DocumentsHub.Com

Application format for personal loan from office.

Sample Application Format for Personal Loan From Office . Loan application for all staff members. Useful for people who want to take money as loan from their organizations/companies. For Further Application for officers, managers, administration you can Visit WideInterest . Changes can be done as per requirements and an easy format to be used.

Application Format for Personal Loan from Office

The Director, Tetra Pak International.

Subject: Request for Loan

Respected Sir,

I am writing this application solely for one reason that has been my biggest misery for past two months. I am in utter need of quick aid for operation of my mother’s eye sight. She has to undergo Radial Keratotomy (RK). I highly need money for her operation and could use office loan. I hope this loan will cover all the treatment expenses. Please be kind and issue me this office loan as I am the only bread earner of the house and a lot is going on with me lately. You can make deductions from my salary, monthly. Thanking in anticipation.

—————–

Personal Loan Request by Employee

Dear [Loan Officer’s Name],

I am writing to request a personal loan of [Loan Amount] to address [Brief Reason for Loan]. I have been a dedicated employee at [Company Name] for [Number of Years] and have a stable income. I kindly request your consideration and guidance in this matter.

[Your Name]

Personal Loan Email to HR

Subject: Personal Loan Request

Dear [HR Manager’s Name],

I hope this email finds you well. I am writing to formally request a personal loan to cover [brief reason, such as medical expenses or emergency home repairs]. I believe this loan will assist me in overcoming this challenging situation.

I have been a committed member of the [Company Name] team for [Number of Years] and have maintained a strong work record. I kindly ask for your assistance in initiating the loan process and providing the necessary guidance.

Thank you for considering my request. Please let me know if there are any further steps or documents required.

Request Application for Loan to Boss

The HR Manager,

Generix Solution

Subject: Application for Loan

Greetings, It is to inform you that myself Kumar, working as a sales manager. Sir, yesterday I had serious accident. I was in car with my family. I am safe now just got leg injury but my car has fully damaged. I went to Mechanic and he told me an expense of 80k. I request you to being an employee of an organization please help me. Approve my loan of 80k and you can deduct this amount from my salary.

Waiting for your positive Response.

Yours Truly,

Sales Manager

Easy Format of Application for Loan

The Managing Director, Falcon’s Association.

Subject: Application for Personal Loan

It is stated that I want to request for Loan from Official Finance owing to some intimate and peculiar need of mine. My mother is admitted in National Hospital and her heart surgery is going on. The operation is critical and I am in need of money. Please sanction me loan of US$ 5000 and consider my supplication. The loan will be returned by deductions from my official gross salary. I shall be beholden of this initiative of yours.

Sincerely, James Bede. Manager Human Resource.

Request for Loan From Company

To, Human Resource Manager, Unique Home Appliances, Doha, Qatar.

Subject: Application for personal loan from the office

Respected Madam,

Often in life one faces difficult circumstances and bitter realities. I am currently living such a situation where everything seems bleak and there seems to be no way out of my misery. My parents are in debt and they need to pay at least 20% of the amount of mortgage or their house will be taken over by the bank, they are ailing and weak, they will not be able to survive such a situation.

The only way I can help them avoid such a fate is by paying the money that is needed by the bank. I can do so if I am allowed to take out loan from the office, which is a privilege granted to employees. I would be grateful if the company allows me to borrow money against my pay.

Yours Truly, Mr. Aslam 5 th November, 2015.

Application for Plot Loan from Company

The Managing Director, Giga Pvt Ltd.

Subject: Application For Plot Loan

It is respectfully stated that I belong to Okara city and living here with family in rented home,It is very difficult to live on rent due to changing homes frequently.

So, I am planning to purchase a plot of 10 marlain new developed LDA City situated on ferozepur road. The cost of land is about Rs 18,75,000. I have saved some money but it is Rs 500,000 short. I request you to give me a loan of Rs 500,000 and deduct Rs 20,000 from my salary.

I will be very thankful to you

Khalid Rana Engineer

Application for Loan (Due to Child Fee)

To The Managing Director, Forma Pvt Ltd.

Subject: Loan Application

Respected Sir/Madam,

Humbly stated that I am in sheer need of your kind aid. You know I am a good reputed employee in your prestigious firm and my ACRs are always up to mark. Your highness appreciated my work style and confidence level many a times and I never put you in any trouble ever. I am an old employee and now I need a loan from office because education is expensive and quality education is even more costly. A mediocre like me is unable to pay the heavy fee from budget pocket of monthly salary so I humbly requested you to please grant me loan of PKR ________.

I will return you in monthly deduction from my monthly salary in installments. Kindly consider my pitiful plight and cooperate with me for loan grant. Praying and waiting anxiously

Ahmed Bajwa Dated: ___________

Application Letter for Home Loan from Office

To, Designation______ Company________

Easy Format of Application for Personal Loan

Application Request Formats by Employee

Sample Loan Application Format by Employee

Loan application requests by employees typically follow certain formats to ensure consistency and clarity. Here are common formats for a loan application request:

- Email Format:

Subject: Loan Application Request

I hope this email finds you well. I am writing to request a loan from [Bank Name] to assist me with [briefly state the purpose, e.g., covering unexpected medical expenses]. As an employee at [Company Name], I am dedicated to my role and believe that this loan will contribute significantly to my financial stability.

I have attached the necessary documents to support my loan application, including [list the documents, e.g., pay stubs, identification, employment verification]. The requested loan amount is [amount], and I am looking for a repayment period of [repayment period, e.g., 18 months]. I am committed to meeting all the repayment terms and conditions outlined by the bank.

Please review my application at your earliest convenience. If any additional information is needed, please do not hesitate to contact me. I am excited about the possibility of working with [Bank Name] for this loan opportunity.

Thank you for your time and consideration.

Best regards, [Your Name]

[Your Contact Number]

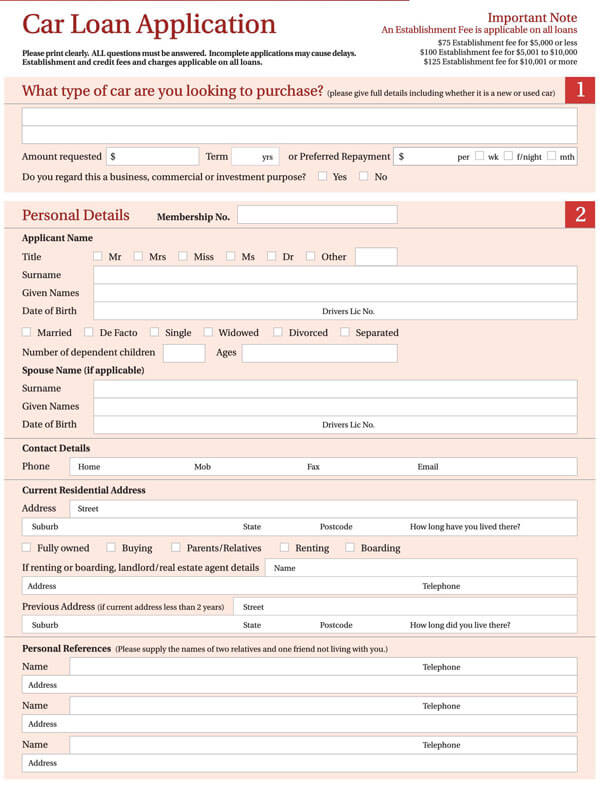

- Online Application Form:

[Bank Name]

Loan Application Form Employee Information:

- Full Name: [Your Full Name]

- Employee ID: [Your Employee ID]

- Department: [Your Department]

- Contact Number: [Your Contact Number]

- Email Address: [Your Email Address]

- Loan Details:

- Loan Purpose: [State the purpose, e.g., education, home improvement]

- Loan Amount: [Amount]

- Preferred Repayment Period: [Repayment Period]

- Supporting Documents:

- [Upload scanned copies of required documents, such as proof of income, identification, employment verification]

Declaration: I hereby declare that the information provided above is accurate and complete to the best of my knowledge. I understand and agree to adhere to the terms and conditions set by [Bank Name] for the loan application process.

