- Now Trending:

- UNDERSTANDING TENANCIES ...

- THE SENIOR PARTNER OF PR...

- Dr. Prince O. Williams-J...

- How To Pick The Right Ho...

DEED OF ASSIGNMENT: EVERYTHING YOU NEED TO KNOW.

A Deed of Assignment refers to a legal document in which an assignor states his willingness to assign the ownership of his property to the assignee. The Deed of Assignment is required to effect a transfer of property and to show the legal right to possess it. It is always a subject of debate whether Deed of Assignment is a contract; a Deed of Assignment is actually a contract where the owner (the “assignor”) transfers ownership over certain property to another person (the “assignee”) by way of assignment. As a result of the assignment, the assignee steps into the shoes of the assignor and assumes all the rights and obligations pertaining to the property.

In Nigeria, a Deed of Assignment is one of the legal documents that transfer authentic legal ownership in a property. There are several other documents like a deed of gifts, Assent, etc. However, this article focuses on the deed of assignment.

It is the written proof of ownership that stipulates the kind of rights or interests being transferred to the buyer which is a legal interest.

Read Also: DIFFERENCE BETWEEN TRANSFER OF PROPERTY THROUGH WILLS AND DEED OF GIFT

CONTENTS OF A DEED OF ASSIGNMENT

Content of a Deed of Assignment matters a lot to the transaction and special skill is needed for a hitch-free transaction. The contents of a deed of assignment can be divided into 3 namely; the introductory part, the second (usually the operative part), and the concluding part.

- THE INTRODUCTORY PART: This part enumerates the preliminary matters such as the commencement date, parties in the transaction, and recitals. The parties mentioned in the deed must be legal persons which can consist of natural persons and entities with corporate personality, the name, address, and status of the parties must be included. The proper descriptions of the parties are the assignor (seller) and assignee (buyer). The Recitals give the material facts constituting the background to the current transaction in chronological order.

- THE SECOND PART (USUALLY THE OPERATIVE PART): This is the part where the interest or title in the property is actually transferred from the assignor to the assignee. It is more like the engine room of the deed of assignment. The operative part usually starts with testatum and it provides for other important clauses such as the consideration (price) of the property, the accepted receipt by the assignor, the description of the property, and the terms and conditions of the transaction.

- The testimonium : this shows that all the parties are involved in the execution of the deed.

- Execution : this means signing. The capacity of the parties (either individual, corporate bodies, illiterates) is of great essence in the mode of execution. It is important to note that the type of parties involved determines how they will sign. Example 2 directors or a director/secretary will sign if a company is involved. In the same way, if an association, couple, individual, illiterate, family land (omonile), firm, unregistered association, etc. is involved the format of signature would be different.

- Attestation : this refers to the witnessing of the execution of the deed by witnesses.

For a Deed of Assignment to be effective, it must include a column for the Governor of the state or a representative of the Government where the property is, to sign/consent to the transaction. By virtue of Sec. 22 of the Land Use Act, and Sec. 10 Land Instrument Registration Law, the Governor must consent to the transaction.

Do you have any further questions? feel free to call Ibejulekkilawyer on 08034869295 or send a mail to [email protected] and we shall respond accordingly.

Disclaimer: The above is for information purposes only and should not be construed as legal advice. Ibejulekkilawyer.com (blog) shall not be liable to any person(s) for any damage or liability arising whatsoever following the reliance of the information contained herein. Consult us or your legal practitioner for legal advice.

Only 22% of poorest Nigerian households have electricity access –World Bank

Related Posts

Look for the following icons as you answer the Q&A to know more about the question and our suggested answer.

What is this?

Click this icon for information about the question.

Suggested Answer

Click this icon to know what is the recommended answer based on similar documents.

Things you need to know about Deed of Assignment.

Last updated on 8 January 2024

1. What is a Deed of Assignment?

A Deed of Assignment is a contract where the owner (the “assignor”) transfers ownership over property to another person (the “assignee”) by way of assignment. The assignee steps into the shoes of the assignor and assumes all the rights and obligations to the property.

If you will assign immovable property (e.g. land, house) then use this Deed of Assignment for Immovable Property instead.

2. When do you need a Deed of Assignment?

A Deed of Assignment is used when the owner wants to transfer ownership (and the rights and obligations) over property to another person.

3. What information do you need to create the Deed of Assignment?

To create your Deed of Assignment you’ll need the following minimum information:

- The type of assignor (e.g. individual or business) as well as name and details (e.g. nationality and address).

- The type of assignee (e.g. individual or business) as well as name and details (e.g. nationality and address).

- Brief description of the property to be assigned.

4. How much is the document?

The document costs PHP 400 for a one-time purchase. Once purchased you have unlimited use and revisions of this type of document.

You can also avail of Premium subscription at PHP 1,000 and get (a) unlimited use of our growing library of documents (from affidavits to contracts); and (b) unlimited use of our “ Ask an Attorney ” service, which lets you consult an expert lawyer anytime for any legal concern you have.

Related Documents.

