- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One CURRENT ARTICLE

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

A business plan is a document that outlines a company's goals and the strategies to achieve them. It's valuable for both startups and established companies. For startups, a well-crafted business plan is crucial for attracting potential lenders and investors. Established businesses use business plans to stay on track and aligned with their growth objectives. This article will explain the key components of an effective business plan and guidance on how to write one.

Key Takeaways

- A business plan is a document detailing a company's business activities and strategies for achieving its goals.

- Startup companies use business plans to launch their venture and to attract outside investors.

- For established companies, a business plan helps keep the executive team focused on short- and long-term objectives.

- There's no single required format for a business plan, but certain key elements are essential for most companies.

Investopedia / Ryan Oakley

Any new business should have a business plan in place before beginning operations. Banks and venture capital firms often want to see a business plan before considering making a loan or providing capital to new businesses.

Even if a company doesn't need additional funding, having a business plan helps it stay focused on its goals. Research from the University of Oregon shows that businesses with a plan are significantly more likely to secure funding than those without one. Moreover, companies with a business plan grow 30% faster than those that don't plan. According to a Harvard Business Review article, entrepreneurs who write formal plans are 16% more likely to achieve viability than those who don't.

A business plan should ideally be reviewed and updated periodically to reflect achieved goals or changes in direction. An established business moving in a new direction might even create an entirely new plan.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. It allows for careful consideration of ideas before significant investment, highlights potential obstacles to success, and provides a tool for seeking objective feedback from trusted outsiders. A business plan may also help ensure that a company’s executive team remains aligned on strategic action items and priorities.

While business plans vary widely, even among competitors in the same industry, they often share basic elements detailed below.

A well-crafted business plan is essential for attracting investors and guiding a company's strategic growth. It should address market needs and investor requirements and provide clear financial projections.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, gathering the basic information into a 15- to 25-page document is best. Any additional crucial elements, such as patent applications, can be referenced in the main document and included as appendices.

Common elements in many business plans include:

- Executive summary : This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services : Describe the products and services the company offers or plans to introduce. Include details on pricing, product lifespan, and unique consumer benefits. Mention production and manufacturing processes, relevant patents , proprietary technology , and research and development (R&D) information.

- Market analysis : Explain the current state of the industry and the competition. Detail where the company fits in, the types of customers it plans to target, and how it plans to capture market share from competitors.

- Marketing strategy : Outline the company's plans to attract and retain customers, including anticipated advertising and marketing campaigns. Describe the distribution channels that will be used to deliver products or services to consumers.

- Financial plans and projections : Established businesses should include financial statements, balance sheets, and other relevant financial information. New businesses should provide financial targets and estimates for the first few years. This section may also include any funding requests.

Investors want to see a clear exit strategy, expected returns, and a timeline for cashing out. It's likely a good idea to provide five-year profitability forecasts and realistic financial estimates.

2 Types of Business Plans

Business plans can vary in format, often categorized into traditional and lean startup plans. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These are detailed and lengthy, requiring more effort to create but offering comprehensive information that can be persuasive to potential investors.

- Lean startup business plans : These are concise, sometimes just one page, and focus on key elements. While they save time, companies should be ready to provide additional details if requested by investors or lenders.

Why Do Business Plans Fail?

A business plan isn't a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections. Markets and the economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All this calls for building flexibility into your plan, so you can pivot to a new course if needed.

How Often Should a Business Plan Be Updated?

How frequently a business plan needs to be revised will depend on its nature. Updating your business plan is crucial due to changes in external factors (market trends, competition, and regulations) and internal developments (like employee growth and new products). While a well-established business might want to review its plan once a year and make changes if necessary, a new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is ideal for quickly explaining a business, especially for new companies that don't have much information yet. Key sections may include a value proposition , major activities and advantages, resources (staff, intellectual property, and capital), partnerships, customer segments, and revenue sources.

A well-crafted business plan is crucial for any company, whether it's a startup looking for investment or an established business wanting to stay on course. It outlines goals and strategies, boosting a company's chances of securing funding and achieving growth.

As your business and the market change, update your business plan regularly. This keeps it relevant and aligned with your current goals and conditions. Think of your business plan as a living document that evolves with your company, not something carved in stone.

University of Oregon Department of Economics. " Evaluation of the Effectiveness of Business Planning Using Palo Alto's Business Plan Pro ." Eason Ding & Tim Hursey.

Bplans. " Do You Need a Business Plan? Scientific Research Says Yes ."

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

Harvard Business Review. " How to Write a Winning Business Plan ."

U.S. Small Business Administration. " Write Your Business Plan ."

SCORE. " When and Why Should You Review Your Business Plan? "

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1222648303-e00f14f235ba4c63aa222a87f430e345.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

What is a Business Plan? Definition, Tips, and Templates

Published: June 28, 2024

Years ago, I had an idea to launch a line of region-specific board games. I knew there was a market for games that celebrated local culture and heritage. I was so excited about the concept and couldn't wait to get started.

But my idea never took off. Why? Because I didn‘t have a plan. I lacked direction, missed opportunities, and ultimately, the venture never got off the ground.

And that’s exactly why a business plan is important. It cements your vision, gives you clarity, and outlines your next step.

In this post, I‘ll explain what a business plan is, the reasons why you’d need one, identify different types of business plans, and what you should include in yours.

Table of Contents

What is a business plan?

What is a business plan used for.

- Business Plan Template [Download Now]

Purposes of a Business Plan

What does a business plan need to include, types of business plans.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

A business plan is a comprehensive document that outlines a company's goals, strategies, and financial projections. It provides a detailed description of the business, including its products or services, target market, competitive landscape, and marketing and sales strategies. The plan also includes a financial section that forecasts revenue, expenses, and cash flow, as well as a funding request if the business is seeking investment.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Don't forget to share this post!

Related articles.

23 of My Favorite Free Marketing Newsletters

![analyze a business plan The 8 Best Free Flowchart Templates [+ Examples]](https://www.hubspot.com/hubfs/free-flowchart-template-1-20240716-6679104-1.webp)

The 8 Best Free Flowchart Templates [+ Examples]

18 of My Favorite Sample Business Plans & Examples For Your Inspiration

![analyze a business plan 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://www.hubspot.com/hubfs/gantt-chart-1-20240625-3861486-1.webp)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![analyze a business plan How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]](https://www.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]

20 Free & Paid Small Business Tools for Any Budget

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2024

16 Best Screen Recorders to Use for Collaboration

The 25 Best Google Chrome Extensions for SEO

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

LLC Formation

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

Business Plan Example and Template

Learn how to create a business plan

What is a Business Plan?