[Your Electronic Signature] [Date]

3- In-Person Application Form:

[Bank Name] Loan Application Form

Employee Information:

- Full Name: __________________________________________

- Employee ID: _________________________________________

- Department: __________________________________________

- Contact Number: ______________________________________

- Email Address: ________________________________________

- Loan Purpose: _________________________________________

- Loan Amount: __________________________________________

- Preferred Repayment Period: ____________________________

- Please attach photocopies of the required documents, such as proof of income, identification, employment verification.

Declaration: I affirm that the information provided above is true and complete. I am aware of the terms and conditions associated with the loan application process at [Bank Name] and agree to comply with them.

Applicant’s Signature: __________________________ Date: __________________________

- Online Application Portal Format:

[Employee logs in to the bank’s online loan application portal]

- Personal Information:

- Loan Purpose: [Select from dropdown, e.g., Home Renovation, Medical Expenses]

- Loan Amount: [Enter Amount]

- Preferred Repayment Period: [Select from dropdown, e.g., 12 months, 24 months]

- Upload scanned copies of required documents, such as proof of income, identification, employment verification.

- Declaration:

- Checkbox to agree to the terms and conditions.

- Submit Button: [Click to submit the loan application]

Sample Application for Personal Loan from Office

Application for Personal Loan from Office

Dated 5th July, 2013

The Managing Director Al-Fatah Travels.

Subject: Application for Advance

It is stated that, I am working for your organization since 2007. I am in urgent need of advance for some personal reasons and I will be very grateful to you if I can get the advance amount of Rs 50,000/- Rupees (Fifty thousand). Kindly grant me the advance and provide me with the deduction plan from my salary. I shall be obliged for this.

Yours Sincerely,

Agha Ahsan Raza Senior Executive.

Sample Loan Application For House

Dated 3rd March, 2014

The Director, Haleeb Foods Lahore.

Most respectfully, It is stated that I am working in this esteemed organization from July 2006. It is humbly stated that I have to purchase a new house but, I am facing immense financial crises now a days. In this situation I want some financial help. I request your good self to kindly grant me sum of Rs 200,000/- on urgent basis. Furthermore you can deduct this amount as Rs 10,000/- per month from my salary for the settlement of loan.

I shall be highly thankful to you for this act.

Yours Truly, Name………..

Date……

Application for Loan from Office for Marriage

Date:__________

The Honorable Director.

M/C Alfatah Center Address:__________ Lahore.

Most respectfully, It is stated that the marriage ceremony of a female relative of mine is going to be held on 12 April 2014. She lives near my house and unfortunately have no source of income being orphan. Her brother is a driver and can not manage the marriage expenses. In this case, I request to you kindly grant some monetary help if possible.

I shall be highly obliged.

Yours Sincerely, Rana Zubair.

Sample Application for Loan due to Eid-Ul-Adha .Eid celebrations are traditional path of Islamic culture across the Islamic world. The festivity of Eid-ul-Azha has an edge on other celebrations as the animals for slaughter are too much costly but Muslims observe this day as a religious ritual.Sample format of loan application is here for employees .

Application for Loan due to Eid-Ul-Azha

Subject: Application for Loan due to Eid-Ul-Azha

Most respectfully it is stated that I had met an accident recently and with the care of Almighty I was saved but my car was badly damaged. My salary was consumed in repairing the damages. I am in need of loan to cater the function of upcoming Eid-ul-Azha. I am the sole bread earner of my family so I request you to grant me loan of 50,000 before Eid and kindly deduct this amount as Rs 5,000/- per month from my salary, So that I can meet the necessities of religious celebration . I will be very thankful to you for accepting my request of loan.

Yours Truly, Mr. Shakeel Rana September 10, 2015

Loan Application against Provident Fund

The Concerned Person,

It is stated that I have been working as a _________ since ____ years in this prestigious organization. This is to inform you that unfortunately owing to some personal/family/health constraints of mine I am in urgent need of loan from my provident fund. As, I am not able to cut off loan amount out of my salary yet I will pay it on account of my provident fund later, within time span of two-three months. I want you to please consider my request and provide me with this grant as soon as possible. I shall be highly obliged for this. Sincerely,

Short Application for Loan

The Branch Manager, Chartered Bank.

With high esteem and regard it is stated that I am in urgent need to loan from bank as I am working here as permanent employee since 3 years and currently working on the designation of Customer Relation Officer. I request you to kindly consent me Rs. 100,000 (One Lac Only) as loan. I will return the lump sum amount after two months. Till then, there should be no deduction from my salary or incentive. I hope that you will consider my plea for sure. I shall be extremely beholden.

Thanking you ahead of time.

ABC CR Officer.

Request for Personal Loan from Office

To, The Manager Steel mills and craft industry Mumbai, India

Subject: Request for personal loan from office

It is to state with much humility that I am an employee of yours from the past twenty years and never availed any favours from this office. My son’s marriage is in pipeline and we, as family decided not to burdens the bride’s family with me for this noble cause. I will pay the loan in twenty month by deducting the amount of 5,000 from my salary per month. I will pursue the case as soon as I get written orders from you. Thanking in anticipation. Yours Truly,

Mr. Chohan Tara 2nd August, 2017

Loan Application from Office

To, January 16,2020 The General Manager/Managing Director, Fatima Group, Main Boulevard DHA, Lahore.

Subject: loan request due to shift rented house

Please be informed that I am living with my family at Ravi road, which is far from the office and it cast me more than I am earning. So I have decided to shift near the office in supper town, I have seen a house for this purpose, but I don’t have enough funds to manage to shift like advance etc. Kindly grant me Rs.40,000/- as an advance loan so that I may shift my house near the office. Kindly deduct Rs.5,000/- per month from my salary.

I shall be very thankful to you for this kindness.

Thanking you I remain, Your’s Truly, X.Y.Z.

10 WhatsApp Text to Boss for Personal Loan

Here are some sample texts that you can use as a reference for requesting a personal loan from your boss on WhatsApp . However, it’s important to note that personal loans from employers can vary depending on company policies and your relationship with your boss. Make sure to adapt these examples to suit your specific situation and maintain a professional tone:

1-Greetings[Boss’s Name], I hope this message finds you well. I wanted to discuss a personal matter with you regarding a potential loan. Is there a convenient time when we can have a conversation about this? 2-Good morning, [Boss’s Name] I hope you’re having a great day so far. I wanted to reach out to inquire about the possibility of obtaining a personal loan from the company. Would it be possible for us to discuss this further? 3-Hello [Boss’s Name], I hope you’re doing well. I wanted to talk to you about a financial matter that has come up, and I was wondering if I could request a personal loan from the company. Please let me know if you’re available to discuss this at your convenience. 4-Respected [Boss’s Name], I hope this message finds you in good health. I wanted to discuss a personal financial need that has arisen recently. Is there a suitable time when we can chat about the possibility of obtaining a loan from the company? 5-Good day, [Boss’s Name]. I hope you’re having a productive week. I’m reaching out to explore the potential of acquiring a personal loan from the company. If it’s appropriate, may we schedule a time to discuss this matter further? 6-Hello [Boss’s Name], I trust you’re doing well. I wanted to speak with you about a personal financial situation I find myself in. Would it be possible to arrange a meeting to discuss the option of a personal loan from the company? 7-Hi [Boss’s Name], I hope you’re having a great day. I wanted to seek your guidance and explore the possibility of securing a personal loan from the company. When you have a moment, I would appreciate the opportunity to discuss this with you. 8-Good morning, [Boss’s Name]. I hope this message finds you in good spirits. I’m writing to discuss the potential of obtaining a personal loan from the company. Would it be possible to schedule a meeting to discuss this further? 9-Dear [Boss’s Name], I hope you’re having a productive day. I wanted to approach you regarding a financial matter and explore the possibility of a personal loan from the company. If it’s suitable, could we arrange a time to talk about this? 10-Dear [Boss’s Name], I hope you’re doing well. I wanted to have a conversation with you about a personal financial need that has come up recently. Is there a convenient time for us to discuss the option of a personal loan from the company?