Activities that involve a Deed of Assignment sometimes use the following documents. You may be interested in them:

Deed of Assignment for Immovable Property

Assign your rights to immovable property (e.g. house, land) to another person

Document Name

Cancel Save

9 Eymard Drive, New Manila Quezon City Owned and operated by JCArteche’s Online Documentation & Referral Services

Back to Top

- Terms of Service

- Privacy Policy

- Create Documents

- Ask An Attorney

- How It Works

- Customer Support

Philippine Legal Resources

Philippine Legal Forms and Resources: Affidavits, Deeds, Contracts, Case Digests

Tuesday, July 14, 2020

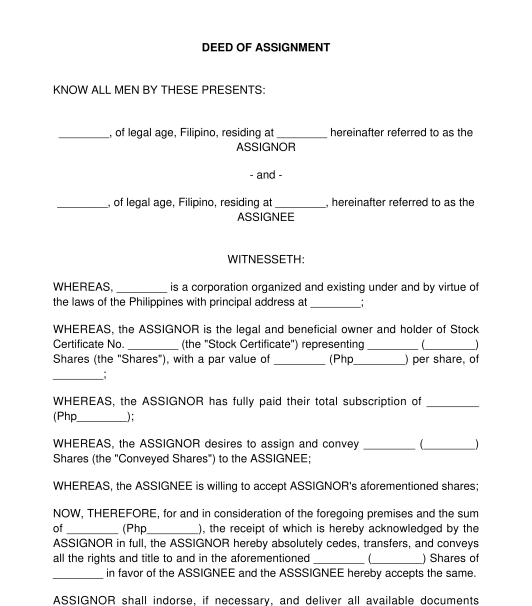

Deed of assignment (shares of stock), popular posts.

- MOA on Sale of Lot

- Affidavit of Damage to Vehicle

- Contract of Lease of Commercial Building

- Affidavit of No Rental

- Deed of Assignment and Transfer of Rights

- Affidavit of Consented Land Use

- Deed of Absolute Sale of Business

- Affidavit of Loss of High School Diploma

- Demand to Vacate

- Special Power of Attorney to Claim Last Pay

Privacy Policy

This privacy policy tells you how we use personal information collected at this site. Please read this privacy policy before using the site or submitting any personal information. By using the site, you accept the practices described here. Collection of Information We collect personally identifiable information, like names, email addresses, etc., when voluntarily submitted by our visitors. The information you provide is used to fulfill your specific request, unless you give us permission to use it in another manner, for example, to add you to one of our mailing lists. Cookie/Tracking Technology Our site may use cookies and tracking technology which are useful for gathering information such as browser type and operating system, tracking the number of visitors to the site, and understanding how visitors use the Site. Personal information cannot be collected via cookies and other tracking technology, however, if you previously provided personally identifiable information, cookies may be tied to such information. Third parties such as our advertisers may also use cookies to collect information in the course of serving ads to you. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. Distribution of Information We do not share your personally identifiable information to any third party for marketing purposes. However, we may share information with governmental agencies or other companies assisting us in fraud prevention or investigation. We may do so when: (1) permitted or required by law; or, (2) trying to protect against or prevent actual or potential fraud or unauthorized transactions; or, (3) investigating fraud which has already taken place. Commitment to Data Security Your personally identifiable information is kept secure. Only authorized staff of this site (who have agreed to keep information secure and confidential) have access to this information. All emails and newsletters from this site allow you to opt out of further mailings. Privacy Contact Information If you have any questions, concerns, or comments about our privacy policy you may contact us by email at [email protected]. We reserve the right to make changes to this policy. You are encouraged to review the privacy policy whenever you visit the site to make sure that you understand how any personal information you provide will be used.

Blog Archive

Featured post, minimum wage and rights of kasambahays (domestic workers in the philippines), affidavit, deed, acknowledgment & waiver, power of attorney, sale of personal property, corporation, real estate, donation & extrajudicial settlement, family law and annulment/nullity of marriage, credit and loan, other forms & pleadings, pageviews all time.

HOW ARE SHARES OF STOCKS TRANSFERRED?

After reading How are shares of stocks transferred? , read also Administrative Sanctions and Criminal Penalties under the Pre-Need Code of the Philippines

For shares of stocks with a stock certificate, there must be delivery of the stock certificate, indorsement and recording in the stock and transfer book of the corporation.

For shares of stocks without a stock certificate, transfer must be done by means of a deed of assignment and recording in the stock and transfer book of the corporation.

The Corporation is not a party to the transfer of shares of stocks through any form of conveyance.

S hares of stocks in a corporation are treated as personal property under our existing laws. Like any other personal property, an owner of shares of stocks can sell, assign, transfer or convey his property to another person as an attribute of ownership. However, the law may regulate shares of stocks since by its nature, it is considered as intangible personal properties. As such, any manner of conveyance or transfer must also be regulated.