A business plan is a document that contains the operational and financial plan of a business, and details how its objectives will be achieved. It serves as a road map for the business and can be used when pitching investors or financial institutions for debt or equity financing .

A business plan should follow a standard format and contain all the important business plan elements. Typically, it should present whatever information an investor or financial institution expects to see before providing financing to a business.

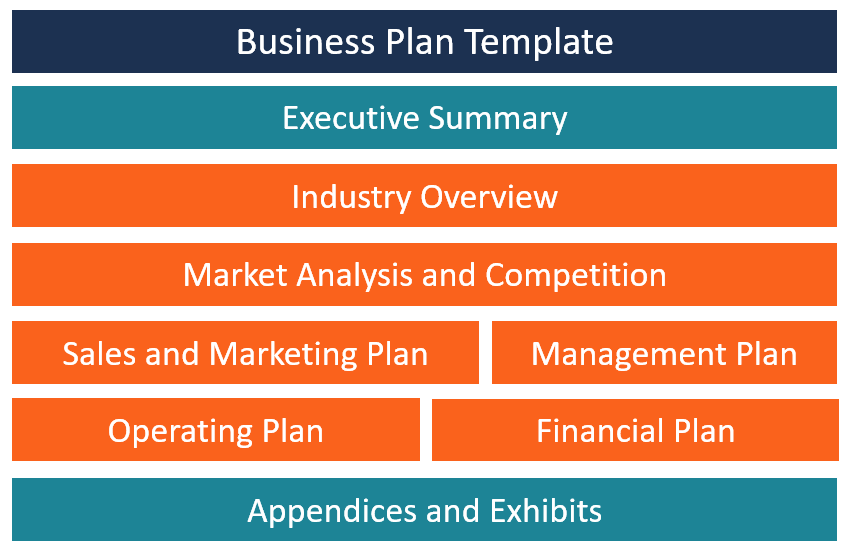

Contents of a Business Plan

A business plan should be structured in a way that it contains all the important information that investors are looking for. Here are the main sections of a business plan:

1. Title Page

The title page captures the legal information of the business, which includes the registered business name, physical address, phone number, email address, date, and the company logo.

2. Executive Summary

The executive summary is the most important section because it is the first section that investors and bankers see when they open the business plan. It provides a summary of the entire business plan. It should be written last to ensure that you don’t leave any details out. It must be short and to the point, and it should capture the reader’s attention. The executive summary should not exceed two pages.

3. Industry Overview

The industry overview section provides information about the specific industry that the business operates in. Some of the information provided in this section includes major competitors, industry trends, and estimated revenues. It also shows the company’s position in the industry and how it will compete in the market against other major players.

4. Market Analysis and Competition

The market analysis section details the target market for the company’s product offerings. This section confirms that the company understands the market and that it has already analyzed the existing market to determine that there is adequate demand to support its proposed business model.

Market analysis includes information about the target market’s demographics , geographical location, consumer behavior, and market needs. The company can present numbers and sources to give an overview of the target market size.

A business can choose to consolidate the market analysis and competition analysis into one section or present them as two separate sections.

5. Sales and Marketing Plan

The sales and marketing plan details how the company plans to sell its products to the target market. It attempts to present the business’s unique selling proposition and the channels it will use to sell its goods and services. It details the company’s advertising and promotion activities, pricing strategy, sales and distribution methods, and after-sales support.

6. Management Plan

The management plan provides an outline of the company’s legal structure, its management team, and internal and external human resource requirements. It should list the number of employees that will be needed and the remuneration to be paid to each of the employees.

Any external professionals, such as lawyers, valuers, architects, and consultants, that the company will need should also be included. If the company intends to use the business plan to source funding from investors, it should list the members of the executive team, as well as the members of the advisory board.

7. Operating Plan

The operating plan provides an overview of the company’s physical requirements, such as office space, machinery, labor, supplies, and inventory . For a business that requires custom warehouses and specialized equipment, the operating plan will be more detailed, as compared to, say, a home-based consulting business. If the business plan is for a manufacturing company, it will include information on raw material requirements and the supply chain.

8. Financial Plan

The financial plan is an important section that will often determine whether the business will obtain required financing from financial institutions, investors, or venture capitalists. It should demonstrate that the proposed business is viable and will return enough revenues to be able to meet its financial obligations. Some of the information contained in the financial plan includes a projected income statement , balance sheet, and cash flow.

9. Appendices and Exhibits

The appendices and exhibits part is the last section of a business plan. It includes any additional information that banks and investors may be interested in or that adds credibility to the business. Some of the information that may be included in the appendices section includes office/building plans, detailed market research , products/services offering information, marketing brochures, and credit histories of the promoters.

Business Plan Template

Here is a basic template that any business can use when developing its business plan:

Section 1: Executive Summary

- Present the company’s mission.

- Describe the company’s product and/or service offerings.

- Give a summary of the target market and its demographics.

- Summarize the industry competition and how the company will capture a share of the available market.

- Give a summary of the operational plan, such as inventory, office and labor, and equipment requirements.

Section 2: Industry Overview

- Describe the company’s position in the industry.

- Describe the existing competition and the major players in the industry.

- Provide information about the industry that the business will operate in, estimated revenues, industry trends, government influences, as well as the demographics of the target market.

Section 3: Market Analysis and Competition

- Define your target market, their needs, and their geographical location.

- Describe the size of the market, the units of the company’s products that potential customers may buy, and the market changes that may occur due to overall economic changes.

- Give an overview of the estimated sales volume vis-à-vis what competitors sell.

- Give a plan on how the company plans to combat the existing competition to gain and retain market share.

Section 4: Sales and Marketing Plan

- Describe the products that the company will offer for sale and its unique selling proposition.

- List the different advertising platforms that the business will use to get its message to customers.

- Describe how the business plans to price its products in a way that allows it to make a profit.

- Give details on how the company’s products will be distributed to the target market and the shipping method.