43 thoughts on “Application Format for Personal Loan From Office”

wow, awesome article post.Much thanks again. Really Cool.

very!!! interesting. Thanks for this article. Fantastic.

its very useful …

I’m very happy for thess letters for laon… Is going to help me for my wedding issues that my employer will consider. Thanks!

This is Nice. Thanks.

I’m very happy for these sample letters, and it will be going to help every one. Thanks.

I need more format on request of loan from school department

I need more on informal letter: letter of request for loan from school department

https://documentshub.com//request-letter/application-for-loan-from-school/ You can change it as per your own requirement.

thanks format letter for guidelines

Very useful

please send me sample of Loan application for my sister marriage.

You can find here https://documentshub.com//salary-and-general-office-applications-salary-and-general-loan-applications/loan-application-for-daughter-marriage/ Thanks Documentshub

wow! this is seriously going to help a lot!

kindly mail me the application for marrige help for ceo thanks alot

YOU CAN MAKE THE NECESSARY CHANGING. The CEO, ABC Organization. Subject: Request for Financial Help Respected Sir, Please be informed that I am getting married in the upcoming month. As, you are aware of my job nature and my salary is not sufficient to cope up with all the arrangements.I am the only earner in my family and I need some financial aid as it is the current stumbling block in front of this event. I request you to kindly support me through employee help fund. I shall be highly obliged. Sincerely, ABC

I am totally blank in writting this kind of applications… thank God I came across this!!! thankx for this article.

required for loan application format for loan from directors to private limited company

The format body is provided below. The Concerned Person, It is stated that I am working as a________ since ____ years in your esteemed organization. This is to inform you that I am in urgent need of loan owing to some of my family/personal/health constraints. I have heard through some reliable source that the management take efficient and supportive steps in such cases. I request you to please consider my plea. I shall be your beholden. Sincerely,

Thank y For given various Application Form Pls Help me to give loan application formet against of Provident fund

Hy, Your query has been updated you can find here.

https://documentshub.com//salary-and-general-office-applications-salary-and-general-loan-applications/sample-application-for-loan/ Thanks Documentshub

Am so happy for this,it would really go a long way…thanks

I am very greatful to this website. Thank you

These all sample is very helpful thanks..

i need a business sample letter loan

The Concerned Person, Hope to find you great. I’m writing for the aforementioned purpose. I am in need of urgent business loan of $10,000 as I have got the work but lacking investment. I shall return the loan within the tenure of two months. As per our telephonic conversation I’ve attached all necessary documents with the application. I hope you’ll consider my request. Thanking you in anticipation. Sincerely, Name.

good and very helpful

Am happy for all this loan format it wil go a long way

A need a format of loan for roofing a building please.

The Concerned Person, Most respectfully, it is stated that I am writing in order to ask for personal help. Sir, I am in urgent need for loan on account of roofing a building. The estimated cost is $0000 and in this hour of need I am sure that you’ll definitely consider my plea. I’ll return this loan within a span of 3 months. Kindly help me in this regard. I shall be utterly obliged. Thanking you I remain. Sincerely, Name & Contact.

really useful nice

please I want to write a letter to the CEO of our company, how can I write it please?

thanks, very helpful

i only need asgmple of humble request writing. requesting for any kind of assistance

All above are the samples. Thanks.

Any request letter format for loan from company to buy flat in apartment

Honourable Sir,

I hope you will be fine and at peace in your life. I also want peace and luxury in my life, but it cannot be possible on rental house. I wish to buy a flat of mine and in need of your cooperation that if you kindly grant me the loan of $60000 it will be more than enough as I would purchase the flat at my earliest. The amount of loan can be paid on regular deduction from my salary each month. Thanking for your time and ear.

I want one application for loan 50’000 my 3 kids 6 manth fee breaking i want 5000 deduction my salary par manth my salary is 35000 you send me argant

Hy kindly visit the below given link:- https://documentshub.com/application/advance-salary-application-format/

best regards

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Notify me of follow-up comments by email.

Documents Hub Consultants

Published In: Applications

How to Write a Loan Application Letter (with Samples)

Sometimes we need financial assistance to push through with our business idea, education, medical emergencies, or any other personal project or goals that require a huge amount of money for its realization. Basically, it is for this reason that banks and other money lending institutions exist.

Applying for a loan from any lending institution requires the applicant to first fill out a form. Along with this form, the applicant can attach a loan application letter that provides more details on what he/she intends to do with the money and an overview of how the loan will be paid.

As a loan applicant, you need to learn how to write the loan request letter in a polite and convincing tone to appeal to your lender for your loan to be granted successfully.

What is a Loan Application Letter?

A Loan application letter is a document that informs the financial lending institution of the amount of money you are asking for, a clear outline of what you intend to do with the money, and convinces the bank why you are a good investment risk. Because it is a request, a loan application letter should be written in a polite tone, short and to the point.

The Loan Application Process

Based on the financial institution you choose, the process and time it takes for you to receive funding may vary. However, the typical loan application process may take on the following critical stages:

Pre-qualification stage

Prior to the loan contract, the potential borrower receives a list of items that they need to submit to the lender for them to get a loan. This may include Identification proof, credit score, current employment information, bank statements as well as previous loan statements.

Immediately this information is submitted, the lender reviews the documents and makes a pre-approval- meaning the borrower can move on to the next phase of the loan application process.

Loan application

In the second phase of the loan origination process, the borrower fills-in the loan application form either electronically- through mobile apps, websites, or paper-based. The data collected is then tailored to specific loan products.

The aspects that are included in the loan application form include the following;

The payment method- if it will be personal, through a check, or via online banking.

The payment frequency- There are several payment frequency methods, for example, Monthly installments, annually, or if the loan will be paid once.

The amount of interest accumulated on the loaned amount. This is the amount of money charged by the lender to the borrower on top of the amount which he/she has loaned.

The assets in the form of properties of the borrower will serve as collateral damage/guarantees in case the borrower defaults loan repayment or is unable to make his payments as per the agreed time.

Application processing

Once the application is received by the credit department, it is reviewed for accuracy, genuineness, and completeness. Lenders then use Loan Originating Systems to determine an applicant’s creditworthiness.

Underwriting process

This process only begins after an application is totally completed. In this stage, the lender checks the application in consideration of various accounts, such as an applicant’s credit score, risk scores, and other industry-based criteria. Today, this process is fully automated using Rule Engines and API integrations with credit scoring engines.

Credit Decision

Based on the results from the underwriting phase, the lender makes a credit decision. The loan is either approved, denied, or sent back to the originator for additional information. If the criteria used do not match with what is set in the engine system, there is an automatic change in the loan parameters, for instance, reduced loan amount or a different interest rate on the loaned amount.

Quality Check

Quality check of the loan application process is very critical since lending is highly regulated. The loan application is then sent to the Quality Control Team to analyze critical variables of the loan against internal and external regulations on loans. This is often the last step of the application process before funding is approved.

Loan funding

Once the loan documents are signed by both the borrower and the lender, funds are released shortly after. Nevertheless, business loans, loans on properties, and second mortgage loans may comparatively take more time to be approved due to legal and compliance reasons.

