATES

Certified Documentary Credits Expert (CDCE)

Achieve the highest level of ICC certified competence on documentary credits

Certified Trade Finance Professional (CTFP)

The advanced all-in-one trade finance qualification from the ICC

Incoterms® 2020 Certificate

The ICC's professional certification for the Incoterms® 2020 rules

Export/Import Certificate (EIC)

Conduct international trade with ease and expertise

Certificate in Digital Trade Strategy (CDTS)

Gain an end-to-end understanding of what is needed to digitise your trade and supply chain processes

Global Trade Certificate (GTC)

ICC Academy's introductory trade finance qualification

ICC Academy certificates are internationally accredited by

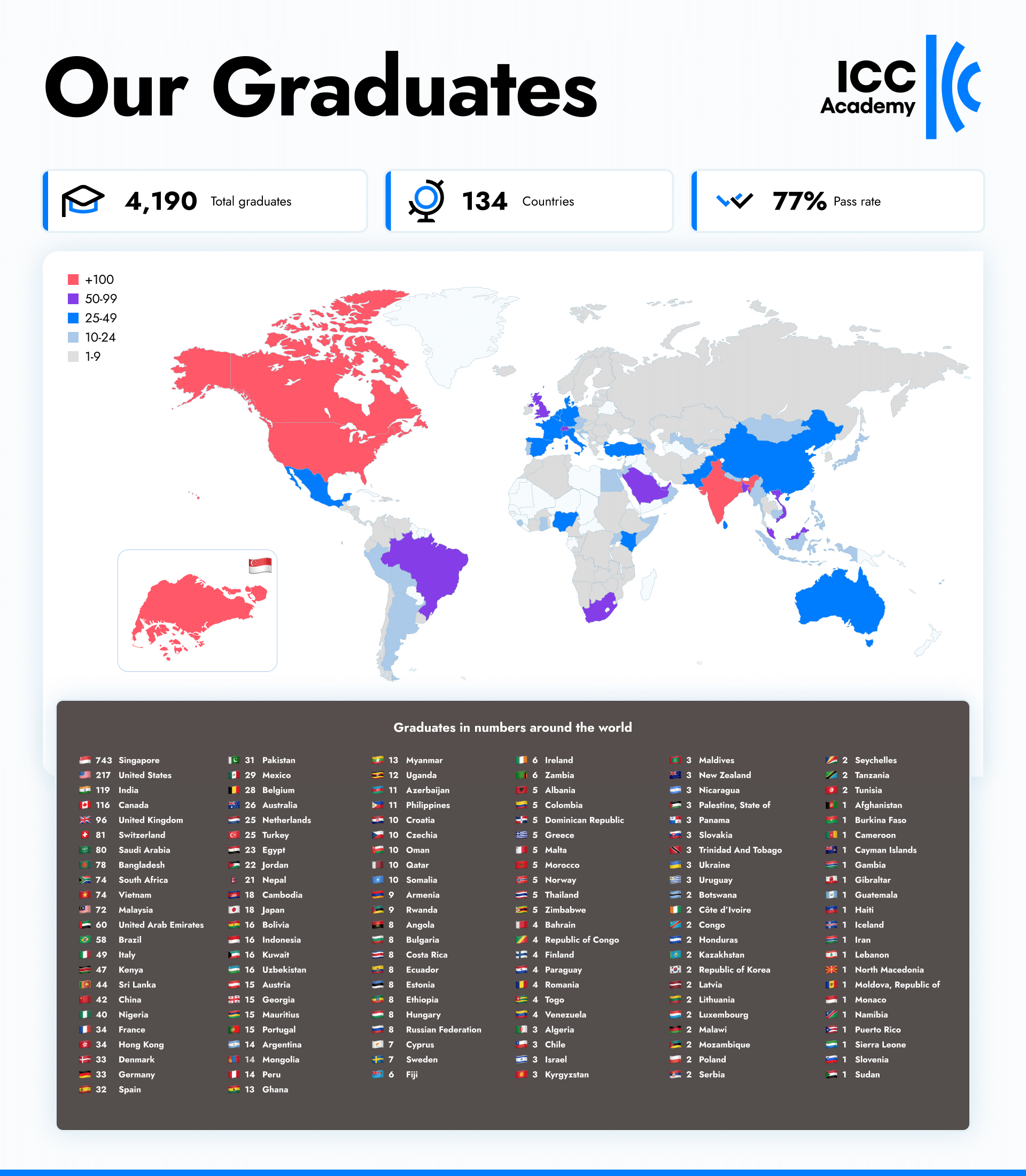

JOIN ALUMNI FROM OVER 100 COUNTRIES

Houssam Hoteit Senior Trade Finance Specialist, Canada

“I see the CTFP as a perfect way for any trade finance person to (a) be part of a global community and (b) have a certification that highlights your expertise and automatically puts you at a certain level that is respected in the industry.”

Ling Fong Tay Head of Transaction Services, Singapore

“I enrolled in the CTFP because this certification is authored by leading trade finance experts from the ICC’s Banking Commission, making it one of the most credible programmes available in the market. Each course is structured to ensure the essentials of global trade finance have been sufficiently covered.”

Praveenkumar Miriyala Senior Trade Specialist, India

"The Incoterms® 2020 qualification gives me an edge. Getting training directly from the 'horse's mouth' is more valuable to me - and other people looking to work with me - than having my knowledge certified by a third party who has not created the Incoterms® rules."

BESTSELLING COURSES

ICC Academy's most popular online short courses (3-5 hours). All authored by ICC experts.

Introduction to Trade Finance

Develop a foundational understanding of global trade and how companies settle their cross-border commercial activities.

Introduction to Documentary Credits

Get a practical overview of the documentary letter of credit and its versatility in addressing a variety of client needs.

Advanced Documentary Credits

A detailed review of documentary credits, from structuring and issuance to document verification to financing and settlement.

Introduction to Supply Chain Finance

Learn how to engage effectively and credibly with clients and recognize opportunities to propose SCF techniques as solutions.

Introduction to Islamic Banking & Finance

Develop a core understanding of the principles and prohibitions that govern contracts in the Islamic financial system.

Advanced Standby Letters of Credit

Get a deep understanding of SBLCs, the purposes for which they can be used, the rules governing them and potential issues.

Introduction to Trade Finance Sales

Understand the best practices and processes required to be an effective and productive trade finance sales person.

Digital Trade Finance & Fintechs

Learn about the digital trade ecosystem, including fintechs, regulatory challenges and digital solutions that support trade.

Advanced Guarantees

Step up your understanding of guarantees with a closer look at issuance, counter guarantees and more complex transactions.

ICC Academy courses are trusted by more than 100 major clients

LEARN DIRECTLY FROM ICC EXPERTS

All ICC Academy courses and certificates are authored by leading experts from the ICC network

Vijay Vashist

Vijay Vashist is the Global Head of Trade & Supply Chain Finance and Trade Asset Management in DBS’ Global Transaction Services, based at the head office in Singapore. Vijay joined DBS in April 2011 from Standard Chartered Bank, where he was previously Managing Director and Global Head of Open Account Trade Finance. He has over 20 years of experience within Institutional Banking covering areas of corporate relationship banking, Supply Chain, Leasing, Open Account and traditional trade business lines, working at Standard Chartered, HSBC and GE Capital. In addition to his appointment as a member of the ICC Banking Commission ExCo, Vijay is also associated with the BAFT-IFSA Asia Financial Supply Chain Committee, spearheading a project to design industry standard open account trade documentation. He has also previously served on the marketing committee of Factors Chain International, Amsterdam.

Andrea Hauptmann

Andrea Hauptmann Joined Raiffeisen Bank International (former RZB) in September 1984 after a short postgraduate study in Cambridge, UK, working in the documentary department on import/export LCs and since 1988 on bank guarantees. She then took over responsibility of the guarantee business in 1991 and was appointed Director in 1997 and Senior Director in 2000. She is a member of ICC Austria and a delegate to the ICC Banking Commission since 1997. She has been the elected Chair of the ICC Guarantee Task Force since March 2012 and was appointed as member of the Executive Committee of the ICC Banking Commission in October 2013.

Daniel Cotti

Daniel has 30+ years’ experience in the trade finance industry and has spent most of his career in leading roles with end-to-end management and P&L responsibility of global businesses of considerable size working for Citibank, ABN AMRO, RBS and JPMorgan. He has achieved significant growth and transformation results with all the institutions that he has worked for and was also proactively engaged with the major relevant industry associations (ICC, SWIFT, BAFT) to drive the trade finance Industry agenda forward (founding member and Head of the Advisory Board of the Banking Commission of the ICC, founding member and Head of the Global Trade Industry Council of BAFT, founding member of the Trade Services Advisory Group of SWIFT).

Anand Pande

Anand has worked in senior corporate and transaction banking roles in Citi, Royal Bank of Scotland and ANZ. He has worked in India, China, Malaysia, Singapore, Hong Kong, Indonesia and in a U.K. role based out of Singapore in country, regional and global leadership assignments in the trade finance and transaction banking space. In February 2015, Anand has recently set-up his own independent advisory firm: The Growth Paradigm Partnership (GPP) in Singapore. Anand was awarded the Asset Asia Trade Finance Banker of the Year Award in 2013. He has been a speaker at ICC, Doha Forum, BAFT and SIBOS.

Kim Fui Liew

Kim Fui Liew has almost 25 years of banking experience with specific expertise in trade finance activities. He is currently the Senior Vice-President of Global Transaction Services at DBS Bank. Mr Liew holds the position of Regional Trade Advisor in the same department and is involved in the management of the technicalities and training of trade finance, especially in the area of commodity and structured trade finance. Before his time at DBS Bank, he worked at Credit Agricole Indosuez, ABN AMRO Bank and the Hong Kong and Shanghai Banking Corporation.

Buddy Baker

Mr Baker has more than 30 years of experience working with companies to finance and insure their trade receivables. He owns the consulting firm Global Trade Risk Management Strategies, which specializes in both online and on-site educational training, and designed the online training/certification programs used by the Association of International Credit and Trade Finance Professionals (ICTF), the Association of Trade and Forfaiting in the Americas (ATFA) and the Finance, Credit and International Business Group (FCIB) of the National Association of Credit Management (NACM). Mr. Baker has authored numerous magazine articles and the books Users’ Handbook to Documentary Credits under UCP600 (ICC publication no. 694), Documentary Payments & Short-Term Trade Finance, and The Regulatory Environment of Letters of Credit and Trade Finance.

Guillermo Jimenez

Guillermo C. Jimenez is a leading global expert in the field of export/import law and international business practices and the author of “ICC Guide to Export/Import – Global Standards for International Trade“. As Head of Division at ICC’s Paris Headquarters from 1990 to 1998, he coordinated work on key ICC instruments and trade tools and has lectured on international business in over 35 countries and before a number of intergovernmental organizations, including the United Nations, European Commission and Organization for Economic Cooperation and Development.

Professor Charles Debattista

Professor Debattista practises in international trade and shipping law at the English Bar and was Chair and Co-Chair of the Drafting Groups for Incoterms® 2000 and 2010. He was a professor of Commercial Law and Director of of the Institute of Maritime Law for more than three decades. He has had extensive experience in charterparty work, bills of lading, CIF and FOB disputes, letters of credit, ship management issues and general commercial contract disputes.

Krishnan Ramadurai

Mr Ramadurai has a wealth of experience in banking and risk management and almost 20 years’ of senior leadership experience delivering industry leading results. He has worked in a variety of locations across the globe for HSBC Bank and Fitch Ratings, and has extensive experience in global roles in Trade Finance, General Banking, Credit, Operational & Market Risk; with an expert knowledge of Basel II, III, Capital Requirements Regulations and Regulatory Frameworks.

Michael McKenzie

Michael McKenzie has over 30 years of experience in international banking and financial services sales. He retired from JP Morgan in 2014 but has held positions including Global Head of Network Trade, Regional Head of Latin America for Treasury & Securities Services and Global Head of Trade Sales. Mr. McKenzie has served numerous terms on the board of the Banker’s Association for Finance and Trade (BAFT) and he was the organization’s President and Board Chair in 2000-2001.

LATEST NEWS

What is international trade?

This article is authored by Dr Chithra Suresh, Senior Faculty […]

Types of documentary credit | A comprehensive guide

It has been argued that a form of documentary credit […]

Documentary credits: Rules, guidelines & terminology

*This article has been updated as of October 2024. Many […]

Incoterms® 2020: CIP or CIF?

In this article, Miguel Angel Bustamante Morales discusses the key […]

‘The storm is normal’: Insights into a career in logistics and supply chain management

In this alumni interview, we speak with Praveenkumar Miriyala, Procurement […]

Digital Trade 101: What you need to know

This guide explores the realities of trade as it is, […]

WHY CHOOSE ICC ACADEMY

Flexible online learning for global trade professionals

Enhance your credibility with industry-accredited qualifications

Tailored and customised training avaiable to meet your needs

Relevant, up-to-date curriculum delivered by ICC specialists

Fast-track your career and open up senior positions

Join ICC's global alumni community

IMAGES

VIDEO

COMMENTS

An assignment of proceeds occurs when a beneficiary transfers all or part of the proceeds from a letter of credit to a third-party beneficiary. Assigning the proceeds from a letter of credit can be utilized in many types of scenarios, such as to pay suppliers or vendors in a business transaction or to settle other …

Understanding the different types of assignment of proceeds is critical for parties involved in bank guarantee transactions. Choosing the right type of assignment can help …

An assignment of proceeds is a guarantee that a bank provides to a beneficiary, which ensures that the bank will release the proceeds of a transaction to the beneficiary …

Furthermore, we understand that a warranty guarantee is required. At the request of (company B) we, the bank, hereby irrevocably undertake to pay you, waiving all rights of …

In addition, the agreement of the guarantor is required for the assignment of proceeds under Article 33(b). Failure to obtain such agreement gives the guarantor the right …

The Assignment of Proceeds (AOP) is a powerful tool that can help maximize security in international trade when dealing with a letter of credit. It can be defined as an …

The International Chamber of Commerce (ICC) have published the International Standard Demand Guarantee Practice (ISDGP) for URDG 758. The purpose of the ISDGP is to …

This guide provides a clear and comprehensive commentary on the URDG 758 rules and the accompanying model forms. Debunks the myths about guarantees and identifies which pitfalls to avoid. Goes into detail on the seven key stages …

The ICC Uniform Rules for Demand Guarantees (URDG) reflect international standard practice in the use of demand guarantees and balance the legitimate interests of all parties.

The Uniform Rules for Demand Guarantees (URDG) are the rules underpinning the commonly used trade finance instruments, demand guarantees. This guide explains the purpose of demand guarantees and the rules …