Section 5: Management Plan

- Describe the organizational structure of the company.

- List the owners of the company and their ownership percentages.

- List the key executives, their roles, and remuneration.

- List any internal and external professionals that the company plans to hire, and how they will be compensated.

- Include a list of the members of the advisory board, if available.

Section 6: Operating Plan

- Describe the location of the business, including office and warehouse requirements.

- Describe the labor requirement of the company. Outline the number of staff that the company needs, their roles, skills training needed, and employee tenures (full-time or part-time).

- Describe the manufacturing process, and the time it will take to produce one unit of a product.

- Describe the equipment and machinery requirements, and if the company will lease or purchase equipment and machinery, and the related costs that the company estimates it will incur.

- Provide a list of raw material requirements, how they will be sourced, and the main suppliers that will supply the required inputs.

Section 7: Financial Plan

- Describe the financial projections of the company, by including the projected income statement, projected cash flow statement, and the balance sheet projection.

Section 8: Appendices and Exhibits

- Quotes of building and machinery leases

- Proposed office and warehouse plan

- Market research and a summary of the target market

- Credit information of the owners

- List of product and/or services

Related Readings

Thank you for reading CFI’s guide to Business Plans. To keep learning and advancing your career, the following CFI resources will be helpful:

- Corporate Structure

- Three Financial Statements

- Business Model Canvas Examples

- See all management & strategy resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

Table of Contents

What is business analysis, analyzing a business: why, factors to consider while analyzing a business, what’s the process involved in analyzing a business, do you want to become a business analyst, analyzing a business: the important aspects for a business analyst.

It’s tough running a successful business. There’s a ton of competition and a constant stream of new technologies available to you and your competitors to chart and navigate the ever-changing seas.

If a business wants to thrive today, it must leverage every possible advantage it can find. While this boring fact is not all that new, technology is changing in new ways — and at warp speed. That’s why business analysis is essential for success, and why professionals adept at analyzing a business strategy and plan are in super-high demand. This article explores the concept of business analysis and why analyzing a business is critical for success. We’ll explore the processes and aspects that matter most to business analysts .

Business analysis is the practice, or discipline, of identifying and creating solutions for business needs. Business analysis helps people understand how their respective company functions to fulfill its primary purpose.

By analyzing a business plan or strategy, you can pinpoint areas that need change and introduce those changes to your team members and the stakeholders in your organization. Solutions will range from organizational changes and strategic planning to process improvement and software systems development.

A business analyst is a professional responsible for analyzing a business and guiding it through the improvement process. They begin by analyzing the business environment, including its systems, processes, and assessing its business model. Once the analysts complete their research, they use data analysis tools and other techniques to shepherd the business by improving products, processes, and services.

We can keep saying that businesses these days are faced with more tremendous obstacles, but that’s not helping matters unless we can specifically show why a company needs to conduct a business analysis. Let’s look at why companies need to be doing this regularly.

1. Figuring Out the Company’s Performance

Analysts conduct a business portfolio analysis to look at its services and products and categorize them based on their performance and competitiveness.

2. Getting an Account of the Company’s Resources and Goals

A thorough business analysis imparts an understanding of a company’s operations, structure, policies, and goals. Armed with this information, business analysts can recommend which solutions are needed to achieve those goals and figure out what resources and tools they need to achieve them.

3. Facilitating Digital Transformation

Digital transformation is the new black, especially considering elements such as data analytics and information management. Simply put, analyzing a business through data-driven stats is the only way to succeed today.

4. Incentivizing Change

It’s one thing to create a business project meant to provide solutions to a company’s most pressing issues. It’s another to get the staff to go along with the changes. A successful business analysis coupled with transparency gives proof to a skeptical staff about why the changes are a positive step.

The fact is, analyzing a business will help organizations determine how their products and services are performing versus the competition, measure digital transformation progress, and provide evidence to the staff and stakeholders to convince them to adopt the recommended solutions.

Become a Business and Leadership Professional

- Top 10 skills in demand Business Analysis as a skill in 2020

- 14% Growth in Jobs of Business Analysis profile by 2028

- $85K Average Salary

Post Graduate Program in Business Analysis

- Get mentored and network with industry experts from Amazon, Microsoft, and Google

- Access Harvard Business Publishing case studies of Pearson, CarMax, EvCard, etc

Business Analyst

- Industry-recognized certifications from IBM and Simplilearn

- Masterclasses from IBM experts

Here's what learners are saying regarding our programs:

I was keenly looking for a change in my domain from business consultancy to IT(Business Analytics). This Post Graduate Program in Business Analysis course helped me achieve the same. I am proficient in business analysis now and am looking for job profiles that suit my skill set.

Assistant Consultant at Tata Consultancy Services , Tata Consultancy Services

My experience with Simplilearn has been great till now. They have good materials to start with, and a wide range of courses. I have signed up for two courses with Simplilearn over the past 6 months, Data Scientist and Agile and Scrum. My experience with both is good. One unique feature I liked about Simplilearn is that they give pre-requisites that you should complete, before a live class, so that you go there fully prepared. Secondly, there support staff is superb. I believe there are two teams, to cater to the Indian and US time zones. Simplilearn gives you the most methodical and easy way to up-skill yourself. Also, when you compare the data analytics courses across the market that offer web-based tutorials, Simplilearn, scores over the rest in my opinion. Great job, Simplilearn!

So if a business is at the point where it recognizes the value of business analysis , the next question is, “What factors weigh into analyzing a business?” The key is to make sure the analysis focuses on details that matter and make a difference.

Here are some key factors that show up in the most successful business analysis examples.

