Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

The Private Equity Case Study: The Ultimate Guide

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

The private equity case study is an especially intimidating part of the private equity recruitment process .

You’ll get a “case study” in virtually any private equity interview process , whether you’re interviewing at the mega-funds (Blackstone, KKR, Apollo, etc.), middle-market funds , or smaller, startup funds.

The difference is that each one gives you a different type of case study, which means you need to prepare differently:

What Should You Expect in a Private Equity Case Study?

There are three different types of “case studies”:

- Type #1: A “ paper LBO ,” calculated with pen-and-paper or in your head, in which you build a simple leveraged buyout model and use round numbers to guesstimate the IRR.

- Type #2: A 1-3-hour timed LBO modeling test , either on-site or via Zoom and email. This is a pure speed test , so proficiency in the key Excel shortcuts and practice with many modeling tests are essential.

- Type #3: A “take-home” LBO model and presentation, in which you might have a few days up to a week to pick a company, research it, build a model, and make a recommendation for or against an acquisition of the company.

We will focus on the “take-home” private equity case study here because the other types already have their own articles/tutorials or will have them soon.

If you’re interviewing within the fast-paced, on-cycle recruiting process with large funds in the U.S. , you should expect timed LBO modeling tests (type #2).

If the firm interviews dozens of candidates in a single weekend, there’s no time to give everyone open-ended case studies and assess them.

You might also get time-pressured LBO modeling tests in early rounds in other financial centers, such as London .

The open-ended case studies – type #3 – are more common at smaller funds, in off-cycle recruiting, and outside the U.S.

Although you have more time to complete them, they’re significantly more difficult because they require critical thinking skills and outside research.

One common misconception is that you “need” to build a complex model for these case studies.

But that is not true at all because they’re judging you mostly on your investment thesis , your presentation, and your ability to answer questions afterward.

No one cares if your LBO model has 200 rows, 500 rows, or 5,000 rows – they care about how well you make the case for or against the company.

This open-ended private equity case study is often the final step between the interview and the job offer, so it is critically important.

The Private Equity Case Study, in Parts

This is another technical tutorial, so I’ve embedded the corresponding YouTube video below:

Table of Contents:

- 4:32: Part 1: Typical Case Study Prompt

- 6:07: Part 2: Suggested Time Split for a 1-Week Case Study

- 8:01: Part 3: Screening and Selecting a Company

- 14:16: Part 4: Gathering Data and Doing Industry Research

- 22:51: Part 5: Building a Simple But Effective Model

- 26:32: Part 6: Drafting an Investment Recommendation

Files & Resources:

- Case Study Prompt (PDF)

- Private Equity Case Study Slides (PDF)

- Cars.com – Highlighted 10-K (PDF)

- Cars.com – Investor Presentation (PDF)

- Cars.com – Excel Model (XL)

- Cars.com – Investment Recommendation Presentation (PDF)

We’re going to use Cars.com in this example, which is one of the many case studies in our Private Equity Modeling course:

The full course includes a detailed, step-by-step walkthrough rather than this summary, an additional advanced LBO model, and many other practice models and case studies.

Part 1: Typical Private Equity Case Study Prompt

In some cases, they’ll give you a company to analyze, but in others, you’ll have to screen for companies yourself and pick one.

It’s easier if they give you the company and the supporting documents like the Information Memorandum , but you’ll also have less time to complete the case study.

The prompt here is very open-ended: “We like these types of deals and companies, so pick one and present it to us.”

The instructions are helpful in one way: they tell us explicitly not to build a full 3-statement model and to focus on the market and strategy rather than an “extremely complex model.”

They also hint very strongly that the model must include sensitivities and/or scenarios:

Part 2: Suggested Time Split for a 1-Week Private Equity Case Study

You have 7 days to complete this case study, which may seem like a lot of time.

But the problem is that you probably don’t have 8-12 hours per day to work on this.

You’re likely working or studying full-time, which means you might have 2-3 hours per day at most.