Essential Elements of a Loan Application Letter

Now that you have already understood the complex loan application process, it is important that you know the critical points to include in your loan request letter to convince your lender to give you a business loan.

Here is how to effectively write a loan application letter:

Header and greetings

The first and most important element of your business or personal loan application letter should be a header and an appropriate greeting.

In your header, include the following details:

- Your business names

- The physical address of your business

- Business telephone and cell phone numbers

- Lender’s contact details

- Lender’s or Loan Agent’s Name and Title

- A subject line stating the loan amount you are requesting for.

Once you have written your header, include a friendly but professional greeting to start off your loan application letter in a cordial tone.

Business Loan Request Summary

The body of your business or personal loan request letter should start with a brief summary of your loan request amount, why you need the loan, your basic business information, and why you are an ideal risk investment for the lender. This section should be brief and concise. Only include the relevant information to capture your loan agent’s interest and keep them reading the body of your loan application letter.

Basic Details about your Business

Ideally, this is the third paragraph of your loan application letter. Use a few short and concise sentences to give a clear outline of your business.

Be sure to include the details below:

- The legal name of your business and any DBA that your business uses

- Your business structure- if it is a corporation- partnership, individually owned, etc.

- A summary of what your business does.

- How long your business has been operational

- Total number of employees

- A brief description of your current annual revenue

Once you have provided your basic business information, it is time to write the meat of your business loan request letter- clearly explaining why you need the business loan and how you intend to recuperate the investment.

The purpose of the business loan

In the fourth paragraph of your loan application letter, explain succinctly how you will use the business loan. Additionally, tell the lender why your intended use of the business loan will be a wise business investment.

While detailing this section, be as specific as possible and demonstrate to the lender that you have carefully considered the kind of revenue generation this new debt will accomplish for your business. for instance, don’t just say that you intend to use the loan for working capital. Rather, say that you plan to increase your inventory by 45% or that you need to increase your Human Resources to 4 to generate more income by 6%.

In the same paragraph, inform the lender exactly how the loaned amount will help generate more profits necessary to cover repayment plus the interest accumulated on loan.

Proof that you’ll be able to fully repay the loan

In this section, you need to demonstrate to the lender that you can pay back the loaned amount together with interest as per the agreed repayment period. You will want to use any figures from your latest income statements or balance sheets to prove your business is financially healthy and that it is a low-risk investment decision for your lender. In case you have other existing debts, be sure to mention them and include a business debt schedule if possible. If your business is profitable, highlight that in your letter since it something that most lenders pretty much look for in successful loan applicants.

In addition to that, consider including specific cash flow projections to demonstrate to your lender how you plan to fit repayment of the loaned amount plus interest into your budget.

Sample: Loan Application Letter

Sample 1: business loan application letter.

Samira Mitchell,

Mitchell Face Masks Limited,

4680 Forest Road

939, New York.

January 17, 2021

Mr. Wesley Kingston

Guarantor Trust Bank

679, New York State

Ref: Loan Request for $10,000

Exactly two years ago, I started my small face mask vending business in our local market. Over the last two years, my business has picked up really well to an extent where I need to expand to a bigger face mask vending company.

It is for this reason that I am writing this letter. I am confident that there is a great market niche for face masks, especially due to the current worldwide Novel Covid-19 Pandemic. Thus far, I have had many repeat customers, new customer links through referrals, and my client base has grown rapidly. Generally, there is an increase in demand for my products; therefore, I am requesting for a loan amounting to $10,000 to be able to supply more and satisfy all my clients.

This money, along with the amount that I have saved up from my profits, will enable me to lease a large, modern storefront and to import supplies that will help me launch my business plan.

I have attached my business plan, my latest business balance sheets, current business schedules, as well as my credit history statements for your perusal and review. If you have any questions or need any further clarifications, please contact me directly on (111) 345 679 or email me at Mitchel.facemasksltd.co.ke. Thank you for your consideration.

Samira Mitchel.

Sample 2: Personal Loan Application Letter

Dear Michael,

It is common for everyone to face difficult situations and bitter realities in life. I am currently facing a situation where everything seems bleak, and there seems to be no way out of this difficult situation. I am in debt, and I need to pay at least 30% of my house’s mortgage will be taken over by the bank, and I am currently ailing and weak, I’ll not be able to survive such a nervewrecking situation.

The only way I can avoid such a fate is by paying the full amount that is needed by the bank. I can be able to do so if I am allowed to take out a loan from the office, which is a privilege that the company has granted to all the employees. I would be thankful if the company allows me to borrow the money against my monthly pay.

Mr Brandon Brown

Do’s and Don’ts of Writing a Loan Request Letter

A loan application letter may increase or break your chances of receiving funding from any lending institution. This is because it is the first thing that lenders look for in the underwriting process when you submit an application. That said, you must know the dos and don’ts of writing a winning loan request letter to help you receive the funding that you really need.

- Check your personal and business credit scores before sending a loan request letter and take the necessary steps to improve them.

- Have all your financial statements ready, including cash flow statements, business balance sheets, P$L statements, etc

- Make sure to submit all your relevant credentials along with your loan application request letter.

- Always provide the correct and factual information to avoid fraudulent consequences.

- Don’t make your letter too long and unnecessarily wordy

- Don’t use an informal format while writing the loan application letter. Instead, follow the proper rules on writing formal letters

- Don’t include any false information in your loan request letter- be it your business’s current financial health, assets, and liabilities that may be used as collateral damage in case you default payment or why you need the money.

Things to Remember When Writing a Loan Application Letter

Generally, you should always consider the following essential tips if you want to write a winning loan application letter:

- The loan application letter is a formal document. Therefore, observe the proper rules of writing a formal letter.

- Clearly state your intent to borrow a given amount of money

- Provide a vivid but brief description of why you need the money. Your explanation should be concise, genuine, and transparent. While at it, explain how you plan to use the loaned amount and be very sincere about it.

- Explain why your business is a low-risk investment decision for the lender.

- Enumerate your assets and liabilities

- Include the time, date, manner, and method that you will use to make your payment.

Free Loan Application Letter Templates

Are you looking to get some financing for your business or personal emergency? Download our free, well-crafted Loan application letter templates to help you customize your loan request letter. Our Templates includes all the critical elements of a winning loan request letter that will successfully help convince your lender to grant you the funding you need. Download our templates today to help you get started!

Collateral is defined as something that helps secure a loan. Generally, based on the type of lending institution you pick, the lender will give you less than your pledged asset value. Lenders every so often quote an acceptable loan to value ratio, meaning that if you borrow against your house, for example, and it worth $400,000, you will be given a loan amounting to $380,000. Again, this depends on the bank.

The prepayment penalty is a fee that some lenders charge if you pay off all or part of your loan before the loan’s maturity date. These do not usually apply if you pay extra principal on your loaned amount in small amounts at a time. However, it is good that you counter check with your lender.

Every lender follows a different criterion to approve a business or personal loan. The application process depends on several factors; therefore, the time taken to receive funding in your account may take anywhere from a few minutes to several days. This depends on the type of institution you choose and the type of loan you are asking for.

Acquiring a loan is sometimes a necessity in one’s business or personal life. Nonetheless, it is not always easy to get a loan as lenders are wary of granting loans due to loan repayment defaults and fraudulent borrowers. This article has provided you with great insight on loan application letters, the loan application process, essential tips for writing a winning loan application letter, and the dos and don’ts of writing a convincing loan request letter. If you keep these things in mind every time you are thinking of applying for a loan, you are sure to get the funds you need to ensure the smooth running of your business and sort any personal emergency that may come your way.

Related Documents

Word & Excel Templates

Printable Word and Excel Templates

Loan Application Letter

Applying for the loan requires you to provide a lot of documentation. Some organizations ask you to fill out the loan application form, while in some cases, you have to write a loan application letter to the institute to apply for the loan.