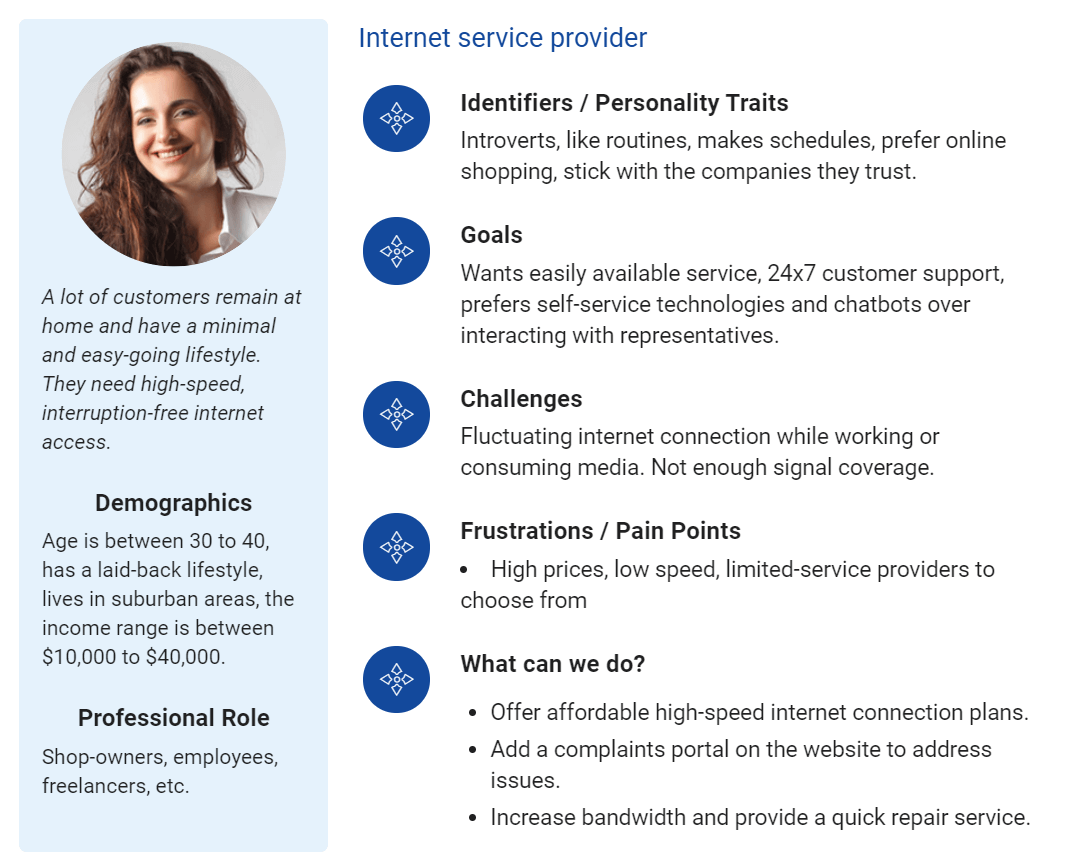

1. Customer Research

Let’s begin with the most essential factor, the customers! After all, if a business doesn’t have customers, it won’t remain around for long. Customer research includes feedback such as surveys (mail, internet, phone, in-person), customer service interactions (often by a chatbot), and online reviews. Analysts use this research to figure out what customers want out of the product, even down to details such as preferred sizes and colors. Accurate customer research, culled by business analysts, is an invaluable tool for determining a company’s future product releases.

2. Product Quality

Covering everything from product testing to quality control and safety checks to benchmarking, product quality and benchmarking is paramount. Benchmarking involves companies constantly measuring their products against similar items produced by competitors. A sound analysis paints a good picture of how the market sees the company’s product value, longevity, and quality.

3. Labor Costs

Employee costs account for the largest piece of most business' budgets, so companies should conduct a thorough analysis of wages and how they line up with the bank. Analysts also need to factor in what the competition is paying their employees as many businesses won’t hesitate to pay (and poach) for qualified, valuable employees. Analyzing a business’ labor costs is often like walking a tightrope between staying within budget and paying a competitive salary. Still, it's worth it in the long run.

4. Success in Meeting Goals

Lots of businesses talk a good game, but talk is cheap. A thorough, unbiased business analysis measures how well the company delivers what it promises, meets its goals, and lives up to the hype. The research focuses on revenue growth and accounts receivable turnover to put together a clear picture that jibes with the quality and reliability of the products and services that are being delivered.

5. Financial Analysis

This ties in with the previous point. But whereas measuring the company’s success at meeting its goals as a “make or break” proposition, a thorough business analysis compares daily, weekly, and monthly sales figures and compares them to sales forecasts during peak shopping seasons, variables such as the global pandemic, natural disasters, changing demographics, and so on. Advice: always be prepared for anything that comes your way.

6. What’s the Competition Up To?

While a business struggles to win the race against ever-changing technology, market uncertainties, and crippling pandemics, it can’t lose sight of the competition. Is the company in question keeping up, passing, or falling behind their rivals, and if the latter is true, what can they do to change the narrative?

7. Company Size and Growth

Companies that grow too quickly often run into pitfalls. Is this business growing too fast and reckless? Because if so, it’s likely to experience shrinkage as the market self-corrects. Additionally, management often struggles with over-confidence and finds it difficult to switch their approach to an even-growth model.

8. Trend Analysis

Game-changing technologies and new business models are popping up like crazy in today’s hyperconnected world. If you’re analyzing a business well, you must be keeping up on the trends. If the competition is doing a better job of adapting to industry changes, they will come out ahead. By leveraging the latest analytics tools, you can stay competitive.

Now that we've ascertained how vital business analysis can be for a company's future and what factors we need to consider, the final step is figuring out the process. That’s called the business process analysis, broken down into the following steps:

1. Identify All Relevant Processes

Analysts must ascertain which processes need improvement and focus attention only on them. Once you identify the necessary processes, you can start putting together goals. Here are some questions that help identify these processes:

- What’s our company’s mission?

- Who are our clients?

- What’s important to our customers?

- What are our Key Performance Indicators (KPI)?

- What’s the plan?

2. Put Together an A-Team

This team consists of people who will help carry out the business analysis — ideally leveraging the members who are already familiar with the daily processes, while always recruiting new talent. The team needs people who understand business process management (BPM), can take on leadership roles, and motivate employees to effect necessary changes swiftly.

Enroll in our Business Analyst Master's Program and gain expertise in this growing field.

3. Create a Business Process Diagram or Flowchart

Analysts who draw up a step-by-step diagram help people to visualize the process and can facilitate better business outcomes. The chart should include:

- Who is responsible for each process

- Events that initiate the processes

- Tasks and their relationships

- Determine how a process ends and how to mark its end

4. Define the Process as It Now Stands

The analyst defines how the process is currently taking place.