So, I would suggest the following schedule:

- Day #1: Read the document, understand the PE firm’s strategy, and pick a company to analyze.

- Days #2 – 3: Gather data on the company’s industry, its financial statements, its revenue/expense drivers, etc.

- Days #4 – 6: Build a simple LBO model (<= 300 rows), ideally using an existing template to save time.

- Day #7: Outline and draft your presentation, let the numbers drive your decisions, and support them with the qualitative factors.

If the presentation is shorter (e.g., 5 slides rather than 15) or longer, you could tweak this schedule as needed.

But regardless of the presentation length, you should spend MORE time on the research, data gathering, and presentation than on the LBO model itself.

Part 3: Screening and Selecting a Company

The criteria are simple and straightforward here: “The firm aims to find undervalued companies with stagnant or declining core businesses that can be acquired at reasonable valuation multiples and then turn them around via restructuring, divestitures , and add-on acquisitions.”

The industry could be consumer, media/telecom, or software, with an ideal Purchase Enterprise Value of $500 million to $1 billion (sometimes up to $2 billion).

Reading between the lines, I would add a few criteria:

- Consistent FCF Generation and 10-20%+ FCF Yields: Strategies such as turnarounds and add-on acquisitions all require cash flow. If the company doesn’t generate much Free Cash Flow , it will have to issue Debt to fund these strategies, which is risky because it makes the deal very dependent on the exit multiple.

- Relatively Lower EBITDA Multiples: If the company has a “stagnant or declining” core business, you don’t want to pay 20x EBITDA for it. An ideal range might be 5-10x, but 10-15x could be OK if there are good growth opportunities. The IRR math also gets tougher at high EBITDA multiples because the maximum Debt in most deals is 5-6x.

- Clean Financial Statements and Enough Detail for Revenue and Expense Projections: You don’t want companies with 2-page-long Cash Flow Statements or Balance Sheets with 100 line items; you can’t spare the time required to simplify and consolidate these statements. And you need some detail on the revenue and expenses because forecasting revenue as a simple percentage Year-Over-Year (YoY) growth rate is a bad idea in this context.

We used this process to screen for companies here:

- Step 1: Do a high-level screen of companies in these 3 sectors based on industry, Equity Value or Enterprise Value, and geography.

- Step 2: Quickly review the list of ~200 companies to narrow the sector.

- Step 3: After picking a specific sector, narrow the choices to the top few companies and pick one of them.

In software , many of the companies traded at very high multiples (30x+ EBITDA), and others had negative EBITDA , so we dropped this sector.

In consumer/retail , the companies had more reasonable multiples (5-10x), but most also had low margins and weak FCF generation.

And in media/telecom , quite a few companies had lower multiples, but the FCF math was challenging because many companies had high CapEx requirements (at least on the telecom side).

We eliminated companies with very high multiples, negative EBITDA, and exorbitant CapEx, which left this set:

Within this set, we then eliminated companies with negative FCF, minimal information on revenue/expenses, somewhat-higher multiples, and those whose businesses were declining too much (e.g., 20-30% annual declines).

We settled on Cars.com because it had a 9.4x EBITDA multiple at the time of this screen, a declining business with modest projected growth, 25-30% margins, and reasonable FCF generation with FCF yields between 10% and 15%.

If you don’t have Capital IQ for this exercise, you’ll have to rely on FinViz and use P / E multiples as a proxy for EBITDA multiples.

You can click through to each company to view the P / FCF multiples, which you can flip around to get the FCF yields.

In this case, don’t even bother looking for revenue and expense information until you have your top 2-3 candidates.

Part 4: Gathering Data and Doing Industry Research

Once you have the company, you can spend the next few days skimming through its most recent annual report and investor presentation, focusing on its financial statements and revenue/expense drivers.

With Cars.com, it’s clear that the company’s “Dealer Customers” and Average Revenue per Dealer will be key drivers:

The company also has significant website traffic and earns advertising revenue from that, but it’s small next to the amount it earns from charging car dealers to use its services:

It’s clear from this quick review that we’ll need some outside research to estimate these drivers, as the company’s filings and investor presentation have little.