The loan application letter allows you to add all the details that you are required to provide. The letter is written to the loan manager of the company, and he then decides whether he should accept the application or not. The letter should include the personal information of the applicant, and since it is a formal letter, it should be written to the point by avoiding unnecessary details. The lender should follow a standard format while writing the loan application letter. The loan manager should be told about the intended use of the money.

The first paragraph of the letter should state the reason for lending the money. It should be assured in the letter that you will not use this money for any illegal purpose. The date on which the applicant will return the borrowed money should be mentioned in the letter.

You should also include information about you in the letter that can make the reader feel that you are a trustworthy person. Here is a sample letter that can help you learn about the structure and format of the letter.

Loan application letter:

Dear [Recipient’s Name],

It is stated that I am writing this letter to request a loan from the finance office of your company because of some of my very peculiar and essential needs. My mother is seriously ill, and I must get her treated at the hospital, for which I need money. Please accept my loan application and sanction me $2000. I assure you that I will return you the loan from the deductions of my gross salary.

I will be highly grateful for this favor of yours.

I am looking forward to your reply.

[Your Name]

Preview and Details of Template

File: Word ( .doc ) 2003 + and iPad Size: 31 KB

More options

I am writing this letter to get a loan from your bank branch situated in New Jersey. Currently, I am working as a sales executive for ABC Organization and need a $10,000 loan. I am in utmost need of this amount as I have to meet the surgery expenses of my father. I have gone through all the requirements related to the loan process and have enclosed the necessary documents along with this email. Please let me know what other documents I need to send you, and you can call me at any time for further queries. I hope you will give a positive response to my request.

This application is a request to ask for a loan from your organization. I am Christiana Roseland, and I am currently running a bakery in New Jersey. I am planning to open a new branch according to the rising demand of people. For this purpose, I need $70,000/- and I will return the amount in installments. I have thoroughly read the rules and policies for the loan process and hopefully, I will return the entire amount within the given time period and the financial pronouncement has been affixed with this application. Waiting to get positive feedback from you.

This letter is a request for a loan application to construct a house. I am the managing director at ABC Company, and my monthly salary is not adequate to meet the construction expenses. I will return the due amount according to the company’s rules and policies and will not let you be disappointed. I contacted the admin office to find out the details, and Mr. Jackson has provided me with all the information. If you need additional information, you can ask me at any time. Thank you for taking my request into account.

Dear Madam, I, Darcy Louis, work in the security office of your company. I live in Valley Stream and travel two hours daily to come to the office. I do not have a personal vehicle, and sometimes it creates a lot of difficulties, and I often arrive late to the workplace. I want to apply for a loan because I have to buy a motorcycle. I need $10,000 in this regard. I have chosen a six-month installment plan, and 20% of my salary will be deducted each month. I request that you accept my loan application. I will be grateful to you. Thanking in anticipation.

Dear Sir, I am Dorothy John, and I live in Toronto. I am running a branch of ABC School. The strength of students is increasing with each session, and it is becoming difficult to adjust to the large number of students in a limited space. Therefore, I need to open a new branch adjacent to the current school and construct a new building, but I do not have enough money. I learned about your loan policy and want to apply for it. I have attached the needed documents along with the application. I am hoping to hear a quick response from you.

I am Julia Hughes, and I am writing this message to ask for a loan from your bank. I have an account in your Brooklyn branch, and my account number is [#]. I have a small business marketing in Brooklyn, and I intend to open a new branch in the Netherlands. Hence, it can be a source of ease for hundreds of people. The savings I have and the loan I am asking for will be of great help in expanding my business. Kindly send me an email detailing all the formalities for the loan process. I would like to ask you to send me a confirmation message so I may visit your branch on an immediate basis.

- Letter Requesting Transfer to another Department

- Letter Requesting Promotion Consideration

- Umrah Leave Request Letter to Boss

- Ramadan Office Schedule Announcement Letters/Emails

- Letter to Friend Expressing Support

- Letter to Employer Requesting Mental Health Accommodation

- Letter Requesting Reference Check Information

- Letter Requesting Salary Certificate

- Letter Requesting Recommendation from Previous Employer

- One Hour Off Permission Letter to HR

- Payroll Apology Letter to Employee

- Advice Letter to Subordinate on Effective Communication

- Advice Letter to Subordinate on Time Management

- Letter to Patient for Feedback/Responding Survey/Online Form

- Holiday Cocktail Party Invitation Messages

Sample Personal Loan Request Letter to Boss ( in Word Format)

Sometimes employees need personal loans for various purposes like the marriage of self (or) marriage of brother/sister (or) for house reconstruction/renovation or for education etc. Most companies will allow their employees to apply for personal loans, and the due amount will be deducted every month from the salary of the employee.

But to apply for the loan employees need to write an application to the company with a proper reason.

Sample Personal Loan request Letter to Boss (Format 1)

To The Manager, Company Name, Address.

Sub: Application for a personal loan.

Dear Sir/Madam,

With due respect, I am [employee name] , [employee id] working as an [designation] in [department] at [company name] , writing this letter to apply for a personal loan of an amount …………………. Rs due to my marriage/ the marriage of my sister (or) brother/ for construction of my house/ for the education of my children .

I will repay the loan in …. Installments, in each installment you can deduct …………….. Rs from my salary.

I hope you sanction me the loan amount, I shall be grateful to you in this regard.

Thanking you.

Sincerely, Your name. Signature.

Loan Application Letter to Company for Daughter’s Marriage

Sub: Loan application for daughter’s marriage.

I, [your name] have been working in your company as a [designation] for … years, with employee ID XXXX .

I would like to inform you that my daughter’s marriage was fixed and the wedding ceremony will be held on [date] .

But due to my financial conditions, I need some financial assistance from the company.

Therefore I request you to kindly grant me a loan amount of ………………. Rs and the amount can be deducted each month from my salary in …. Installments.

I hope you approve my loan request.

Sincerely, Your name.

Loan Application Letter to Company for Education

From Employee name, Employee ID, Designation, Department.

Sub: Loan application.

I have been working in your company as a [your designation] for the last …. Years. As my son is going for higher studies we need some financial support.

I hereby request you to kindly sanction me a loan amount of ………….. Rs and the amount can be deducted each month from my salary in ….. Installments.

We will be really thankful to you in this regard.

Sincerely, Your name, Signature.

Sample Email to Request Personal Loan from Company

Sub: Request for a personal loan due to [reason].

My name is [your name], working as a [your designation] in [department] at [company name] .

I am writing this email to request a personal loan for an amount of ……………….. Rs, because of my marriage/ the marriage of my sister (or) brother/ for construction of my house/ for the education of my children .

I will pay back the loan amount in ….. Installments, in each installment you can deduct ……………… Rs from my monthly salary.

Therefore please approve my loan request.

Regards, Your name. Signature.

Will companies charge interest on personal loans?

It depends on your company loan policy, most companies don’t charge any interest on loans given to their employees.

Is taking a personal loan from the company good?

Yes, it is a good idea. Instead of taking personal loans using credit cards or from banks, it is better to take loans from your office with Zero interest (or) less interest.

Recommended:

- Salary slip request mail to the boss.

- Form 16 in excel format for Ay 2022-23

8 thoughts on “Sample Personal Loan Request Letter to Boss ( in Word Format)”

wow this is well understood and simple love this

10,000 lone

Wow! Very simple and straight to the point. Thanks

Well detailed, Thankyou

Very apt and straight to the point!

its very helpful . love it

Wow! It’s very easy and interesting I love it

Very simple and straight to the point. I love it.