The law says:

Section 62 of the Revised Corporation Code of the Philippines states that:

SEC. 62 . Certificate of Stock and Transfer of Shares . – The capital stock of corporations shall be divided into shares for which certificates signed by the president or vice president, countersigned by the secretary or assistant secretary, and sealed with the seal of the corporation shall be issued in accordance with the bylaws. Shares of stock so issued are personal property and may be transferred by delivery of the certificate or certificates indorsed by the owner, his attorney in-fact, or any other person legally authorized to make the transfer. No transfer, however, shall be valid, except as between the parties, until the transfer is recorded in the books of the corporation showing the names of the parties to the transaction, the date of the transfer, the number of the certificate or certificates, and the number of shares transferred. The Commission may require corporations whose securities are traded in trading markets and which can reasonably demonstrate their capability to do so to issue their securities or shares of stocks in uncertificated or scripless form in accordance with the rules of the Commission. No shares of stock against which the corporation holds any unpaid claim shall be transferable in the books of the corporation. (Emphasis supplied.)

What are the requirements of a valid transfer of shares of stocks?

For shares of stocks that are represented by a stock certificate, the following must be strictly complied with:

- delivery of the stock certificate;

- indorsement by the owner or his agent;

- recording in the books of the corporation. (Sec. 62, Revised Corporation Code)

However, if the shares of stocks are not represented by a stock certificate, such as when the certificate has not yet been issued or when such certificate is not in the possession of the stockholder, the transfer must be:

- by means of a deed of assignment; and

- such is duly recorded in the books of the corporation.

Jurisprudence says:

For the delivery of the stock certificate, the Supreme Court ruled that the term delivery means delivery to the assignee or the transferee and not delivery to the corporation. (Teng v. Securities and Exchange Commission, G.R. No. 184332, 17 February 2016)

In the case of Rural Bank of Lipa v. Court of Appeals (G.R. No. 124535, 28 September 2001) , the Supreme Court has held that for the transfer of shares of stocks to be valid and binding to third parties, such transfer must be recorded in the books of the corporation.

It must be noted that the registration in the stock and transfer book is not necessary if the conveyance is by way of chattel mortgage. However, there must be due registration with the Register of Deeds . (Chua Guan v. Samahang Magsasaka, G.R. No. L-42091, 2 November 1935)

Registration is likewise necessary if the heirs of the deceased shareholder acquire the latter’s shares of stocks. (Reyes v. RTC and Zenith Insurance Corporation, G.R. No. 165744, 11 August 2008)

The corporation whose shares of stock are the subject of a transfer through sale, donation, or any mode of conveyance, is not a party to the transaction. (Forest Hill Golf & Country Club v. Vertex Sales and Trading, G.R. No. 202205, 6 March 2013)

May a stockholder bring a suit to compel the corporate secretary to register valid transfer of stocks?

Yes, a stockholder may compel the corporate secretary to register a valid transfer of stocks. It is the duty and obligation of the corporate secretary to register the transfer of stocks.

Is the attachment or mortgage of shares of stocks required to be registered in the corporation’s stock and transfer books to be valid and binding on the corporation and third parties?

No, an attachment or mortgage of shares of stocks need not be registered in the corporation’s stock and transfer books inasmuch as a chattel mortgage over shares of stocks does not involve a transfer of shares.

Only absolute transfers of shares of stocks are required to be registered in the corporation’s stocks and transfer book in order to have the force and effect against third persons. (Chemphil Export and Import Corporation v. Court of Appeals, G.R. No. 112438-39, 12 December 1995)

Alburo Alburo and Associates Law Offices specializes in business law and labor law consulting. For inquiries, you may reach us at [email protected], or dial us at (02)7745-4391/0917-5772207.

All rights reserved.

[email-subscribers-form id=”4″]

Deed of Assignment: Everything You Need to Know

A deed of assignment refers to a legal document that records the transfer of ownership of a real estate property from one party to another. 3 min read updated on January 01, 2024

Updated October 8,2020:

A deed of assignment refers to a legal document that records the transfer of ownership of a real estate property from one party to another. It states that a specific piece of property will belong to the assignee and no longer belong to the assignor starting from a specified date. In order to be valid, a deed of assignment must contain certain types of information and meet a number of requirements.

What Is an Assignment?

An assignment is similar to an outright transfer, but it is slightly different. It takes place when one of two parties who have entered into a contract decides to transfer all of his or her rights and obligations to a third party and completely remove himself or herself from the contract.

Also called the assignee, the third party effectively replaces the former contracting party and consequently assumes all of his or her rights and obligations. Unless it is stated in the original contract, both parties to the initial contract are typically required to express approval of an assignment before it can occur. When you sell a piece of property, you are making an assignment of it to the buyer through the paperwork you sign at closing.

What Is a Deed of Assignment?

A deed of assignment refers to a legal document that facilitates the legal transfer of ownership of real estate property. It is an important document that must be securely stored at all times, especially in the case of real estate.

In general, this document can be described as a document that is drafted and signed to promise or guarantee the transfer of ownership of a real estate property on a specified date. In other words, it serves as the evidence of the transfer of ownership of the property, with the stipulation that there is a certain timeframe in which actual ownership will begin.