Fortunately, it’s easy to Google the number of new and used car dealers in the U.S. and estimate the market size and share like that:

The company’s market share has been declining , and we expect that trend to continue, but it’s not clear how rapid the decline will be.

Consumers are increasingly buying directly from other consumers, and dealers have less reason to use the company’s marketplace services than in past years.

We create an area for these key drivers, with scenarios for the most uncertain one:

You might be wondering why there’s no assumed uptick in market share since this is supposed to be a “turnaround” case study.

The short answer is that we think the company is unlikely to “turn around” its core business in this time frame, so it will have to move into new areas via bolt-on acquisitions .

For example, maybe it could acquire smaller firms that sell software and services to dealers, or it could acquire physical or online car dealerships directly.

Another option is to acquire companies that can better monetize Cars.com’s large and growing web traffic – such as companies that sell auto finance leads.

As part of this process, we also need to research smaller companies to acquire, but there isn’t much to say about this part.

It comes down to running searches on Capital IQ for smaller companies in related industries and entering keywords like “auto” in the business description field.

In terms of the other financial statement drivers , many expenses here are simple percentages of revenue, but we could also link them to the employee count.

We also link the website traffic to the sales & marketing spending to capture the spending required for growth in that area.

Finally, we need to input the financial statements for the company, which is not that hard since they’re already fairly clean:

It might be worth consolidating a few items here, but the Income Statement and partial Cash Flow Statement are mostly fine, which means the Excel versions are close to the ones in the annual report.

Part 5: Building a Simple But Effective Model

The case study instructions state that a full 3-statement model is not necessary – but even if they had not, such a model would rarely be worthwhile.

Remember that LBO models, just like DCF models , are based on cash flow and EBITDA multiples ; the full statements add almost nothing since you can track the Cash and Debt balances separately.

In terms of model complexity, a single-sheet LBO with 200-300 rows in Excel is fine for this exercise.

You’re not going to get “extra credit” for a super-complex LBO model that takes days to understand.

The key schedules here are:

- Transaction Assumptions – Including the purchase price, exit assumptions, scenarios, and tranches of debt. Skip the working capital adjustment unless they specifically ask for it. For more on these nuances, see our coverage of Enterprise Value vs. purchase price and cash-free debt-free deals .

- Sources & Uses – Short and simple but required to calculate the Investor Equity.

- Revenue, Expense, and Cash Flow Drivers – These don’t need to be super-complex; the goal is to go beyond projecting revenue as a simple percentage growth rate.

- Income Statement and Partial Cash Flow Statement – The goal is to calculate Free Cash Flow because that drives Debt repayment and Cash generation in an LBO.

- Add-On Acquisitions – These are part of the “turnaround strategy” in this deal, so they’re quite important.

- Debt Schedule – This one is quite simple here because the deal is not dependent on financial engineering.

- Returns Calculations – The IPO vs. M&A exit options add a bit of complexity.

- Sensitivity Tables – It’s difficult to draft the investment recommendation without these.

Skip anything that makes your life harder, such as circular references in Excel (to avoid these, use the beginning Cash and Debt balances to calculate interest).

We pay special attention to the add-on acquisitions here, with support for their revenue and EBITDA contributions:

The Debt Schedule features a Revolver, Term Loans, and Subordinated Notes:

The Returns Calculations are also simple; we do assume a bit of Multiple Expansion because of the company’s higher growth rate by the end:

Could we simplify this model even further?

I don’t think the M&A vs. IPO exit options mentioned above are necessary, and we could also drop the “Growth” vs. “Value” options for the add-on acquisitions:

Especially if we recommend against the deal, it’s not that important to analyze which type of add-on acquisition works best.

It would be more difficult to drop the scenarios and Excel sensitivity tables , but we could restructure them a bit and fold the scenario into a sensitivity table.