Leave a Comment Cancel reply

FREE Loan Application Letter Templates & Examples

Embark on your financial journey with confidence using Template.net's Loan Application Letter Templates. Our offerings, seamlessly editable and fully customizable, empower you to articulate your borrowing needs effortlessly. Harness the potential of our Ai Editor Tool, ensuring each application reflects your unique narrative. Streamline your loan process with precision – because financial aspirations deserve tailored expression.

- Loan Agreement

- Loan Amortization Schedule

- Loan Application

- Loan Application Letter

- Loan Calculator

- Loan Letter

- Loan Proposal

- Loan Repayment

- Personal Loan Agreement

- Letter Design

- Letter Examples

- Letter of Intent to Purchase

- Letter of Interest

- Letter of Recommendation for Graduate School

- Letter of Intent

- Letter Layout

- Letter of Recommendation for Student

- Letter Outline

- Business Letter of Intent

- Complaint Letter to Landlord

- Job Application Letter for Engineer

- Job Application Letter for Executive

- Job Application Letter for Teacher

- Real Estate Letter of Intent

- Recommendation Letter for Student

- Request Letter for Approval

- Request Letter to Principal

- Resignation Letter with Notice Period

- Retirement Letter to Employer

- School Letter of Intent

- Thank You Letter After Interview

- Thank You Letter For Gift

- Thank You Letter to Boss

- Thank You Letter to Employee

- Thank You Letter to Recruiter

- Warning Letter to Employee

- Absence Letter

- Academic Letter

- Acceptance Letter

- Account Letter

- Account Manager Letter

- Accountant Letter

- Accounting Letter

- Acknowledgement Letter

- Acquisition Letter

- Admin Letter

- Administration Letter

- Administrative Assistant Letter

- Administrative Letter

- Admission Letter

- Advertising Letter

- Advisor Letter

- Agency Letter

- Agent Letter

- Analyst Letter

- Animal Care letter

- Apartment Letter

- Apology Letter

- Appeal Letter

- Applicant Letter

- Application Letter

- Application Rejection Letter

- Appointment Cancellation Letter

- Appointment Letter

- Appointment Request Letter

- Appraisal Letter

- Appreciation Letter

- Approval Letter

- Architect Letter

- Architectural Letter

- Assistant Letter

- Assistant Manager Letter

- Assurance Letter

- Attendance Warning Letter

- Attendant Letter

- Attorney Letter

- Auditor Letter

- Authorization Letter

- Automotive Letter

- Award Letter

- Bank Letter

- Banking Letter

- Basic Letter

- Beauty Letter

- Behavior Warning Letter

- Beverage Letter

- Billing Letter

- Board Letter

- Board Resignation Letter

- Bonus Letter

- Brand Letter

- Bus Driver Letter

- Business Apology Letter

- Business Appointment Letter

- Business Introduction Letter

- Business Letter

- Business Meeting Letter

- Business Partnership Letter

- Business Proposal Letter

- Business Relationship Letter

- Buyer Letter

- Call Center Letter

- Camp Letter

- Campaign Letter

- Cancellation Letter

- Care Letter

- Career Letter

- Carpenter Letter

- Case Letter

- Catering Letter

- Catering Proposal Letter

- Certified Letter

- Change Letter

- Character Letter

- Character Reference Letter

- Check Letter

- Chief Letter

- Child Care Letter

- Christmas Letter

- Church Letter

- Church Resignation Letter

- Claim Letter

- Class Letter

- Cleaner Letter

- Cleaning Letter

- Cleaning Services Letter

- Client Letter

- Clinic Letter

- Clinical Letter

- Club Letter

- Coach Letter

- Coach Resignation Letter

- Colleague Recommendation Letter

- Collection Letter

- College Application Letter

- College Letter

- College Recommendation Letter

- College Reference Letter

- Commercial Letter

- Communications Letter

- Community Letter

- Community Service Letter

- Company Introduction Letter

- Company Letter

- Company Transfer Letter

- Complaint Letter

- Computer Letter

- Confirmation Letter

- Congratulation Letter

- Construction HR Letter

- Construction Letter

- Consultant Letter

- Consulting Letter

- Content Letter

- Contractor Letter

- Controller Letter

- Cook Letter

- Corporate Letter

- Corporate Sponsorship Letter

- Counselor Letter

- Counter Letter

- Counter Offer Letter

- COVID-19 Letter

- Coworker Recommendation Letter

- Credit Letter

- Customer Complaint Letter

- Customer Letter

- Customer Service Letter

- Daycare Letter

- Daycare Termination Letter

- Delivery Letter

- Demand Letter

- Dental Letter

- Department Letter

- Department Transfer Letter

- Designer Letter

- Development Letter

- Digital Letter

- Director Letter

- Disciplinary Letter

- Doctor Appointment Letter

- Doctor Letter

- Donation Letter

- Donation Thank You Letter

- Drafter Letter

- Editorial Letter

- Education Letter

- Educational Letter

- Educator Letter

- Electrician Letter

- Emergency Letter

- Employee Acknowledgement Letter

- Employee Appointment Letter

- Employee Appraisal Letter

- Employee Complaint Letter

- Employee Letter

- Employee Reference Letter

- Employee Resignation Letter

- Employee Termination Letter

- Employee Transfer Letter

- Employer Letter

- Employment Letter

- Employment Offer Letter

- Employment Verification Letter

- Engineer Letter

- Engineering Letter

- Enterprise Letter

- Environment Complaint Letter

- Environmental Letter

- Equipment Letter

- Event letter

- Event Proposal Letter

- Eviction Letter

- Examiner Letter

- Excuse Letter

- Executive Letter

- Experience Letter

- Facilities Letter

- Family Letter

- Farewell Letter

- Fashion Letter

- Field Letter

- Final Letter

- Final Warning Letter

- Finance Letter

- Financial Letter

- Financial Services Letter

- First Letter

- First Warning Letter

- Flight Letter

- Follow Up Letter

- Food Letter

- Formal Apology Letter

- Formal Complaint Letter

- Formal Letter

- Formal Resignation Letter

- Freelance Letter

- Freelancer Letter

- Fresher Letter

- Friend Letter

- Friendly Letter

- Fund Letter

- Fundraising Letter

- Game Letter

- General Letter

- General Manager Letter

- Gift letter

- Goodbye Letter

- Government Letter

- Grade Letter

- Grant Letter

- Greeting Letter

- Guarantee Letter

- Hardship Letter

- Health Letter

- Help Letter

- High School Letter

- Home Letter

- Hospital Letter

- Hotel Letter

- HR Employee Letter

- Human Letter

- Immediate Resignation Letter

- Immigration Letter

- Income Letter

- Informal Letter

- Information Letter

- Information Request Letter

- Inquiry Letter

- Inspector Letter

- Instructor Letter

- Insurance Letter

- Intent Letter

- Internal Letter

- Internal Transfer Letter

- International Letter

- Internship Acceptance Letter

- Internship Letter

- Internship Offer Letter

- Internship Reference Letter

- Interview Appointment Letter

- Interview Letter

- Interview Rejection Letter

- Introduction Letter

- Investigator Letter

- IT and Software Letter

- Job Acceptance Letter

- Job Application Letter

- Job Appointment Letter

- Job Experience Letter

- Job Offer Letter

- Job Recommendation Letter

- Job Reference Letter

- Job Resignation Letter

- Laboratory Letter

- Landlord Letter

- Landlord Reference Letter

- Late Letter

- Late Payment Letter

- Late Warning Letter

- Lawyer Letter

- Lease Letter

- Lease Renewal Letter

- Lease Termination Letter

- Leave Letter

- Manager Job Application Letter

- Manager Letter

- Marketing Job Application Letter

- Marketing Letter

- Mechanic Letter

- Mechanical Engineer Letter

- Media Letter

- Medical Leave Letter

- Medical Letter

- Medical School Letter

- Medical Thank You Letter

- Meeting Appointment Letter

- Meeting Letter

- Membership Application Letter

- Membership Letter

- Motivation Letter

- Negotiation Letter

- Noise Complaint Letter

- Notarized Letter

- Nurse Letter

- Nurse Resignation Letter

- Nursing Letter

- Offer Letter

- Office Letter

- Officer Letter

- Official Letter

- Online Letter

- Operations Letter

- Operator Letter

- Ownership Transfer Letter

- Parents Thank You Letter

- Partnership Letter

- Patient Letter

- Patient Termination Letter

- Payment Letter

- Payment Reminder Letter

- Performance letter