The deed of assignment is the main document between the seller and buyer that proves ownership in favor of the seller. The party who is transferring his or her rights to the property is known as the “assignor,” while the party who is receiving the rights is called the “assignee.”

A deed of assignment is required in many different situations, the most common of which is the transfer of ownership of a property. For example, a developer of a new house has to sign a deed of assignment with a buyer, stating that the house will belong to him or her on a certain date. Nevertheless, the buyer may want to sell the house to someone else in the future, which will also require the signing of a deed of assignment.

This document is necessary because it serves as a temporary title deed in the event that the actual title deed for the house has not been issued. For every piece of property that will be sold before the issuance of a title deed, a deed of assignment will be required.

Requirements for a Deed of Assignment

In order to be legally enforceable, an absolute sale deed must provide a clear description of the property being transferred, such as its address or other information that distinguishes it from other properties. In addition, it must clearly identify the buyer and seller and state the date when the transfer will become legally effective, the purchase price, and other relevant information.

In today's real estate transactions, contracting parties usually use an ancillary real estate sale contract in an attempt to cram all the required information into a deed. Nonetheless, the information found in the contract must be referenced by the deed.

Information to Include in a Deed of Assignment

- Names of parties to the agreement

- Addresses of the parties and how they are binding on the parties' successors, friends, and other people who represent them in any capacity

- History of the property being transferred, from the time it was first acquired to the time it is about to be sold

- Agreed price of the property

- Size and description of the property

- Promises or covenants the parties will undertake to execute the deed

- Signatures of the parties

- Section for the Governors Consent or Commissioner of Oaths to sign and verify the agreement

If you need help understanding, drafting, or signing a deed of assignment, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Contract for Deed California

- Contract for Deed in Texas

- Assignment Law

- Assignment Of Contracts

- Legal Assignment

- Deed Contract Agreement

- Deed vs Agreement

- Assignment Legal Definition

- Deed of Gift Virginia

- Assignment of Rights Example

The Philippines, an archipelago in Southeast Asia, boasts a rich tapestry of culture, history, and legal traditions. Within its legal landscape, the process of transferring property is of paramount importance, and central to this process is the "Deed of Conveyance." This document plays a crucial role in ensuring secure and legal transactions involving real property.

What is a Deed of Conveyance?

In its essence, a Deed of Conveyance is a legal document used to transfer the title of real property from one person (the seller or donor) to another (the buyer or donee). It signifies the intent of the owner to convey the property and indicates that the transfer has been made willingly.

Types of Deed of Conveyance in the Philippines:

Deed of Absolute Sale : This is the most common type used when a property is sold, and ownership is transferred for a certain price. Upon payment, the seller conveys the property rights to the buyer without any conditions.

Deed of Donation : In this type, a property is given as a gift. The donor willingly transfers the property to the donee without expecting any monetary compensation in return.

Deed of Assignment : This is used for transferring rights, title, or interest in a particular property, often relating to mortgages.

Deed of Exchange : Here, properties are exchanged between two parties.

Essential Elements For a Deed of Conveyance to be valid, it must contain:

- Names and details of the parties involved (both the transferee and the transferor). - The legal description of the property being conveyed. - The consideration (which could be monetary or otherwise). - An assertion that the transferor has the legal right to convey the property. - The signatures of the parties involved.

Legal Processes and Requirements: After the Deed of Conveyance is executed, several steps need to be followed:

Notarization: This gives the document public trust. A notary public certifies that the parties appearing before them are the ones they claim to be and have executed the deed willingly.

Payment of Taxes: Before registering the sale with the Registry of Deeds, certain taxes, like the capital gains tax and documentary stamp tax, need to be settled.

Transfer of Title: The buyer must present the Deed of Conveyance to the local Registry of Deeds to apply for a new land title under their name.

Registration with the Local Government: After acquiring the new title, the buyer should register with the local assessor's office for tax declarations.

The Deed of Conveyance is an essential instrument in the Philippines, safeguarding the rights and interests of parties in real property transactions. It ensures clarity, legitimacy, and protection for both the buyer and seller. As with any legal process, it's crucial to understand the intricacies and seek legal counsel when engaging in property transfers to ensure that rights are protected and obligations are clearly defined.

This website uses cookies to ensure you get the best experience. By using our site, you acknowledge that you have read and understand our Cookie Policy and Privacy Policy .

- Estate Settlement

- Business Law

- Employee Tips

- Store (workshops and books)

- Feedback - What people say about us

- www.legalguide.ph

Contract of Sale vs. Deed of Donation Which should you choose

Are you transferring property to a loved one? Or is a loved one transferring property to you? What is the best way to transfer property between relatives? In the Philippines, it's typical for parents to transfer properties to their children during their lifetime... either it's a gift as an advanced inheritance. Sometimes they do this so that the properties are already transferred before they pass away.

Our question comes from Ronald P. and he asks, Attorney,

My parents are old and they want to transfer their house and lot to me so that I won't have any more problems when they die. What's the best way for them to transfer the property to me? I heard from my friends that we can choose between a sale or a donation. Which do you think is better?