All investing is probabilistic, and there’s a huge range of potential outcomes – so it’s difficult to make a serious investment recommendation without examining several outcomes.

Even if we think this deal is spectacular, we must consider cases in which it goes poorly and how we might reduce those risks.

Part 6: Drafting an Investment Recommendation

For a 15-slide recommendation, I would recommend this structure:

- Slides 1 – 2: Recommendation for or against the deal, your criteria, and why you selected this company.

- Slides 3 – 7: Qualitative factors that support or refute the deal (market, competition, growth opportunities, etc.). You can also explain your proposed turnaround strategy, such as the add-on acquisitions, here.

- Slides 8 – 13: The numbers, including a summary of the LBO model, multiples vs. comps (not a detailed valuation), etc. Focus on the assumptions and the output from the sensitivity tables.

- Slide 14: Risk factors for a positive recommendation, and the counter-factual (“what would change your mind?”) for a negative one. You can also explain the potential impact of each risk on the returns and how you could mitigate these risks.

- Slide 15: Restate your conclusions from Slide 1 and present your best arguments here. You could also change the slide formatting or visuals to make it seem new.

“OK,” you say, “but how do you actually make an investment decision?”

The easiest method is to set criteria for the IRR or multiple of invested capital in each case and say, “Yes” if the deal achieves those numbers and “No” if it does not.

For example, maybe the targets are a 30% IRR in the Upside case, a 20% IRR in the Base case, and a 1.0x multiple in the Downside case (i.e., avoid losing money).

We do achieve those numbers in this deal, but the decision could go either way because the deal is highly dependent on the add-on acquisitions.

Without these acquisitions, the deal does not work; the IRR falls by 10%+ across all the scenarios and turns negative in the Downside case.

We need at least 5 good acquisition candidates matching very specific financial profiles ($100 million Purchase Enterprise Value and a 15x EBITDA purchase multiple with 10% revenue growth or 5x EBITDA with 3% growth).

The presentation includes some examples of potential matches:

While these examples are better than nothing, the case is not that strong because:

- Most of these companies are too big or too small to fit into the strategy proposed here of ~$100 million in annual acquisitions.

- The acquisition strategy is unclear ; acquiring and integrating dealerships (even online ones) would be very, very different from acquiring software/data/media companies.

- And since the auto software market is very niche, there’s probably not a long list of potential acquisition candidates beyond the few we found.

We end up saying, “Yes” in this recommendation, but you could easily reach the opposite conclusion because you believe the supporting data is weak.

In short: For a 1-week open-ended case study, this approach is fine, but this specific deal would probably not stand up to a more detailed on-the-job analysis.

The Private Equity Case Study: Final Thoughts

Similar to time-pressured LBO modeling tests, you can get better at the open-ended private equity case study by “putting in the reps.”

But each rep is more time-consuming, and if you have a demanding full-time job, it may be unrealistic to complete multiple practice case studies before the real thing.

Also, even with significant practice, you can’t necessarily reduce the time required to research an industry and specific companies within it.

So, it’s best to pick companies and industries you already know and have several Excel and PowerPoint templates ready to go.

If you’re targeting smaller funds that use off-cycle recruiting, the first part should be easy because you should be applying to funds that match your industry/deal/client background.

And if not, you can always make a lateral move to a bulge bracket bank and interview at the larger funds if you prefer the private equity case study in “speed test” form.

If you liked this article, you might be interested in:

- Private Equity Value Creation : Equally Viable Alternative to PE Deal Teams?

- The Growth Equity Case Study: Real-Life Example and Tutorial

- The Full Guide to Healthcare Private Equity, from Careers to Contradictions

- Healthcare Investment Banking: The Best Group to Check Into When Human Civilization is Collapsing?

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Master LBO Modeling & PE Cases

Complete 6 short models and 6 real-life case studies and master the key skills for PE interviews, from paper LBOs to detailed models.