- Performance Warning Letter

- Permission Letter

- Personal Letter

- Personal Reasons Resignation Letter

- Personal Recommendation Letter

- Personal Reference Letter

- Pharmaceutical Letter

- Pharmacist Letter

- Pharmacy Letter

- Photographer Letter

- Physician Letter

- Planning Letter

- Practitioner Letter

- Principal Letter

- Printable Letter

- Producer Letter

- Product Letter

- Production Letter

- Professional Letter

- Professional Thank You Letter

- Program Letter

- Programmer Letter

- Project Letter

- Project Manager Letter

- Promotion Letter

- Promotion Recommendation Letter

- Proof Letter

- Property Letter

- Purchase Letter

- Purchase Order Letter

- Quality Letter

- Query Letter

- Real Estate Letter

- Real Estate Offer Letter

- Rebuttal Letter

- Receptionist Letter

- Recommendation Letter

- Refusal Letter

- Rejection Letter

- Relieving Letter

- Reminder Letter

- Renewal Letter

- Rent Letter

- Rental Letter

- Rental Reference Letter

- Rental Termination Letter

- Representative Letter

- Request Letter

- Requisition Letter

- Reschedule Appointment Letter

- Reschedule Letter

- Research Letter

- Resignation Acceptance Letter

- Resignation Letter

- Response Letter

- Restaurant Letter

- Retail Letter

- Retirement Letter

- Safety Letter

- Salary Letter

- Salary Negotiation Letter

- Sales Consultant Letter

- Sales Letter

- Sales Promotion Letter

- Scholarship Application Letter

- Scholarship Letter

- Scholarship Recommendation Letter

- Scholarship Thank You Letter

- School Letter

- School Recommendation Letter

- Science Letter

- Secretary Letter

- Security Letter

- Service Complaint Letter

- Service Letter

- Service Recommendation Letter

- Service Termination Letter

- Sharepoint Letter

- Short Letter

- Site Letter

- Software Letter

- Solicitation Letter

- Specialist Letter

- Sponsorship Letter

- Sports Sponsorship Letter

- Staff Letter

- Store Letter

- Student Letter

- Student Reference Letter

- Superintendent Letter

- Supervisor Letter

- Support Letter

- Teacher Letter

- Teacher Promotion Letter

- Teacher Recommendation Letter

- Teacher Resignation Letter

- Teacher Thank You Letter

- Teaching Letter

- Team Leader Letter

- Technologist Letter

- Tenant Letter

- Tenant Warning Letter

- Thank You Letter

- Thank You Resignation Letter

- Therapist Letter

- Trainee Letter

- Trainer Letter

- Training Letter

- Training Proposal Letter

- Transfer Letter

- Transfer Request Letter

- Travel Letter

- Truck Driver Letter

- Two Weeks Notice Letter

- Underwriter Letter

- University Letter

- Vacation Leave Letter

- Vacation Letter

- Verbal Letter

- Verbal Warning Letter

- Verification Letter

- Volunteer Letter

- Volunteer Thank You Letter

- Waiver Letter

- Warehouse Letter

- Warning Letter

- Welcome Letter

- Work Apology Letter

- Work Experience Letter

- Work From Home Letter

- Work From Home Request Letter

- Work Letter

- Worker Letter

- Writer Letter

Writing load request letters should not take too much of your time. Thankfully, our reliable letter templates can help you if you are aiming to write professional-looking loan request letters. Check out Loan Application Letters Templates to get access to our numerous original, customizable ready-made templates and be able to download them on your mobile phone or PC. Write a loan request without having to start from scratch by using our ready-made templates today.

How to Write Loan Request Letters?

According to First Banking, loans are an important factor in planning the finances of both big businesses and ordinary individuals. Writing request letters for loans may seem complicated, but it's just like writing another letter. You only have to know what to consider when writing one. That is why we have several tips below about what to consider when writing a loan request letter.

1. Be Aware of the Loan Policies

Financial institutions like banks can be very strict with their loan policies. This makes sense because of the amount of money being loaned to entities and individuals. Being aware of the policies would make it easier for you to request a loan.

2. Specify the Reason for the Loan Request

The banks would be interested in where you plan to spend the money you are borrowing. Make sure to specify the reason for borrowing money.

3. Mention the Specific Amount You Are Requesting

The amount of money you are borrowing should also be specified. The amount should be exact so that you can avoid possible troubles that could lead to your letter's rejection.

4. Ensure that the Necessary Documents are Present

Lending large amounts of money is not taken lightly by financial institutions. So make sure that you include the supporting documents that the loan will require.

5. Be Professional and Address the Recipient Politely

Addressing the recipient with a professional attitude will give the impression that you are trustworthy and serious when it comes to conducting financial transactions. So be polite and show respect when addressing your letter's recipient.

Frequently Asked Questions

How can the letter templates aid you.

- The letter templates are designed to be customizable. This means you can write request letters without having to start from the beginning.

- Professionals write the contents of the templates. That is why you will never have to worry about quality.

- You can save a great deal of effort and time by editing the ready-made contents of the letter templates.

- The templates do not require to be edited in select software applications because you can customize them using your browser.

- Each template can be downloaded on your digital device. This means you can prepare documents on the move.

- The templates are made available in different file formats.

Why write a letter when requesting loans?

Loans are no small matter. Hence you must approach professionally by writing a formal document such as a request letter.

What are the four types of loans?

There are four main types of loans.

- Variable Rate Loans

- Fixed-Rate Loans

- Secures Personal Loans

- Unsecured Personal Loans

What happens if you don't pay your loan?

Not paying your loan will result in penalties that will increase the money you owe. This will also lead to your credit rating plummeting, and you will have a hard time securing loans in the future.

Get Access to World's largest Template Library & Tools

- Access to 1 Million+ Templates & Tools

- Unlimited access to Design & Documents AI editors

- Professionally Made Content and Beautifully Designed

- Instant Download & 100% Customizable

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Apply for a Personal Loan

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

How to Apply for a personal loan

- Betterment is best for:

- Wealthfront is best for:

- IRA vs. 401(k)

- What is alternative minimum tax?

- What is a Treasury bill?

- California state income tax

- Key takeaways

- What is a financial plan?

- » This page is out of date

- What is the earned income tax credit?

- What is a custodial Roth IRA?

- Dividend definition

- What is a W-4?

- Life insurance buying guide

- Still deciding on the right carrier? Compare Medigap plans

- What is a home equity line of credit?

- What is the FIRE movement?

- What is a meme stock?

- Current promotional CD rates

- See CD rates by term and type

- What's an adjustable-rate mortgage?

- What is Shopify?

- Shopify Ecommerce

- What is a jumbo loan?

- What is a mutual fund?

- Find the right business loan

- What is personal finance?

- Definitions: Money Transfer Rates

- Fidelity is best for:

- Robinhood is best for:

- » This article is out of date

- Bluevine Business Checking

- What Medicare covers

- Still deciding on the right carrier? Compare Medicare Part D Plans

- What is a backdoor Roth IRA?

- » These offers have expired

- Learn more about cryptocurrencies

- See how to get your business started quickly

- What is the qualified business income deduction?

- What is the average stock market return?

- What is a hedge fund?

- Bank statement definition

- Bizee: Easily form your new business

- This page is out of date:

- What is Upwork?

- What is the federal estate tax?

- Compound interest definition

- Mortgage rates this week

- What is a budget?

- What is a jumbo CD?

- What is a debit card?

- Coinbase is best for:

- E*TRADE is best for:

- How to earn a Chase checking account bonus

- What are Treasury bonds?

- What is mortgage pre-qualification?

- What is Plaid?

- What is a budget planner?

- » Editor's note

- Learn more about the good credit range

- Blockchain: A definition

- Compare your business loan options

- Looking for more money?

- What is a cashier's check?

- The best home insurance companies at a glance

- Still deciding on the right carrier? Compare Medicare Advantage plans

- Synchrony Bank CD rates 2024

- The latest news in unionization efforts and successes:

- Should you bother with airline rewards?

- What makes a credit card 'eco-friendly'?

- What’s in it for you?

- What card issuers can do: Ditch the physical card altogether

- What consumers can do: Make small choices that add up

- Optional: Get an airline credit card?

- Optimize your miles

- Expert level: Earn elite status

- Additional resources

- Betterment vs. Wealthfront: Which is right for you?

- What is a Level 2 charger?

- What is a construction loan?

- What is shrinkflation?

- How much does HBO Max cost per month?

- What is a Roth 401(k)?

- How much emergency fund should I have?

- Where they’re based and where they fly

- What are commodity stocks?

- 4 ways to make money blogging

- How to make money in stocks

- About Farmers home insurance

- What is FICA tax?

- Bond ETF definition

- What are dividend stocks?

- How to invest your 401(k)

- What is passive income?

- The miles stacker

- About USAA home insurance

- High-yield savings accounts defined

- How to make money as a kid

- High-dividend ETFs may generate income

- Does applying for a credit card hurt your credit?

- What is Planet Fitness?

- What is a credit card CVV?

- What is a good used iPhone model?

- Best-performing tech ETFs

- What does it mean to be 'in escrow'?

- What is a credit freeze?

- Hawaiian Airlines checked bag fees

- What is a first-time home buyer grant?

- How to buy stocks in 6 steps

- Determining how much mortgage I can afford

- What is an emergency fund?

- HELOC and home equity loan interest deduction rules

- About Nationwide home insurance

- Hulu subscription cost

- Estate planning checklist

- The difference between Roth and traditional IRAs

- What are non-custodial crypto wallets?

- Best-performing leveraged ETFs

- IHDA highlights and eligibility requirements

- What are monthly dividend stocks?

- What is YouTube Premium?

- Small-cap ETF definition

- How to use this calculator

- Can non-U.S. citizens get personal loans?

- 7 budgeting tips for everyone

- Best-performing real estate ETFs

- Current student loan interest rates

- How much is an oil change?

- What is a 529 college savings plan?

- IRA contribution limits and rules

- About Amica home insurance

- About Copa Airlines

- About Mercury home insurance

- How to use a savings goal calculator

- How to get a Diners Club card

- What is a hard inquiry?

- How to get your free credit report information

- About Hartford/AARP renters insurance

- Best-performing utility stocks

- What is a Closing Disclosure?

- Personal loan alternatives to Capital One

- What are crypto stocks?

- What is the gift tax?

- Apple Music subscription cost

- What is a high net worth individual?

- What is a utility bill?

- What is an index fund?

- Limits can be cut any time, even with good credit habits

- Lower credit limits mean less risk for issuers

- Economic uncertainty in 2024 may fuel credit line caution

- How you can prevent a credit reduction

- Managing a credit limit cut

- What is a savings account?

- What is a balance transfer?

- What is a bonus?

- Earn points by charging purchases

- Making money with Rover

- Does pet insurance cover spaying or neutering?

- Choosing an IRA vs. a 401(k)

- How many bags can you bring on TAP Air Portugal?

- How much does a wedding cost?

- What are small-cap stocks?

- Can you withdraw money from a 401(k) early?

- 7 best-performing AI stocks

- Los mejores y peores días para viajar en avión para el Día de Gracias

- Know where your credit score stands

- Lufthansa economy fares

- High-value hotels in Calgary to book with points

- How much should you spend on rent? It depends

- All about the Schumer box

- Best stocks by one-year performance

- 1. Hands-on or hands-off investing?

- 1. The Platinum Card® from American Express

- How to tip in general

- What is predatory lending?

- Best Hilton Caribbean resorts

- Current United credit card offers

- What ANA miles are worth

- Best Prepaid Debit Cards

- Nerdy takeaways:

- Online marketplace and auction sites

- How to find a passport number on your passport

- Microsoft Office Excel budget templates

- Calculate your debt-to-income ratio

- What is a cosigner for a business loan?

- What is Zelle?

- About Silversea

- What are alternative assets?

- 1. Certificates of deposit (CDs)

- What is self-employment tax?

- 5 best-performing meme stocks

- 13 ways to get the best online deals

- ETF vs. mutual fund

- 2024 data highlight: minor drops for high-yield CDs so far

- What is the AmEx Trifecta and why should you have it?

- How to get paid on YouTube

- Number of properties and pricing

- Why is personal finance important?

- Spotify Free

- Paramount+ Essential

- Virginia state income tax rates and tax brackets

- Top credit cards for bills and utilities

- Invest based on your goals

- What is the SENTRI Pass?

- What is home equity?

- What is an accredited investor?

- Medical insurance

- What are home equity loans and HELOCs?

- What is SPY?

- What is covered under professional liability insurance?

- Routes and destinations

- How much does a 24 Hour Fitness membership cost?

- How much does the Babbel app cost?

- Are gas prices going up?

- How much does a wire transfer cost?

- How does the Fear and Greed Index work?

- How many miles do you need to redeem for award flights?

- How much is YouTube TV a month?

- What to know about American Airlines delayed flight compensation

- What are FHA closing costs?

- What are restricted stock units, or RSUs

- How does the lottery work?

- Original Medicare costs are going up

- What is a budget calendar?

- What are Vanguard index funds?

- How does a lending circle work?

- Capital One private student loan alternatives

- What is a conventional mortgage?

- 7 best e-commerce fulfillment centers

- What does APY mean?

- Available American credit cards

- What does a credit freeze do?

- 1. Report lost debit cards ASAP

- Solar loan calculator

- Key differences between personal loans and credit cards

- How much should you tip at the nail salon?

- Is Upwork a legit way to make money?

- How to buy Amazon stock

- What is a sole proprietorship?

- Mortgage options

- What you need to open a bank account

- Domestic travel

- Where can you work as a Dasher?

- Preparing to buy tips

- What is a down payment?

- Claim United miles for past flights on the airline

- Does home insurance cover mold?

- What is a payday alternative loan?

- The pros of the American Airlines loyalty program

- When to write a follow-up email after no response

- A few examples

- Why get an airline credit card

- How is a business loan proposal different from a business plan?

- The right time to ask for a credit limit increase

- What is tax evasion?

- United fare classes: The differences

- When do I need a cashier's check?

- Roth IRA pros and cons

- Exchange gift cards for ones you actually want

- Important questions to ask a recruiter

- If you’re in a rush, turn the card in

- About Spot pet insurance

- What is umbrella insurance?

- The Benefits of Hyatt Globalist status

- What are variable expenses?

- Why get the Chase Sapphire Reserve® ?

- Betterment at a glance

- Wealthfront at a glance

- How does leasing work?

- What is an ITIN loan?

- How to get a home equity loan with bad credit

- What is an investment property?

- Minimum wage over time

- What is the Walt Disney World VIP tour?

- 4 budgeting methods to consider

- Why is having a low credit utilization important?

- When is a construction loan used?

- 1. Strengthen your financial profile

- Alternatives to Marcus by Goldman Sachs personal loans

- Annual fees

- 1. South Beach