5. Call Out Improvement Points

Analysts figure out the necessary improvements, and if they’re possible, make sure that they fit with the company’s overall goals. Potential improvement points include:

- Addressing bottlenecks and obstacles

- Increasing customer interaction

- Decreasing task and information handoffs between people and systems

- Bolstering the value to the customer

- Continuously defining business standards, rules, and procedures

6. Creating Better Processes

Here is where the analysts take all the above information and model the new process, aligning it with data-driven and informed objectives and goals.

Business analysts are a precious resource in today’s high-pressure environments. If you would like a business analysis career, Simplilearn is ready to provide you with the tools to make your dreams come true. The Business Analytics for Strategic Decision Making with IIT Roorkee helps you master critical business analysis techniques, Agile Scrum methodologies, SQL databases, and visualization tools like Excel, Power BI, and Tableau.

According to Indeed , you can earn an annual average of USD 79,690 as a business analyst, not counting bonuses. So if you’re ready for a challenging, in-demand career that offers excellent benefits, let Simplilearn help you take those first steps!

Our Business And Leadership Courses Duration And Fees

Business And Leadership Courses typically range from a few weeks to several months, with fees varying based on program and institution.

| Program Name | Duration | Fees |

|---|---|---|

| Cohort Starts: | 5 months | € 4,500 |

| Cohort Starts: | 8 Months | € 2,499 |

| Cohort Starts: | 6 Months | € 1,990 |

| 11 Months | € 1,299 |

Learn from Industry Experts with free Masterclasses

Data science & business analytics.

Program Overview: How Purdue University Can Help You Succeed in Business Analysis

Business and Leadership

Program Overview: The Reasons to Get Certified in Business Analysis in 2023

The Modern Day Business Analyst Role: AI Tools and Techniques for Success

Recommended Reads

Business Intelligence Career Guide: Your Complete Guide to Becoming a Business Analyst

The Ultimate Guide to Business Impact Analysis

A Complete Guide to Get a Grasp of Time Series Analysis

Business Analytics Basics: A Beginner’s Guide

Top 10 Most Effective Business Analysis Techniques

What Is Exploratory Data Analysis? Steps and Market Analysis

Get Affiliated Certifications with Live Class programs

- PMP, PMI, PMBOK, CAPM, PgMP, PfMP, ACP, PBA, RMP, SP, and OPM3 are registered marks of the Project Management Institute, Inc.

The Leading Source of Insights On Business Model Strategy & Tech Business Models

Business Analysis: How To Analyze Any Business

Business analysis is a research discipline that helps driving change within an organization by identifying the key elements and processes that drive value. Business analysis can also be used in Identifying new business opportunities or how to take advantage of existing business opportunities to grow your business in the marketplace.

Table of Contents

A quick intro to the Business Analysis Framework

On FourWeekMBA, I’ve looked at hundreds of business models of companies from high-tech industries ( Alphabet’s Google , Amazon , Facebook , Apple , and Microsoft ) to more traditional industries, like luxury empires ( LVMH , Kering Group , Tiffany , Brunello Cucinelli , Prada ) and more.

I’ve analyzed from listed public companies, for which data can be found in financial statements, to small businesses for which data is not publicly available.

As I received this question repeatedly, I thought to show a simple framework to analyze any business.

For the sake of this framework, we’ll leverage business analysis to reverse engineer a business to either help it grow or to gather insights that can help us grow our own company.

Keep in mind that business analysis requires a good amount of creativity.

While a single framework is a good starting point, you will need to use your experience, understanding of the industry, and what is available out there to draw a picture of what you’re looking at.

In short, I think a practical approach to business analysis is that of the artist rather than the scientist.

Thus, while we’ll be using a few data points to understand a business, we want to keep our minds able to connect the dots in several areas to draw a picture that unlocks strategic insights that we can test.

To provide a framework as a starting point to analyze any sort of business, you’ll need to answer a few simple questions, each addressing a key element of the business.

We’ll tackle it by looking at three main competitive advantages a business can create over time:

- What’s the key asset? (core asset)

Market moat :

- Who’s the key stakeholder? (stakeholder profiling)

- What player is competing for the same customer? (context mapping)

- What’s the key touchpoint between the brand and the customer? (core distribution )

Financial moat:

- How does it make money? (revenue generation)

- Where’s the real cash? (cash generation)

- How does the company spend money? (cost structure)

Let’s analyze each of those elements to uncover and draw the picture of any business. We’ll start from the outer layer (the financial moat, to get to the core asset.

Financial moat

In the. financial moat stage we’ll answer:

The purpose of the financial moat is to follow the money to dig deeper into the business and move toward what gives it a real market advantage, and eventually, we’ll look for the business core asset.

How does it make money?

Revenue streams are important as a baseline to understand any business.

Following the money can be very powerful in business as it unlocks a set of questions that will help us drill down into the current picture but also to draw some possible conclusions about future operations and strategy .

For instance, if you look at Google revenue streams it’s interesting to notice a few things right away:

- The company still primarily makes money from advertising

- Google revenue streams are diversified (even though advertising is still the primary revenue stream)

- A very small percentage of Google’s revenues come from other bets

From those simple statements, we can drill further down and look at each revenue stream:

- Advertising revenues: Google makes money by two primary mechanisms: Google Ads and Google AdSense

- Other revenues: that comprises things like in-app revenues, but also hardware devices which Google sells

- Other bets: it comprises investments in other ventures

From this first look, we can depart from looking at other bets and other revenues. Not because those are not important for the future. Quite the opposite, one of the hidden gems of Google’s success in the next ten, twenty years might hide there.

But here we’re not trying to predict the future, which is impossible.

We want to reverse engineer the current business to gather some insights which will help us drive our own strategy now (for instance, if you’re building a business today by gaining organic traffic from Google understanding its logic helps a lot!).

Therefore, we’ll decide to drill down more

Why? We want to uncover where the real cash is.

Where’s the real cash?

When asking “where’s the real cash?” we’re not talking about cash flows, but rather about margins. In short, for companies like Netflix which run cash negative business models , it would be misleading to ask where’s the cash.

Instead, we want to look at the part of the business that has high-profit margins. For instance, if we look at Google’s advertising machine we can notice a few things:

To build a cash cow the company might do the following:

- Give up part of the margins on a line of business to strengthen another more strategic and scalable part of the business ( think of how Google splits revenues with network members thus giving up a good chunk of margins, yet by making its search pages way more valuable for users, and advertisers)

- Build a freemium part of the business which while doesn’t get monetized it helps amplify the brand and to build a valuable core asset monetized asymmetrically (we’ll see what that means)

How does the company spend money?

How the company spends its money informs about how it’s investing back into strengthening its core asset, thus building future growth .

Market moat

At this stage, we’ll ask:

The objective here is to understand what creates a competitive market advantage and point us toward the core asset of the company, which makes the business sustainable in the long-term.

Who’s the key stakeholder?

If you look at a companies’ like Amazon the complexity of the business goes well beyond a regular company.

In short, at this stage, it’s important to highlight the difference between small businesses which are more linear in how they approach customers.

And platform business models that instead have a more complex value chain.

We could make this process harder and harder by finding more business types, and classifying them into B2B, B2C, B2B2C, and more.

Or we can take a more straightforward approach.

Who’s the key user/customer, and what’s the value provided to her?

In Amazon’s case, for instance, the company has multiple products and each of them has a different value proposition .

Therefore, focusing on them all would be a mistake, as we want to go back and reconsider.

Who’s the Amazon repeat customer?

The customer who goes back to the Amazon e-commerce platform to buy over and over again is the key customer and where the company has built its success.

When you do look at the customer from that perspective, you stop assuming that Amazon Prime is another revenue stream . Instead, you understand that besides that, that is a way for Amazon to lock-in loyal customers and make their repeat purchases convenient (Prime Customers won’t pay for delivery).

The same happens if you go back and ask a similar question for a company like Google.

Who’s the person that drives up the value of the most important company’s asset?

If you look at Google’s business model , it’s easy to get fooled:

You might assume that as Google makes money by selling advertising to businesses, it will be the advertiser who pays Google to be the most valuable customer.

Yet, in Google’s case, the most valuable customer is the one who doesn’t pay: its users

That is because Google runs an asymmetric model .

In short, the company won’t monetize directly its users, but it will monetize the core asset which is built on top of the free users’ attention.

Where free users provide valuable data to Google’s algorithms, the company matches its technology with the users’ data and sells part of that as paid adverting.

In short, in an asymmetric model user and customers are not the same.

In a more symmetric model instead, users and customers are the same stakeholders.

The customer wearing the hat of the user provides valuable data to the platform. The company refines that data through proprietary algorithms and as a result, it gives back a valuable service to its customers.

That is how the Netflix business model works.

In those cases when the user is what provides valuable data to the core asset of the company, it’s important to understand that the tech company will prioritize its strategy around the user over time.

What player is competing for the same customer?

Once found the key stakeholder, the person who helps the company build its most valuable asset, we can zoom out a bit and understand the context in which the company operates.

One way to find comparable companies to map out the context is to look for those organizations that match the business and financial profile.

We do that because there is no company operating in a vacuum.

And even when a company that is better suited to help customers get things done might dominate.

In many other circumstances, better distribution strategy , capital moats, and more effective business models can help companies dominate beyond the value provided by their core products.

That’s why context matters.

In Google’s case we’ll look at the other players which are also grabbing the attention of users around the globe:

An attention-based model usually follows an asymmetric monetization strategy . Therefore, given Google’s key stakeholders (its users), and the fact that it’s an attention-based model, we can understand right away what products/platforms in the marketplace are comparable:

- Google (Alphabet)

- YouTube (Alphabet)

- Instagram (Facebook)

- Bing (Microsoft)

- TikTok (ByteDance)

Therefore, in order for Google to keep its competitive advantage is important to keep an eye on these.

* Note : The reason why Amazon is on the list as its website is one of the most important product search engines, intercepting the commercial intents of billions of people in the western world.

What’s the key touchpoint between the brand and the customer?

While disruptive startups built their name and grabbed market shares quickly by breaking down the trade-off between value and cost (at the basis of a blue ocean strategy ) there is another component of the success of any organization which can’t be ignored: distribution .

Distribution is the key touchpoint that makes customers connect with a brand , that enables companies to monetize their core assets and that enables them to keep tight long-term control over their business.

The importance of a distribution strategy can’t be overstated. Distribution isn’t just about delivering a product in the hands of the key customer that is also about:

- Enabling the company to be perceived inline with its pricing strategy and the brand ’s identity

- Building up the habits that enable users/customers to become champion of the product (just like you can’t stop using Google)

- Build competitive moats

Finally, at this stage, we can identify the core asset and put all together.

What’s the key asset?

The key asset is the main property that enables the company to make money in the long run.

For a tech business like Google, which is represented by its search results pages endowed by users’ data and algorithms, makes them extremely valuable to advertisers.

If we think of a smaller business or a non-tech company that can be represented by its premises or its brand .

For instance, a small Boutique hotel’s location is the key asset. For a luxury company, its brand is the most important asset.

The former is physical and easily identifiable.

The latter is instead non-physical and abstract, yet still extremely valuable as it enables companies like Prada, LVMH, Tiffany and other luxury brands to capture high margins.

Therefore depending on the company, the main asset might be the technology, data or brand . Or better yet a mixture of those things.

Putting it all together

As we identified the core asset, market, and financial moat, we can move backward to uncover the whole story.

In a case like Google, the company makes its money primarily by monetizing its search results pages (core asset).

It runs an asymmetric business model where the user and the customer are not the same (stakeholder profiling). Products and platforms like Amazon, Facebook and Twitter also draw the attention of users (context mapping), however, Google has a strong distribution network given for instance by the fact the company can cover the whole users’ journey (core distribution ), and most of its money is spent to maintain its core asset competitive (cost structure), while advertisers provide revenues and cash to the company which makes it financially sustainable (financial moat).

Where do you find the data?

A set of useful resources to find the data you need to analyze several businesses are:

- EDGAR Filings

It’s important to remark that when it comes to data it’s not important how many data points you find. Often it requires a bit of creativity to ponder the right question.

In that case, a single data point can tell you a lot about a business that you can use to assess the company or to drive the strategy for your own business.

FourWeekMBA business analysis framework summarized

To analyze any business, you can ask a few simple questions:

Each of those questions will lead to an understanding of the several blocks that make up internal and external strategic forces that shape the business.