- Education Requirement

- Experience Requirement

- Learning Resources

- CPEP™ Journey

- Register for CPEP™

- Examination

- Careers in Private Equity

Our commitment to fostering the growth of private equity professionals is reflected in the introduction of Private Equity Central, a virtual community that serves as your comprehensive resource and networking platform for success in this ever-evolving industry.

- myUSPEC

- Career in Private Equity

- Private Equity Central

- Help Center

Don't Have an Account?

Start your CPEP™ journey and manage your profile conveniently by creating your myUSPEC Account today.

Sign In to Your my USPEC Account

- Remember Password

- Forgot Password?

Create myUSPEC Account >

Reset Your Password

Please enter the Email ID you use to sign-in to your account:

Private Equity Case Study: Tips, Prompt & Presentation

Private equity case studies serve as a pivotal stage in recruitment. They offer firms a window to assess candidates' analytical, investing, and presentation skills. Understanding the nuances of these case studies can significantly enhance your preparation and success rate.

This comprehensive guide provides insights into the types of case studies, preparation strategies, and key aspects of presentation and analysis. Whether you're new to private equity or a seasoned professional, mastering these case studies is essential for succeeding in a competitive industry.

What Should You Expect in a Private Equity Case Study?

Private equity case studies are a critical component of the recruitment process, offering firms a valuable opportunity to assess candidates' analytical, investing, and presentation skills. Understanding what to expect in a private equity case study can significantly enhance your preparation and improve your chances of success.

What are the Types of Private Equity Case Studies?

Private equity case studies can take various forms, each presenting its unique set of challenges. Candidates can anticipate encountering one of the following formats.

- Candidates are provided with company information and tasked with evaluating the feasibility of an investment. This type of case study typically involves preparing a comprehensive presentation or investment memo, supported by a detailed LBO (leveraged buyout) model, within a specified timeframe.

- Candidates are granted several days to a week to research a company, develop a model, and formulate a recommendation for or against an acquisition. This type of case study necessitates critical thinking and external research.

- Similar to the take-home assignment, but completed on-site at the firm's office within a few hours. Candidates must construct a financial model and make an investment decision based on the provided information.

- A 1-3-hour test, either conducted on-site or remotely, where candidates must swiftly build an LBO model. Proficiency in Excel shortcuts and familiarity with modelling tests are crucial for success.

- A condensed version of an LBO model completed either on paper or verbally. This type of case study focuses on the fundamental aspects of the model and requires candidates to demonstrate their understanding without the use of Excel.

- Candidates construct a simple leveraged buyout model using pen-and-paper or mental calculations, estimating the internal rate of return (IRR) using rounded figures.

Preparation Strategies

To prepare effectively for a private equity case study, focus on developing your investment thesis, honing your presentation skills, and enhancing your ability to respond to questions thoughtfully. Remember, the complexity of your model is secondary to your capacity to construct a compelling argument for or against the investment.

How to Present a Private Equity Case Study?

Presenting a private equity case study requires a strategic and thorough approach to effectively convey your analysis and recommendations. Whether you're preparing for a take-home assignment or an in-person presentation, mastering the art of presentation is crucial for success in the private equity recruitment process.

The core question you'll encounter in any private equity case study is whether you would invest in the company under consideration. To answer this, you'll need to analyze the provided materials and construct a leveraged buyout (LBO) model to assess the potential return on investment. Typically, a return of 20% or higher is sought.

The case study prompt often includes specific assumptions to guide your LBO model construction, such as the pro forma capital structure, financial assumptions, and acquisition and exit multiples. Some firms may provide an Excel template for the LBO model, while others may expect you to create one from scratch.

Presentation

In a take-home assignment scenario, you'll likely be required to present your investment memo during the interview. This presentation is typically conducted in front of one or two representatives from the private equity firm.

The presentation format may vary among firms, with some expecting you to present first and then field questions, while others may prefer the reverse. Regardless of the format, be prepared to articulate your findings and respond to inquiries.