If you're in a similar position as Ronald? Stick around as we answer his question.

This video is brought to you by "Transferring Land in the Philippines" a workshop that teaches Filipinos the basic modes of transferring land and real properties in the Philippines. It provides the pros and cons of each mode, as well as the steps and procedures so that you eliminate your confusion and successfully navigate the whole process. Transfer with confidence. A transfer without fixers. Go to info.legalguide.ph to learn more.

Welcome to Legal Guide Philippines, where we simplify the law to help you make better choices. I'm Atty. Ramon Ramirez and I are with my partner, Atty. Erwin Zagala. So today we're talking about transferring properties to loved ones. Specifically, what's the best way to transfer property from one person to another, especially if it's to or from a loved one. Now, Atty. Ramon, we've seen a lot of these situations happening where parents will transfer their properties to their kids during their lifetime so that when they die, the kids no longer need to pay taxes. When they do that, what is the best way to transfer the property?

Do we document it as a sale or as a donation? Should we execute a deed of absolute sale or a DOAS, or a deed of donation? Okay, so you're correct Atty. Erwin, this happens a lot. This transfer is usually done by parents as some sort of "tax" planning strategy.

So, why? So that their children no longer need to bear the burden of a tax that we call, right now, we call it the estate tax. which is a tax that needs to be paid when a parent dies, and before the properties can be transferred to the children. Okay, so in effect, it's some sort of "tax planning" because it's already being done by the parents.

What is a sale and what is a donation

But before we answer that question, which is better? A sale or donation? I think I'd want to tackle three things first. So you need to understand these three? Yes. So that we can understand the answer. So we can understand the answer. The first thing we want to tackle is I think it would be helpful to explain what is a sale, and what is a donation and what is the difference? Let's start with the sale.

So under, of course, for lawyers, we have to give the definition under the civil code. Okay, Atty. Ramon, read. I am the Attorney. A sale is an agreement whereby one of the parties obligates himself to deliver something to the other, who on his part, binds himself to pay, therefore for a sum of money or its equivalent. The sale is very clear.

So let's break it down. So basically it's a contract whereby one party, says, okay, I'm going to deliver something to you. Like, let's say, I'm delivering this phone. Delivering something to you. On your part, you also bind yourself to pay for whatever it is that I delivered to you.

I deliver the payment? Yes. A sum of money or its equivalent. So elements of a sale, basically, like any contract, there's the meeting of minds. There's a definite agreement between the parties with respect to the thing, our object. And the cost or price of the thing. Let's say you're selling it, I'm selling it for 100 pesos. That is our cost.

Of course, it's important that both of us have legal capacity. So I think we look like we're of age. So we have legal capacity. We have the ability to enter into legal affairs or contracts. Okay, the second element is we should have an object or a subject matter which is a determinate thing to be sold.

So in our case, it's the cell phone. So it's the determinate thing. We agree that this is the thing that will be the subject of the sale. And last is the Cause or Consideration. As I said, it's 100 pesos. It's a price, certain in money. Very clear. Okay. Now, what is a donation Atty? Erwin?

It's better if we read it. Under Article 725, a donation is an act of liberality whereby a person disposes gratuitously of a thing or right in favor of another who accepts it. It's also clear. So basically, it's an act of liberality whereby, instead of involving money, I want to, because of my liberality, I will just give you my phone. So in Tagalog, give or bestow. Yes. But you also need to accept it.

It's a requirement. Because even if you give it, what if the other party doesn't want it? I think I saw a pattern, there's two B's. What's the first B attorney, "Buy", the other one is, "Bestow" Yes. Pick between the two Bs. Okay so, the sale buys a donation is bestow. B or B. Alright, so that is the difference of a sale between the sale and donation. I hope that's clear.

Okay, so it's actually even without the legal definitions, I think it's pretty clear in our heads. B or B. All right, now and then. Okay second, the second thing I want to discuss is now, how come you can "choose your own adventure", so to speak. In terms of how to transfer something to your loved one? Usually, people say "Ah land? Which is better? Sale or Donation?"

Why was there such a big fuss between sales or donations?

Now, why did this become popular? Well, well definitely under our laws parties are definitely free to contract in whatever manner they see fit, as long as they don't violate, of course, our laws, good morals, customs, etc. they can contract. But in my experience, the reason for this "choose your own adventure" kind of thing and why it became a thing was because well before the TRAIN law, the tax rates for these two kinds of contracts, the sale, and the donation were quite different.

Ah, there is an effect to the tax Atty. Ramon. So it was kind of a tax-driven decision. So on the one hand, for a sale of property or land or whatever. Usually, this will trigger a tax called the CGT or the Capital Gains Tax Remember that, CGT. That usually just means capital gains tax. Okay, which was 6% of the fair market value or gross selling price whichever is higher.

Just remember 6% as opposed to a donation before the train law, okay? Donations at that time, it was based on graduated rates ranging from 2% to 15%, so it changes. Yes. So depending on the value of what you will donate. So depending on how much you'll donate, it becomes more expensive Yes, you cap it around 15%.

And this is for relatives only. Okay, so it is a different topic when they are not your relatives. Like for example, we are not blood relatives, Even if we are "brotha from another motha" Even in that case, we are treated as strangers.

And at that time, if I donated something to you or you donated something to me, it was a whopping 30%. Yes. It's like they don't want us to give to each other. It's like getting a penalty when you give. Anyway, so that was why it became popular, so back in the day, people, what will they do?

They'll make computations on their Excel spreadsheets and determine which is cheaper. And then on top-line -- sale, bottom line -- donation, and you'll see which one is cheaper. It's like you are pulling from memory, it looks like you've had a lot of experience computing this. And then, of course, that's what you would base. If you're a service provider, you would base your advice on that.

"Guys this is much cheaper." So Atty. Ramon, basically the main consideration before is not the type of transaction, not it's not the B or B... It was because, "How much will I pay for it?" That's why it became a big issue before --- choosing between sale or donation. Which is better? Usually made that computation. The question has finally been answered. So in many ways, it made sense to regular people to do this.

Why? Because these CGTs or capital gains tax and donor's taxes were expenses of ordinary people. People like you and me who probably work jobs work really hard for our living. Why make waste money in our minds, unnecessarily on unnecessary taxes. As supposed to be a business expense, that the business pays. While this one comes from your own pocket. That's why this became rampant and of course, add to that some experts and advisors would advise them to pick and choose the transaction.

Atty. Ramon, you've mentioned before that, when the segment started, you said, "... before the train law" Yes. And now, the TRAIN law is in operation. So my big question is, and I'm that our viewers thought about this, is this still applicable considering the train law is now applicable? Thank you for that question Atty. Erwin. And that's exactly the third thing I want to talk about.

Is this still applicable now?

So the third thing I want to talk about is, is this still applicable now? Well, the answer is no. People have been doing this for years. Obviously, the BIR knows that people do this in sale versus donation. They're not stupid. The government knows this. No, they're not idiots. So they knew that this was being practiced. So they made important changes to our tax laws very recently through the train law.

Now with the new law, with the train law, this practice is no longer as prevalent. Why? Because now the rates are, remember CDT, what was the rate for CDT? six percent CGT then it's based on the fair market value or gross selling price. And then the donor's tax, you have your two to fifteen percent, or sometimes thirty percent. What is it now? Now they're both six percent.

Okay, so it's a pretty big leap. So I think that was a smart thing for the government, it is now equalized. Because it was just driving people to not tell the truth. And I would like to note, it's a very fair percentage. If you noticed, it's on the lower level. Not all of it was standardized at the top. We're at the bottom. Yeah. Thank you, legislators for that. Yeah. So, in fact, the donor's tax, before, you had to make a distinction.

Is it part of the family? Or stranger? Right? Now under new law, there's no such distinction that needs to be made. So that's pretty cool. Atty Ramon, you can now give me a piece of land. It's now possible at six percent. So now when you make a comparative computation, the values of the CGT and donor's tax, should generally not be too different. Okay, so of course, each tax is computed differently, so there may be differences, but generally they're not that different.

Okay, Atty. Ramon, I now understand that they're both the same now if you're gonna look at it from a tax perspective. So going back to our original question, Atty. Ramon, what's better, sale or donation? Okay, I said a lot already. We're gonna go back to the question. Okay. Which is better? I would say that the better option between a sale or donation is the contract that you really intended.

So if you intended to sale, you should execute a document that best reflects the intent of the parties for you guys. Okay. So if the party has intended a sale, then execute a deed of sale. If the party is intended a donation, then execute a deed of donation.

Don't simulate a contract, guys, that's just lying. Don't lie, please. Don't try to trick the others or the government just to save on some pesos. That's bad. We can do better than that. If you execute a deed of sale when you really secretly intended a donation, then that would be called a simulated sale.

And there are legal implications to that. Actually, a simulated sale may be invalidated, or it can be argued to be invalidated because there's really no consideration. For example, hey let's just execute this, let's execute this document as if it's a sale so that we can save on tax, but actually, it's a donation. So in truth, there's really one of the elements of a sale is a consideration.

Now, if there's no consideration, then it could be invalidated. In fact, during the time of BIR Commissioner Jacinto-Henares, it was really something that she wanted to crack down on. So she made it a point to really investigate the capacity to pay off so-called buyers. Okay, so if ever they find that there's no capacity, they assess additional taxes that need to be paid.

That's very useful Atty. Ramon, do you have any other tips for our viewers and listeners? Yes. Okay. So I hope I answered your question. So, sale or donation, the answer is, what's the truth? Go with that. You can never go wrong. It has the same tax rate. Okay. As a bonus tip.

Even this whole concept of transferring land to your kids to avoid paying so much estate taxes, later on, may no longer be such a good idea. Why? Because before, similar to the donor's tax, the estate tax rates would again be based on a graduated scale and the maximum, which would be around twenty percent. Okay. So it's a pretty big chunk that goes to taxes.

So and again, that was before. That's why a lot of people avoided it by "I'm gonna transfer it to my child so that there's no problem" but now under the train law, that is also six percent as well. So it's all the same level now: donation, sale, and estate are six percent. Same rate. Thank you. Thank you, legislators. Okay. And also another reason why I'd say probably doing that kind of tax planning is no longer as good as an idea as it was before is because we will be letting go of deductions.

Because the deductions have changed. Yes. It is much more beneficial now for the heirs. Yeah. So as opposed to CGT also and donor's tax where there's no deduction, the estate tax has deductions. Okay, so it might not be anymore that good of an idea. Again, you want to consult your lawyer on that. Or if you want a very quick intro on estate laws, you might want to consider info.legalguide.ph/estate to learn more. So that's it Atty. Ramon, thank you so much for all of those points.

And to recap guys, we've gone through a lot. First off, we talked about what is a sale and what is a donation. In its simplest terms, the two B's: "buy and bestow", choose which applies. Now, number two is we talked about why was there such a big fuss between sale or donation? Why was it like choose your own adventure for some people? And we went through the history that the tax rate was different before. So to take advantage, people chose the mode which was more beneficial to them.

Third, we talked about does it still apply today? Apparently not with the introduction of the train law, the tax rates are all equal. And as a result, if the tax is the same, have the contract reflect what is your original intent. Yes. And finally, we had a bonus tip. Pre-transferring your properties may no longer be such a good idea. Why? The allowable deductions changed under the estate law, it may be cheaper to pay estate tax instead of transferring it while you are alive.

Additional Resources

Now, if you want to learn more about how to transfer land in the Philippines, please go to info.legalguide.ph/land to learn more. And if you want to use to tackle your question in our show, go to legalguide.ph and click the submit topic button. Next, we would like to know what's your biggest takeaway from today's video. Write it down in the comments and let's talk about it. And if you feel we've earned a good rating, please give us a like and a subscribe. It gives us feedback that we're doing a good job and encourages us to make more videos. One last thing guys, trying to trick the government by concealing or simulating contracts just to save on a few thousand, hundreds, or even millions is very often a short-sighted strategy that can definitely bite you in the ass later on.

Many times cheating the government of its taxes by simulating contracts, or whatnot stems from merely a lack of understanding or lack of preparation and lack of planning. We can always educate ourselves, research, discuss, or even consult someone. Now, let's give our country what it's due by paying the right taxes, let's influence our leaders in government by being honest in all our dealings and transactions.

So wasn't that simple? Now go make better choices.

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Deed of Assignment of Stock Subscription

A Deed of Assignment of Stock Subscription is a written document used to transfer shares of stock of a corporation from the registered owner (the "assignor") to another person (the "assignee"). It should specify the names of the parties , the date of the transfer , the number of the stock certificate that represents the shares to be transferred, and the number of shares that will be transferred.

Only shares that have been fully paid are transferable. This means that if the assignor has not yet paid the full amount of the subscription, then the shares under the subscription cannot be transferred .

In order to transfer the shares, the stock certificate should be endorsed by the owner or any person legally authorized to make the transfer. Indorsement means signing the back of the stock certificate.

Finally, the transfer of shares will only be valid between the parties until it is recorded in the books of the corporation.

How to use this document

This document can be used by the registered owner of shares of stock of a corporation to transfer the shares (or part of the shares) to another person. It assumes that the purchase price for the shares has been fully paid .

The user should complete the document by entering the information required in the document. Once it is completed, the assignor and the assignee should sign the document .

This Deed of Assignment also includes an Acknowledgment. An Acknowledgment is an act of a person before a notary public stating that the signature on a document was voluntarily affixed by him and he executed the document as his free and voluntary act . Acknowledging a document before a notary public turns the document into a public document . Public documents are generally self-authenticating, meaning no other evidence will be needed to prove the execution of the document.

The Documentary Stamp Tax ("DST") and other applicable taxes, such as the Capital Gains Tax, should also be paid to the Bureau of Internal Revenue ("BIR") by the assignor or the assignee. The DST is required to be paid for any issuance or transfer of shares. The BIR shall issue a Certificate Authorizing Registration ("CAR") once the DST and other taxes are paid.

The assignor or assignee can then present the document, together with the endorsed stock certificate and the CAR , to the Corporate Secretary so the transfer can be recorded in the books of the corporation .

Applicable law

The Revised Corporation Code and the general laws of contracts and obligations found in the Civil Code govern the transfer of shares. However, other laws, their rules and regulations, and SEC rules may affect the conduct and transactions of the Corporation such as but not limited to the 1987 Constitution of the Philippines , the Securities Regulation Code, the Foreign Investment Act, the Republic Act 8179, specifically the Foreign Investment Negative List, the Anti-Money Laundering Act, and the Anti-Dummy Law may affect the ownership requirements of a corporation, depending on the business of the corporation. Tax laws may also affect the transfer of the shares.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

- What to do after Creating a Contract?

- When and how to Notarize a Document?

Deed of Assignment of Stock Subscription - template

Country: Philippines

General Business Documents - Other downloadable templates of legal documents

- Acknowledgement Receipt

- Minutes of the Meeting of the Stockholders

- Notice for Non-Renewal of Contract

- Loan Agreement

- Secretary's Certificate

- Minutes of the Meeting of the Board of Directors

- Monetary Demand Letter

- Notice of Meeting

- Letter of Consent of Nominee

- Business Name Change Letter

- Release, Waiver, and Quitclaim (One-Way)

- Notice of Dishonor for Bounced Check

- Withdrawal of Consent of Nominee

- Request to Alter Contract

- Subscription Agreement for Shares of Stock

- Breach of Contract Notice

- Affidavit of Closure of Business

- Debt Assignment and Assumption Agreement

- Notice of Death or Insolvency of a Partner

- Other downloadable templates of legal documents

IMAGES

VIDEO

COMMENTS

A Deed of Assignment is a contract where the owner (the "assignor") transfers ownership over property to another person (the "assignee") by way of assignment. The assignee steps into the shoes of the assignor and assumes all the rights and obligations to the property. 2. When do you need a Deed of Assignment?

A deed of assignment, on the other hand, is a contract entered into by parties, wherein by way of assignment, the assignor transfers property ownership to the assignee. In assignment, the rights of the assignor are being transferred to the assignee. The obligations of the assignor are likewise being transferred to the assignee.

DEED OF ASSIGNMENT AND TRANSFER OF RIGHTS. KNOW ALL MEN BY THIS PRESENTS: This deed, made and entered into this 23rd of July 2019 at the City of Cebu, Philippines, by and between: (NAME OF ASSIGNOR), Filipino, of legal age, single/married to (Name of Spouse, if any) and a resident of (Address of Residence), hereinafter referred to as the ...

A Deed of Assignment refers to a legal document in which an assignor states his willingness to assign the ownership of his property to the assignee. The Deed of Assignment is required to effect a transfer of property and to show the legal right to possess it. It is always a subject of debate whether Deed of Assignment is a contract; a Deed of ...

A Deed of Assignment is a contract where the owner (the "assignor") transfers ownership over property to another person (the "assignee") by way of assignment. The assignee steps into the shoes of the assignor and assumes all the rights and obligations to the property.

Deed - A written instrument which, when properly executed and delivered, conveys title.2. Basically, a Deed of Assignment is a document that states the transfer of property or rights and obligations from one person to another. The persons may be natural (individual) or legal (e.g. a private or public organization) persons.

Deed of Assignment (Shares of Stock) DEED OF ASSIGNMENT OF SHARES OF STOCK. KNOW ALL MEN BY THESE PRESENTS: This Deed of Assignment, made and executed this (Date) at (Place), by and between: (NAME OF ASSIGNOR), of legal age, Filipino, single/married, and resident of (Place of Residence), and hereinafter referred to as the "ASSIGNOR"; - in ...

A deed of conveyance, commonly referred to as a deed, is a legal document used to transfer ownership of real property from one party (the grantor) to another (the grantee). In the Philippines, such documents are crucial in the sale, gifting, or inheritance of property. The deed not only evidences the transfer but also the agreement between the ...

by means of a deed of assignment; and; such is duly recorded in the books of the corporation. Jurisprudence says: For the delivery of the stock certificate, the Supreme Court ruled that the term delivery means delivery to the assignee or the transferee and not delivery to the corporation. (Teng v.

The deed of assignment is the main document between the seller and buyer that proves ownership in favor of the seller. The party who is transferring his or her rights to the property is known as the "assignor," while the party who is receiving the rights is called the "assignee.". A deed of assignment is required in many different ...

The Philippines, an archipelago in Southeast Asia, boasts a rich tapestry of culture, history, and legal traditions. Within its legal landscape, the process of transferring property is of paramount importance, and central to this process is the ... Deed of Assignment: This is used for transferring rights, title, or interest in a particular ...

Can a deed of assignment transfer ownership of the property to the assignee? ... 18 Tolentino, Civil Code of the Philippines (Book V), p. 188. 19 Nyco Sales Corp. vs. BA Finance Corps. 200 SCRA 637 (1991). 20 Koa vs. Court of Appeals, 219 SCRA 541 (1993).

I would say that the better option between a sale or donation is the contract that you really intended. So if you intended to sale, you should execute a document that best reflects the intent of the parties for you guys. Okay. So if the party has intended a sale, then execute a deed of sale. If the party is intended a donation, then execute a ...

Here are some key elements of the Deed of Assignment that you should take note of: If there's more than one owner to the property purchased, the names of all owners must be mentioned in the document. Agreed price of the property, if applicable. Size and description of the property. Date of transaction. Signatures of the parties.

Formats Word and PDF. Size 2 to 3 pages. Fill out the template. A Deed of Assignment of Stock Subscription is a written document used to transfer shares of stock of a corporation from the registered owner (the "assignor") to another person (the "assignee"). It should specify the names of the parties, the date of the transfer, the number of the ...

The deed of assignment is the document used to transfer the contracting party's rights. The parties may also choose to accomplish assignment via an assignment contract. In real estate, the deed of ...