Case study: how to make an everyday free tool your go to BI alternative

While it’s tempting to complex things up when performing business analysis, in reality, there is a simple tool, that you have been using for years, which can help you to perform a good part of your analysis: Google.

As pointed out on the Google blog in 2012:

Search is a lot about discovery—the basic human need to learn and broaden your horizons. But searching still requires a lot of hard work by you, the user. So today I’m really excited to launch the Knowledge Graph, which will help you discover new information quickly and easily. …The Knowledge Graph enables you to search for things, people or places that Google knows about—landmarks, celebrities, cities, sports teams, buildings, geographical features, movies, celestial objects, works of art and more—and instantly get information that’s relevant to your query. This is a critical first step towards building the next generation of search, which taps into the collective intelligence of the web and understands the world a bit more like people do. …the Knowledge Graph can help you make some unexpected discoveries. You might learn a new fact or new connection that prompts a whole new line of inquiry. Do you know where Matt Groening, the creator of the Simpsons (one of my all-time favorite shows), got the idea for Homer, Marge and Lisa’s names? It’s a bit of a surprise:

In 2012, Google started to roll out officially its Knowledge Graph (though its attempt to make the search experience even smarter and more semantic started way back and it escalated when the company acquired MetaWeb).

With that, Google started do develop more and more features related to giving beyond the classic ten blue links we have seen for years.

Those features we see appearing more and more on search results are coming from the massive Google’s semantic database made of billions of data points called Knowledge Graph.

Within the Knowledge Graph, Google combined semantic knowledge, to billions of users’ preferences and data, refined by its powerful algorithms and refined by its human raters.

This massive knowledge base is there to be explored, for free, it only requires you to be aware of it.

Industry analysis and setup

When searching for “Amazon” on Google, at the bottom of the page (from desktop) you will find several suggestions from Google, based on the industries where Amazon operates.

In short, Google is suggesting that Amazon primarily operates as an online retailer, and as such it compares it with other retailers (online and offline). Yet Google’s Knowledge Graph also expands on that and tells you more.

Amazon is also an AI company competing against other AI companies which offers you an interesting insight into the products of the company.

At the same time, Google is suggesting that Amazon is also a key player in the cloud space, thus it offers you some perspectives of how the cloud industry looks like by pointing out some direct competitors (like Microsoft and Oracle) and other companies operating in the cloud space.

Expand the research

From there, you can drill down into each of the carousels you see showing on Google to have a more detailed overview and expand the research. You can stretch it as far as you want, depending on the scope of the analysis.

Discover new data points

As an example, when you drill further down and search for “cloud companies” at the bottom of the search result page, you will find other categories of companies part of the cloud industry.

From PaaS to IaaS models, all were born as part of the cloud industry.

Key takeaway

While it’s easy to look for the ultimate business intelligence tools when performing an analysis, in reality, it makes sense to stop for a second and think about what might be the single data points that can give you insights about a company.

From there, you can use explorative tools, like Google to find out and drill down to draft an analysis that can give you different insights and enable you to reverse engineer many large companies.

Key Highlights

- The framework aims to analyze businesses for growth opportunities and strategic insights.

- It involves three main competitive advantages: Core moat, Market moat, and Financial moat.

- Identifying the key asset that gives the company a competitive advantage.

- Understanding the main value proposition of the business.

- Recognizing the key stakeholders and their value in the business.

- Identifying competing players in the same customer segment.

- Understanding the crucial touchpoints between the brand and customers.

- Analyzing revenue generation methods of the business.

- Identifying where the significant cash flows come from.

- Understanding the cost structure and how the company spends money.

- Distinguishing between users and customers in the business model.

- Highlighting the importance of leveraging data and technology.

- Using Google’s Knowledge Graph for insights and research.

- Expanding analysis by exploring suggested entities and categories.

- Discovering new data points to enhance the analysis.

- Focusing on single data points that offer valuable insights.

- Using explorative tools like Google to gather insights about a company.

- Emphasizing the importance of creative analysis and critical questions.

- The framework provides a structured approach to understanding various aspects of a business.

- It aids in identifying growth opportunities, competitive advantages, and strategic insights.

- The use of Google’s Knowledge Graph enhances research capabilities.

Connected Analysis Frameworks

Failure Mode And Effects Analysis

Agile Business Analysis

Business Valuation

Paired Comparison Analysis

Monte Carlo Analysis

Cost-Benefit Analysis

CATWOE Analysis

VTDF Framework

Pareto Analysis

Comparable Analysis

SWOT Analysis

PESTEL Analysis

Business Analysis

Financial Structure

Financial Modeling

Value Investing

Buffet Indicator

Financial Analysis

Post-Mortem Analysis

Retrospective Analysis

Root Cause Analysis

Blindspot Analysis

Break-even Analysis

Decision Analysis

DESTEP Analysis

STEEP Analysis

STEEPLE Analysis

Activity-Based Management

PMESII-PT Analysis

SPACE Analysis

Lotus Diagram

Functional Decomposition

Multi-Criteria Analysis

Stakeholder Analysis

Strategic Analysis

Related Strategy Concepts: Go-To-Market Strategy , Marketing Strategy , Business Models , Tech Business Models , Jobs-To-Be Done , Design Thinking , Lean Startup Canvas , Value Chain , Value Proposition Canvas , Balanced Scorecard , Business Model Canvas , SWOT Analysis , Growth Hacking , Bundling , Unbundling , Bootstrapping , Venture Capital , Porter’s Five Forces , Porter’s Generic Strategies , Porter’s Five Forces , PESTEL Analysis , SWOT , Porter’s Diamond Model , Ansoff , Technology Adoption Curve , TOWS , SOAR , Balanced Scorecard , OKR , Agile Methodology , Value Proposition , VTDF Framework , BCG Matrix , GE McKinsey Matrix , Kotter’s 8-Step Change Model .

Main Guides:

- Business Models

- Business Strategy

- Marketing Strategy

- Business Model Innovation

- Platform Business Models

- Network Effects In A Nutshell

- Digital Business Models

More Resources

About The Author

Gennaro Cuofano

Discover more from fourweekmba.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

- Sources of Business Finance

- Small Business Loans

- Small Business Grants

- Crowdfunding Sites

- How to Get a Business Loan

- Small Business Insurance Providers

- Best Factoring Companies

- Types of Bank Accounts

- Best Banks for Small Business

- Best Business Bank Accounts

- Open a Business Bank Account

- Bank Accounts for Small Businesses

- Free Business Checking Accounts

- Best Business Credit Cards

- Get a Business Credit Card

- Business Credit Cards for Bad Credit

- Build Business Credit Fast

- Business Loan Eligibility Criteria

- Small-Business Bookkeeping Basics

- How to Set Financial Goals

- Business Loan Calculators

- How to Calculate ROI

- Calculate Net Income

- Calculate Working Capital

- Calculate Operating Income

- Calculate Net Present Value (NPV)

- Calculate Payroll Tax

12 Key Elements of a Business Plan (Top Components Explained)

Starting and running a successful business requires proper planning and execution of effective business tactics and strategies .

You need to prepare many essential business documents when starting a business for maximum success; the business plan is one such document.

When creating a business, you want to achieve business objectives and financial goals like productivity, profitability, and business growth. You need an effective business plan to help you get to your desired business destination.

Even if you are already running a business, the proper understanding and review of the key elements of a business plan help you navigate potential crises and obstacles.

This article will teach you why the business document is at the core of any successful business and its key elements you can not avoid.

Let’s get started.

Why Are Business Plans Important?

Business plans are practical steps or guidelines that usually outline what companies need to do to reach their goals. They are essential documents for any business wanting to grow and thrive in a highly-competitive business environment .

1. Proves Your Business Viability

A business plan gives companies an idea of how viable they are and what actions they need to take to grow and reach their financial targets. With a well-written and clearly defined business plan, your business is better positioned to meet its goals.

2. Guides You Throughout the Business Cycle

A business plan is not just important at the start of a business. As a business owner, you must draw up a business plan to remain relevant throughout the business cycle .

During the starting phase of your business, a business plan helps bring your ideas into reality. A solid business plan can secure funding from lenders and investors.

After successfully setting up your business, the next phase is management. Your business plan still has a role to play in this phase, as it assists in communicating your business vision to employees and external partners.

Essentially, your business plan needs to be flexible enough to adapt to changes in the needs of your business.

3. Helps You Make Better Business Decisions

As a business owner, you are involved in an endless decision-making cycle. Your business plan helps you find answers to your most crucial business decisions.

A robust business plan helps you settle your major business components before you launch your product, such as your marketing and sales strategy and competitive advantage.

4. Eliminates Big Mistakes

Many small businesses fail within their first five years for several reasons: lack of financing, stiff competition, low market need, inadequate teams, and inefficient pricing strategy.

Creating an effective plan helps you eliminate these big mistakes that lead to businesses' decline. Every business plan element is crucial for helping you avoid potential mistakes before they happen.

5. Secures Financing and Attracts Top Talents

Having an effective plan increases your chances of securing business loans. One of the essential requirements many lenders ask for to grant your loan request is your business plan.

A business plan helps investors feel confident that your business can attract a significant return on investments ( ROI ).

You can attract and retain top-quality talents with a clear business plan. It inspires your employees and keeps them aligned to achieve your strategic business goals.

Key Elements of Business Plan

Starting and running a successful business requires well-laid actions and supporting documents that better position a company to achieve its business goals and maximize success.

A business plan is a written document with relevant information detailing business objectives and how it intends to achieve its goals.

With an effective business plan, investors, lenders, and potential partners understand your organizational structure and goals, usually around profitability, productivity, and growth.

Every successful business plan is made up of key components that help solidify the efficacy of the business plan in delivering on what it was created to do.

Here are some of the components of an effective business plan.

1. Executive Summary

One of the key elements of a business plan is the executive summary. Write the executive summary as part of the concluding topics in the business plan. Creating an executive summary with all the facts and information available is easier.

In the overall business plan document, the executive summary should be at the forefront of the business plan. It helps set the tone for readers on what to expect from the business plan.

A well-written executive summary includes all vital information about the organization's operations, making it easy for a reader to understand.

The key points that need to be acted upon are highlighted in the executive summary. They should be well spelled out to make decisions easy for the management team.

A good and compelling executive summary points out a company's mission statement and a brief description of its products and services.

An executive summary summarizes a business's expected value proposition to distinct customer segments. It highlights the other key elements to be discussed during the rest of the business plan.

Including your prior experiences as an entrepreneur is a good idea in drawing up an executive summary for your business. A brief but detailed explanation of why you decided to start the business in the first place is essential.

Adding your company's mission statement in your executive summary cannot be overemphasized. It creates a culture that defines how employees and all individuals associated with your company abide when carrying out its related processes and operations.

Your executive summary should be brief and detailed to catch readers' attention and encourage them to learn more about your company.

Components of an Executive Summary

Here are some of the information that makes up an executive summary:

- The name and location of your company

- Products and services offered by your company

- Mission and vision statements

- Success factors of your business plan

2. Business Description

Your business description needs to be exciting and captivating as it is the formal introduction a reader gets about your company.

What your company aims to provide, its products and services, goals and objectives, target audience , and potential customers it plans to serve need to be highlighted in your business description.

A company description helps point out notable qualities that make your company stand out from other businesses in the industry. It details its unique strengths and the competitive advantages that give it an edge to succeed over its direct and indirect competitors.

Spell out how your business aims to deliver on the particular needs and wants of identified customers in your company description, as well as the particular industry and target market of the particular focus of the company.

Include trends and significant competitors within your particular industry in your company description. Your business description should contain what sets your company apart from other businesses and provides it with the needed competitive advantage.

In essence, if there is any area in your business plan where you need to brag about your business, your company description provides that unique opportunity as readers look to get a high-level overview.

Components of a Business Description

Your business description needs to contain these categories of information.

- Business location

- The legal structure of your business

- Summary of your business’s short and long-term goals

3. Market Analysis

The market analysis section should be solely based on analytical research as it details trends particular to the market you want to penetrate.

Graphs, spreadsheets, and histograms are handy data and statistical tools you need to utilize in your market analysis. They make it easy to understand the relationship between your current ideas and the future goals you have for the business.

All details about the target customers you plan to sell products or services should be in the market analysis section. It helps readers with a helpful overview of the market.