While technical proficiency is important in private equity recruitment, communication skills and attention to detail are equally critical. Interviewers will assess your ability to convey complex ideas clearly and concisely, as well as your meticulousness in addressing all aspects of the case study.

In the private equity interview process, every detail matters. Therefore, strive to provide a comprehensive and well-structured presentation, demonstrating your analytical rigour and ability to communicate effectively.

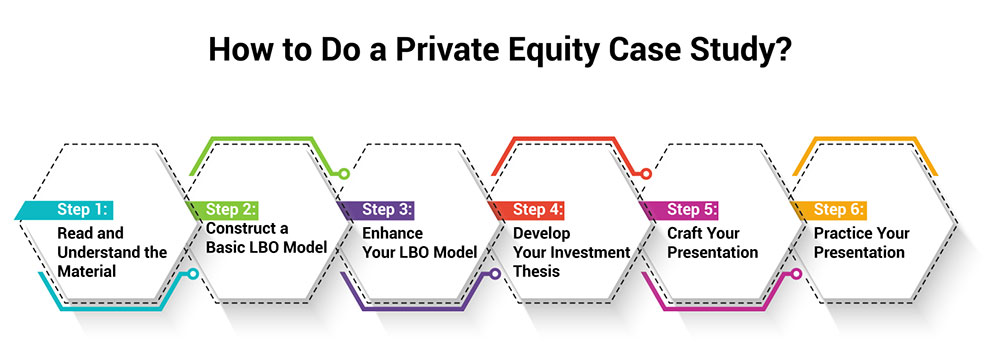

How to Do a Private Equity Case Study?

When tackling a private equity case study, a structured approach is crucial to deliver a comprehensive analysis and recommendations.

Step 1: Read and Understand the Material

Begin by thoroughly reading and understanding the provided materials. Gain insights into the company's background, industry dynamics, and financials.

Step 2: Construct a Basic LBO Model

Build a fundamental leveraged buyout (LBO) model using the ASBICIR method (Assumptions, Sources & Uses, Balance Sheet, Income Statement, Cash Flow Statement, Interest Expense, and Returns). This foundational model will underpin your analysis.

Step 3: Enhance Your LBO Model

Incorporate advanced features into your LBO model as required by the case study prompts. While it's essential to cover all aspects, prioritize completing the core financial model to ensure thoroughness.

Step 4: Develop Your Investment Thesis

Step back and formulate your investment view based on your analysis. Consider critical assumptions, conditions for proceeding with the investment, key risks, and primary drivers of returns.

Step 5: Craft Your Presentation

Organize your insights and analysis into a structured presentation. Clearly articulate your investment thesis, supporting analysis, and key findings.

Step 6: Practice Your Presentation

Rehearse your presentation to ensure clarity and confidence. Be prepared to engage in a discussion and defend your investment thesis.

Approaching a private equity case study with this methodical approach demonstrates your analytical prowess and strategic thinking.

How to Succeed in a Private Equity Case Study?

Succeeding in a private equity case study demands a strategic blend of analytical prowess, strategic acumen, and effective communication.

- Master the Fundamentals: Start by focusing on the foundational aspects of the case study before delving into the complexities. Build a solid understanding of financial modelling principles and investment analysis basics. This will provide you with a strong grounding to tackle more intricate tasks with confidence.

- Demonstrate Nuanced Investment Judgment: Avoid simplistic yes or no answers when presenting your investment recommendation. Instead, offer a nuanced analysis that considers the price point at which you would consider investing and the key assumptions driving your decision. Highlight potential avenues for value creation in the deal and discuss the primary risks and uncertainties involved.

- Engage in Meaningful Dialogue: While the ability to build complex financial models is important, what truly sets you apart is your capacity to think critically and engage in intelligent discussion about the investment. Focus on presenting a well-considered recommendation supported by solid reasoning and analysis. Be prepared to discuss your model and elaborate on your investment thesis clearly and concisely.

- Prioritize Substance Over Complexity: While showcasing your proficiency in financial modelling is essential, the goal is not to build the most intricate model. Concentrate on constructing a model that is accurate, logical, and well-structured. The true measure of success lies in your ability to derive meaningful insights from the model and utilize them to make informed investment decisions.

- Highlight Value-Creation Opportunities: In addition to identifying risks, emphasize the potential opportunities for value creation in the deal. Discuss how you would leverage these opportunities to enhance the company's performance and generate returns for investors.

By following these strategies, you can significantly enhance your prospects of success in a private equity case study. Demonstrating your ability to think critically, analyze investments, and communicate effectively will showcase your thought leadership and analytical prowess.

How Do I Prepare for a Private Equity Case Study?

Preparing for a private equity case study requires a structured approach and a solid understanding of the fundamentals of financial analysis and investment evaluation.

- Understand the Case Study Objective: Begin by understanding the objective of the case study, which is typically to evaluate the investment potential of a company. Familiarize yourself with the key concepts and methodologies used in private equity investing.

- Review Financial Modeling Basics: Brush up on your financial modelling skills, focusing on key concepts such as revenue forecasting, expense modelling, and valuation techniques. Practice building and analyzing financial models to prepare for the case study.

- Familiarize Yourself with LBO Modeling: Since leveraged buyout (LBO) modelling is a common aspect of private equity case studies, make sure you are comfortable with building LBO models. Understand the key components of an LBO model, such as debt structure, cash flow projections, and exit strategies.

- Practice Case Studies: Practice solving case studies to hone your analytical skills and improve your ability to think critically. Look for case studies online or create your own based on real-world scenarios to simulate the interview experience.

- Stay Updated on Industry Trends: Keep yourself informed about the latest trends and developments in the industries you are interested in. This will help you make informed assumptions and recommendations during the case study.

- Develop a Structured Approach: Develop a structured approach to solving case studies, including how you will analyze the company's financials, identify key risks and opportunities, and formulate your investment thesis.

- Seek Feedback: Seek feedback from mentors, peers, or professionals in the field to improve your case study skills. Consider participating in case study competitions or workshops to gain practical experience.

FAQs (Frequently Asked Questions)

1. How do you approach a private equity case study? Approach a private equity case study by understanding the objective, reviewing financial basics, practicing LBO modelling, staying updated on industry trends, and developing a structured analysis approach.

2. How can I stand out from other candidates? Stand out by demonstrating nuanced investment judgment, engaging in meaningful dialogue, prioritizing substance over complexity in modelling, and highlighting value-creation opportunities.

3. What is the role of modelling in a private equity case study? Modelling plays a crucial role in a private equity case study as it helps evaluate investment potential, assess risks, and determine the feasibility of an acquisition.

Most Popular

Brought to you by USPEC

Never miss an insight!

Keep reading valuable insights when you sign up for our newsletter.

Stay Updated!

Get the latest in Private Equity with USPEC Newsletter straight to your inbox.

This website uses cookies to enhance website functionalities and improve your online experience. By browsing this website, you agree to the use of cookies as outlined in our privacy policy .

IMAGES

VIDEO

COMMENTS

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

Learn the basics of private equity interviews, from networking and recruiting processes to topics and tips. Find out how to prepare for case studies, modeling tests, and fit/background questions.

Watch me build a 3-statement LBO model from scratch. Great practice and review for private equity case study interviews!About me: My name is Josh Jia and I h...

Learn how to prepare for and complete a 1-week private equity case study, a common part of the recruitment process. Follow the step-by-step tutorial with a Cars.com example, a video, and a PDF guide.

Approach a private equity case study by understanding the objective, reviewing financial basics, practicing LBO modelling, staying updated on industry trends, and developing a structured analysis approach.

It's 3 hours to read the case, do financial analysis, and prepare a presentation/report. I haven't gotten much clarity from the firm on the amount of financial analysis that needs to be done (re: build a simple lbo model, or do some easier calcs/valuations like multiples or DCF). So a few things: